- Crypto markets face heightened volatility as $443 million in long positions are liquidated following robust US jobs data.

- A strong labor market signals fewer interest rate cuts, putting pressure on Bitcoin, Ethereum and risk assets.

The crypto market is in a slump on January 9 as a combination of stronger-than-expected US economic data and significant liquidation events weigh heavily on investor sentiment.

The recession has hit major cryptocurrencies like Bitcoin[BTC] and ether[ETH]This raised concerns about the market’s ability to maintain recent momentum.

Stronger than expected US job figures are sending shock waves

On January 8, the US Bureau of Labor Statistics has published the latest Job Openings and Labor Turnover Survey (JOLTS), which revealed 8.096 million vacancies for November 2024. This figure easily exceeded the consensus estimate of 7.605 million, indicating robust demand in the labor market.

Stronger job postings indicate the U.S. economy remains resilient despite concerns about slowing growth. While this is good news for the broader economy, it has significant implications for monetary policy.

A strong labor market reduces the likelihood of aggressive interest rate cuts by the Federal Reserve, a scenario that typically favors risky assets like cryptocurrencies.

The anticipation of higher interest rates for an extended period of time has prompted many investors to move away from speculative assets, which has contributed to the current downturn in the crypto market.

Liquidations reinforce the decline

Adding to the pressure, the crypto market experienced its largest liquidation event of the year.

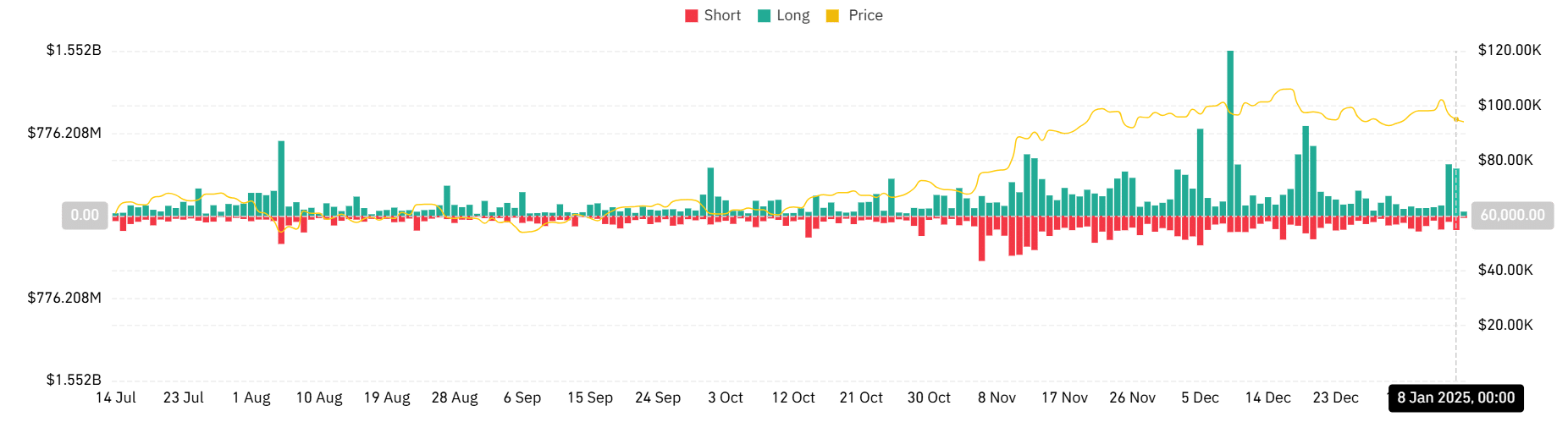

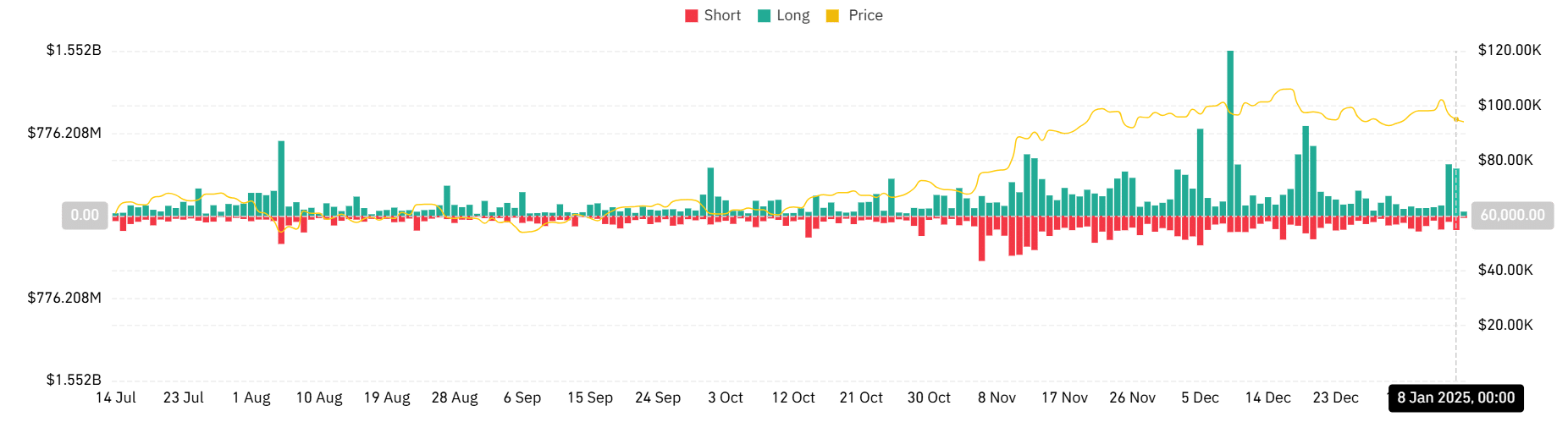

According to the data, long liquidations in the last 24 hours totaled $443.023 million, while short liquidations totaled $135.539 million.

AMBCrypto’s analysis of the liquidation chart highlights the spikes, where long positions dominated losses as prices fell sharply. Liquidations of this magnitude indicate excessive leverage among traders, exacerbating market volatility during price declines.

These forced liquidations have further fueled downward pressure on Bitcoin, Ethereum, and other major cryptos.

Source: Coinglass

The analysis found that Bitcoin had the largest liquidation, with a recorded value of over $143 million. Ethereum had the second largest liquidation, with a recorded value of over $97 million.

Why the crypto market is bad today: the broader context

The sell-off comes amid broader economic and geopolitical concerns. A recent decline in technology stocks and continued uncertainties in global markets have created a challenging environment for cryptos.

While central banks maintain an aggressive stance and investors struggle with reduced liquidity, the crypto market remains particularly vulnerable to macroeconomic shocks.

Stablecoins have shown relative resilience during this period, as evidenced by a slight increase in market share, reflecting a cautious investor turn towards safer crypto assets.

However, the riskier altcoins have borne the brunt of the recession, with significant losses across the board.

What is the future for crypto markets?

The current decline in the crypto market underlines the sector’s sensitivity to macroeconomic developments.

As investors digest the latest jobs data and its implications for Federal Reserve policy, attention will now shift to upcoming economic events, including December’s ADP employment report and Friday’s official jobs numbers.

Market participants should prepare for continued volatility as the interplay between macroeconomic data and cryptocurrency dynamics remains dominant.

For now, cautious trading and close monitoring of global economic conditions will likely determine the market’s next moves.