- BTC fell about 9% to $90,000 amid panic selling of $4 billion by short-term holders.

- Analysts predicted a likely post-Thanksgiving recovery in the US, citing historical trends.

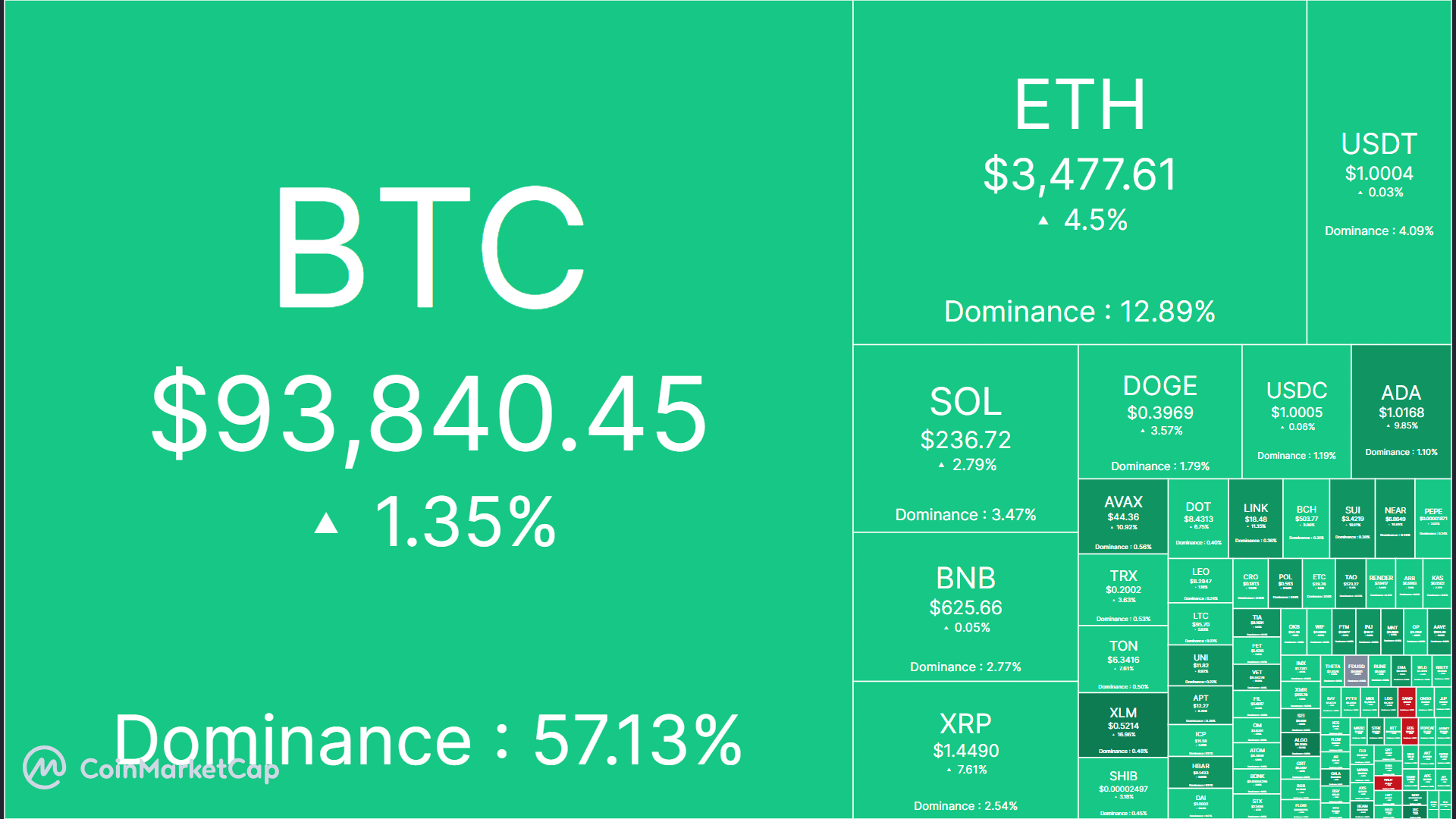

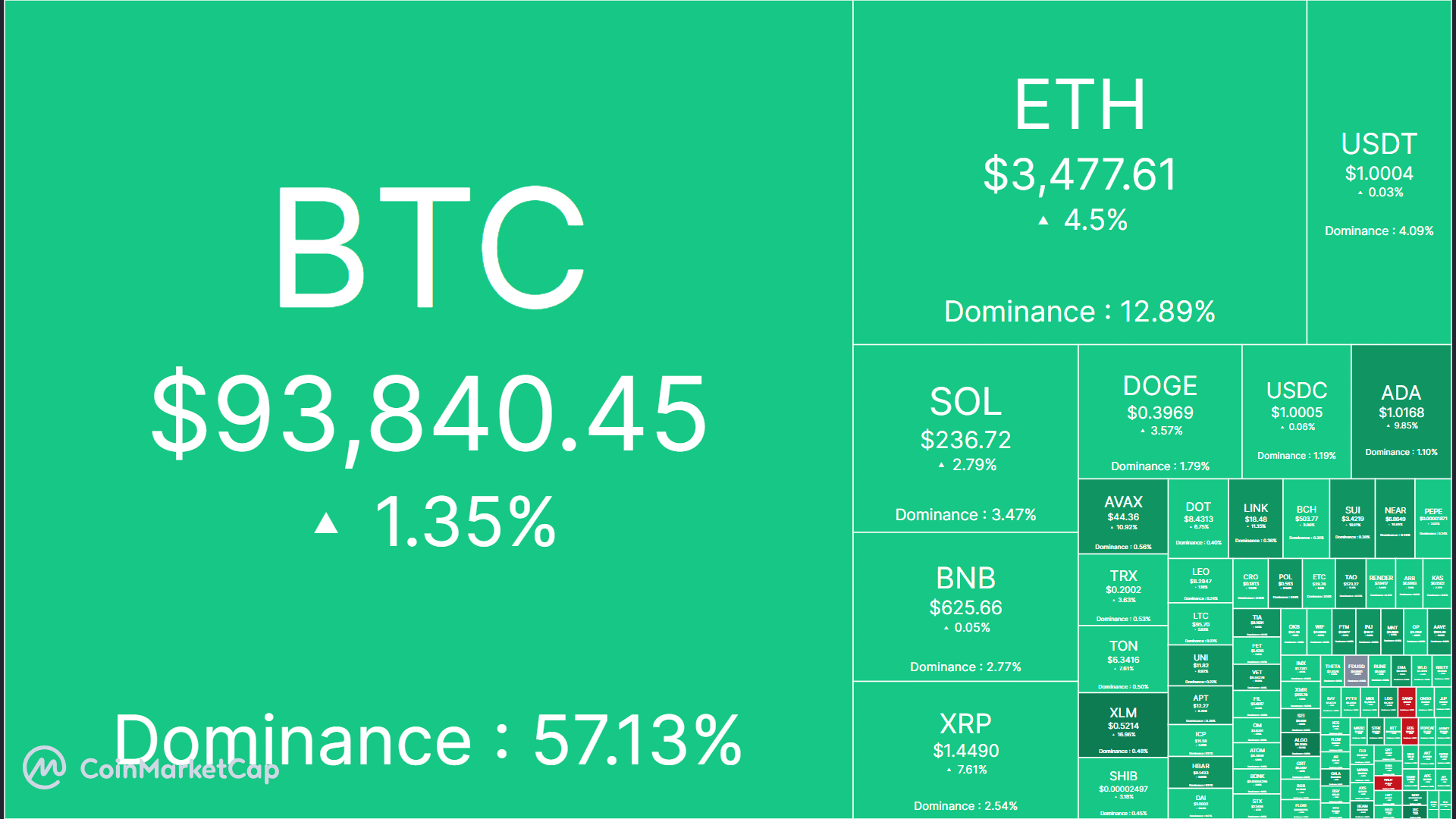

Bitcoin [BTC] fell 9% in recent days, falling from an all-time high (ATH) of $99.5K to $90.7K, due to what analysts linked to the panic sell-off of STH (short-term holders) and the US Thanksgiving holiday.

At the time of writing, the king coin stabilized above $93,000, easing the carnage of the past 24 hours. But what precipitated the flash crash on Tuesday, November 26?

