- Bitcoin’s dominance has waned, allowing altcoins to emerge as “safe havens” during risky periods.

- However, complete independence is still far away as altcoins remain vulnerable to Bitcoin’s fluctuations.

The past twenty days have been a rollercoaster for the crypto market, filled with wild swings and intense emotions.

It all started with that Bitcoin [BTC] It rose to a new all-time high of $99,317, pushing its market dominance to an impressive 61%.

But just as quickly as the excitement increased, the market began to cool, leaving everyone wondering: what’s next?

The bears have certainly made it clear that reaching $100,000 won’t be an easy feat; patience will be tested.

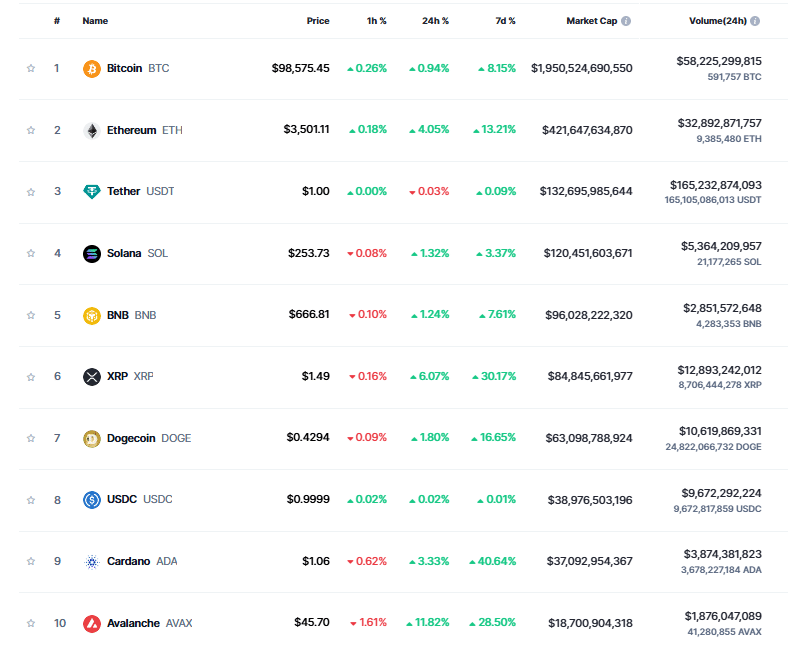

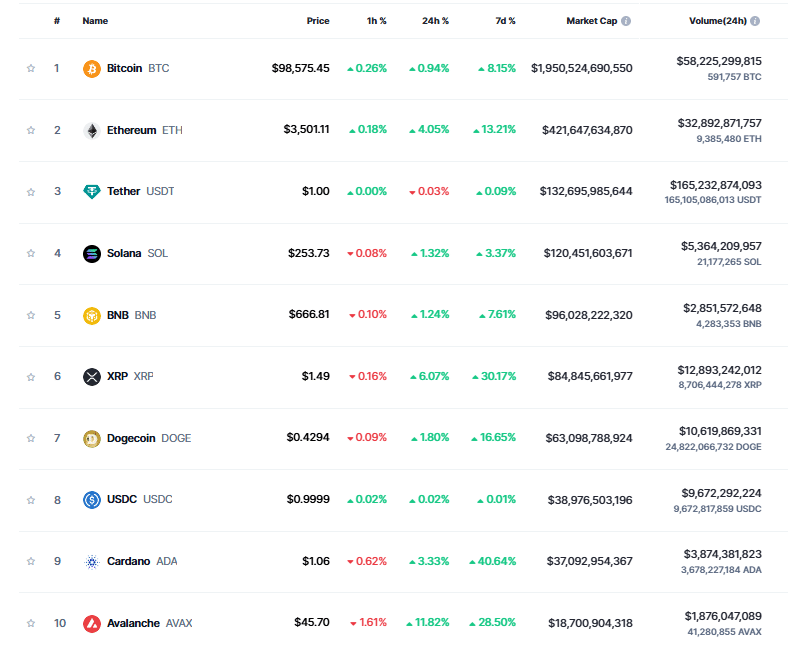

As a result, another day has passed where the target was still out of reach, with Bitcoin now trading at $98,300 and its dominance having fallen below 59%.

Amidst the uncertainty, altcoins have emerged as the biggest winners, with some racking up triple-digit gains in less than a week.

Bitcoin’s high stakes appear to have shifted investors’ focus to more affordable assets.

Still, the fate of altcoins remains dependent on Bitcoin’s performance. While consolidation has allowed many to break through key psychological resistance levels, a Bitcoin pullback could quickly reverse these gains.

Altcoins should focus on ‘unique’ strengths

It is true that there is an underlying one shift is gaining momentum in the market. Historically, altcoins have closely followed Bitcoin’s movements.

However, in recent cycles, altcoins have diverged, developing as a distinct asset class.

For example, on the time frame of one day, Ethereum has reclaimed the $3,500 resistance level, a target last seen in July.

In fact, ETH is just one of many altcoins hitting major price milestones in this cycle, including breaking the elusive $1 barrier.

Source: CoinMarketCap

This shift corresponds to a steady decline in Bitcoin dominance over the past four days. Contrary to popular belief, a decline in Bitcoin dominance does not automatically indicate a bearish phase.

Instead, it reflects the growing popularity of altcoins as they capture a larger share of the market.

As discussed, this is often caused by investors reallocating profits from Bitcoin’s rise to altcoins to diversify and pursue higher returns.

However, achieving true independence from Bitcoin’s market fluctuations requires focusing on the unique strengths of individual altcoins to differentiate them from broader market volatility.

Solana [SOL]for example, has become a standout and is known for its high throughput and lightning-fast transaction speeds, making it a promising competitor.

That said, a complete decoupling of altcoins and Bitcoin is still in its infancy. Currently, only a handful of altcoins exhibit significant independence.

Therefore, their correlation with Bitcoin’s performance remains largely unchallenged until more altcoins show similar resilience. Therefore,

If Bitcoin’s dominance falters, it could drag the market down

With Bitcoin hovering below $100,000 after 20 days of market excitement, analysts suggest a healthy retracement is imminent. to draw of overheating are becoming increasingly apparent.

According to AMBCrypto, a pullback to the $96,000 – $98,000 range would likely maintain market confidence given BTC’s week-long fluctuations within this range.

However, a dip below this range could mean problemespecially for altcoins.

In March, after Bitcoin reached its previous ATH of $73,000, a 5% drop over the next two days caused panic, sending Bitcoin down to $69,000 and dropping its dominance to around 50%.

This led to a market-wide crash, with altcoins suffering even more. However, much has changed since then, with select altcoins now emerging as ‘safe havens’ during periods of high risk.

While a reaction as severe as last time may not occur, a correction remains inevitable as altcos’ movements remain closely linked to Bitcoin’s.

Read Bitcoin’s [BTC] Price forecast 2024-25

Therefore, altcoins are likely to follow suit if Bitcoin’s dominance falters and falls below $95,000.

Despite growing confidence in certain altcoins, their safe-play status won’t protect them from losses as investors retreat in fear of a broader market slide.