- DOGE has experienced a massive exodus of private buyers as speculation over its fundamentals finally took its toll.

- But is this the start of something new for DOGE?

There are few exceptions among memecoins that have remained in the green over the past thirty days. With double-digit losses, both Dog and Cat coins have fallen well below their psychological targets. Even the largest memecoin, Dogecoin [DOGE]has not been spared.

However, as the market begins to recover from the recent collapse, even memecoins are showing signs of life, with DOGE seeing an 11% jump from the previous day’s closing price.

The momentum is increasing. Still, DOGE still has a long way to go to recoup its losses and get stakeholders in the green.

How can DOGE break out?

A look at the daily chart reveals clear signs of profit taking, with DOGE approaching $0.50 – a level it has not reached in three years. For cautious investors, cashing out at the peak was an easy decision.

With the RSI falling below 40, a potential recovery seems possible. A low RSI often indicates that an asset is oversold, providing a tempting opportunity to buy the dip.

History, however, advises caution. While DOGE’s RSI dipped below 40 has occasionally led to small bullish moves, the infamous volatility has kept traders on edge.

Dogecoin only reached an overheated state when its momentum aligned with Bitcoin peaking.

Source: TradingView

So can Bitcoin lead Dogecoin out of its two-week consolidation? After weeks of long red candlesticks depressing DOGE’s daily chart, we are finally seeing some relief with a solid double-digit jump.

This rise coincides with Bitcoin’s recovery from the recent crash, making it likely that momentum could carry DOGE further.

However, with memecoins like DOGE it is rarely that simple. While the low price tag may be tempting, retail buyers are showing signs of fatigue. The speculative nature of these coins is starting to take its toll – a trend that warrants deeper investigation.

Is it still worth the risk?

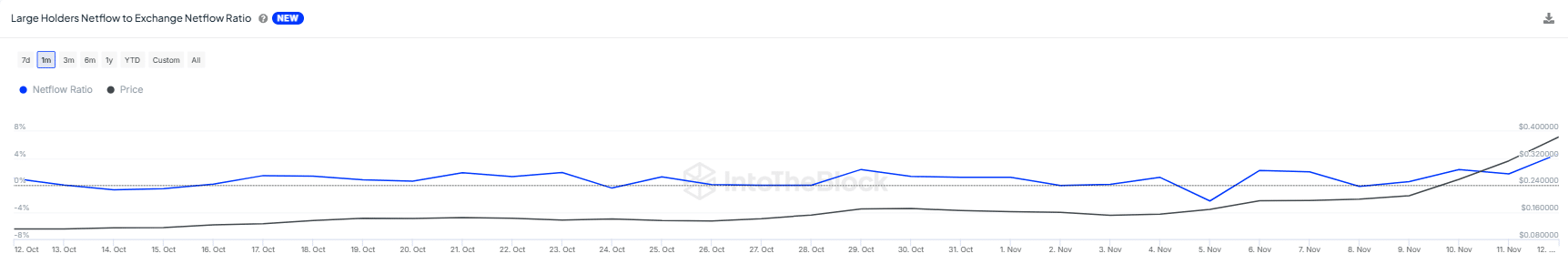

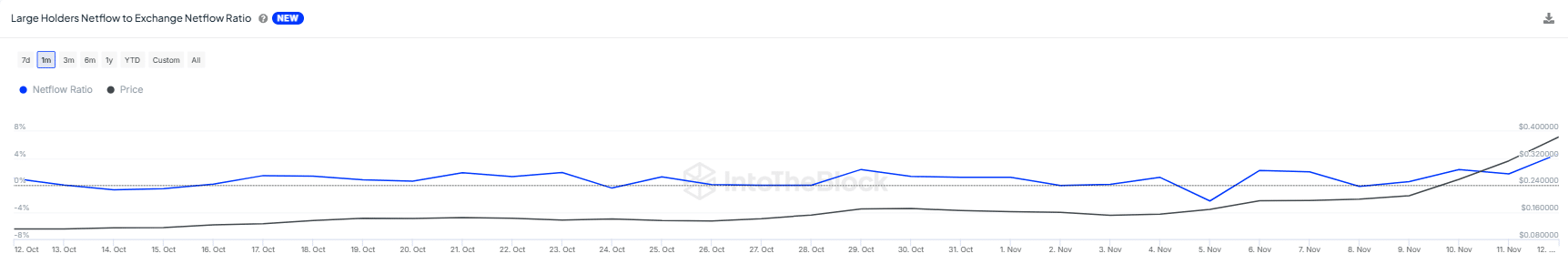

Since mid-November, DOGE retail buying and selling has stalled as major HODLers tighten their grip on the market, as shown in the chart below.

Source: IntoTheBlock

The increasing control of big players with big stakes continues to define the DOGE market, a trend we first highlighted here at AMBCrypto.

However, an intriguing shift is occurring: retail purchasing activity fades, putting the focus back on DOGE’s weak foundations. What we’re likely to see with this recent surge is whales taking advantage of the ‘dip’ – and not a real shift in market sentiment.

In the short term, this whale-driven buy could push DOGE back toward the $0.40 mark. But the real test comes afterwards.

Read Dogecoin [DOGE] Price forecast 2024-2025

For the memecoin to rise to $0.48-$0.50, it will take more than just wishful thinking. The perfect storm of bullish Bitcoin momentum, a new influx of retail capital, and whales pulling back from their manipulation are critical.

If all these factors align, DOGE could very well break through. But if they don’t, investing in this memecoin can still be a risky gamble.