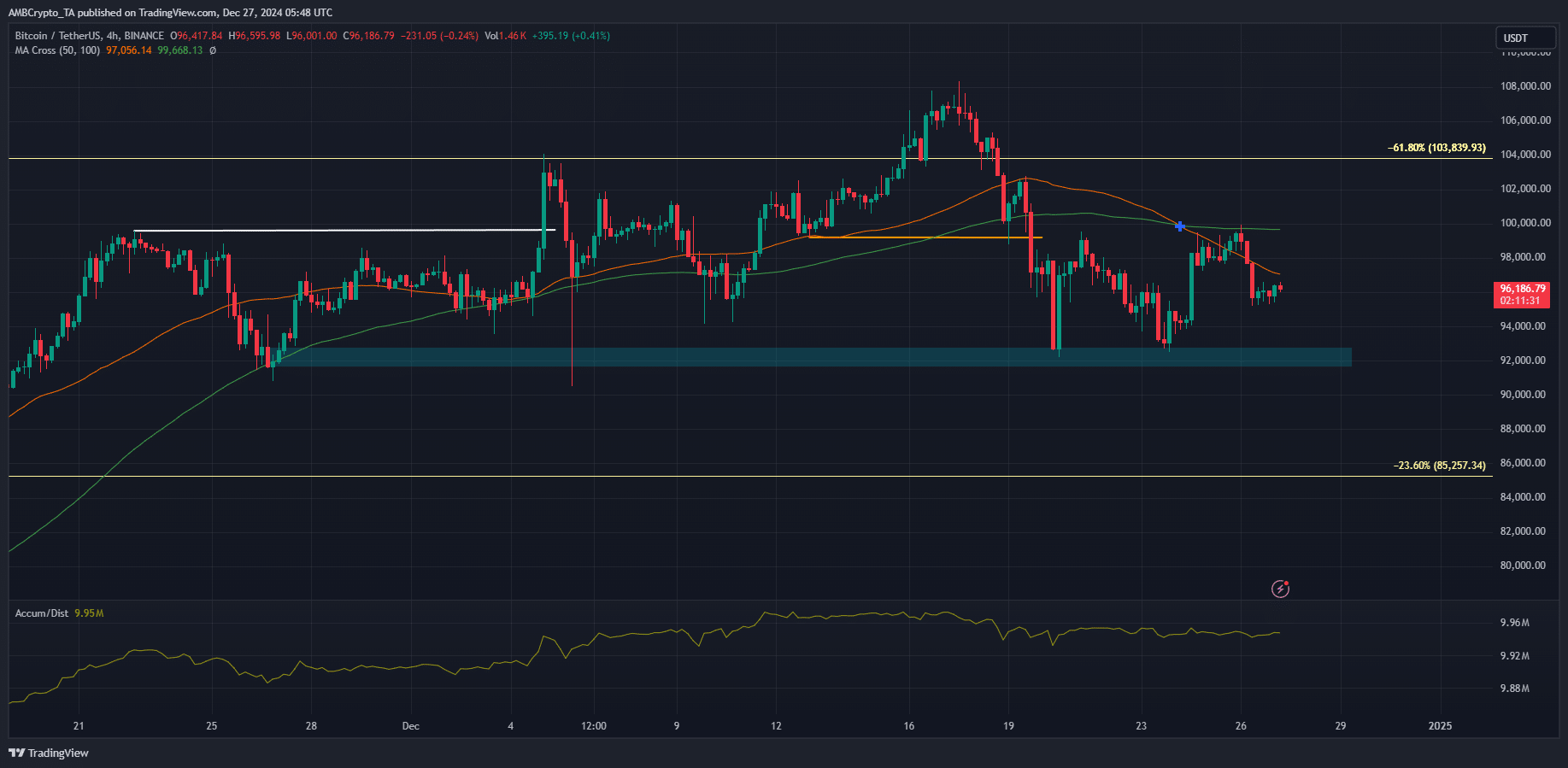

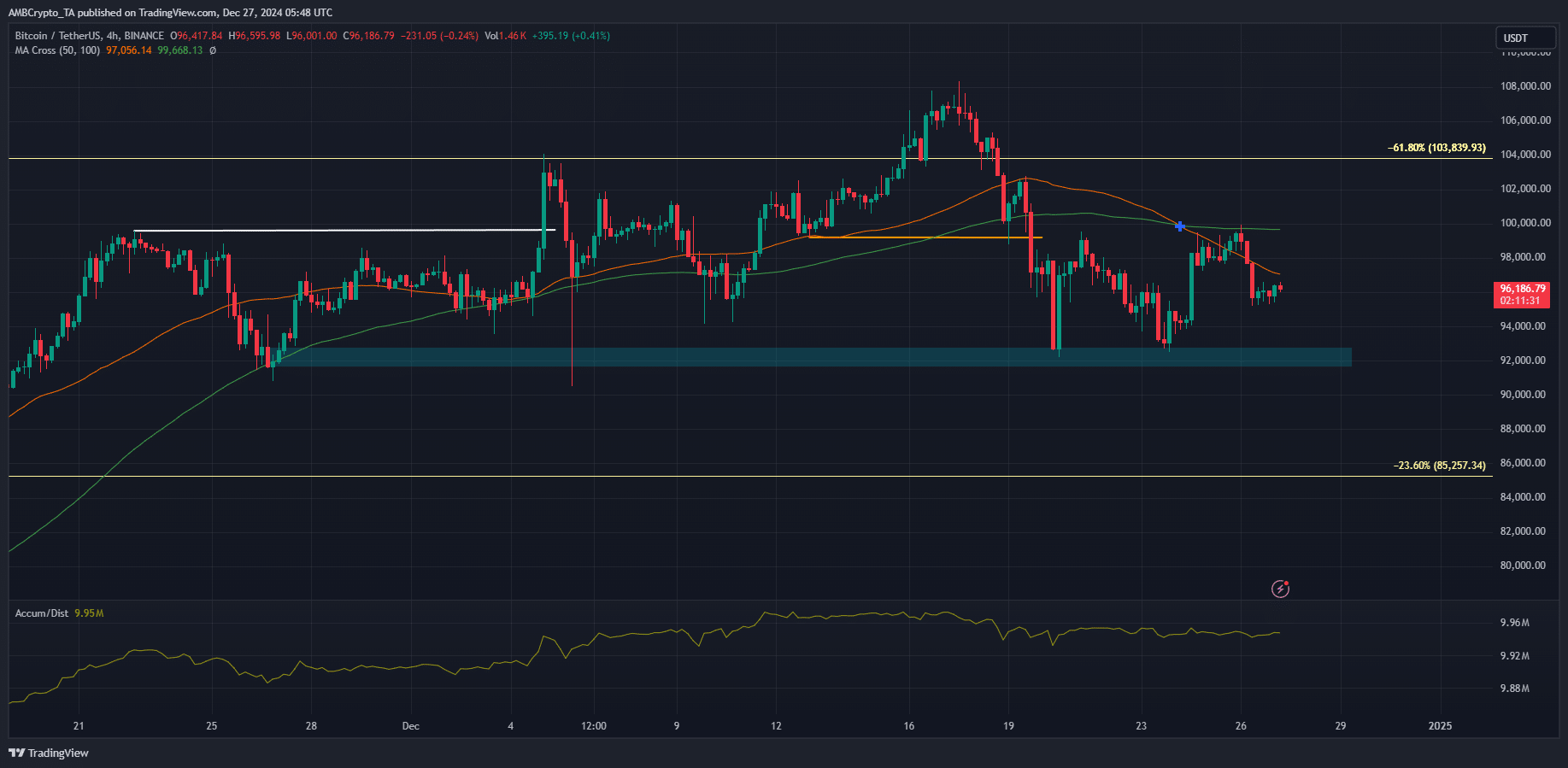

- Bitcoin maintained a bearish structure on the 4-hour chart

- There has been steady selling lately, but sentiment seemed to point to a price increase

Bitcoin [BTC] saw its Christmas rally start to fade, and an attempt to climb past the $100,000 mark was halted on Boxing Day. The two-day meeting of the US Federal Reserve, which started on December 17, ended in a policy statement. One that predicted only two interest rate cuts in 2025, instead of the previously expected four.

As a result, the Dow Jones fell by more than 2.5%, or just over 1,150 points. These losses have since been recovered, but the market was not so kind to Bitcoin.

The risk status of assets slows recovery

Source: BTC/USDT on TradingView

The broader crypto market generally follows the trend of Bitcoin. In the past 24 hours, BTC fell 2.75% and the altcoin market lost 2.31% of its value. If we examine the trend of BTC on the 4-hour chart, we can see that the bearish market structure was still at play.

It turned bearish on December 19, highlighted in orange. Since then, the A/D indicator has also slowly declined, indicating reduced buying pressure. The moving average formed a bearish crossover, further highlighting the downward momentum of the past ten days.

Crypto fell today. Will it regain the uptrend next month?

