- Memecoins could outperform DeFi in the short term.

- A Fed rate cut would boost the memecoins and DeFi sectors.

As the Fed’s easing cycle begins, memecoins could return as a top performer and even eclipse the DeFi sector in the fourth quarter. These were the outlooks of Toe Bautista, research analyst at crypto trading and liquidity provider GSR.

Bautista told Blockworks that renewed speculative interest could increase memecoins’ upside potential.

“Memecoin’s strength may continue due to the recent increase in speculative appetite.”

Memecoins vs DeFi

He added that the sector could outperform DeFi as the segment was still fraught with regulatory uncertainty ahead of the US elections.

“On the other hand, DeFi finds itself in a tricky middle ground. A Trump election victory is likely to lead to regulatory relaxation, offering potential DeFi outperformance, while a Harris victory could lead to continued hostility.”

In short, memecoins could benefit from the massive rally in the short term, but the segment’s outperformance versus DeFi was dependent on the outcome of the US elections.

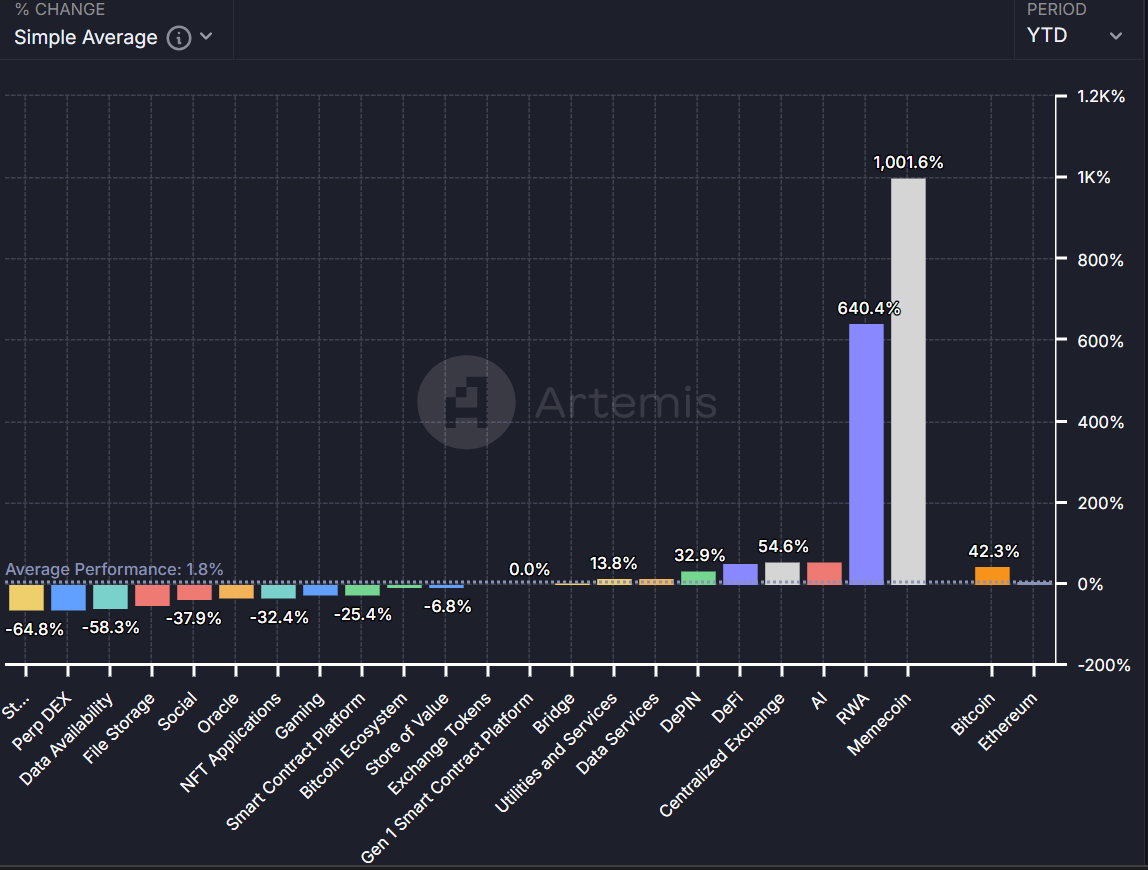

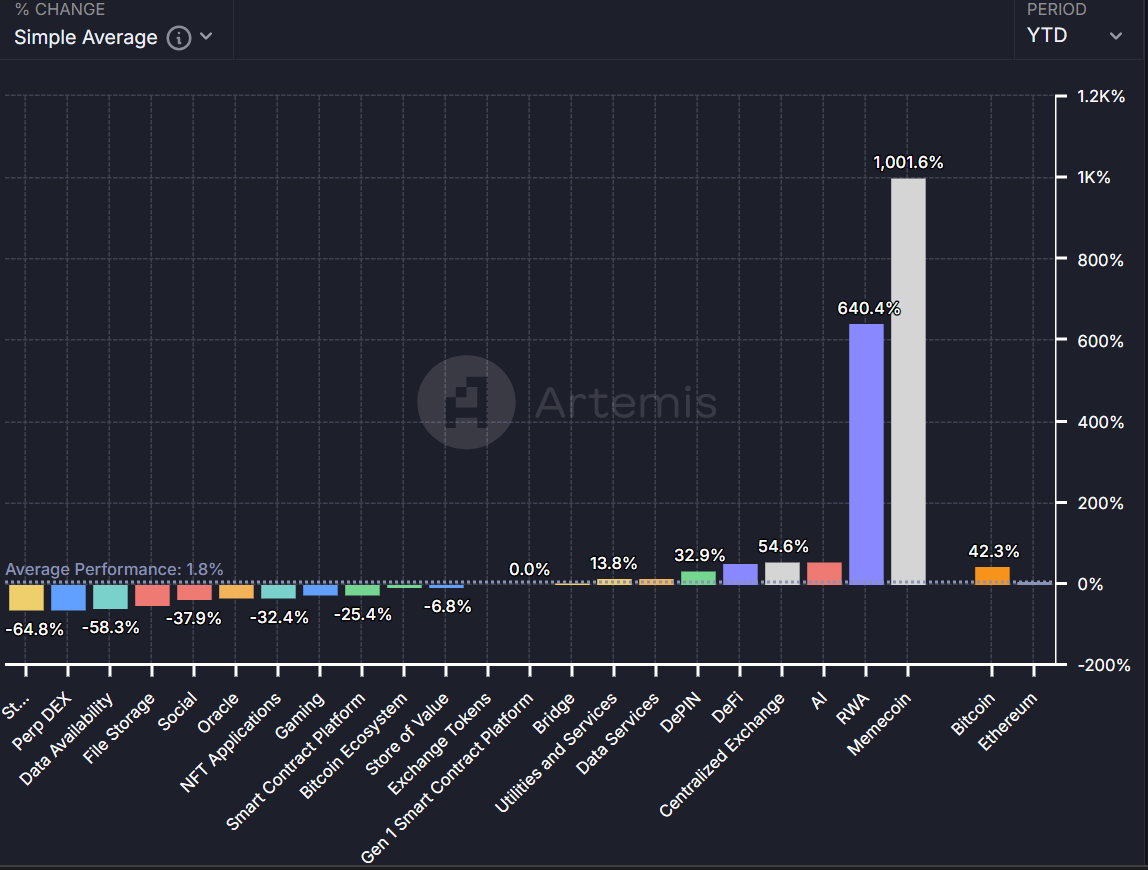

Source: Artemis

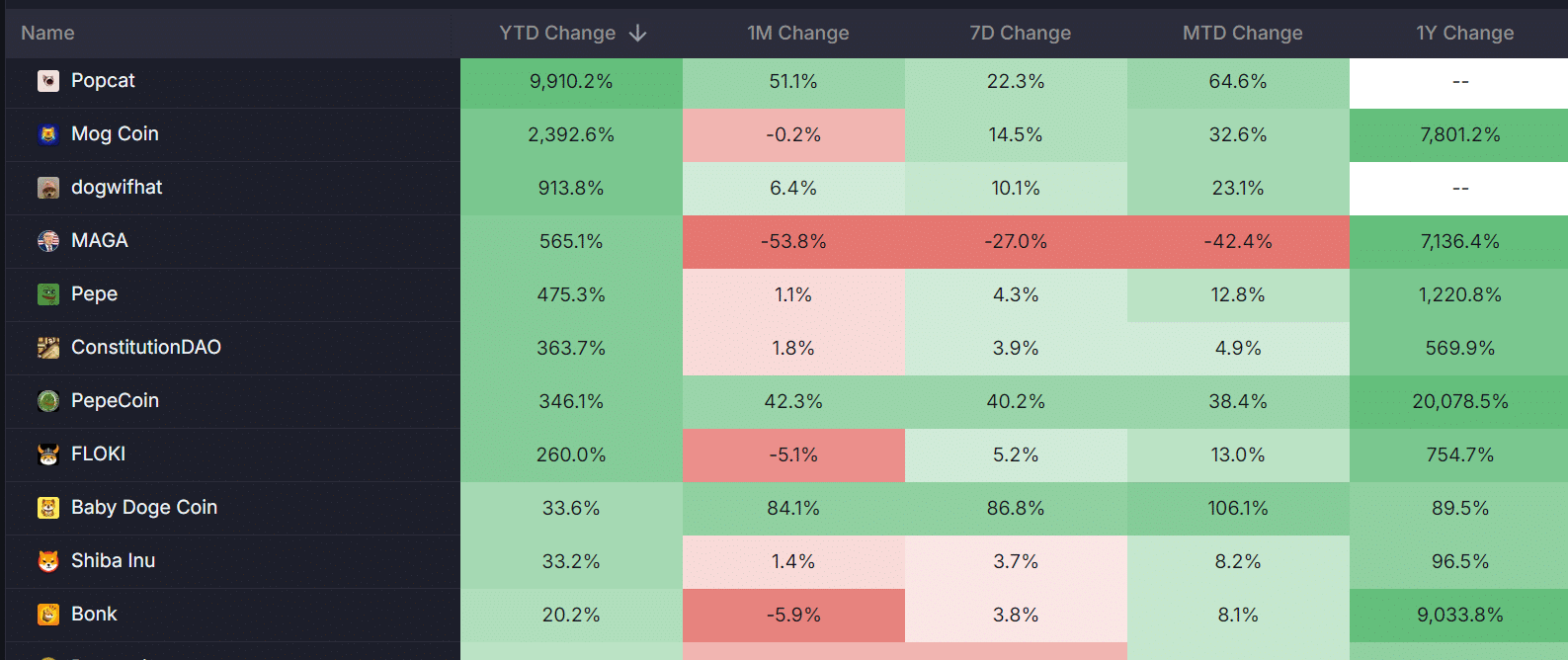

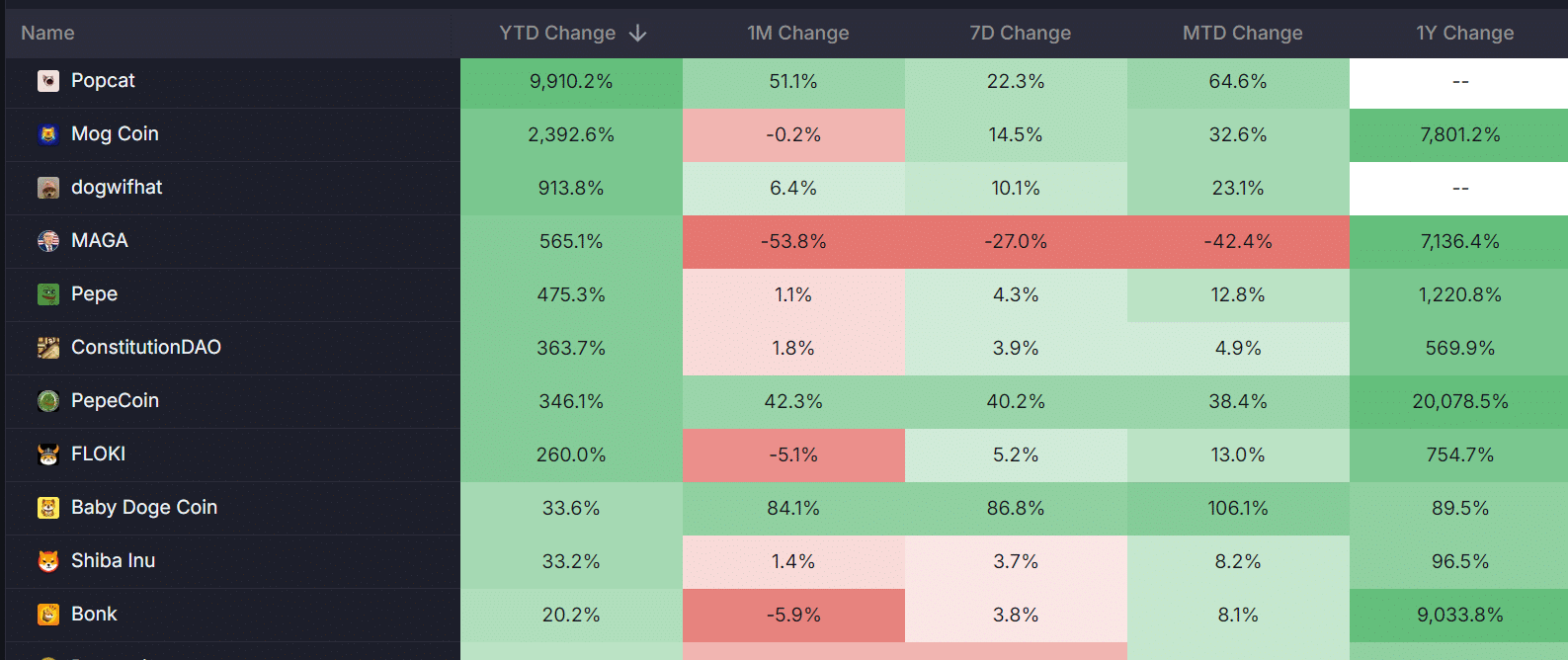

On an annual basis (YTD), Popcat [POPCAT] topped the charts with gains of almost 10,000% at the time of writing. dog hat [WIF] And Pepe [PEPE] were also outliers with triple-digit gains over the same period.

A recent Bernstein indeed report tipped the DeFi sector for upside potential amid falling interest rates in TradFi.

Bernstein analysts noted that DeFi yields could rise above 5%, beating US money market funds and segment leaders like Aaf [AAVE], Uniswap [UNI]And Airport Finance [AERO].

That said, the memecoins moat was still strong in the market. After topping the charts in the first and second quarters, the segment continued to lead on a YTD basis. On the contrary, DeFi ranked fifth with an average gain of 51% per Artemis facts.

Source: Artemis

The Fed pivot will boost speculation about memecoins and increase market interest in DeFi interest, which could boost returns from these segments. However, it remains to be seen how performance will be affected by the upcoming US elections.