- The cryptocurrency market witnessed a carnage that wiped out $500 million in both long and short positions.

- The massacre was sparked by escalating geopolitical tensions in the Middle East.

The cryptocurrency market traded in the red on October 2 as the total market capitalization fell by more than 5% to $2.25 trillion at the time of writing.

Bitcoin [BTC] succumbed to bearish pressure and fell to a seven-day low below $61,000. Most altcoins have also wiped out their recent gains Ethereum [ETH] fell 6.5% to trade at $2,473 at the time of writing.

Binance coin [BNB] And Solana [SOL] also fell 4.9% and 5.7% respectively, while Ripple [XRP] fell below $0.60 after a 3.6% dip.

Dogecoin [DOGE] recorded the most losses among the top ten largest cryptocurrencies by market capitalization, after falling 9% and trading at $0.108 at the time of writing.

Similar declines were also seen in traditional financial markets, with Japan’s Nikkei 225 index down 2.5%, according to figures. Google Finance.

Crypto market responds to geopolitical tensions

Escalating geopolitical tensions in the Middle East after Iran fired hundreds of missiles into Israel have fueled these widespread losses. During this event, traders became concerned about the performance of risky assets.

In times of uncertainty, investors tend to flee risky assets like crypto and flock to safe havens.

For example, when crypto prices plummeted, gold experienced minimal losses of less than 1%.

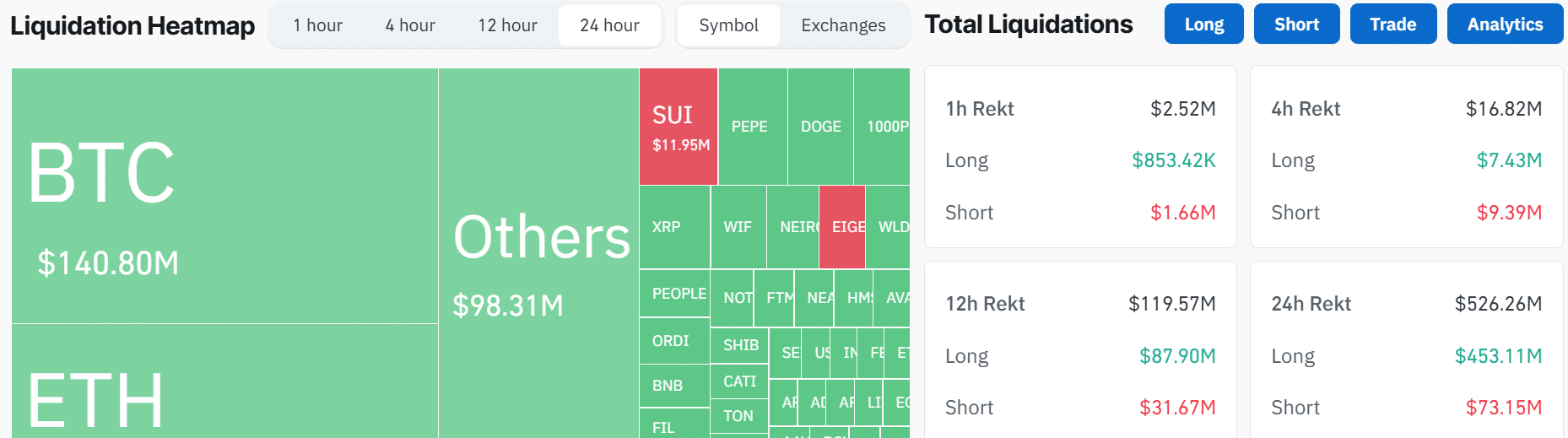

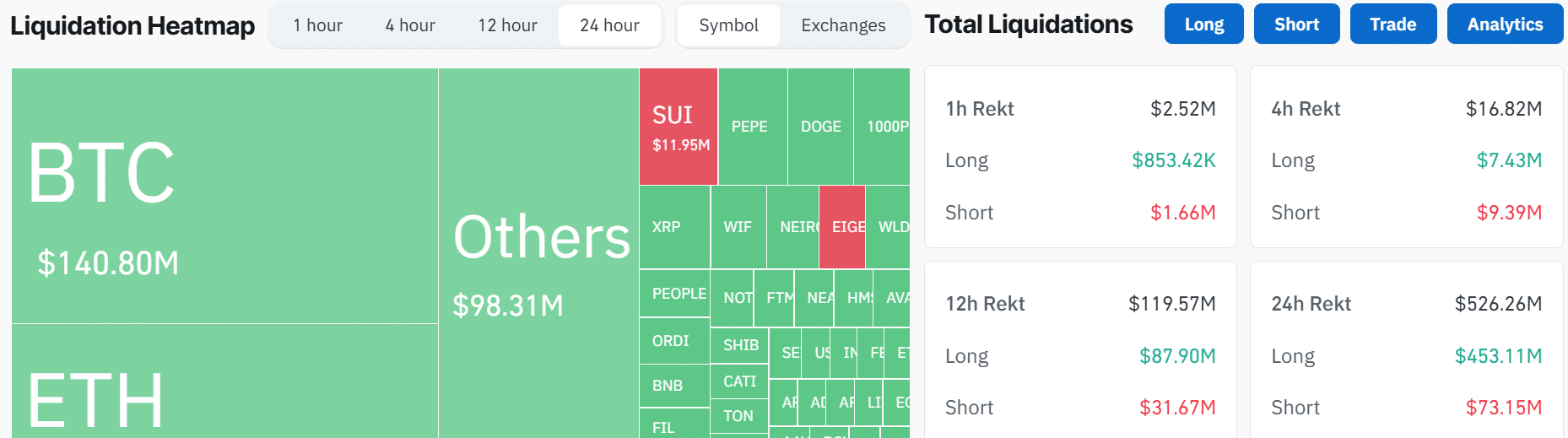

Source: Coinglass

Data from Mint glass shows that over $500 million has been liquidated from the market in the last 24 hours, of which $450 million are long positions. These liquidations affected more than 155,000 traders.

Bitcoin and Ethereum saw the highest liquidations at $140 million and $110 million respectively. According to Coinglass, the largest single liquidation occurred on Binance, where one trader was liquidated for more than $12 million.

Crypto ETFs Post Outflows

Data from SoSoValue shows that on October 2, US Bitcoin Exchange Traded Funds (ETFs) saw outflows of $242 million on October 2, the highest level since early September.

Fidelity’s Bitcoin ETFs saw the largest outflows at $144 million. All other Bitcoin ETF products had zero to negative flows except BlackRock. The iShares Bitcoin Trust ETF continued its positive trend, with inflows of $40 million.

Ethereum ETFs also turned negative with outflows of $48 million, the highest in more than a week.

The negative data comes as the Bitcoin fear and greed index plummeted to 42, the lowest reading in more than two weeks, as fear gripped the market.