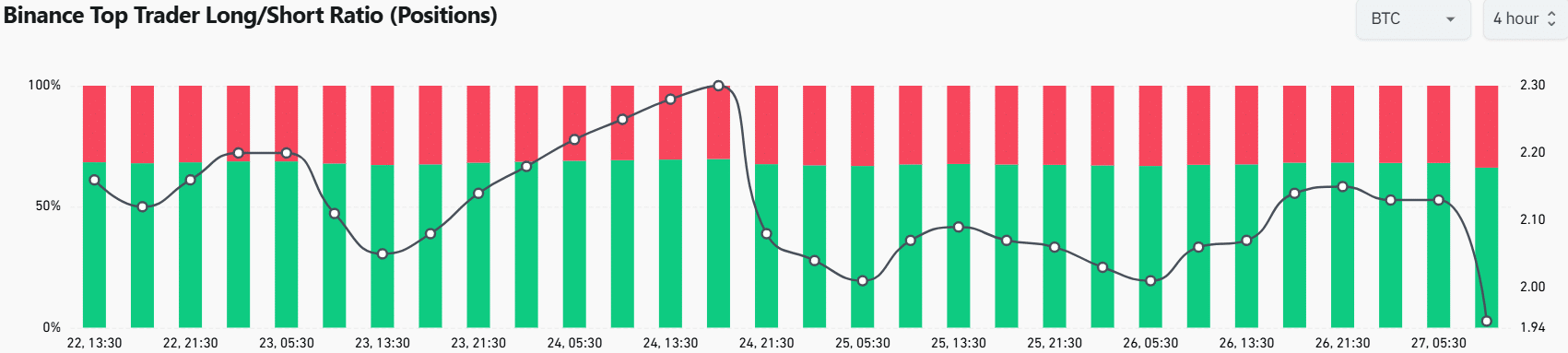

Analysis of the positions of top traders on Binance using Coinglass data showed that there is some hope in the short term. AMBCrypto found that this metric, which measures the long or short positions of the top 20% of traders, was 1.95.

Long positions accounted for 66.12%, and shorts 33.88% – a sign of bullish sentiment among top traders.

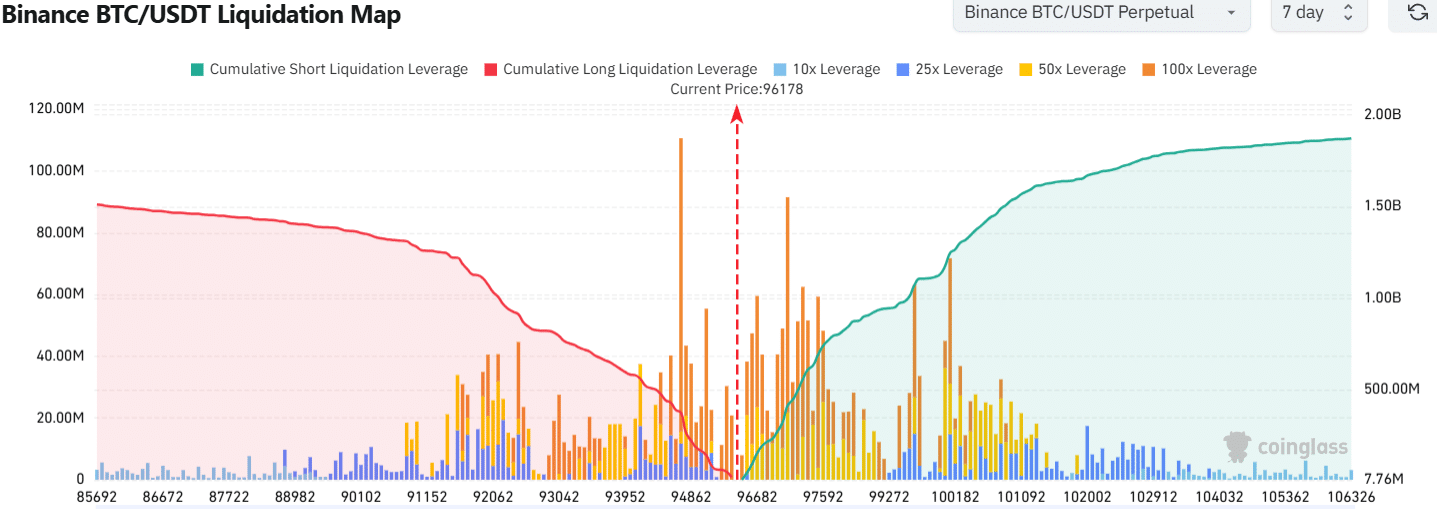

The liquidation chart helped reinforce this bullish short-term idea. Liquidations in the north were more numerous, meaning a liquidity rush to the north was more likely in the coming days.

Is your portfolio green? Check the Bitcoin Profit Calculator

Based on last week’s data, AMBCrypto found that a price move near $97.6k could be monitored and rejected by sellers. Further volatility can be expected as 2024 draws to a close.