In the world of financial markets, Bitcoin and crypto, fear and uncertainty often dominate the headlines. In recent months, there has been increasing speculation about an impending recession and the possibility of a major crash of risky assets. Theses like Bitcoin will rise to $40,000 and then crash are currently plentiful.

While most analysts expect a recession crash and the timing is hotly contested, macro analyst Alex Krueger says presents a compelling reason why such fears may be unfounded. In his research report, Krüger debunks prevailing bearish beliefs and sheds light on why he remains bullish on risky assets, including Bitcoin and cryptocurrencies.

1/ A recession is imminent, risky assets are expensive and equities always bottom out during deleveraging recessions.

Is a major crash inevitable?

Not at all

In this research report, we examine how widely held bearish theorems are flawed and why we are bullish on risky assets. pic.twitter.com/6b456Pvz2l

— Alex Kruger (@krugermacro) July 3, 2023

Debunking bearish propositions for high-risk assets like Bitcoin

According to Krüger, the coming recession, if any, is one of the most anticipated in history. This anticipation has led market participants and economic actors to prepare, reducing the probability and potential size of the recession. As Krüger astutely points out, “What really matters is not whether the data is positive or negative, but whether the data is better or worse than what is priced in.”

A flawed idea often associated with recessions is the belief that risky assets must bottom out when a recession hits. Krüger emphasizes the limited sample size of recessions in the US and gives a counterexample from Germany, where the DAX has reached an all-time high despite the country being in recession. This reminds us that the relationship between recessions and risky assets is not as simple as some might think.

Valuations, another important aspect of market analysis, can be subjective and depend on several factors. The analyst emphasizes that biases in data selection and timeframes can significantly affect valuations. While some metrics may point to overvaluation, Krüger suggests taking a closer look at fair price indicators, such as the future price-to-earnings ratio for the S&P 500 ex FAANG. By taking a nuanced approach, investors can gain a more accurate understanding of the market landscape.

In addition, the emergence of artificial intelligence (AI) offers a revolutionary opportunity. Krüger highlights the ongoing AI revolution and compares it to the transformative power of the internet and the industrial revolution. He notes that AI has the potential to replace a significant portion of current employment and boost productivity growth, ultimately boosting global GDP. Krüger says: “Is an AI bubble emerging? Probably yes, and it’s only just begun!”

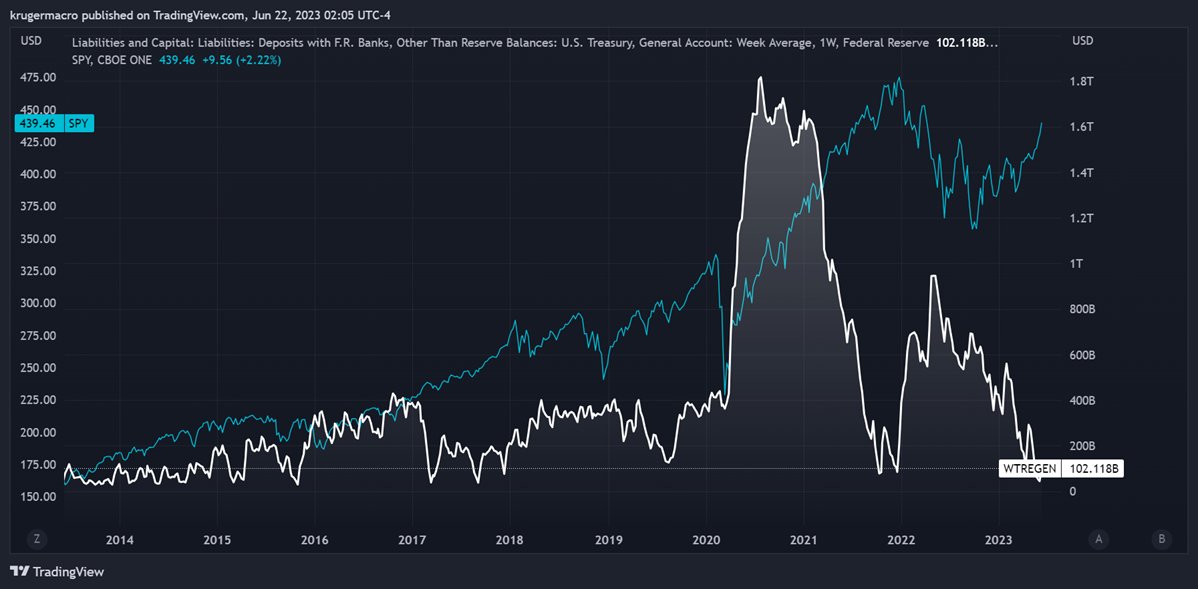

Krüger addresses concerns about liquidity and challenges the belief that only liquidity determines the prices of risk assets. He argues that positioning, prices, growth, valuations and expectations collectively play a greater role. While the Treasury General Account (TGA) refill is currently viewed by some analysts as a potential headwind for Bitcoin and crypto, Krüger points out that historical evidence suggests that the impact of the TGA on the market has been minimal. He states:

The TGA is known to be decorrelated with risky assets for very long periods of time. In fact, the four largest TGA rebuilds of the past two decades have had minimal impact on the market.

The best has yet to come

Given the monetary policy landscape, Krüger notes that the US Federal Reserve’s tightening cycle is nearing its end. With most rate hikes already behind us, the potential impact of a few more hikes is unlikely to cause a significant shift. Krüger assures investors that the Fed’s tightening cycle is nearly 90% complete, reducing the perceived risk of a risk asset crash.

Positioning is another factor Krüger highlights as being cash-heavy, as indicated by record-high money market funds and institutional holdings. This suggests that a significant proportion of market participants have taken a cautious approach, which could serve as a buffer against potential downside effects. Kruger explains:

Money market funds hit a record $5.4 trillion, while institutions held $3.4 trillion on June 28, about 2% above the previous all-time high, which happened in May 2020, the darkest point of the pandemic, according to the ICI.

All in all, Krüger’s analysis offers a refreshing perspective amid a wave of bearish sentiment. While market conditions remain unpredictable, Krüger concludes:

Everyone is bearish. But the recession is ahead, the AI revolution is here, the Fed is almost done, and the market is cash heavy. We see no reason to change our optimistic attitude, which we have maintained throughout 2023. The trend is your friend. And the trend is up.

At the time of writing, Bitcoin price was up 1.2% over the past 24 hours and was trading at USD 31,050.

Featured image from iStock, chart from TradingView.com