- BTC crossed $100K and reached an ATH of $104K.

- Analysts predicted that BTC could rise above $110,000, but a pullback to $85,000 was also likely.

On December 5, during the early Asia session, Bitcoin [BTC] has surpassed the $100,000 mark, likely driven by a recent comment from Fed Chairman Jerome Powell.

In an interview with the New York Times, Powell said that BTC is a competitor to gold and not to the US dollar. He declared,

“People use Bitcoin as a speculative asset; it’s like gold, but virtual. It is not a competitor of the dollar, but of gold.”

A few hours after Powell’s comment, BTC rose from $97,000 to a new all-time high of $104,000, bringing its gains since the US elections in November to more than 50%.

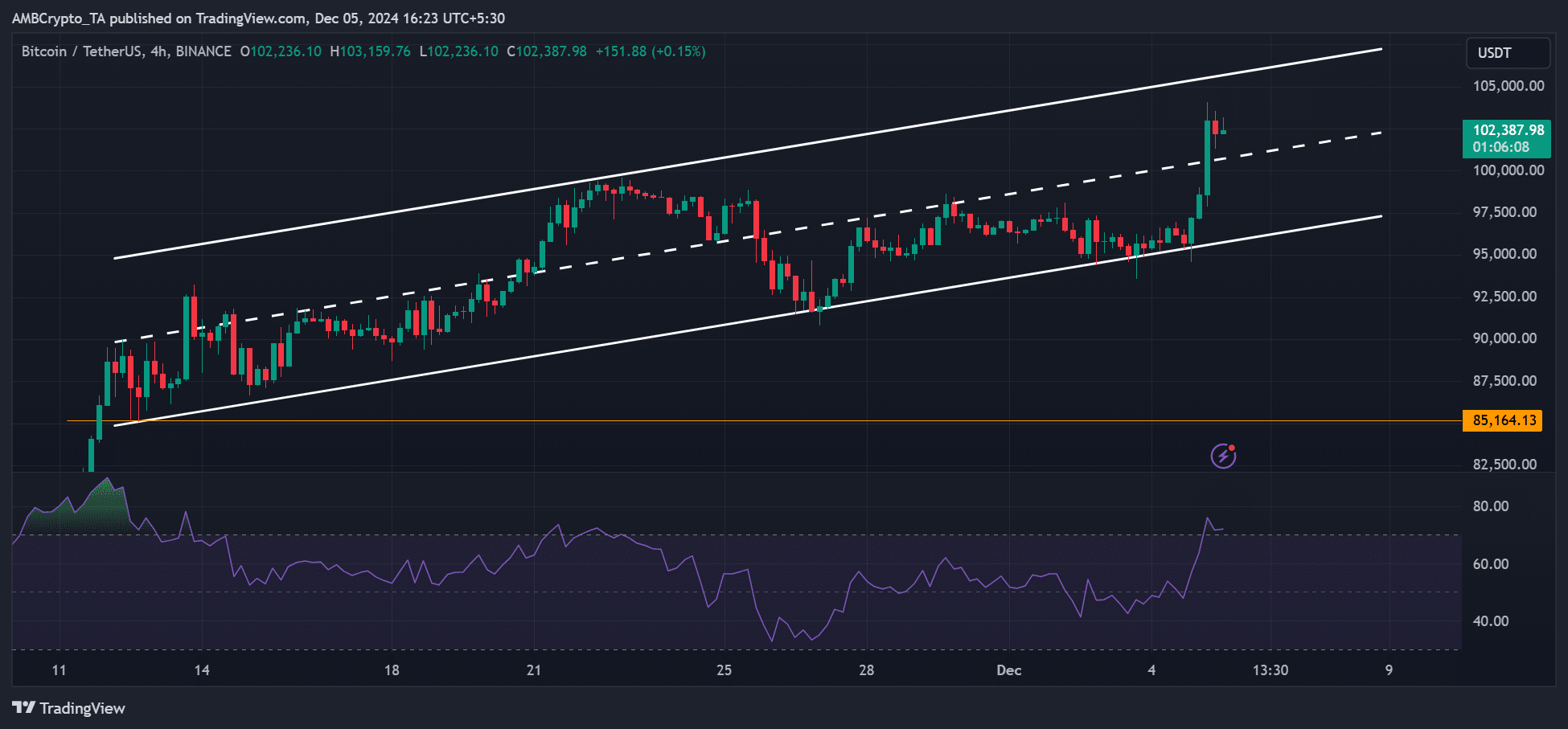

Source: BTC/USDT, TradingView

What’s next for BTC?

Commenting on this, SwissBlock, a crypto research firm, acknowledged that Powell’s impact was a surprise but a big welcome for the digital asset. The company declared,

“It’s a lucky $100,000! Absolutely, Fed Chairman Jerome Powell pumping Bitcoin was not on our bingo card. Our next short-term goal? $105,000.”

