- The United States added 142,000 jobs in August, below the expected 160,000

- Bitcoin fell to a monthly low, but aggressive bets on Fed rate cuts increased

Bitcoin [BTC]the world’s largest cryptocurrency, fell to a monthly low of $52.5k on the charts – a trend that mirrored Friday’s decline in US stocks. The extended decline followed a weaker-than-expected August Jobs report released Friday.

According to the U.S. Bureau of Labor Statistics (BLS), 142,000 jobs were created in August. This number was well below analyst expectations of 160,000. On the contrary, the unemployment rate fell slightly to 4.2%.

Impact on BTC and Fed rate cut prospects

The aforementioned US Jobs Report is critical for BTC and the rest of the market. Especially since Fed Chairman Jerome Powell had initially stated that the pace of interest rate cuts would also depend on the state of the labor market. Needless to say, many in the community had a lot to say about the same thing.

Leena ElDeeb, research analyst at digital asset manager 21Shares, told AMBCrypto that the weak jobs report is a “moment of truth” for risk assets like BTC.

“The recent US labor market results acted as a moment of truth for risk assets like Bitcoin, as the labor market is seen as the key sector that could influence the Fed’s decision to cut rates this month.”

She added:

“With the unemployment rate slightly improving, investors traded positively, pricing in looser monetary policy on September 18.”

