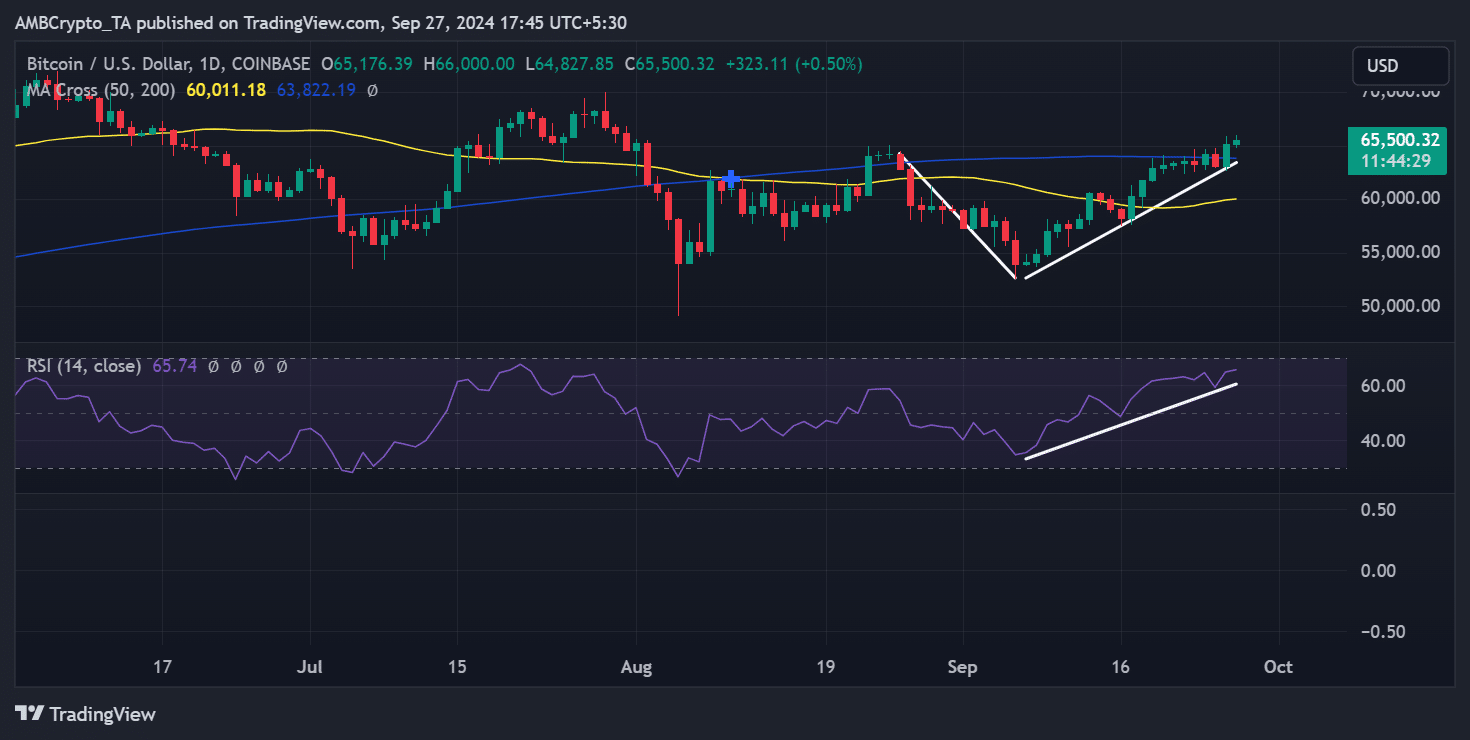

- BTC broke its 200-day moving average and turned previous resistance into potential new support, indicating a bullish trend.

- Rising market sentiment towards greed and increased withdrawal of BTC from exchanges are key factors driving Bitcoin’s price higher.

Bitcoin[BTC] has finally surpassed its long-term moving average that previously acted as a resistance level. The positive trend has continued over the past 24 hours, leaving many investors asking the question: why did Bitcoin rise today?

Bitcoin breaks through important resistance

During the last trading session, Bitcoin saw an impressive increase of over 3%, pushing its price to around $65,177.

As of now, the uptrend continues, with a modest gain of less than 1%, bringing the price to around $65,400.

The 200-day moving average, which once served as resistance, is now gearing up to become new support – a bullish sign for the cryptocurrency.

Source: TradingView

Analysis also shows that Bitcoin is up more than 11% since the start of the month. Despite seemingly slow daily movements, the general trend is upward.

