This article is available in Spanish.

While Bitcoin was trading at $59,076 yesterday, it fell to $57,127 during the early Asian trading session today. BTC closed the week at $57,565, once again losing key ground needed to create a bullish reversal. The trajectory is influenced by various factors.

#1: Macro fear of a recession

The looming threat of a US recession is causing palpable tension in the financial markets. This is especially relevant for Bitcoin, which has yet to endure a full economic downturn since its inception.

As the Federal Reserve prepares for the Federal Open Market Committee (FOMC) meeting on September 17-18, 2024, the discourse around monetary policy has intensified. The expectation of a rate cut is reinforced by Jerome Powell’s comments at the Jackson Hole Symposium, with the CME FedWatch tool indicating that a rate adjustment is unanimously expected.

Related reading

The analysis of expectations shows that 69% are leaning towards a cut of 25 basis points, while a significant minority of 31% predict a more aggressive cut of 50 basis points. According to Tom Capital, a crypto analyst, such drastic cuts could be interpreted as signs of an economic crisis rather than mere adjustments, complicating the investment outlook for Bitcoin.

“The Fed’s 50 basis point cut is an emergency cut, there is simply no other way to look at it. If your current bullish thesis for crypto rallies is based on big rate cuts, you might want to reconsider,” says Tom Capital. noted via

Tom Capital added: “There needs to be some really crappy jobs data leading up to the NFP on Friday, and then a shocking NFP itself to hit 50 basis points (which isn’t out of the question given the unreliability of the data). However, I think the big shock of a terrible NFP is a bigger risk in a move, starting in Nas.”

#2: Bitcoin seasonality

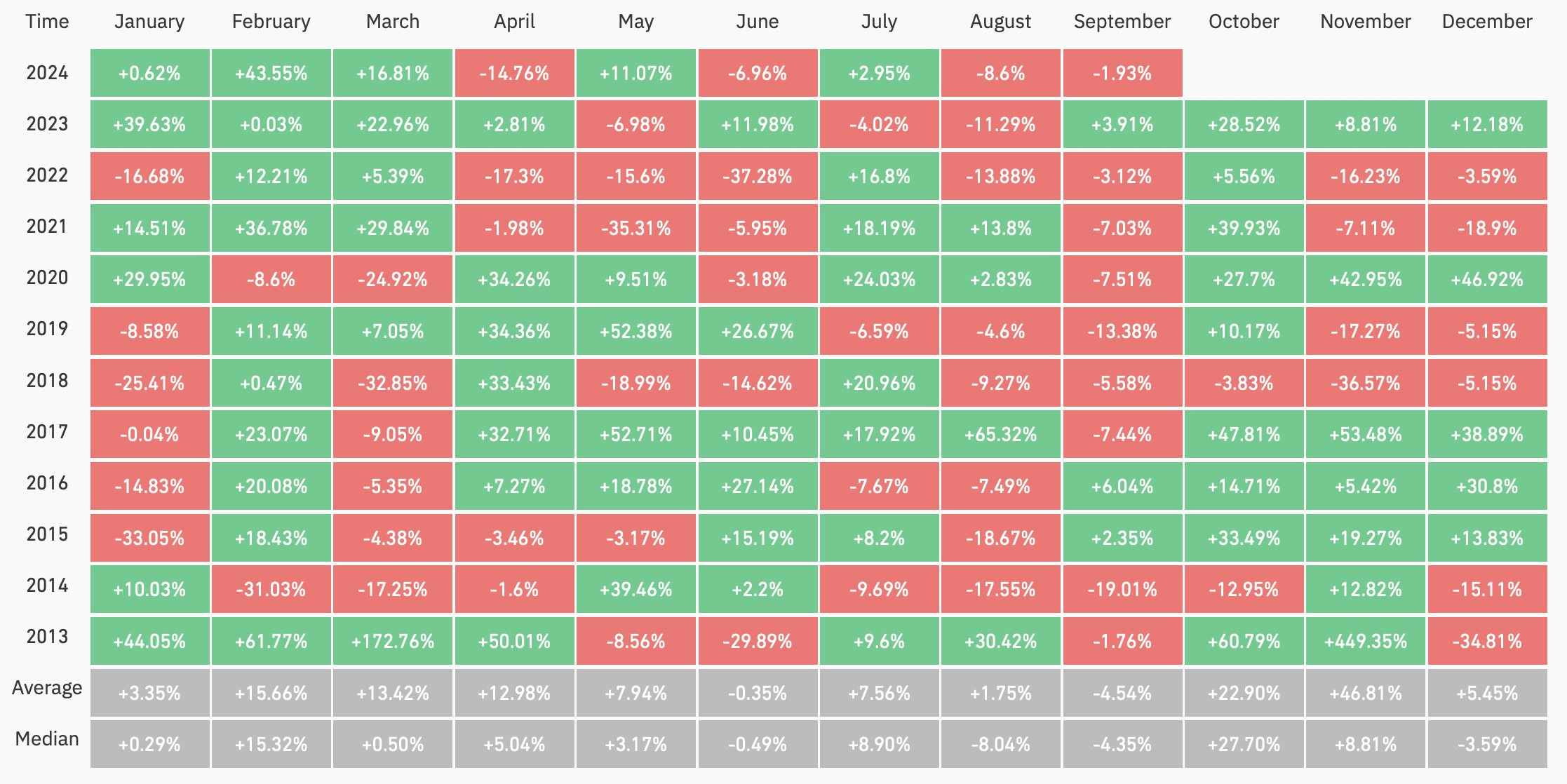

Rekt Capital, another crypto analyst, provided insight into the seasonal patterns that influence Bitcoin. Historical data since 2013 shows mixed performance for Bitcoin in September, with gains in some years being offset by losses in others.