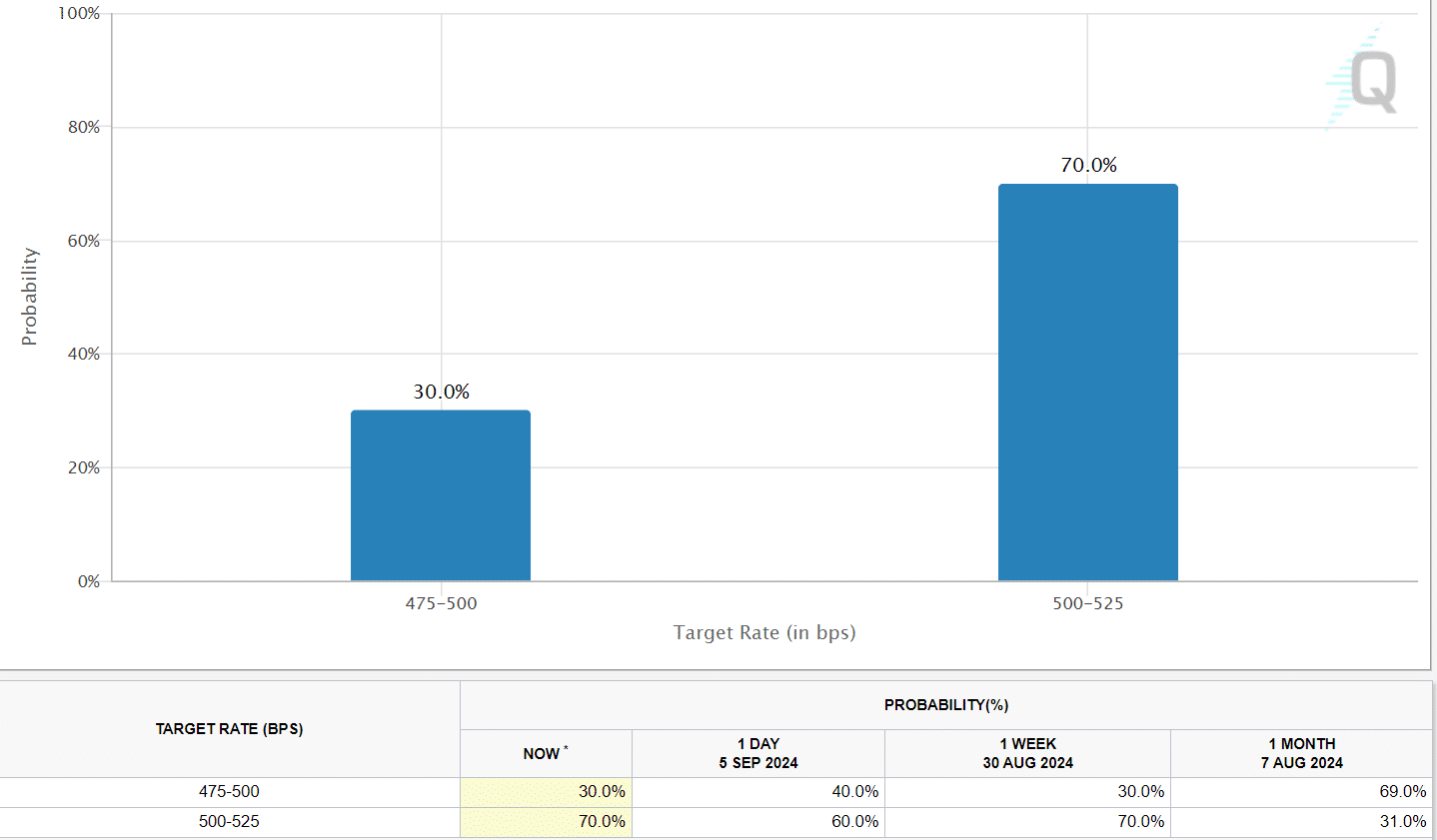

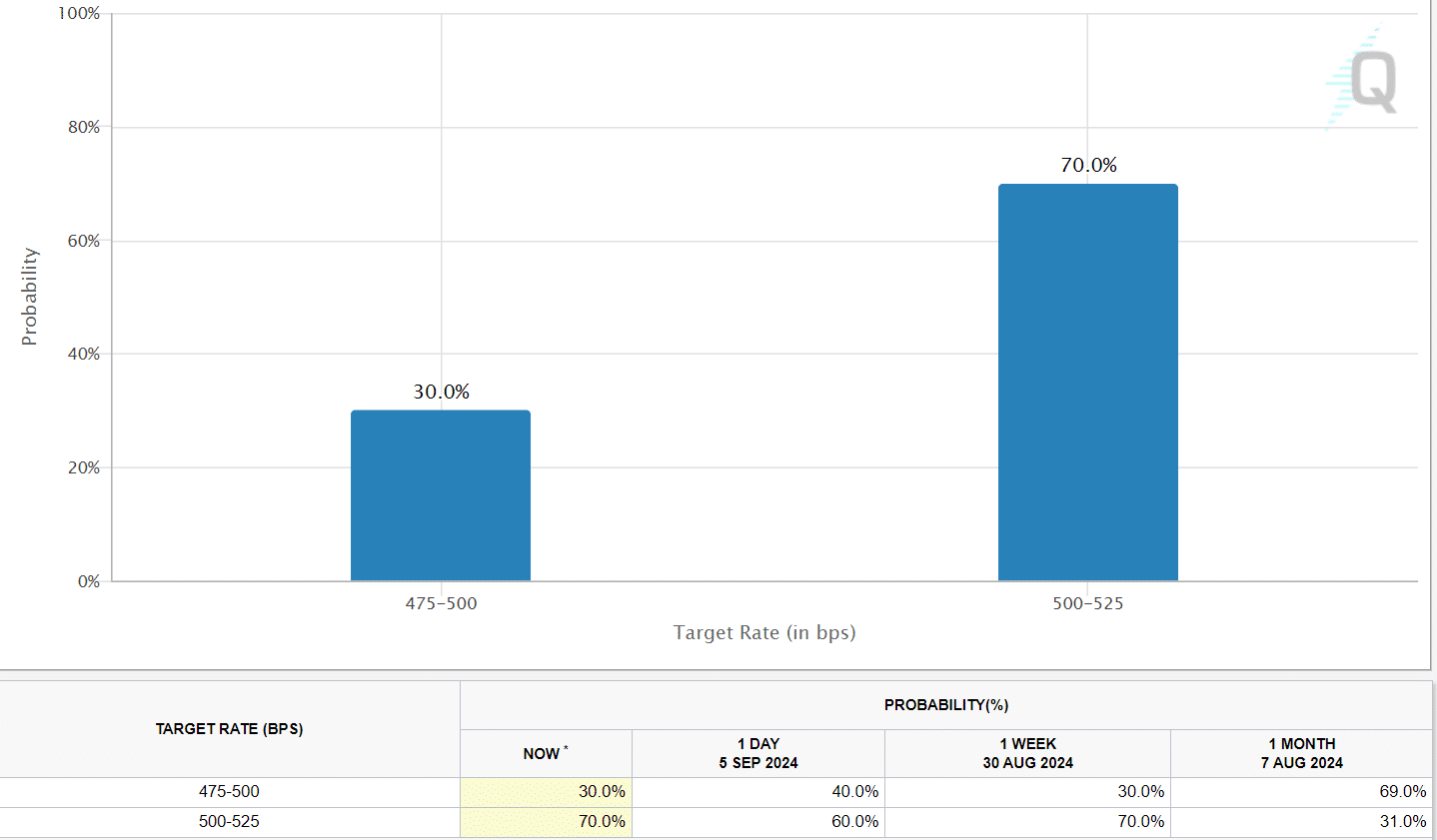

For context, a few minutes after the report’s release, aggressive bets on a 0.5% Fed rate cut rose above 50%, eclipsing the chances of a 0.25% rate cut. However, after the market processed the data, the chances of a 0.25% interest rate cut on Saturday during the early hours in Asia increased to 70%.

