Solana corrects gains from the $25 resistance against the US dollar. SOL price remains supported and could aim for another rally towards $30.

- SOL price started a downward correction after failing to clear the USD 25 resistance against the US dollar.

- The price is now trading above $23.00 and the 100 simple moving average (4 hours).

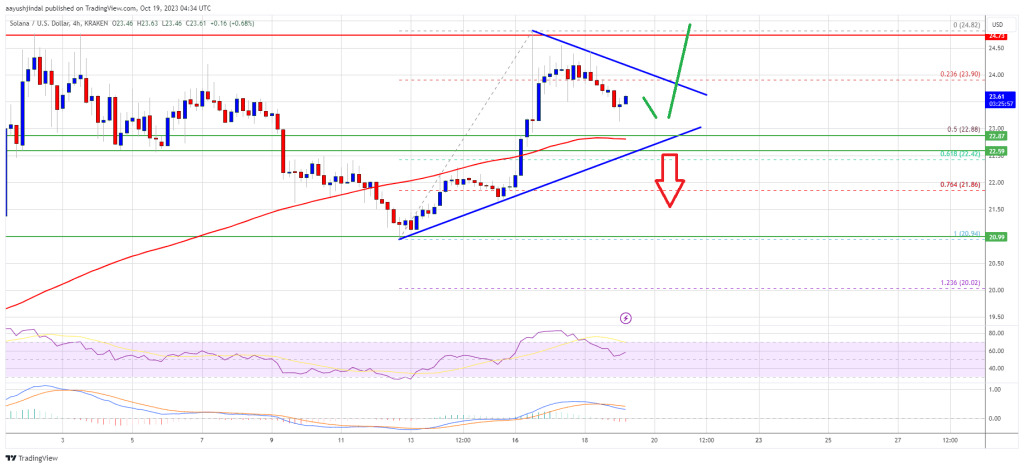

- A major contracting triangle is forming with resistance near $23.90 on the 4-hour chart of the SOL/USD pair (Kraken data source).

- The pair could start a strong rally if it overcomes the $24 and $25 resistance levels.

Solana price remains in uptrend

After a steady rise, Solana struggled to break the $25 resistance zone. SOL peaked at $24.82 and recently started a downward correction, much like Bitcoin.

There was a move below the USD 24.20 and USD 22.00 levels. The bears pushed the price below the 23.6% Fib retracement level of the upward move from the $20.94 swing low to the $24.82 high. There is also a major contracting triangle forming with resistance near $23.90 on the 4-hour chart of the SOL/USD pair.

SOL is now trading above $23.00 and the 100 simple moving average (4 hours). It is now showing positive signs and remains supported above the $22.00 pivot level.

Source: SOLUSD on TradingView.com

On the upside, immediate resistance is around the $24.00 level and the triangle area. The first major resistance is around the $24.00 level. The main resistance is still near the $25.00 zone. A successful close above the $25.00 resistance could set the pace for a bigger rise. The next major resistance is near $28.50. Any further gains could send the price towards the USD 30.00 level.

Are the dips limited in SOL?

If SOL fails to recover above the USD 24.00 resistance, the price could continue to decline. The initial downside support is near the $22.85 level or the 50% Fib retracement level of the upward move from the $20.94 swing low to the $24.82 high.

The first major support is near the $22.40 level. If there is a close below the USD 22.40 support, the price could fall towards the USD 21.80 support. In the mentioned case, there is a risk that more downsides will occur towards the USD 20.50 support in the short term.

Technical indicators

4-hour MACD – The MACD for SOL/USD is losing pace in the bearish zone.

4-hour RSI (Relative Strength Index) – The RSI for SOL/USD is above the 50 level.

Major support levels – $22.85 and $22.40.

Major resistance levels – $23.90, $24.00 and $25.00.