It is time for the US to implement intelligent, progressive and specific regulation of digital assets.

The Securities and Exchange Commission’s recent indictments against Coinbase and Binance have brought the digital asset classification debate to a boiling point, and I believe this shows that the organization is not equipped to competently regulate digital assets.

Included in the packs are lists of more than 15 digital assets whose SEC claims pass the Howey Test and are therefore securities. To pass the suit, SEC Chairman Gary Gensler told CNBC,

“All we have to show is that one of [the tokens listed by the exchanges] is a security and they should register correctly.

However, when reviewing the purported securities listed by the exchanges, there is no mention of the black swan that was the collapse of Terra-Luna (other than a passing reference in the Binance series). Binance currently still lists LUNA and the classic token LUNC, while Coinbase listed and still has packaged LUNA (wLUNA) available through the Coinbase Wallet. Terra Luna’s failure wiped out tens of billions of dollars from the cryptocurrency market cap and led to individual investors losing massive amounts of money.

The SEC also invokes trading of tokens on FTX as part of their argument that Coinbase is wrong. In the lawsuit, SOL’s listing on FTX.US is presented as part of the evidence claiming that Solana is a security. An almost identical section is also included in the Binance pack.

At this point, it is common knowledge that FTX and its executives had a very well-known presence on Capital Hill and that SBF and its cohorts formed personal or work relationships with several members of the US government, including Gensler. U.S. customers lost huge amounts of money when that exchange fell through, leaving more than a few members of the government with an embarrassing record of nestling with alleged fraudsters and the uncomfortable reality of having to release themselves from their substantial campaign donations.

The US has failed on crypto regulation

Coinbase has been publicly asking for advice on digital asset regulation for years. “The SEC is one we’ve really struggled with over the last few years,” Coinbase CEO Brian Armstrong stated in a Twitter Space earlier this year, implying an intransigence at that agency that you don’t see anywhere else.

Armstrong explained that Coinbase had tried unsuccessfully to contact the SEC to discuss the regulatory landscape until the SEC specifically requested to visit Coinbase last year. Coinbase had “30 meetings in the past nine months” with the SEC, which would culminate in a meeting where feedback would be provided.

However, Armstrong claimed that the SEC canceled the meeting the day before and sent a Wells Notice to Coinbase the following week. Nine weeks later, it sued the exchange for multiple violations of securities laws.

Digital Assets listed in Congressional Record

While there has been a significant increase in digital asset convention activity in recent years, with over 1,065 mentions of the term on record. Nevertheless, real progress in digital asset regulation has been painfully slow.

Digital assets were first mentioned in a 2000 Senate hearing titled “Utah’s Digital Economy and the Future: Peer-to-Peer and Other Emerging Technologies,” comparing them to “databases.”

Digital assets were also mentioned in a 2001 Congressional hearing by the Commerce, Commerce, and Consumer Protection Subcommittee on Energy and Commerce. John Schwarz, the president and CEO of Reciprocal, Inc., argued that “Securing digital assets and preventing unwanted digital intrusion is tantamount to defending personal and possibly national integrity.”

While Schwarz talked about digital files such as mp3 audio and mp4 videos, it is the first official mention of the term that is now making headlines.

The term was rarely mentioned every year until 2019, when the number of digital asset listings rose to 21, including the proposed bills, Managed Stablecoins are Securities Act, and the Keep Big Tech Out Of Finance Act.

By 2022, there were 598 mentions of the term “Digital Assets”, including 22 bills, 14 congressional hearings and more than 500 congressional calendar entries. This year, in 2023, there have been only 68 entries so far, with the convention calendar collection being the biggest driver of the drop, down from 501 to just eight entries.

Trends in the use of digital resources

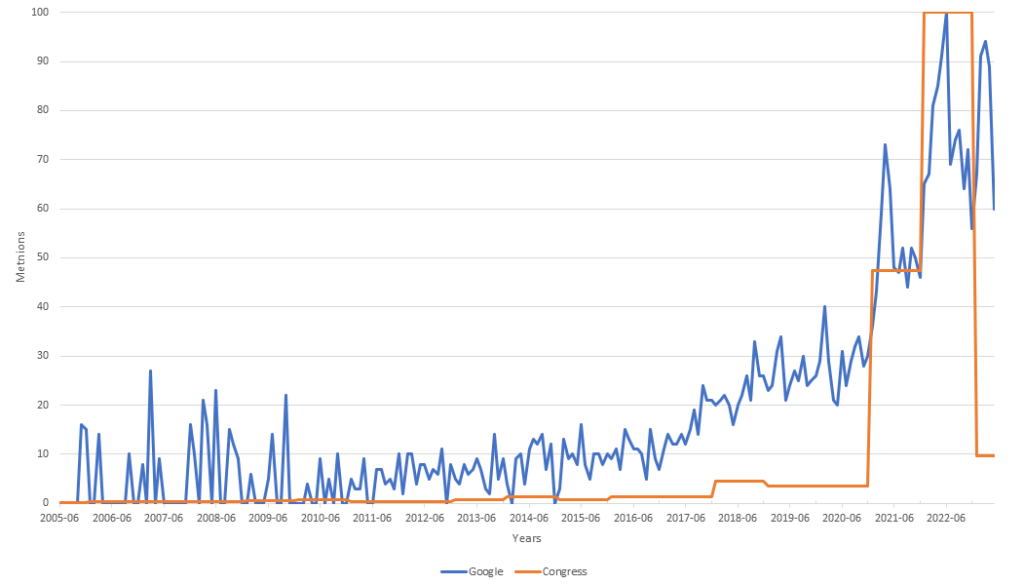

I compared the “Digital Assets” entries in Govinfo.gov’s Congressional and Federal databases with the search volume of the same term on Google from 2005 to the present.

The normalized chart below shows that interest in Google Search picks up from about 2017, while it was not until 2020 that the US government officially ramped up the use of the term.

The graph scales the data to a common reference point, making it easy to compare and analyze the different data sets. Notably, there has been an extreme drop in official public registry listings for “Digital Assets” to just 9.7 at a time when Google search traffic is above 60.

Google Search interest appears to have formed a double top, peaking in 2021 and a lower peak in early 2023. The world’s technical analysts would suggest that such a move is a bearish indicator if it were a stock or token chart. .

Moreover, Congressional interest has simply fallen off a cliff, with mentions dropping from 598 in 2022 to just 58 six months into 2023.

Why?

Has the digital asset conversation moved from the official public record to back channels and social media? Was the surge in 2022 related to an urgent need to define Digital Assets?

If that were the case, why are companies that (publicly) beg for guidance on digital asset regulation being sued by the SEC?

In part two of this three-part article, we’ll explore the implications of the SEC’s actions and examine alternative approaches to crypto regulation that could benefit the industry and its investors.

To follow CryptoSlate on Twitter or join our Telegram channel to be notified when the second part is available.