- BTC has recorded an ATH with its latest price development.

- A new ATH could be on the horizon with the continued rise in the coin’s realized limit.

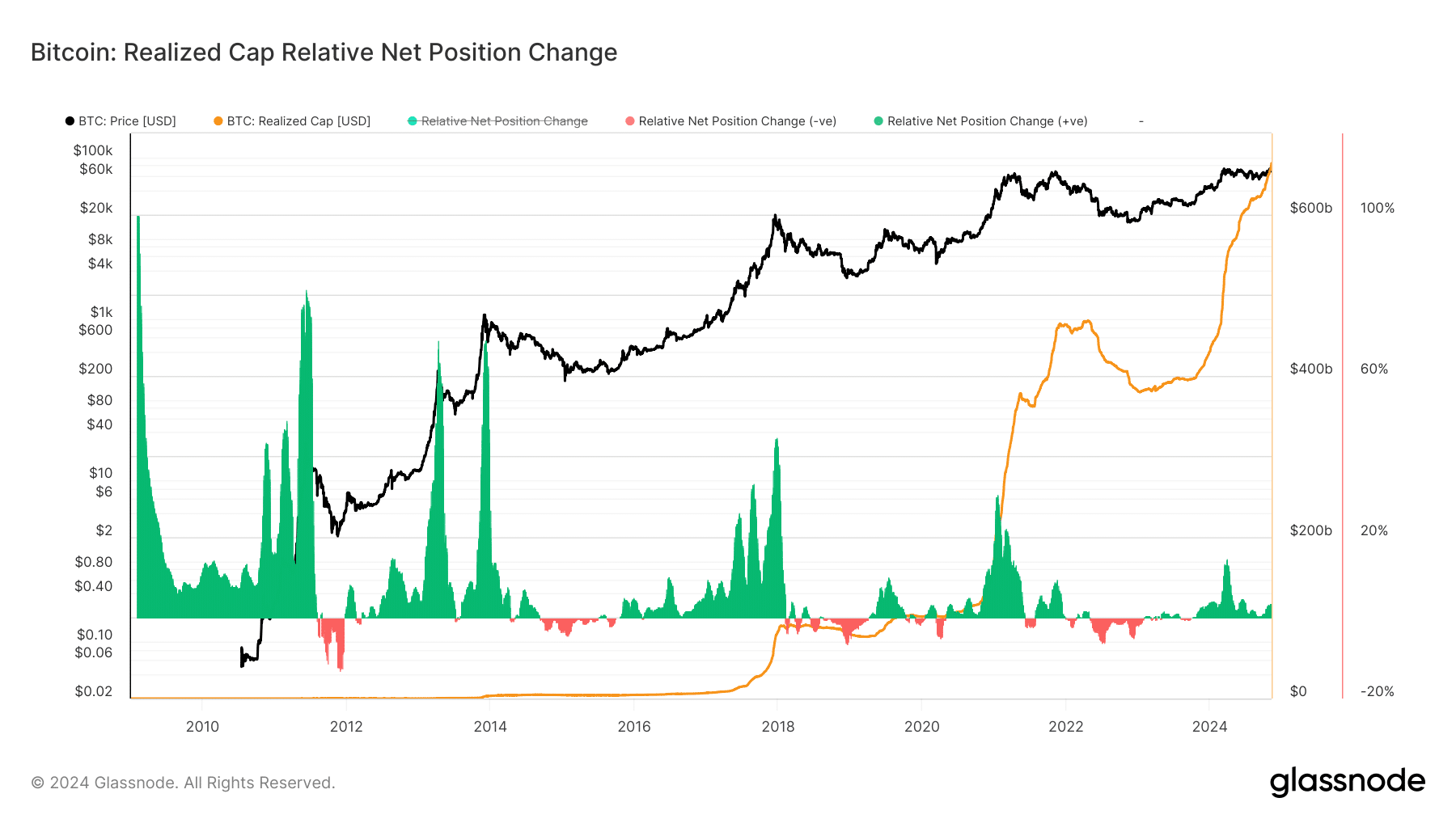

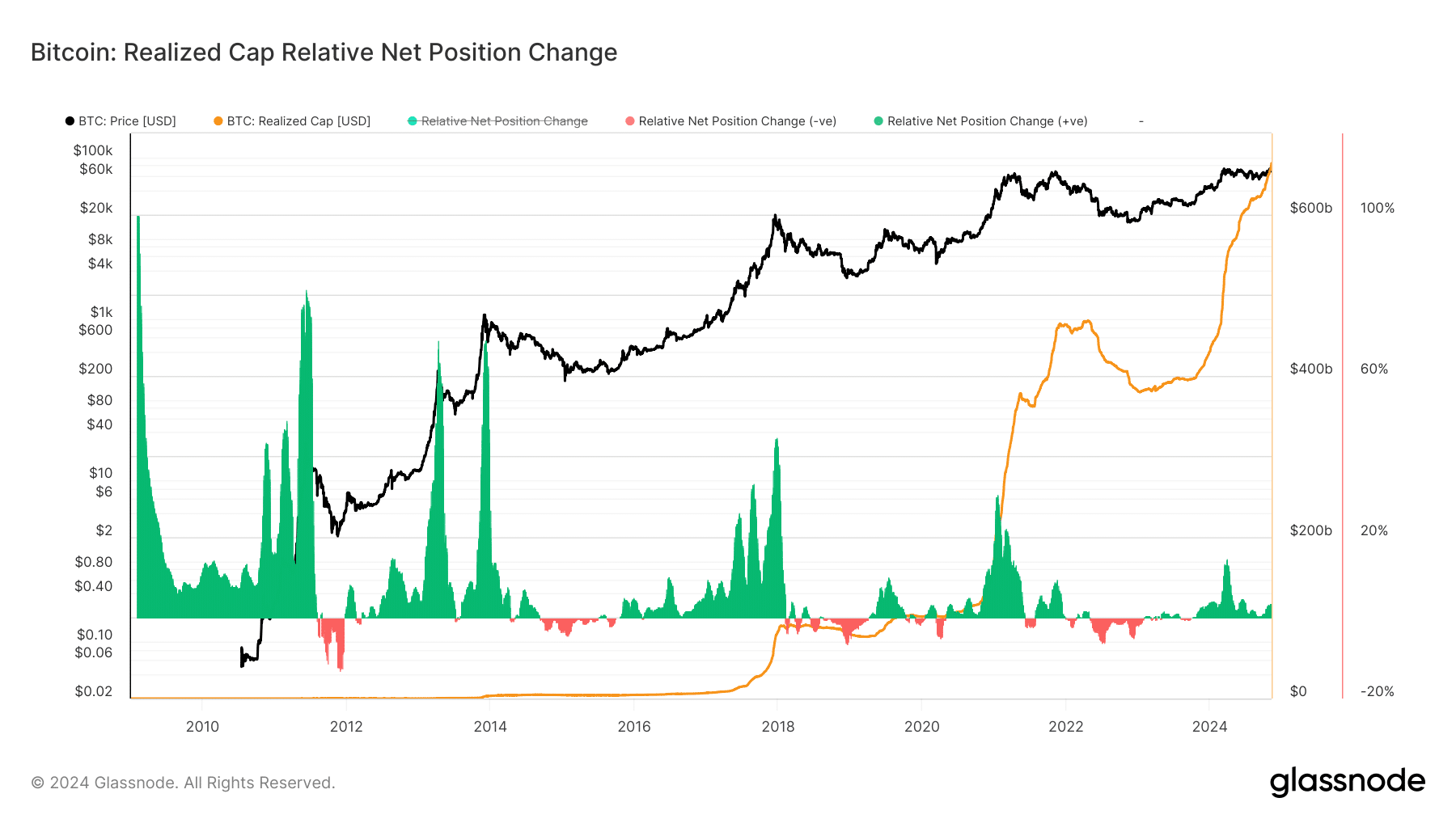

The Bitcoin[BTC] The market is no stranger to price volatility, with investors constantly monitoring numbers that signal potential shifts. Data on the coin’s realized limit adds weight to a bullish narrative.

Recently, Bitcoin’s realized limit saw a significant increase, a shift that could be crucial in predicting BTC’s price direction.

What does the increase in the realized limit mean for the price development of BTC?

Bitcoin sees record realized market capitalization

The realized cap is an alternative to market cap that takes into account the acquisition cost of each Bitcoin instead of its current market value. It reflects the sentiment of holders who acquired BTC at different price levels.

Analysis of statistics Glass junction showed that it has risen to approximately $663 billion, the highest level in its history.