For his part, Arthur Azizov, CEO of B2BINPAY, an all-in-one crypto ecosystem for business, told AMBCrypto that the pump was related to Trump’s appointment of pro-crypto Paul Atkins as chairman of the SEC.

Azizov added that BTC could consolidate at $100,000 before retreating to $85,000.

“I believe the price of Bitcoin will consolidate around $100,000 before returning to a five-digit level, possibly reaching around $85,000 in the coming months.”

Crypto research firm Presto Research too warned that the rally could attract profit-taking.

However, the research firm also noted that the $100,000 could attract more demand from institutional investors.

“We believe there is more room for a rally as there should be demand waiting for BTC to break 100,000, which will attract more public attention.”

What are the next key levels of BTC?

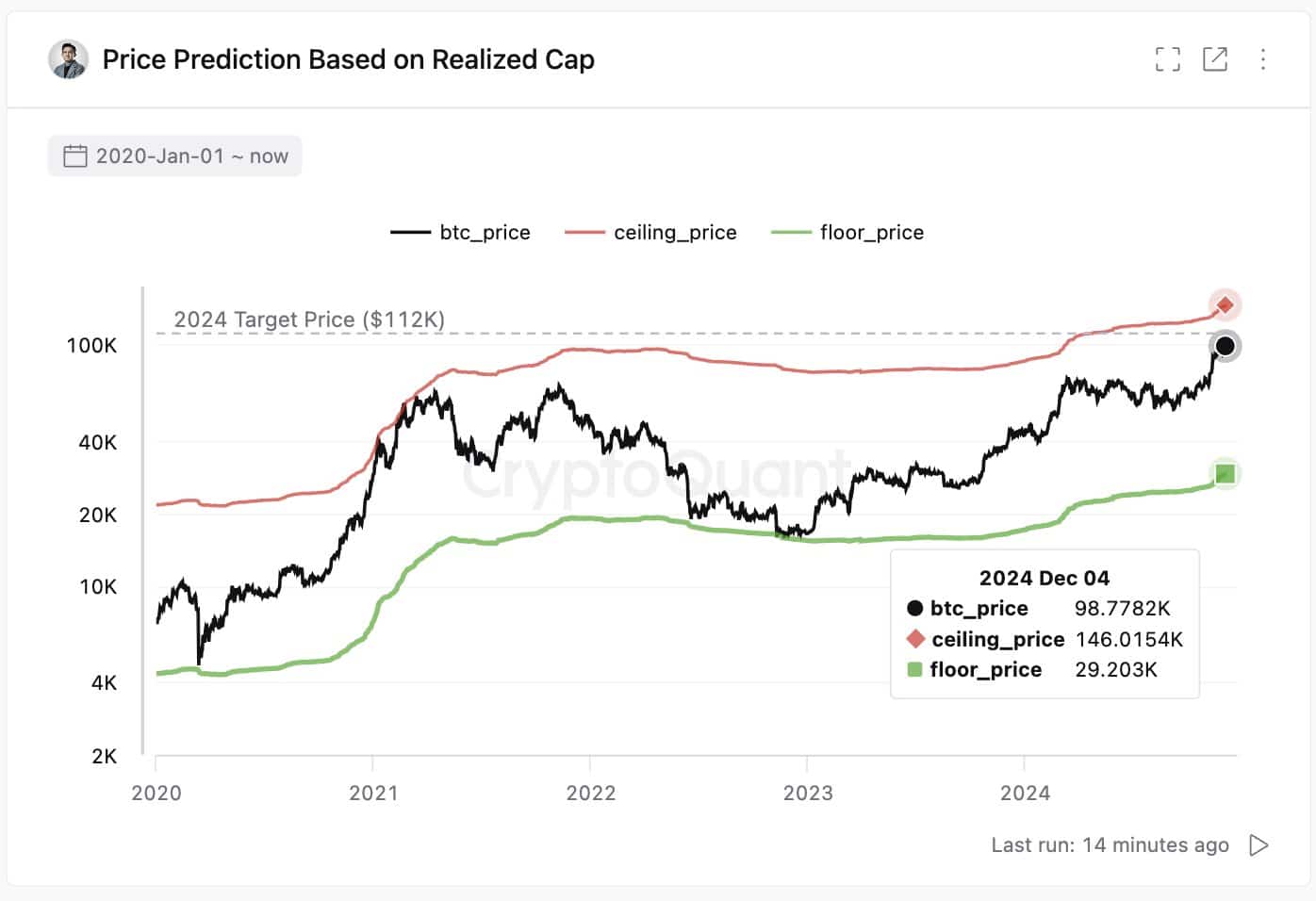

Ki Young Ju from CryptoQuant projected that, based on the realized maximum price band, BTC could see $146,000 as a cycle top and $112,000 as an end-of-year target.

Source: CryptoQuant