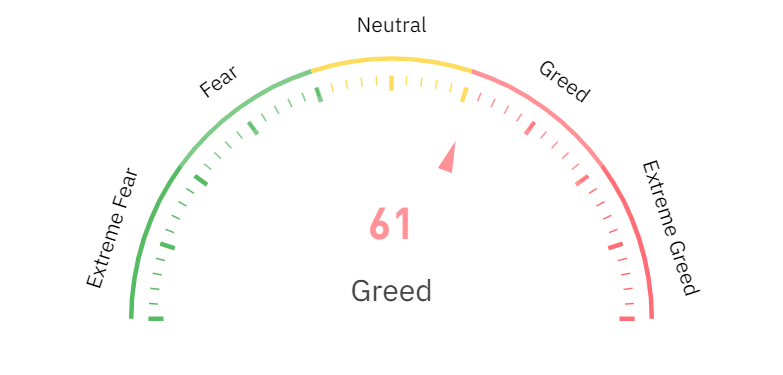

Bitcoin sentiment shifts to greed

One reason why Bitcoin is rising today is the shift in market sentiment. BTC has been on a rebound since the Federal Reserve announced its first interest rate cut in four years.

Moreover, the US market is awaiting a speech from Fed Chairman Jerome Powell, which could have a significant impact on BTC and other digital assets.

Also data from Mint glass shows that Bitcoin’s sentiment measure has risen to around 65%, indicating that the market has entered the ‘greed’ phase. This shift in sentiment is a key factor in BTC’s recent price rise.

Source: Coinglass

Furthermore, September has historically not been a strong month for BTC, but this year is different. The current increase may also be due to anticipation of a more positive trend typically associated with October.

