This article is available in Spanish.

Data shows that Dogecoin and other meme coins are getting a lot of attention on social media, a sign that may not be ideal for Bitcoin.

The top 6 memecoins have seen their social dominance rise lately

In a new post on

The ‘social dominance’ here refers to an indicator that basically tells us about the mindshare that a particular asset or group of coins currently has on the major social media platforms.

Related reading

More formally, the value of the metric is calculated as a percentage of the discussions regarding the top 100 cryptocurrencies by market capitalization that the given asset makes up for.

To determine this, the indicator collects posts/threads/messages available on five platforms: X, Reddit, Telegram, 4Chan and BitcoinTalk. They are then filtered by the relevant keyword.

Note that for measuring ‘discussion’ the metric simply counts those posts that contain at least one mention of the item, rather than counting the mentions themselves. The advantage of this methodology is that outliers with hundreds of entries do not distort the data.

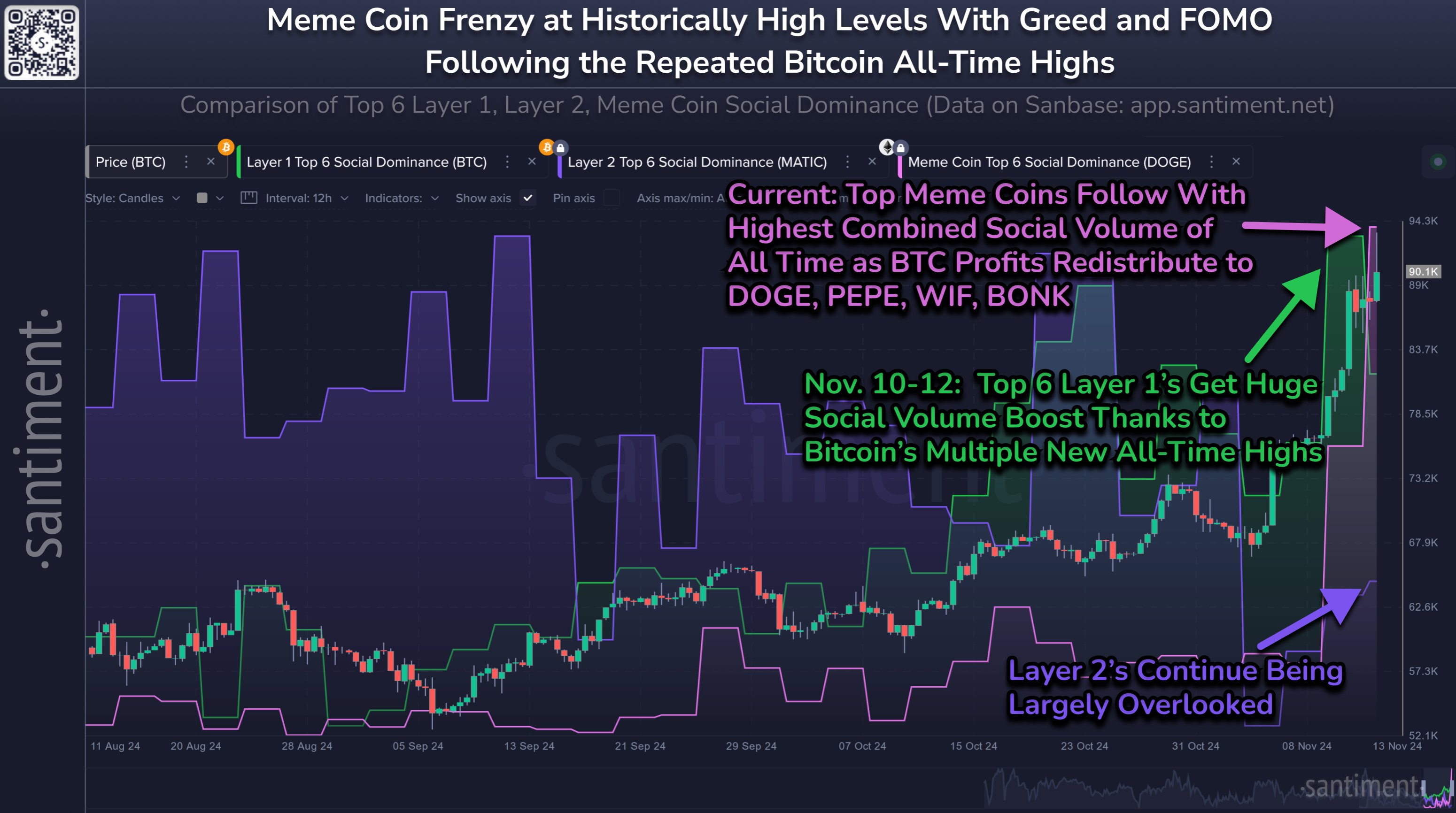

Here is the graph shared by the analytics firm showing how social dominance regarding three subsections of the market has changed in recent months:

The three segments in question are the top six tier 1, the top six tier 2, and the top 6 memecoin. “Layer 1” networks refer to the primary blockchains that provide their own security, such as Bitcoin and Ethereum. Networks like Polygon that are built on top of these chains are known as ‘layer 2’. Naturally, the meme coins refer to the popular meme-based tokens, such as Dogecoin and Shiba Inu.

The chart shows that the social dominance of layer 1, top 6, had skyrocketed a few days ago due to Bitcoin setting multiple new all-time highs (ATHs).

BTC has continued to explore new highs since then, but it appears that the focus of social media users has shifted elsewhere, with the social dominance of the tier 1 giants witnessing a cooling off.

The indicator has remained relatively low for the tier 2 coins during this period, implying that traders have not cared much about it lately. The assets that have attracted all the attention are the memecoins, which have just seen their discussion reach a new high.

The reason behind this high interest in these tokens is the impressive rally that Dogecoin has experienced over the past week, leaving the rest of the sector in the dust after gaining over 104%. However, if history is anything to go by, this outperformance may not be such a good thing.

“Historically high social dominance in speculative assets tends to indicate greed and emotional trading,” Santiment notes. Assets in the cryptocurrency sector tend to move opposite to the public’s views, so greed is something that has generally led to top figures for the market.

Related reading

As such, there may need to be a shift in focus away from Dogecoin if Bitcoin and others are to continue their bull run.

Dogecoin price

At the time of writing, Dogecoin is trading around $0.398, up more than 2% in the last 24 hours.

Featured image from Dall-E, Santiment.net, chart from TradingView.com