Source: CoinMarketCap

Why Bitcoin Got Dumped

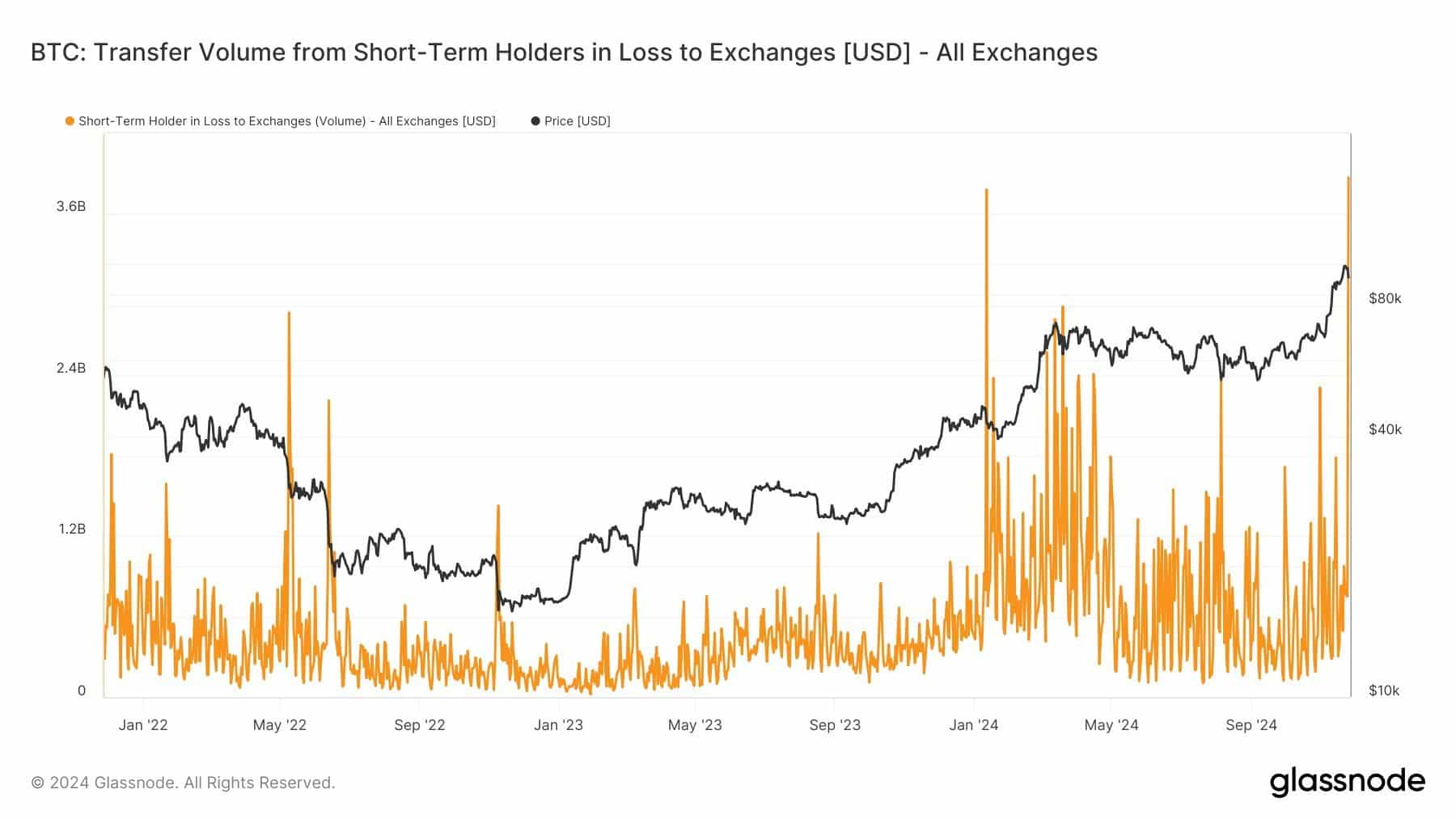

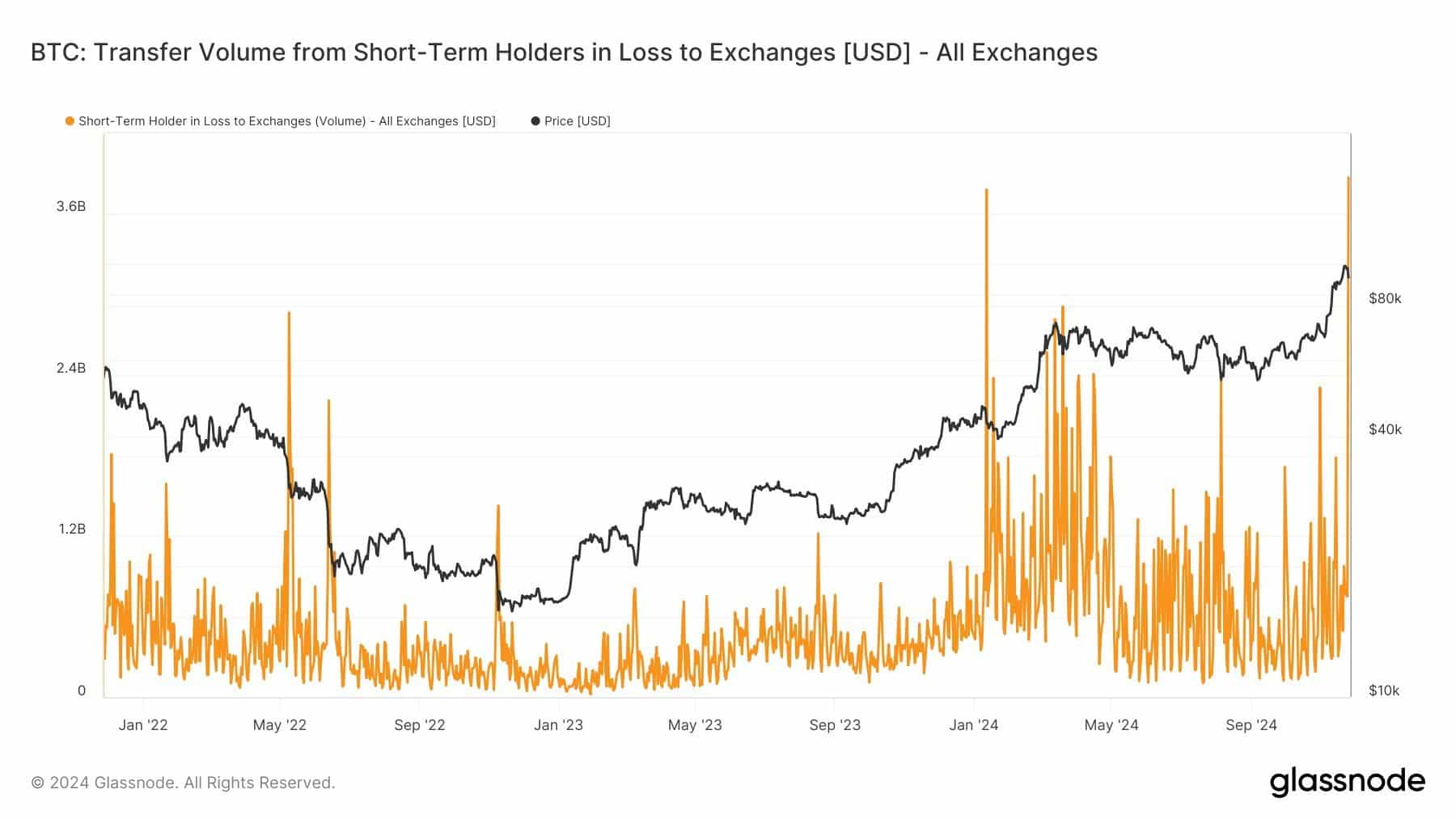

A significant portion of the dump occurred on November 25 and 26, where market analysts collectively held on to panic selling of STH (short-term holders).

Crypto analyst James Van Straten noted that short-term holders dumped nearly $4 billion worth of BTC, eclipsing August’s carry trade.

Source: Glassnode

Another possible factor at play was the American Thanksgiving holiday. This is what Alex Thorn, head of research at Galaxy Digital, says.

Drawing insights from the 2020 Thanksgiving BTC dump, Thorn said,

“Who remembers the 2020 Thanksgiving dump? Bitcoin dumped 17% between Wednesday, November 25 and Friday, November 27, 2020. BTCUSDT later went up to over 3x over the next 5 months. Does history rhyme?’

Thorn added that the local Thanksgiving bottom for BTC could be located after the recent 9% dip, based on historical trends.

