- DOT could rise as high as $17 if it breaks the key resistance around $10.

- On-chain metrics showed that spot buyers were aggressively purchasing DOT.

According to analyst Michaël van de Poppe, it is from Polkadot [DOT] A rise in the past 24 hours could be the start of a run that pushes the price to an all-time high.

In the post, the analyst considered DOT’s performance against Tether [USDT] and the one against Bitcoin [BTC] couple. van de Poppe said the token formed higher highs and lower lows against USDT.

North is the direction

A higher high and lower low is considered a bullish signal. It shows that an asset can withstand a downtrend and reach a higher value.

The chart the analyst shared showed that DOT had established an uptrend from $8.97. But it faced crucial resistance around the $10 region.

Source:

As it stands now, a close above resistance could foreshadow the trend triggering a rally towards $17. Furthermore, if DOT reaches $17, a breakout could occur and drive the value to an all-time high.

In terms of performance against Bitcoin, AMBCrypto, like the analyst, noted that it was at a cycle low. This condition confirmed the long-term bullish thesis for the token.

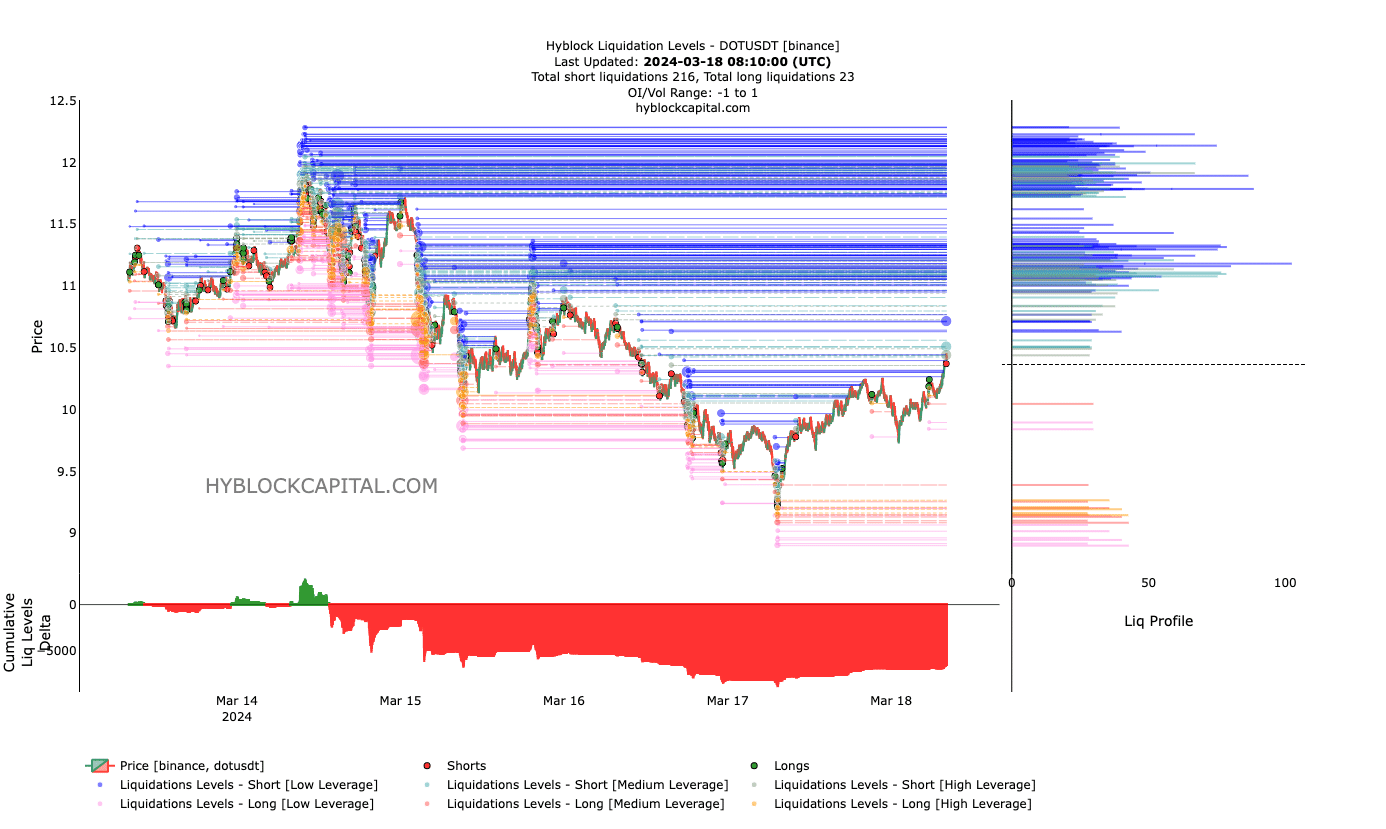