Related reading

“Is September really a bad month for BTC? Since 2013, BTC has achieved monthly returns of +2.35%, +6.04% and +3.91% over the three September months. And on September 6, BTC recorded negative monthly returns ranging from -1% to -7.5%, with only two examples of double-digit downsides (namely -19.01% and -13.38%). However, from a macro perspective, September is typically a month of consolidation,” said Rekt Capital analyzed.

#3: Low Bitcoin sentiment

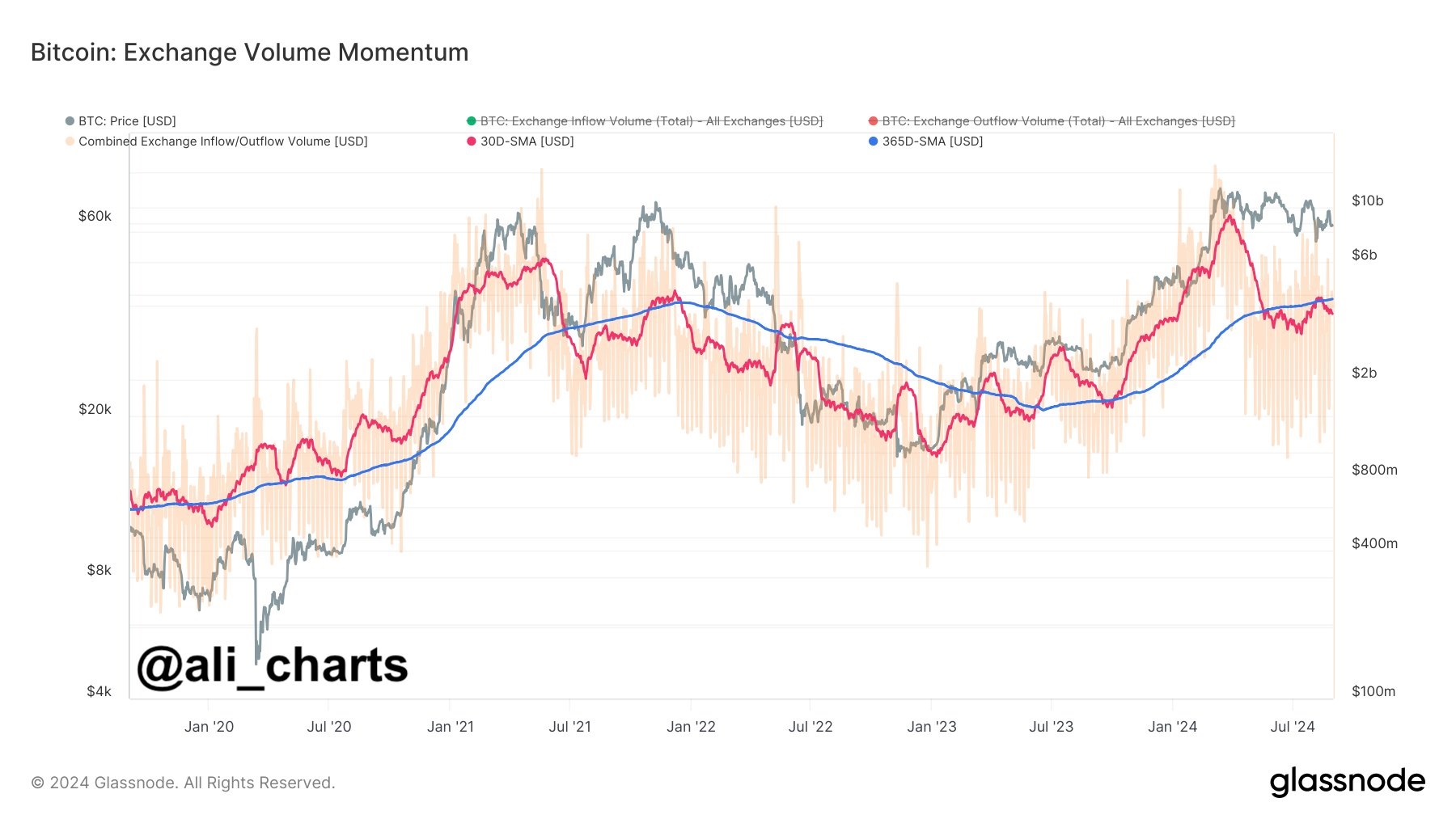

By analyzing stock market-related on-chain data, Ali Martinez has identified a continued decline in investor interest and network usage. “The Exchange Volume Momentum indicator shows a continued decline in on-chain exchange-related activity, which typically indicates lower investor interest in Bitcoin and reduced network usage,” says Martinez. declaredThis suggests that enthusiasm for using Bitcoin has cooled somewhat, potentially negatively impacting its price.

Martinez added: “Bitcoin miners sold 2,655 BTC this weekend, worth approximately $154 million!”

#4: Technical trading terms

The technical outlook for Bitcoin is also bleak as the cryptocurrency fails to secure a strong weekly close. “Bitcoin needs to close above ~$58,450 weekly to protect the Channel bottom and secure support in this retest. The price is currently at this support. In fact, an ideal close would be ~$59,000 to get BTC above the blue higher low of early July,” noted Rekt Capital.

At the time of writing, BTC was trading at $58,036.

Featured image from iStock, chart from TradingView.com