- There was a sharp increase in the number of institutional investors.

- Fees collected by miners fell 32% in the week.

In what was a sign of clear bullish sentiment, Bitcoin [BTC] Nearly $540 million was withdrawn from the centralized exchanges last week. This according to an analysis company in the chain In the block, was the largest weekly net outflow since June 2023.

Typically, spikes in currency outflows imply a short-term accumulation trend, likely driven by expectations of higher returns in the future.

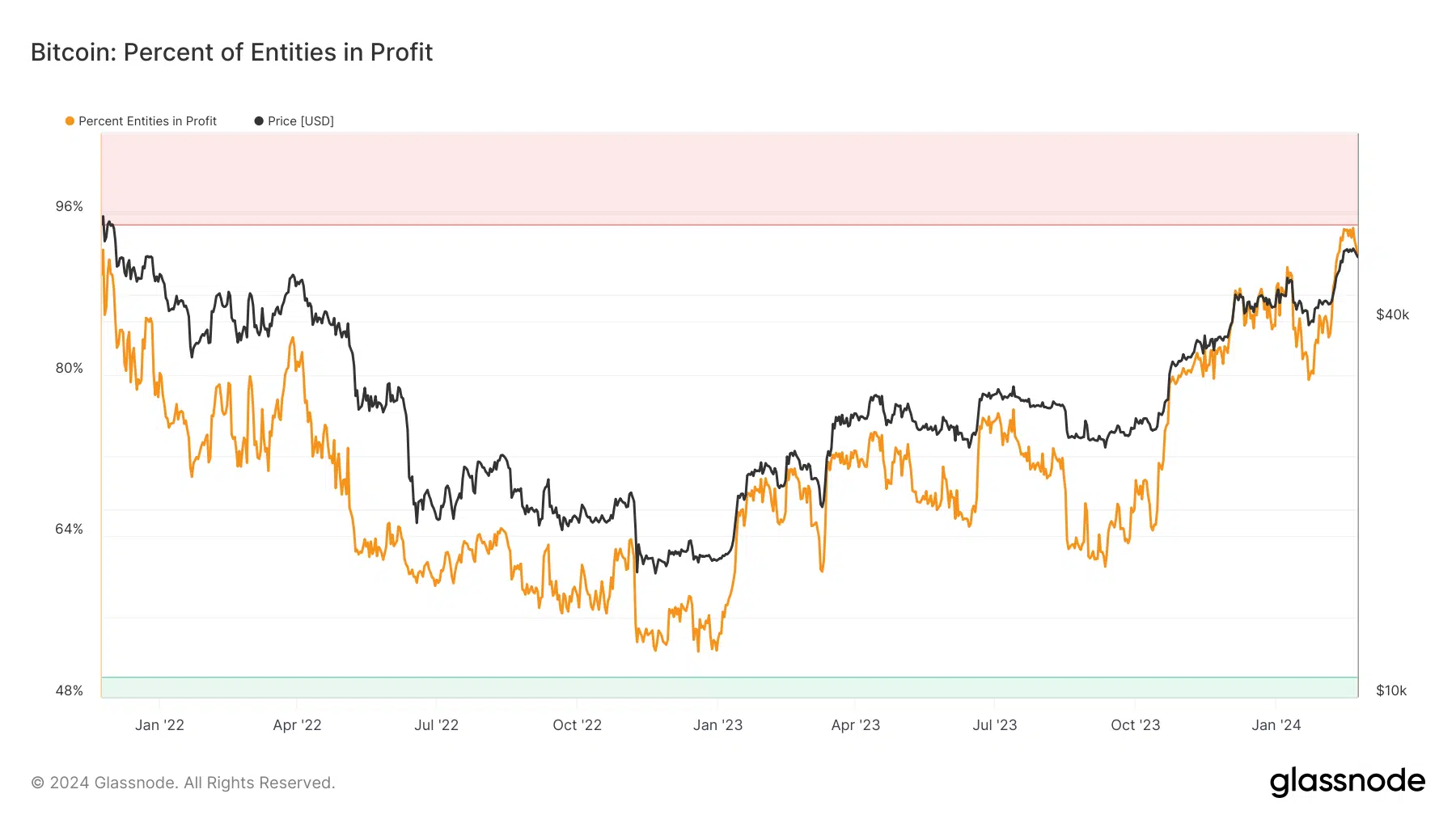

The trend also reflected investors’ preference for HODL rather than liquidating their holdings for profit. This was interesting considering that over 94% of all Bitcoin entities were making profits at the time of writing, according to AMBCrypto’s analysis of Glassnode’s data.

What the traders are doing

Another telling indicator of broader market accumulation was the jump in the number of institutional investors.

The number of unique entities holding at least 1k coins reached 1,670 at the time of writing, an increase of 12% from the past month. This figure was also reminiscent of the early bull market period of 2021.

As users focused on accumulation, transaction activity on the network decreased. Bitcoin miners collected just over $11 million in network usage fees last week, marking a 32% drop.

In fact, further investigation revealed that the percentage of miner revenue from fees fell sharply, from 26% at the start of the year to 3.23% at the time of writing.

This may not be pleasant reading for miners monitoring the first-generation blockchain, who will face a drop in block rewards after next month’s halving.

The king coin has hit a range limit in the past week, hovering in a narrow zone between $51,000 and $52,000, according to CoinMarketCap. The sideways move was another sign that Bitcoin was piling up.

Read BTC price forecast for 2024-2025

The market was “extremely greedy” at press time, as evidenced by AMBCrypto’s research into the Hyblock Capital movement.

This suggested that more investors would enter the market, eventually leading to an upside breakout.