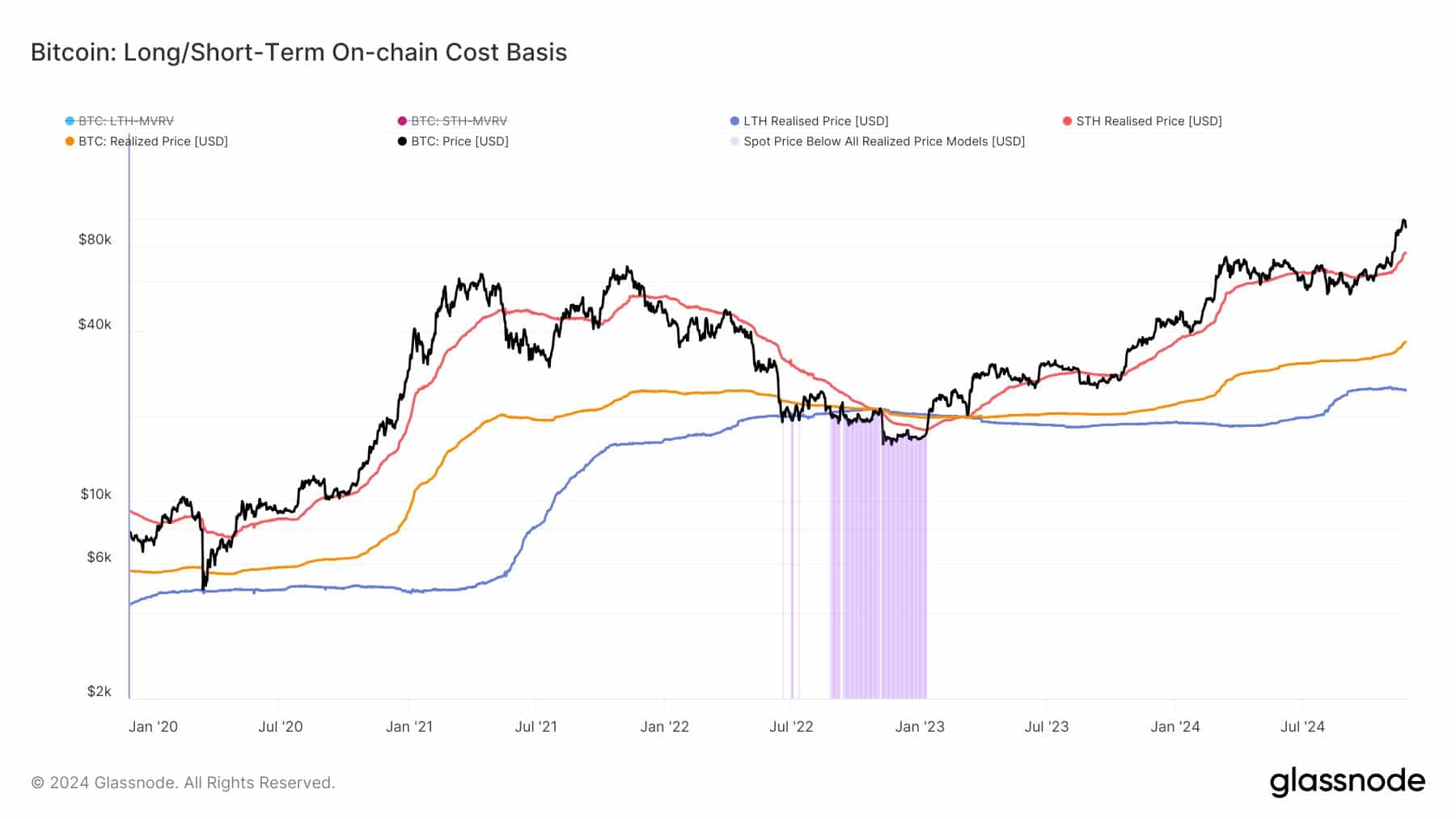

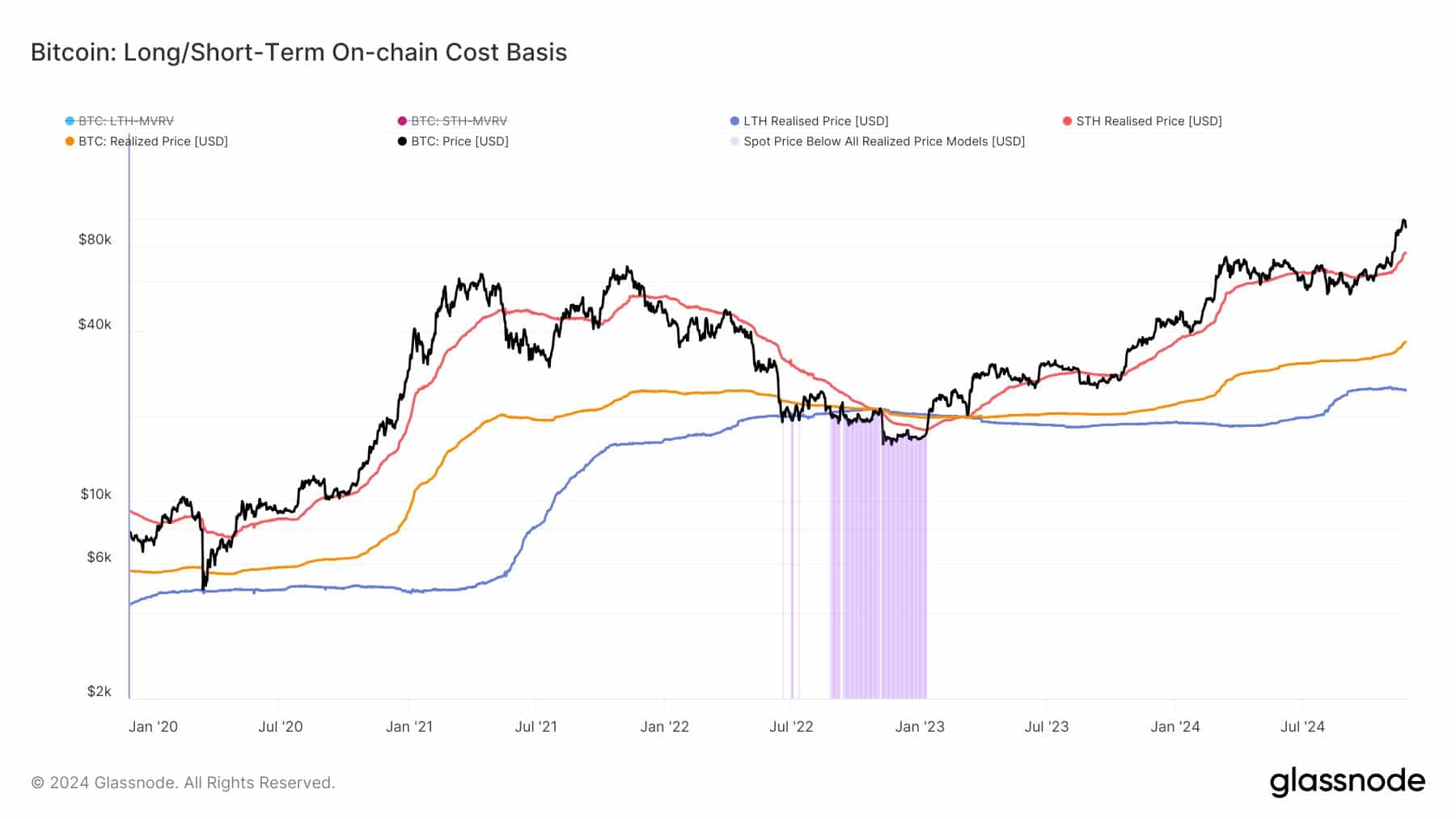

Straten reiterated the same, emphasizing that BTC followed the price realized by STH after previous dumps. He declared,

“Very similar setup to Q4 2020, with a huge flushout during Thanksgiving 2020. Soon after, $BTC went vertical from $10,000 to $60,000, with plenty of pullbacks along the way using STH Realized Price as support.”

Source: Glassnode

Does this mean $90.7K was the local floor for this US Thanksgiving? Well, not everyone was downright optimistic about that.

According to BTC trader Cryp Nuevothe downtrend could extend to the $85,000-$88,000 region before reversing.

Source:

Whether BTC will fall below $90,000 remains to be seen; However, market consensus was trending towards a likely recovery after the US Thanksgiving.