- Trump’s rate announcement has wiped out $ 490 million from Crypto when the prices of Bitcoin and Ethereum fell sharply.

- Sentiment caught up with fear, while correlated stock sale deepens the downward momentum of Crypto.

The Cryptocurrency market saw intense volatility over the past 24 hours, fueled by the radical new rates of US President Donald Trump.

These include a minimum 10%duty for all input, with higher rates for important partners such as China (34%), Japan (24%) and the European Union (20%).

As the news broke out, both traditional and digital markets responded quickly. Bitcoin [BTC] fell from $ 88,500 to $ 83,500, while Ethereum [ETH] Fell from $ 1,934 to less than $ 1,800 at the time of writing.

Moreover, the total crypto market capitalization fell by 2%and settled almost $ 2.68 trillion. This decrease took place during the Mid-Eastern trading session on 3 April.

Such a sharp reaction underlines how sensitive crypto stays into global macro -economic shocks. That is why these rates not only disrupted world trade – they caused a direct hit for digital assets.

Liquidations destroy more than 160,000 traders

After the recent price decrease, more than $ 490 million were liquidated by lifting tree positions, with more than 160,000 traders. The largest single liquidation took place on Binance, where an ETH/USDT position worth $ 12 million was closed. Most losses were sustained by long traders who had gambled on rising prices.

Bitcoin Futures was good for $ 170 million in liquidations, while Ethereum contracts lost $ 120 million. Smaller Altcoins contributed an extra $ 50 million to the total.

Interestingly, the volatility influenced both markers – $ 257 million came from long positions from liquidated, while $ 232 million came out of shorts. This recession ultimately punished both Bullish and Bearish traders.

Market sentiment shifts sharply in fear

In the first instance, the market experienced a short wave of optimism. However, since traders fully assessed the impact of the rates, that trust disappeared quickly.

Market analyst Rachael Lucas reported an increase of 46% in trade volume, driven by major players who adjust their positions. Retail traders, on the other hand, remained especially careful.