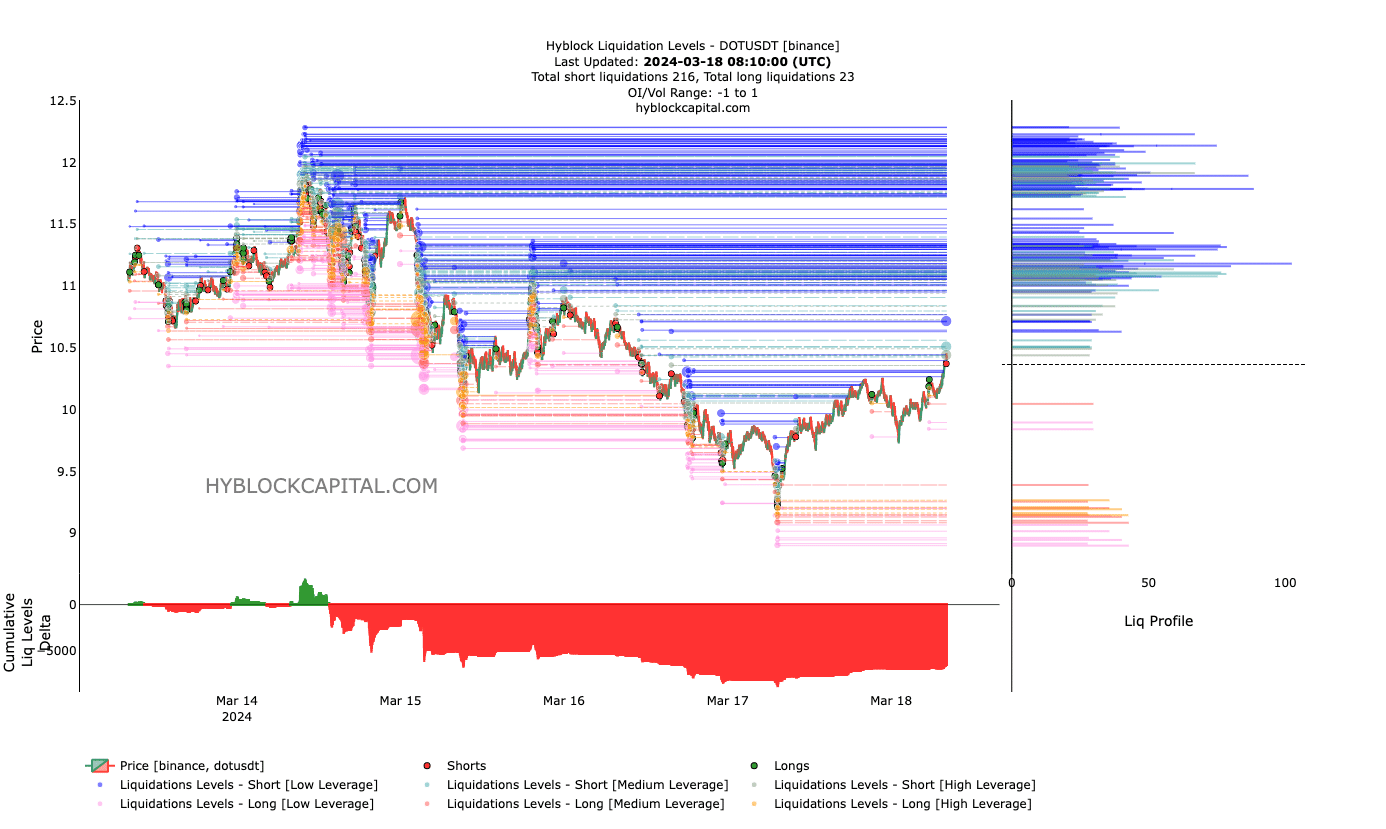

However, it is also important to assess DOT using other indicators. The first indicator we came across was the liquidation levels available on HyblockCapital’s platform.

Liquidation levels represent estimated price points where liquidation events may occur. The plot also includes a section for the Cumulative Liquidation Level Delta (CLLD).

This CLLD indicates whether actions in the derivatives market are fueling a bullish or bearish bias.

It doesn’t look good for shorts

At the time of writing, AMBCrypto noted that there was no cluster of liquidity between $10.36 and $10.96. Therefore, DOT could find it easy to climb towards $11.

However, above the above value, many liquidations can occur, especially for highly indebted traders.

On the CCLD part, the conclusion we got was that medium to high leverage short positions could be wiped out. This was because the CLLD had entered negative territory.

Source: HyblockCapital

The negative numbers suggested that short positions were trying to absorb the dip, as DOT’s price fell slightly. But long liquidation levels were also affected by the rapid recovery.

Thus, this provides a bullish thesis for the token.

