Data shows that Binance’s NFT marketplace wasn’t really a popular destination for Ordinals anyway – with traders now fixated on Runes.

Binance’s decision to remove support for Ordinals in April raised eyebrows among Bitcoin enthusiasts.

The embattled exchange, which has faced legal battles on multiple fronts in recent months, said the move was aimed at “streamlining” its product offering.

Subsequently, anyone holding Bitcoin NFTs was warned to move them elsewhere so they can continue to be eligible for airdrops.

This marks a fairly sudden turnaround from Binance, the largest crypto platform in terms of trading volume.

Ordinals only became technologically possible early last year and allow inscriptions to be made on a single satoshi – the equivalent of one 100 millionth of a Bitcoin.

As a result, images, videos and other forms of data can now be linked to sats, but critics argue that this only serves to clog Bitcoin’s blockchain.

Last May, Binance Product Head Mayur Kamat said:

“Bitcoin is the OG of crypto. We believe things are just getting started here and can’t wait to see what the future holds in this area.”

Mayur Kamat

So why this dramatic turnaround – and will it be a crushing blow to Ordinals’ future?

How do the Ordinals hold up?

Binance officially ended support for Ordinals on April 18, meaning they could no longer be traded through the platform’s NFT marketplace.

Data from CryptoSlam! shows that since then there has been a clear decline in Ordinals sales volumes – as well as in the number of unique buyers and sellers.

Ordinal numbers sales, unique buyers and sellers | Source: CryptoSlam!

Sales volume was $28.2 million on April 19, with a total of 9,469 unique buyers and 9,728 unique sellers.

A week later, to April 26, revenues had dropped to $11.4 million. Meanwhile, the number of buyers and sellers had more than halved to 4,722 and 4,515 respectively.

However, it is important to emphasize that correlation does not imply causation, and there are other factors at play here.

First, April 19 officially marked Bitcoin’s final halving, with block rewards dropping from 6.25 to 3.125 BTC. Traders have been busy with other matters.

But secondly, the halving also led to the launch of Runes – a new standard that allows fungible tokens (like ERC-20 on Ethereum) to be rolled out on Bitcoin more efficiently.

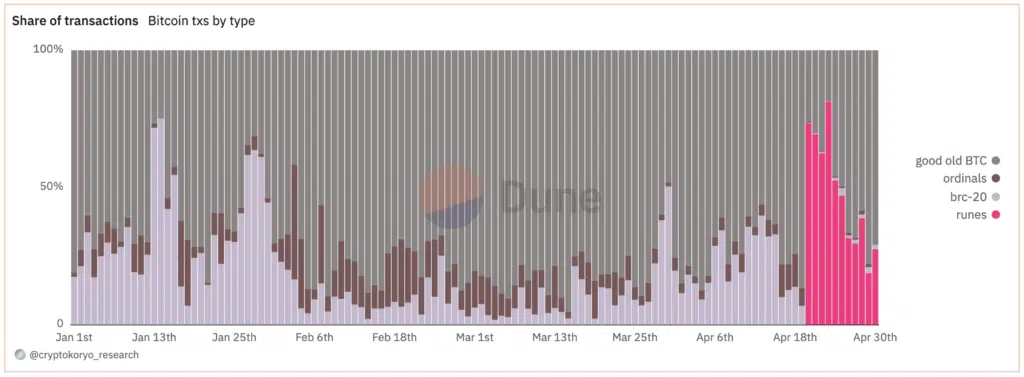

Data from Dune Analytics powerfully explains what happened in the second half of April:

Source: Dune Analytics

As of April 19, Ordinals had a 6.5% share of transactions on the Bitcoin blockchain.

A day later – when Runes made their debut – Ordinals represented just 0.4% of the stock as the frenzied demand for memecoins skyrocketed.

The bright pink in the chart above represents the share of daily Runes transactions, which reached a staggering 73.5% share on launch day.

In other words, Binance is not solely responsible for the declining demand for Ordinals; Runes steal their lunch money.

What next for ordinals?

Ordinals collectors are unlikely to lose much sleep if Binance exits the market – especially considering the exchange has been banned or severely restricted in 20 countries worldwide. They include Canada, China, Japan, Italy, Australia, Great Britain and the US

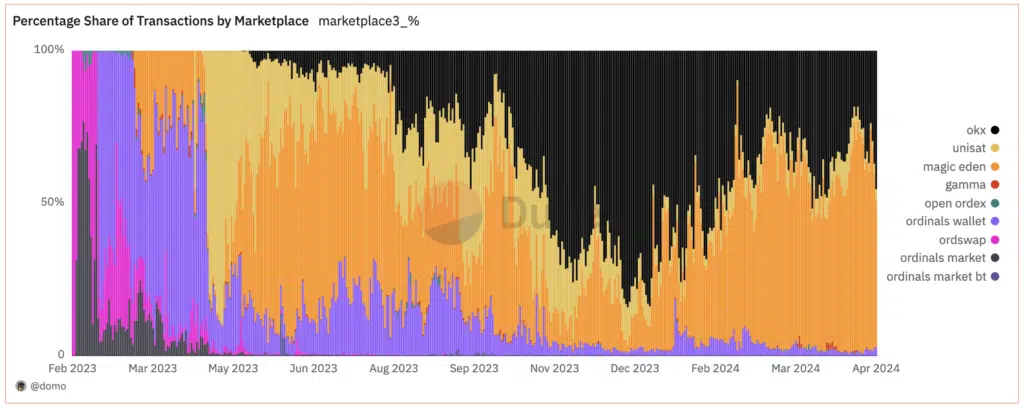

Further Dune Analytics dashboards show that Binance’s NFT platform wasn’t really a popular destination for Ordinals anyway.

On April 29, two marketplaces – OKX and Magic Eden – handled 94% of mutual transactions.

Source: Dune Analytics

You could argue that this amounts to Binance putting its resources in areas where it can actually gain greater market share.

The bigger question now is: will Binance roll out support for Runes soon?

Binance teases mention of Runes

They didn’t list BRC-20 until many months after launch

But when they did, there was hundreds of millions of dollars in volume and it led to $ORDI reaching a $1 billion valuation. pic.twitter.com/ut7hVx3B7t

— trevor.btc (@TO) April 22, 2024

As trading volumes for newly launched memecoins on the Bitcoin network continue to rise, it seems inevitable that Binance will want a piece of the pie.

With exchanges waging a brutal price war to stay competitive on transaction fees, trading platforms are always looking to diversify their revenue streams.

Demand for Ordinals may have fallen in recent weeks, but Bitcoin remains the second-largest blockchain in terms of NFT sales volume – a street ahead of Solana, with Ethereum recently returning to the top spot.

If interest in Bitcoin NFTs recovers, Binance’s decision to stop offering Ordinals through its marketplace may prove shortsighted.

Read more: Binance’s CZ in conversation with Sam Altman to explore AI investments