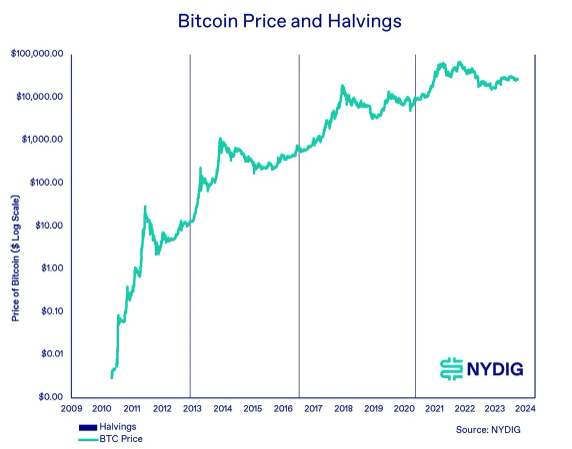

- Bitcoin could repeat a pattern similar to the halvings of 2012, 2016 and 2020.

- All eyes would be on the Bitcoin ETF’s fourth quarter outcome.

A lot in recent months Bitcoin [BTC] holders viewed the decision on the ETF applications as the possible catalyst that could rocket the king coin to parabolic price levels. However, that has not been the situation. This is because the supervisors involved have chosen to postpone the applications until they deem this appropriate.

Read Bitcoins [BTC] Price prediction 2023-2024

Despite this, BTC’s Year-To-Date (YTD) performance has remained at an impressive 63.3% gain. Bitcoin strategy fund New York Digital Investment Group (NYDIG), in its third quarter judgement of the market, considered its performance great, especially as Bitcoin surpassed any other asset class.

The scenario will not change

As AMBCrypto reported previously, the currency’s 11% decline in the third quarter was a bit disappointing. However, NYDIG said this was not surprising as there were growing concerns about the economic downturn and rising interest rates.

Regardless of current events, the asset management firm noted that Bitcoin’s halving next year is still the most important facet that could influence BTC’s price action.

Source: NYDIG

By April 2024, the halving will reduce the block reward from 6.25 BTC to 3.125 BTC on exactly 840,000 blocks. According to NYDIG, the halving remains one significant factor from an economic perspective, noting that,

“By repeatedly halving the supply function, Bitcoin will eventually reach a point in 2140 where it can no longer be divided in two. This will effectively stop the growth of the number of Bitcoins, a key part of Bitcoin’s ‘controlled supply’ feature.”

The ETF is also important

On the price front, the company also said this would continue the pattern of previous cycles. For example, after the 2016 halving, BTC rose from 1,700 to over 15,000 months later.

The scenario was not exactly different in 2012 and 2020 either. NYDIG also mentioned that the November 2021 decline was similar to the experience of the 2018-2019 cycle.

Source: NYDIG

The report further added that 2023 was already showing signs of the recovery that took place in 2019. NYDIG explained that:

“While 2023 looks a lot like 2019, it has not yet experienced such a significant retracement. Nevertheless, it is important to emphasize the repetitive cyclical nature as Bitcoin appears to be following the path set by the previous two cycles.”

Nevertheless, NYDIG noted that sticking with halving as a catalyst doesn’t negate this influence may have the Bitcoin ETF approval.

Is your portfolio green? Check the BTC profit calculator

It also mentioned that the lawsuit between Grayscale and the SEC, as well as the final decision on the ETF applications, could make or break BTC. The report read,

“As we enter the fourth quarter, all eyes are on legal proceedings and the industry’s concerted efforts to gain approval for spot Bitcoin trading in the US.”