The current Bitcoin price movement is a confluence of factors including massive liquidations, macroeconomic pressures, and the impact of a negative Coinbase Premium in addition to Bitcoin ETF dynamics. These elements together have led to a noticeable drop in the price of Bitcoin.

#1 Long liquidations

The current Bitcoin market experienced a significant price drop, initiated by a major liquidation in the futures market. According to Coinglass, crypto trader liquidations in the past 24 hours totaled more than $682.54 million across more than 191,000 traders. facts.

This wave of liquidations resulted in Bitcoin’s price dropping 8% in just a few hours, from $72,000 to $66,500. Although there was a small recovery, with Bitcoin’s price returning to the $68,000 level, the price is currently almost 10% below the March 14 all-time high of $73,737.

A notable 80% of these liquidations were long positions, contributing $544.99 million of the total. Liquidations on short positions made up the remaining $136.94 million, while Bitcoin longs alone were responsible for $242.37 million in liquidations.

#2 Macro Conditions Weighing on Bitcoin Price

The macroeconomic landscape has put additional pressure on Bitcoin’s value. Ted, a macro analyst known as @tedtalksmacro, highlighted on X the influence of macro conditions on the cryptocurrency market.

He declared“If BTC is digital gold, you can expect it to trade in parallel with gold, but with a higher beta.” With the Federal Reserve meeting looming next week, macroeconomic factors are expected to temporarily will play a leading role.

Yesterday’s US Producer Price Index (PPI) data, showing a 0.6% increase in February and beating forecasts of 0.3 month-on-month, has caused a ripple effect with the CPI also recently being hotter than expected, leading to a rise in US bond yields. The benchmark 10-year rate rose 10 basis points to 4.29%, while the two-year rate rose from 4.63% to 4.69%. These developments have led traders to revise their expectations for the Federal Reserve’s interest rate policy in 2024.

Mohamed A. El-Erian, from Queens’ College, Cambridge University, Allianz and Gramercy, noticed on the situation: “US Treasury yields rose today in response to yet another (slightly) higher than expected inflation (this time PPI).” This signals a growing awareness of the challenges that persistent inflation poses to achieving the Fed’s 2% inflation target.

#3 Negative Coinbase Premium/Silent Bitcoin ETF Day

Bitcoin’s decline below the $70,000 threshold is also attributed to “Coinbase Premium” – the exchange that controls the majority of all spot Bitcoin ETFs – entering negative territory for the first time since February 26, indicating a bearish sentiment in the US markets. This phenomenon is likely a result of the significant selling of Grayscale GBTC, while the spot ETF saw relatively quiet activity.

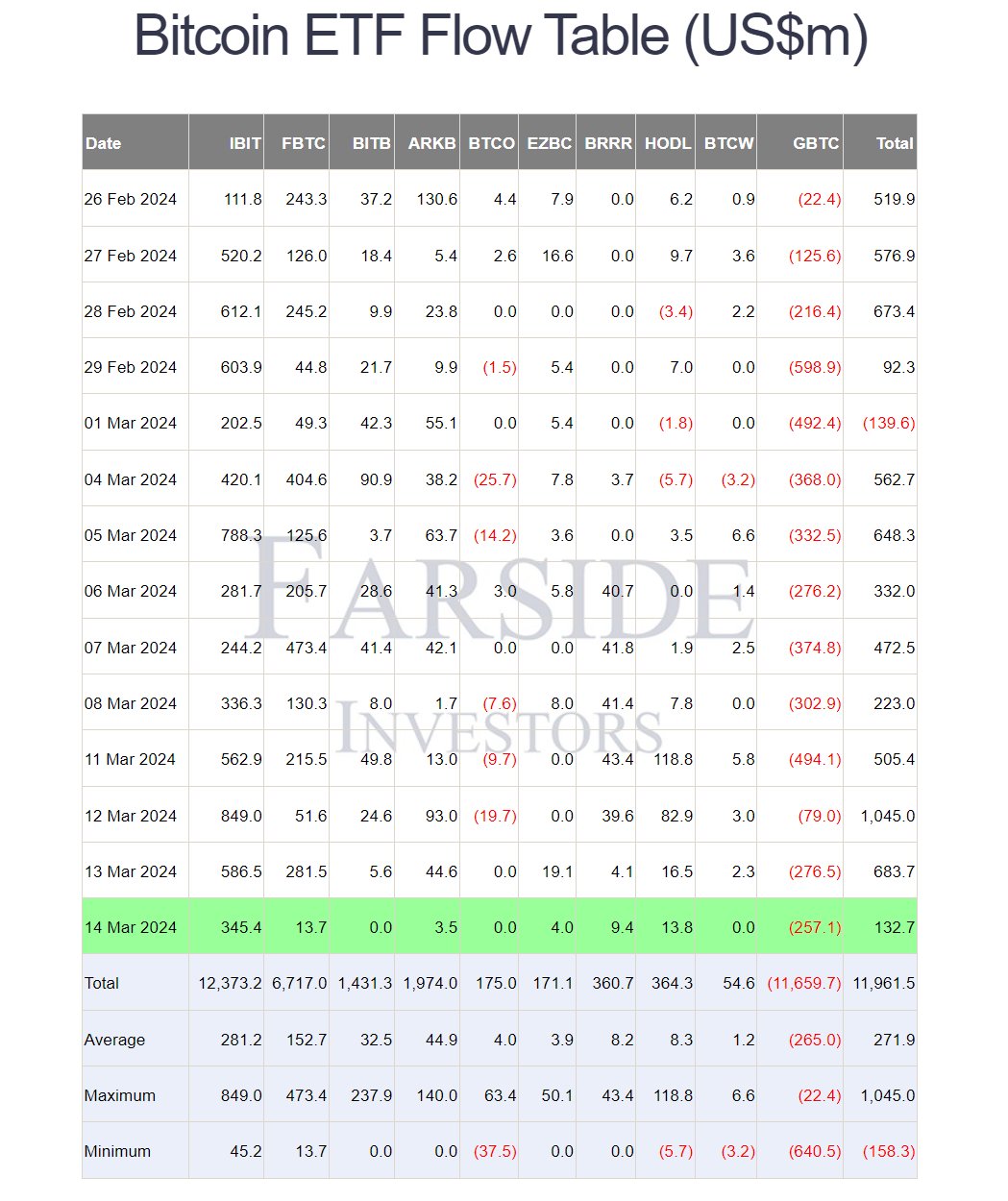

After a record day of net inflows of $1 billion for the spot ETF on March 12, inflows recently fell to just $132.7 million, with Blackrock contributing the lion’s share at $345.4 million. Meanwhile, Fidelity and ARK saw minimal inflows of $13.7 million and $3.5 million, respectively, after a previously strong week. GBTC outflows were reported at $257.1 million, in line with the average level.

Crypto analyst WhalePanda commented on the situation, noting that despite the reduced inflow, “$132.7 million is still two full days of mining rewards.” He suggests a possible recovery of the market and states: “We are just now varying and people with over-indebtedness are being asked for a margin. I think the next step up is for next week.

At the time of writing, BTC was trading at $67,916.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.