Source: Glassnode

A rising realized limit indicates that coins held by long-term investors are growing in value. This is a positive sign of market stability and investor confidence. The recent increase in Bitcoin’s realized limit indicates that more capital is flowing into BTC even as the price fluctuates.

For Bitcoin, a higher realized limit often indicates less selling pressure among holders. Analysis of the realized limit showed that over the years, when the metric reaches an all-time high, there is usually a price drop followed by a new all-time high for the coin.

With BTC’s realized cap hitting new highs, it shows that investors have more confidence in the future price growth of the cryptocurrency. This potentially reduces the supply available for trading.

The impact on the price development of BTC

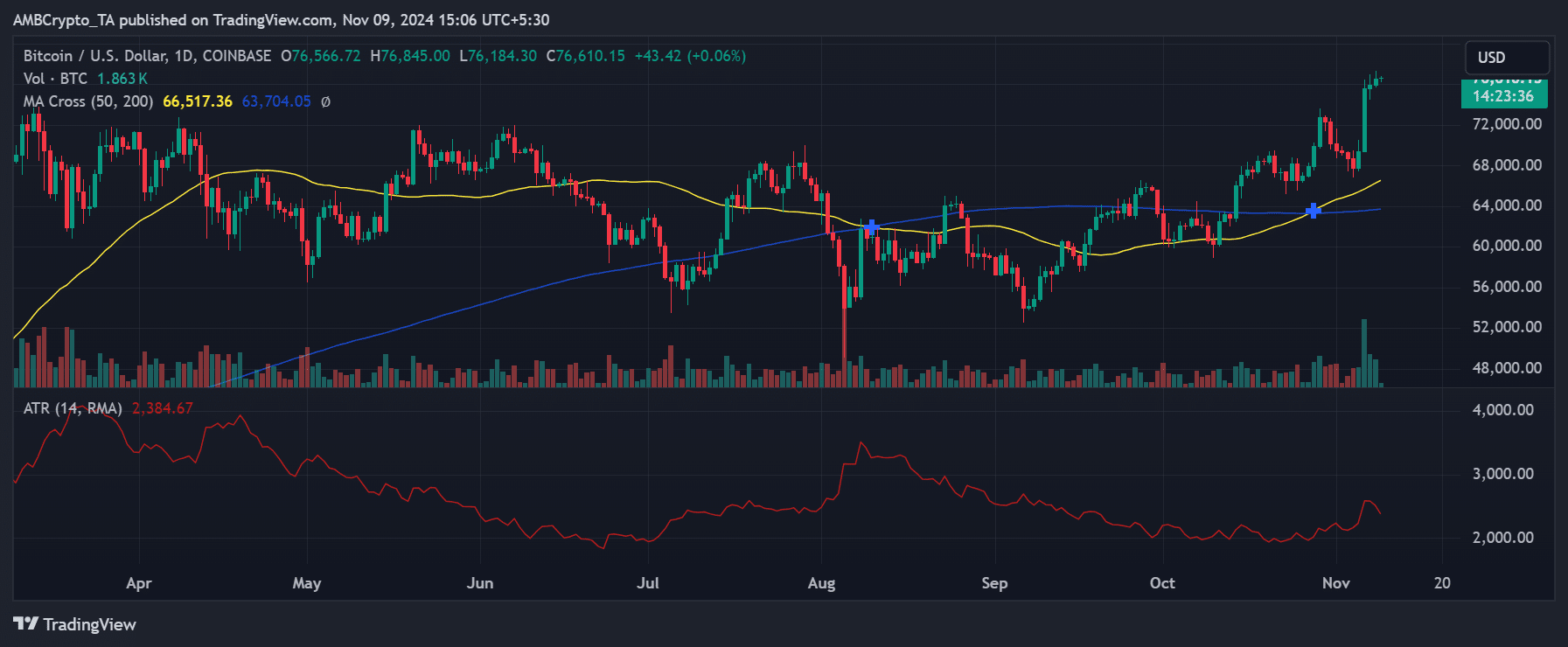

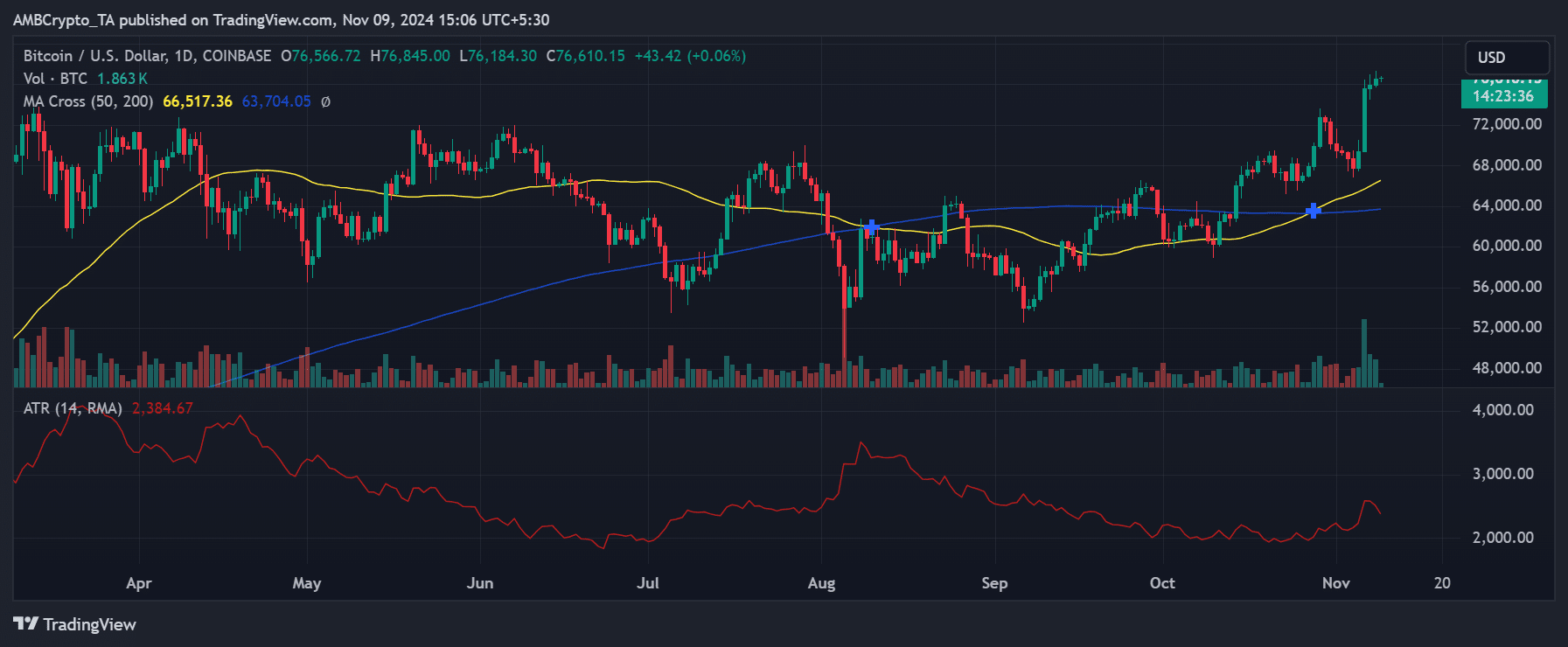

The upward shift in the realized limit could significantly impact Bitcoin’s price. As the realized cap grew, it suggested that more investors were holding on to their assets rather than selling.

This move could support BTC’s current price levels and provide a basis for further price appreciation.

Source: TradingView

Technical indicators, such as the moving averages on the BTC price chart, confirm this sentiment. At the time of writing, BTC was trending above its 50-day and 200-day moving averages (MA), showing bullish momentum.

If the realized cap continues to grow, it could encourage more investors to buy and hold, contributing to sustainable price support at higher levels.