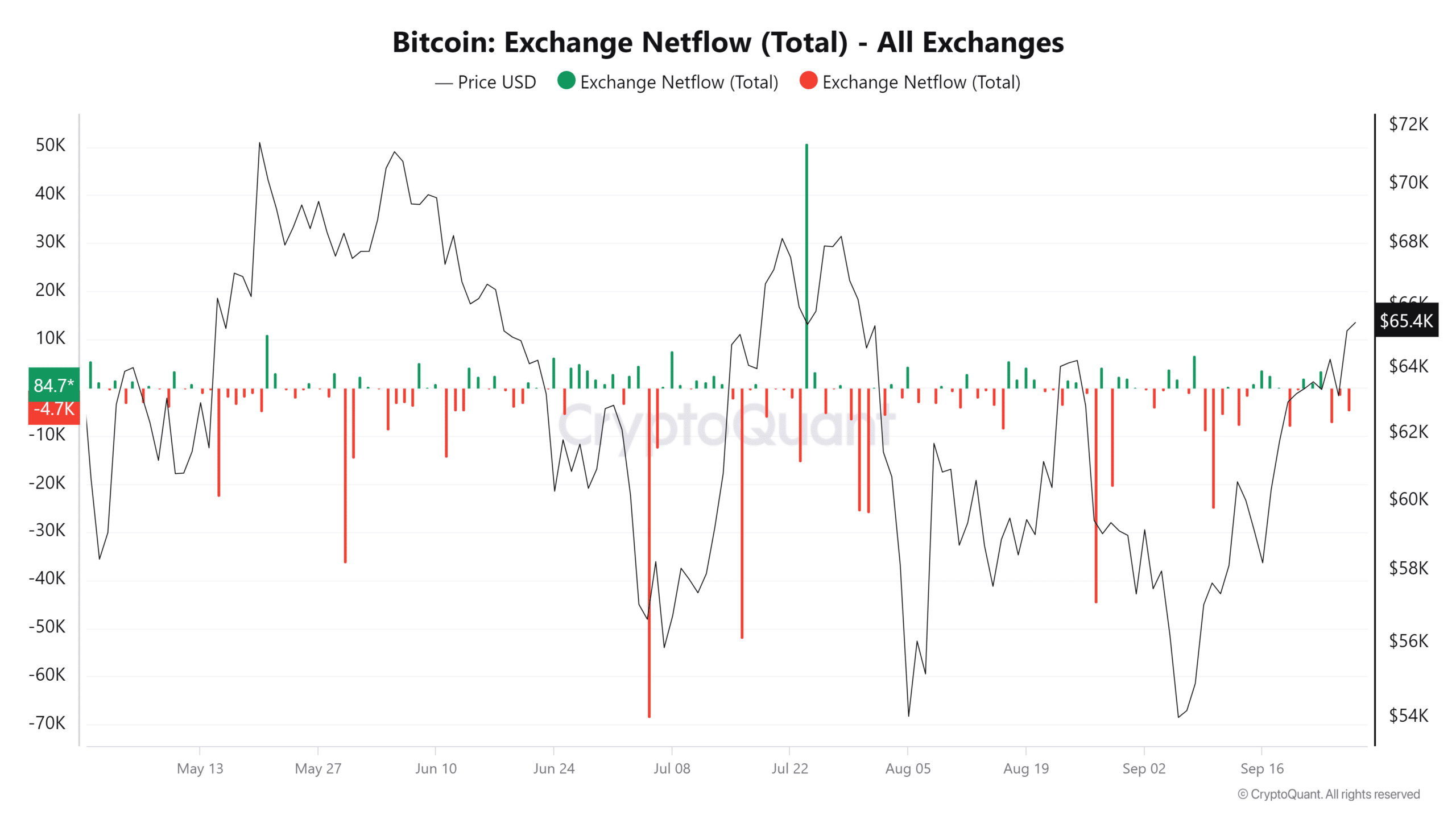

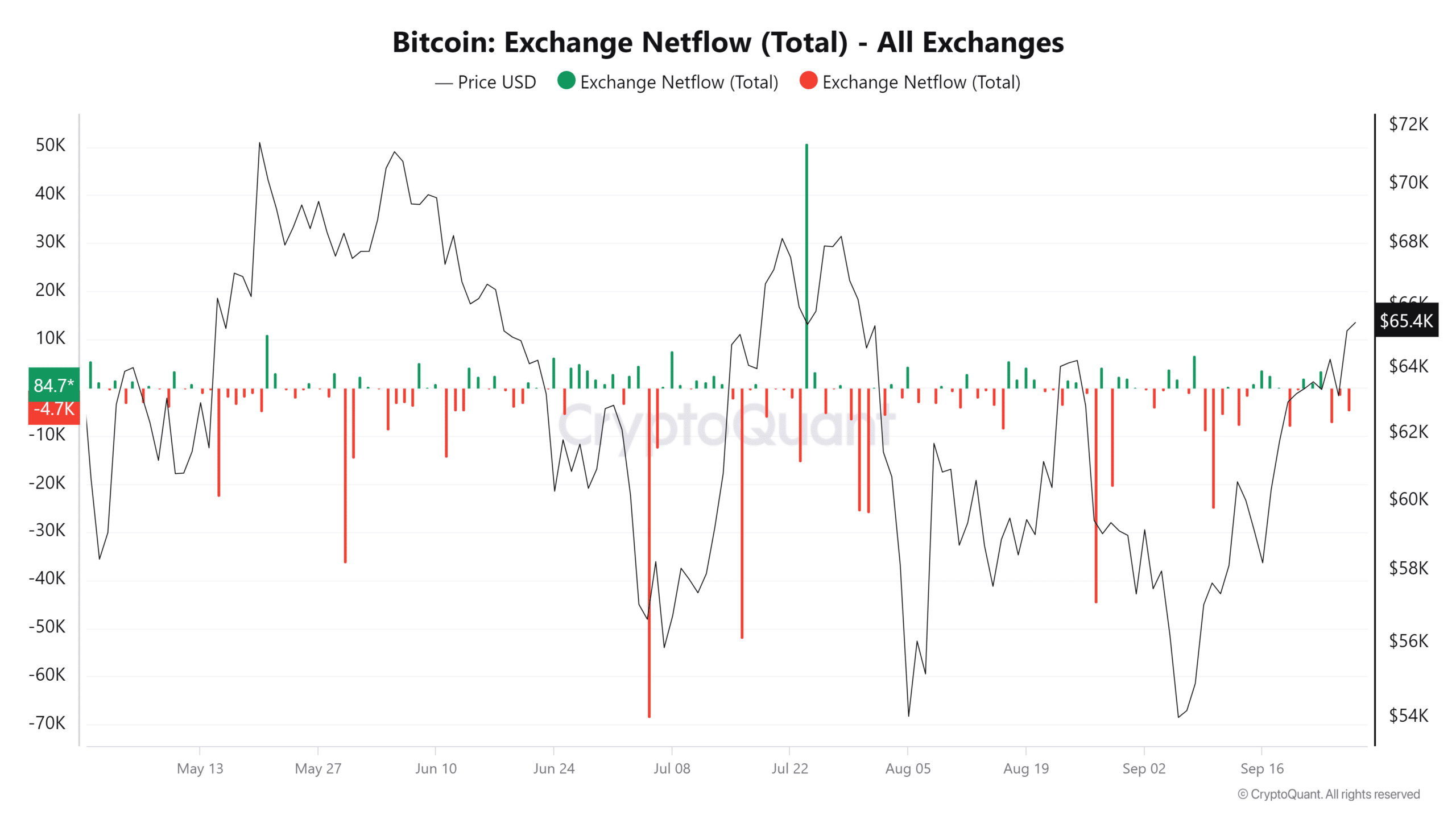

More Bitcoin is leaving the exchanges

Another factor that explains why Bitcoin is rising today is the movement of BTC off the exchanges.

Data from CryptoQuant shows that the net alternating current has been negative recently. This means that more BTC is being withdrawn from exchanges than is being deposited, indicating that holders prefer to keep their assets in private wallets rather than sell them.

Source: CryptoQuant

A negative net flow during a price increase is usually a positive signal. It indicates that investors are betting on a further rise in prices and are less inclined to sell. This reduced selling pressure could push the price of BTC even further.

Is your portfolio green? Check out the BTC profit calculator

Conclusion

Bitcoin’s recent price surge can be attributed to major resistance levels breaking, shifts in market sentiment toward greed, and more investors withdrawing BTC from exchanges.

These factors together explain why Bitcoin is on the rise today, and they could soon contribute to continued upward momentum.