- More and more long-term holders are letting their Bitcoin fall into the hands of their short-term counterparts.

- A notable Bitcoin recovery could happen in 2024, as shown by historical data.

Holding hands Bitcoin [BTC] are actively changing, according to a recent revelation from Korean on-chain analyst Yonsei_dent. The analyst revealed this is stated in his analysis of October 8 published on CryptoQuant.

Read Bitcoins [BTC] Price prediction 2023-2024

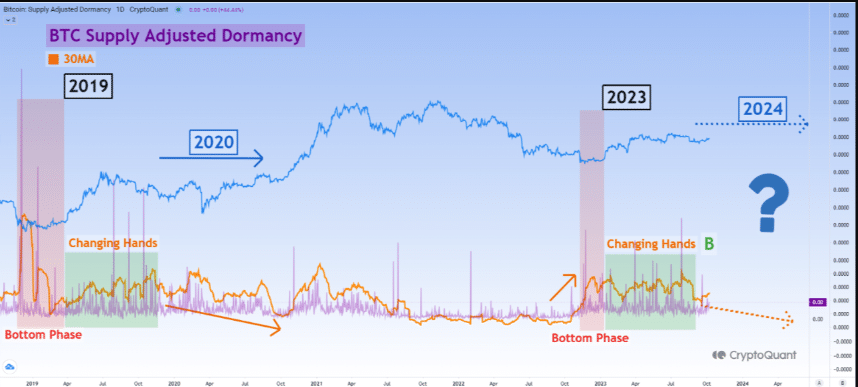

One metric he used in coming to the conclusion was the Bitcoin Supply-Adjusted Dormancy.

Bitcoin’s move could fuel the recovery

The Bitcoin Supply-Adjusted Dormancy simply refers to the average time it takes for each Bitcoin to change hands, based on the last transfer of the specific BTC in question. Dormancy reaches peak values as more coins are spent and collected by the overall network.

Based on Yonsei’s analysis, there has been a rapid increase in dormancy lately, meaning Short Term Holders (STHs) are actively buying BTC from Long Term Holders (LTHs).

Source: CryptoQuant

But that wasn’t the only point the analyst was trying to make. For Yonsei, history almost always seems to repeat itself in every cycle, and this current state of dormancy could fuel a BTC recovery.

Yonsei opined that the revival may not be immediate. However, he said it was probably for the influence to reflect in 2024 as it happened between 2019 and 2020.

He added that

“The point is that the price movement and dormancy are quite similar to 2019, when the market went from the bottom to the recovery period. While 2020 showed sideways movement (excluding the COVID-19 shock period), it is confirmed that a large portion of BTC supply was transferred to STH as the Dormancy indicator fell overall.”

Not close to the top yet

Looking at the LTH market value to realized value (MVRV), Glassnode showed that there has been a substantial increase in the metric between 2022 and the time of writing. The measure serves as an indicator to evaluate the behavior of long-term investors.

Source: Glassnode

It is also noteworthy to mention that only UTXOs with a service life of at least 155 days are considered. From the chart above, Bitcoin’s LTH MVRV was 1.35. Normally, a reading above 10 coincides with market tops, as we have seen in previous cycles.

Therefore, the current BTC value seems to be closer to the bottom, and there could be more room for it grow. Meanwhile, it is possible that Bitcoin’s next surge could come from accumulation in Asia and not the US

This is due to the contrasting condition of the Korea Premium Table of contents and Coinbase Premium Index. At the time of writing, the Coinbase Premium Index was flat out at 0.009. However, its Korean counterpart was trading higher at 1.03.

Is your portfolio green? look at the BTC profit calculator

This disparity means that buying pressure for Bitcoin could rise from Asia instead of the US. This could be related to the hostile condition that the crypto market has endured in the Joe Biden-led country.

Source: CryptoQuant

Additionally, Bitcoin research analyst Axel Adler noted that LTH supply was still much larger than STHs despite the recent change in ownership.

Bitcoin STH Supply vs LTH Supply (%) – shows how supply shifts from one cohort to another.

As of today, LTH owns 15.7 million BTC or (86.18%), and STH owns 2.5 million BTC or 13.82%. pic.twitter.com/I7GDQqyKnm

— Axel

Adler Jr (@AxelAdlerJr) October 9, 2023