Key levels indicate BTC’s next step

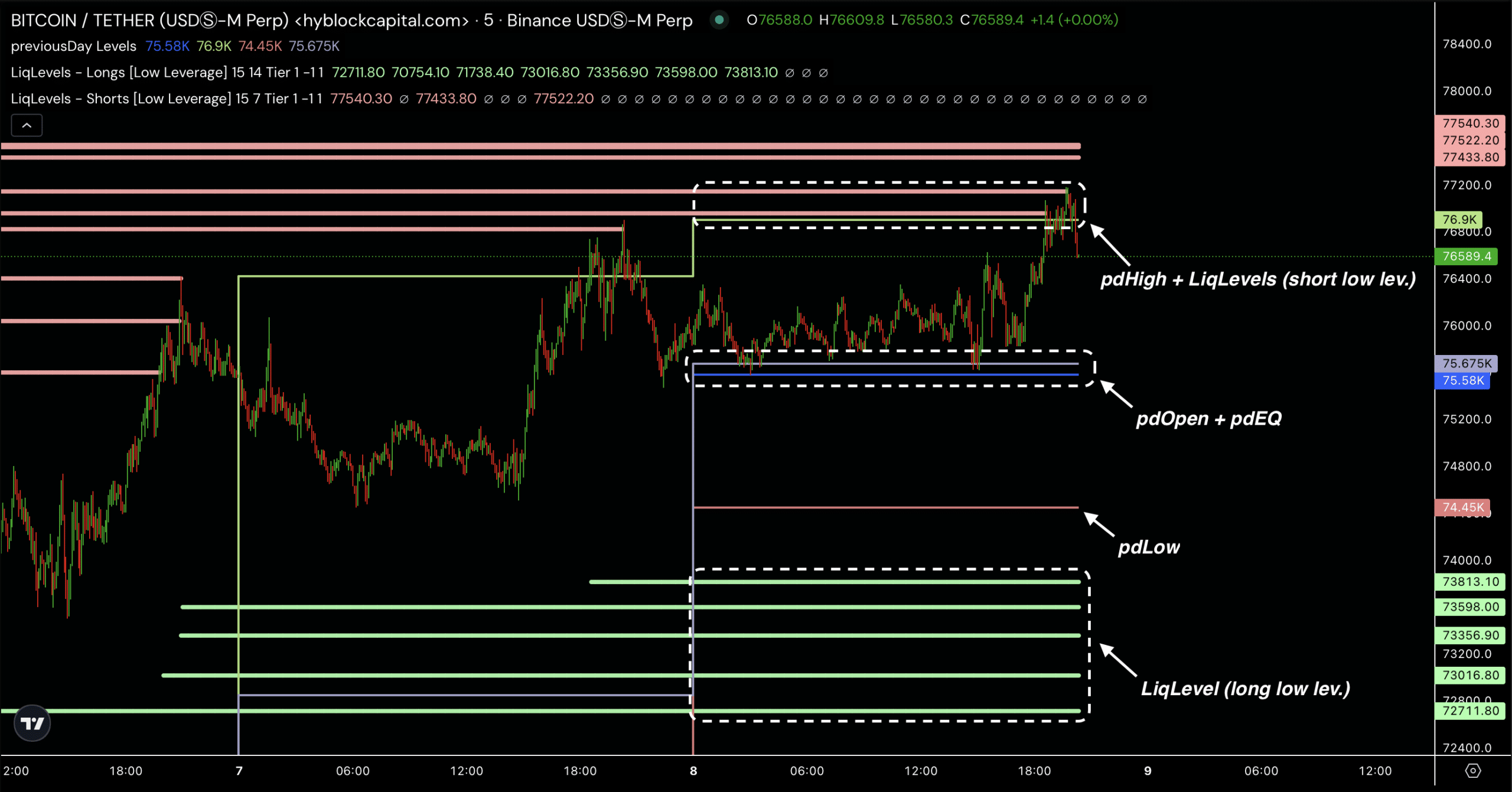

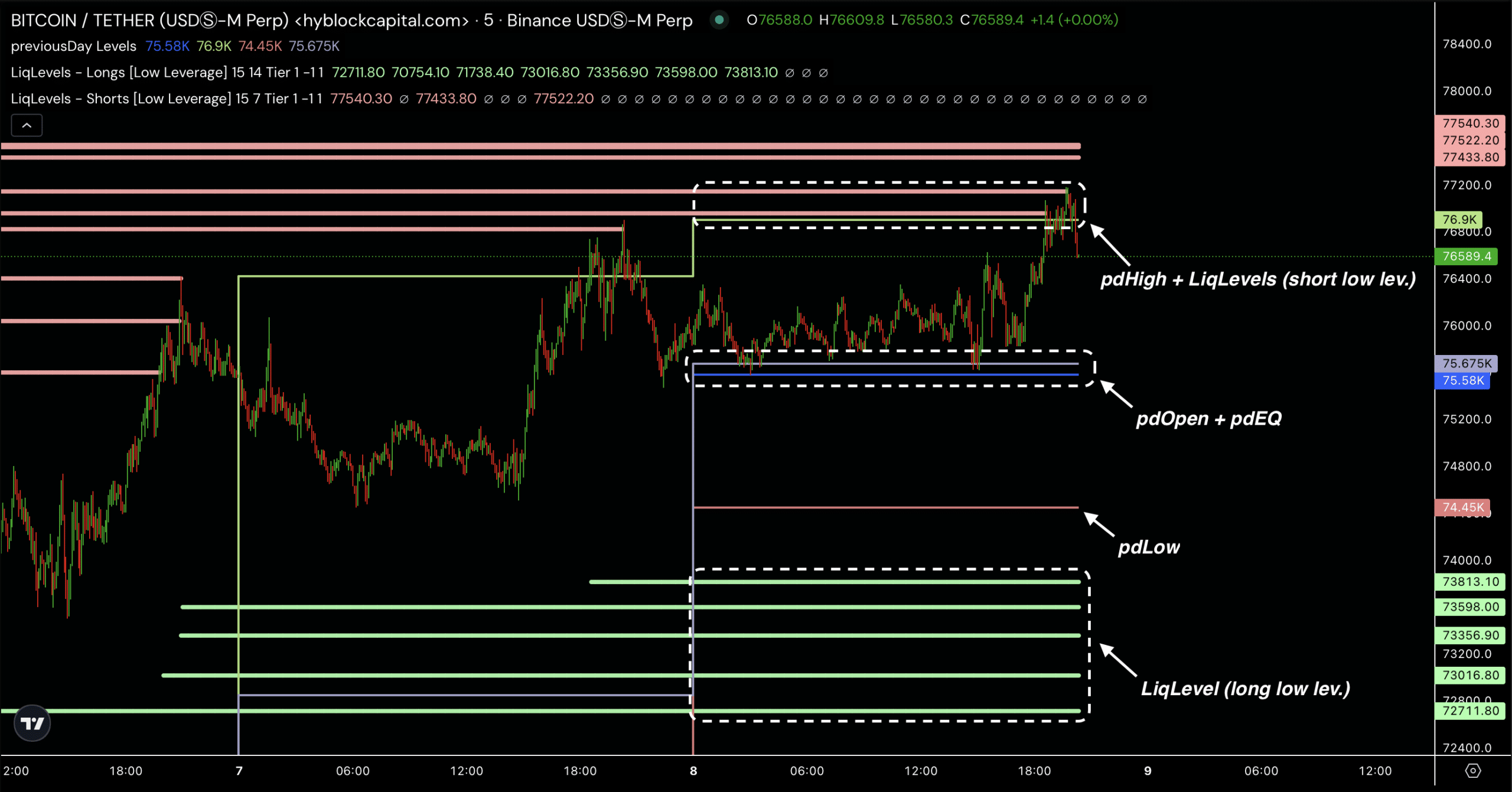

Analysis of data from Hyblock showed that Bitcoin traded within a tight range between the previous day’s high (pdHigh) and the combined levels of the previous day’s open and equilibrium (pdOpen + pdEQ). Market dynamics indicated significant resistance and support zones at these levels.

According to the latest data, BTC faced resistance around the pdHigh, with a cluster of short liquidation levels indicating strong selling pressure.

If Bitcoin exceeds this level, it could trigger short liquidations, fueling upward momentum.

Source: Hyblock

On the support side, Bitcoin found strength around the pdOpen + pdEQ zone, providing a potential entry point for bullish traders. Long liquidation levels below the pdLow indicated additional layers of support that could prevent a sharp decline, especially if buying interest increases.

This consolidation reflected a market that was cautious. It aligns with broader trends in Bitcoin’s rising realized cap. This underlines the strong confidence of shareholders in the long term.

What can you expect in the coming months?

Historically, significant price gains have often followed a rising realized limit during a BTC uptrend. This is because investor sentiment remains strong and the sell-off is limited.

Bitcoin could be positioned for another rally if this trend continues and possibly reach or even surpass recent highs. Furthermore, the Average True Range (ATR) values indicate manageable volatility, providing a stable environment for BTC’s continued growth.

– Read Bitcoin (BTC) price prediction 2024-25

The rising realized limit indicates a strong base for Bitcoin’s price as long-term holders show minimal intent to sell.

If historical patterns hold, this trend could act as a launching pad for Bitcoin to reach new price milestones.