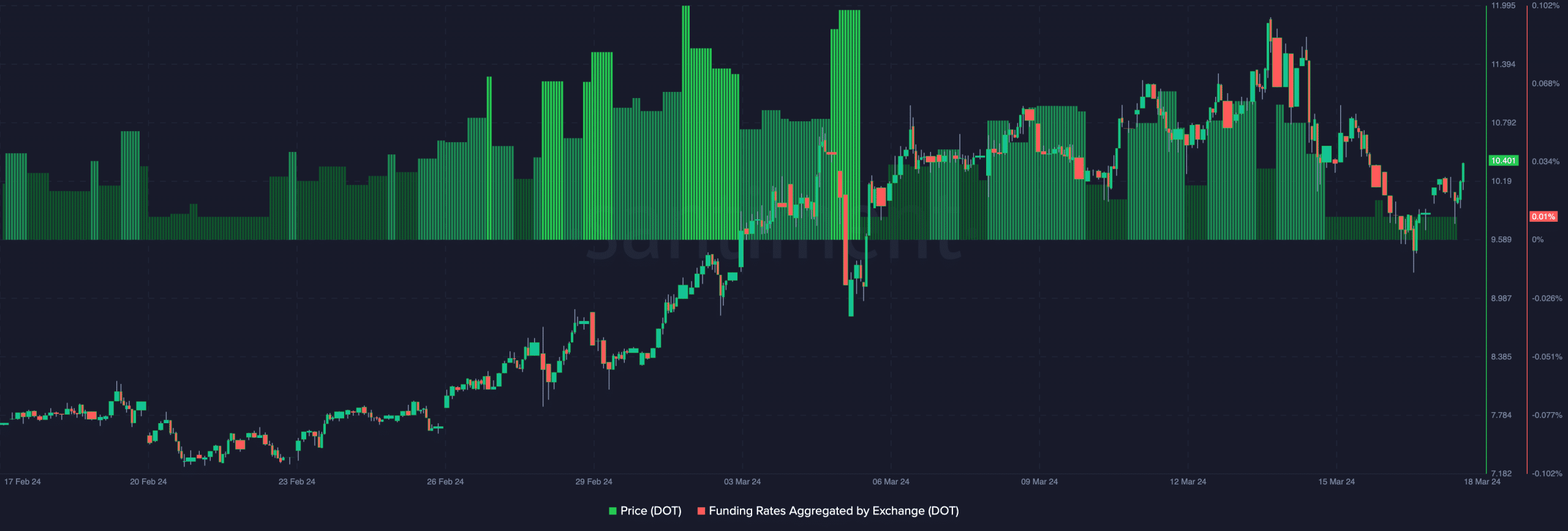

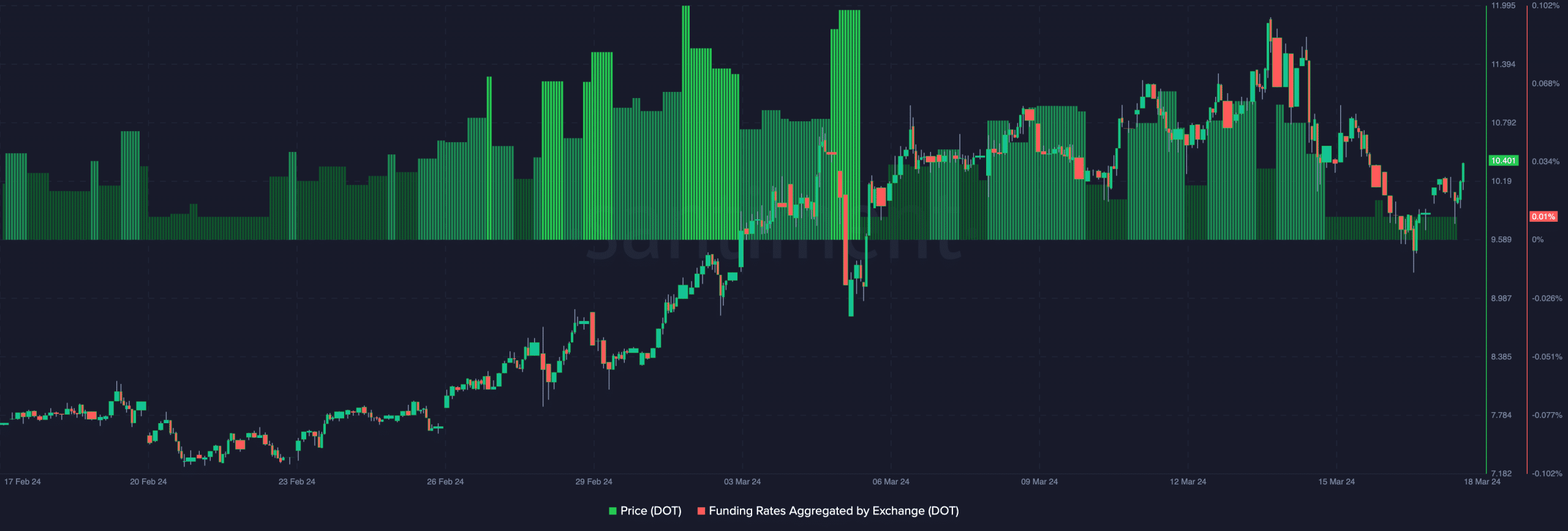

Moreover, the financing rate was positiveindicating that open long positions paid shorts to hold their positions.

For the uninitiated, financing is a product of the difference between the spot price and the perp price. One thing AMBCrypto noticed was that the financing rate became lower as the price of DOT increased.

Read Polkadots [DOT] Price forecast 2024-2025

This indicated that spot buyers were accumulating aggressively, while offender sellers didn’t believe it. For the price of the token, this was a bullish signal.

As such, DOT’s northward run could continue in the coming weeks.

Source: Santiment