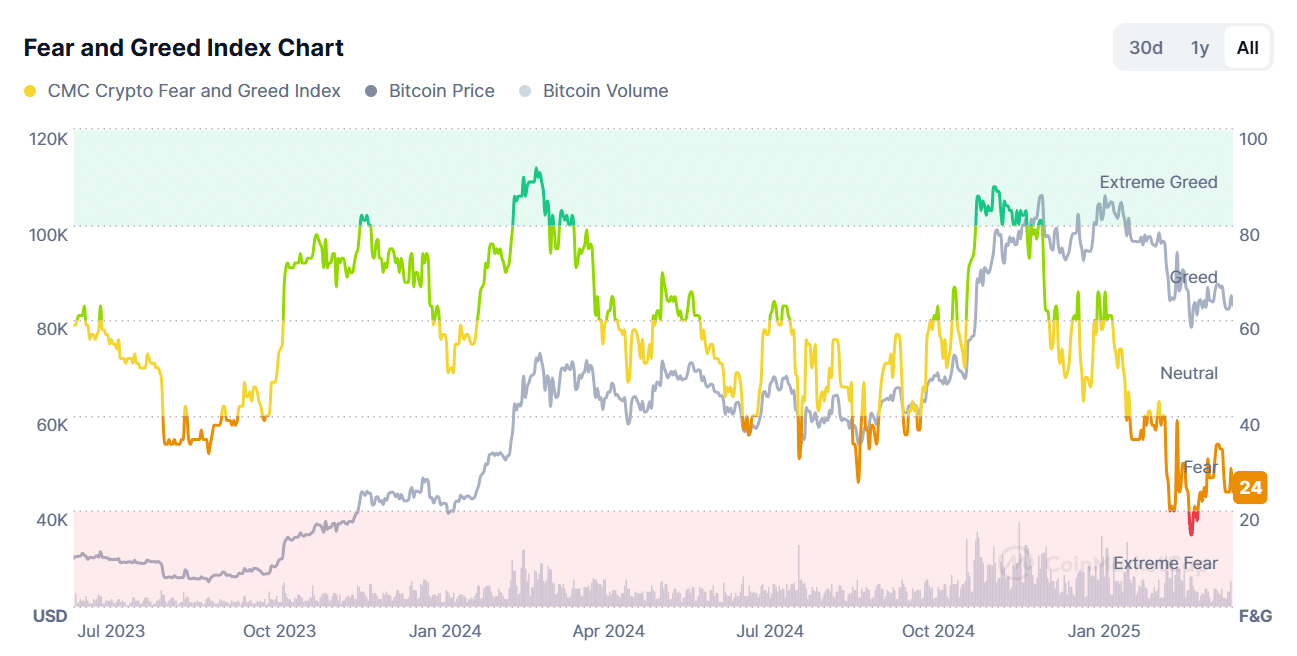

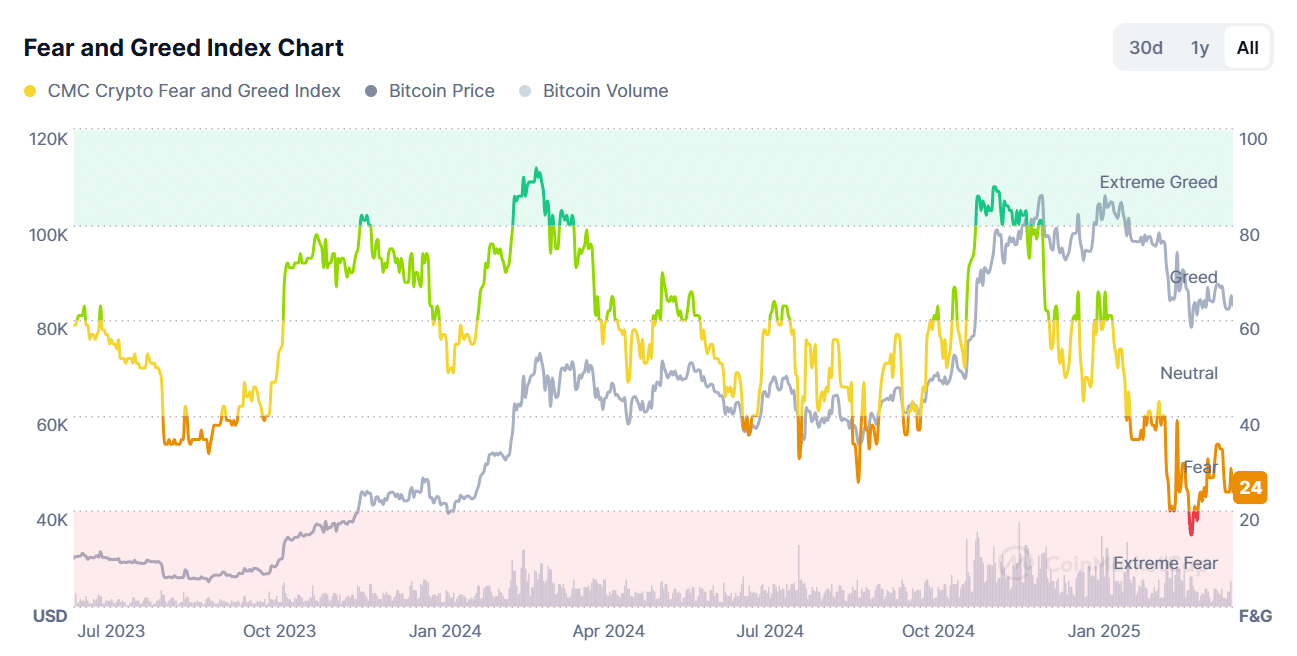

The Crypto Fear & Greed Index dropped to 24, which indicates increased fear on the market. Just a week ago, sentiment was closer to neutral. This sharp shift in investors forecast emphasizes how sensitive the market is to important policy changes.

Source: Coinmarketcap

The sale of the heavy stock market is burning crypto losses

The S&P 500 Futures will throw $ 2 trillion to market capitalization within just 15 minutes after the announcement. Large technical shares, including Apple (-5.59%), Amazon (-4.50%) and Nvidia (-3.43%), experienced significant losses.

This broad sale also came across to cryptocurrency markets.

As cryptom markets have been correlated with shares, both sectors fell at the same time. Consequently, the panic in traditional finances increases the crypto -crash. The shock was both immediately and closely connected to widespread economic fears.

In conclusion, the crypto market crash was directly caused today by US trade rate announcements.

These caused anxiety, caused mass liquidations and were tailored to a global sale of shares. That is why a clear geopolitical policy – no rumors – was the main cause of the crash.