Source: CME Fed Monitoring Tool

Bitcoin’s price reaction to US jobs data

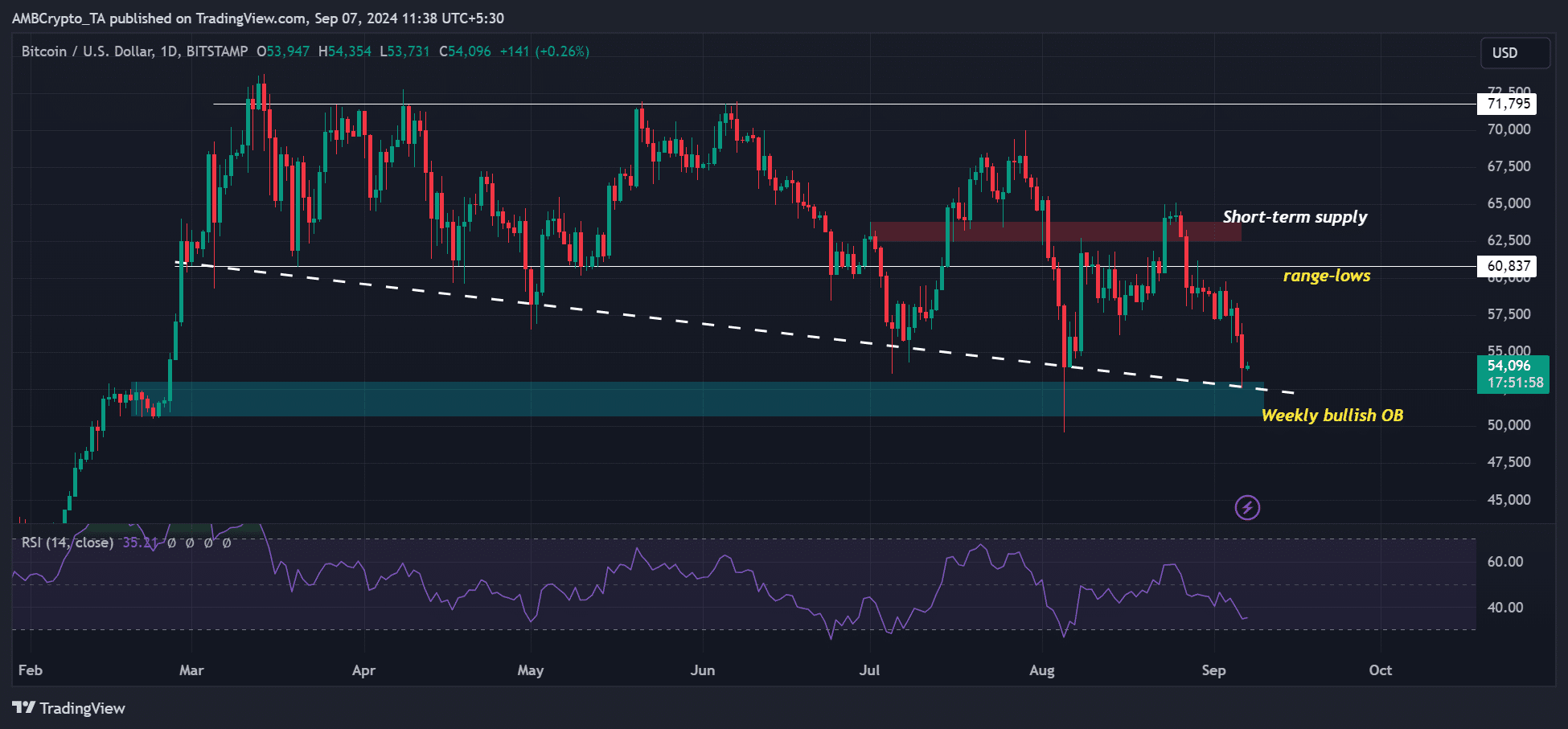

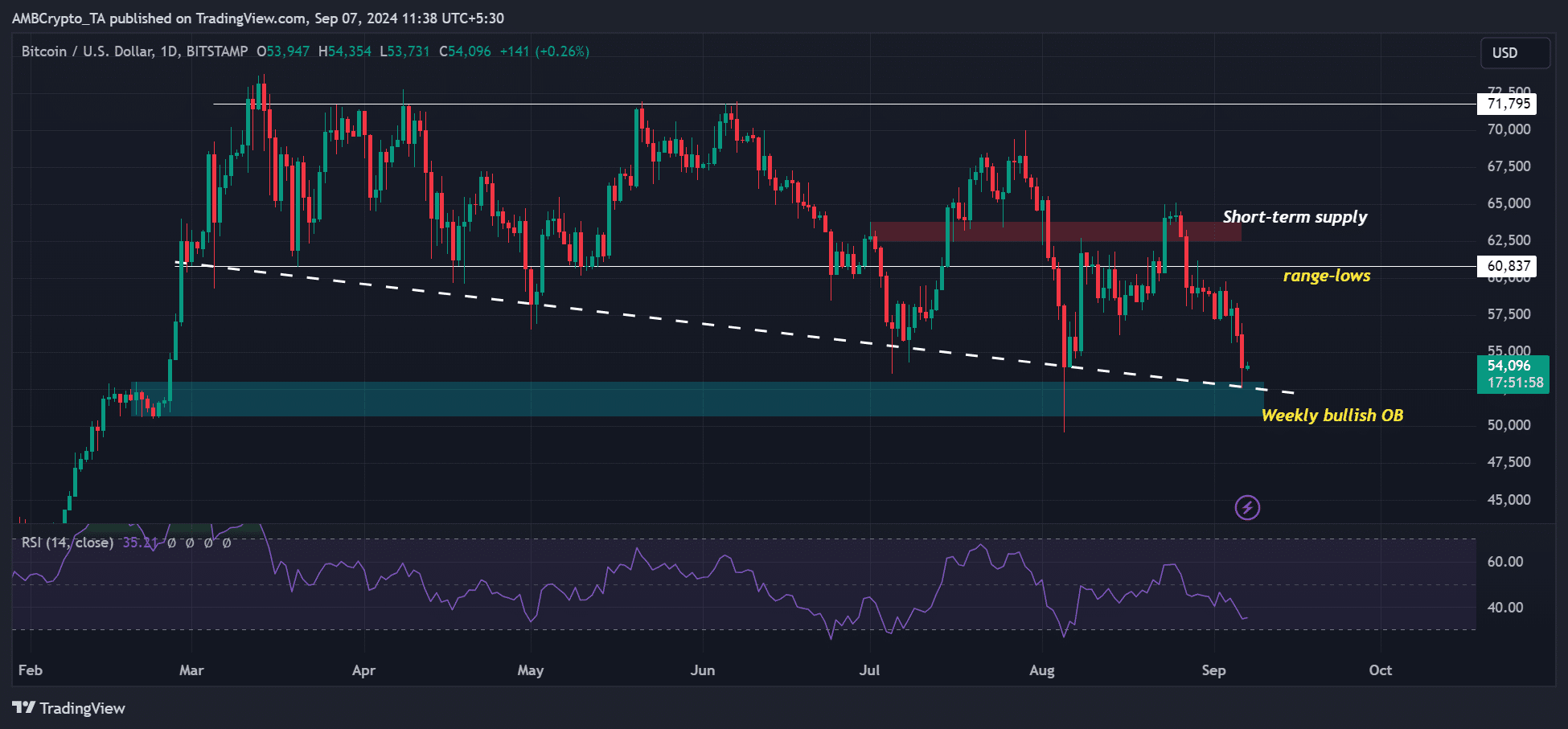

After the report was released, BTC rose to $56.9k on the charts. However, this turned out to be a short-term bull trap.

The cryptocurrency soon fell sharply to $52.5k later – a monthly low.

Source: BTC/USD, TradingView

Here it is worth noting that the extended decline to $52,000 hit a weekly bullish order block (OB) and support level (marked in cyan), halting the early August plunge.

Therefore, a Bitcoin drop to $52,000 could be a great buy possibilityspecial if support holds.