- The number of addresses holding more than 1 BTC has decreased since the beginning of the year

- Statistics showed that investors may have sold to make a profit

After a comfortable uptrend, Bitcoin [BTC] saw a price drop on the charts and began to consolidate below $70,000. Meanwhile, it appears that players with deep pockets have reduced their holdings in 2024 as well.

Does this mean they have lost confidence in BTC? Or did they reduce their positions to make a profit?

Do Whales Sell Bitcoin?

Here it is worth noting that even though the value of BTC fell, the price was still hovering close to all-time highs at the time of writing. With Bitcoin performing as it has, IntoTheBlock shared a tweet shows an interesting development. According to the same, 1,013,120 addresses had more than 1 BTC. This number decreased from 1,024,437 since the beginning of the year.

At first glance, this could indicate that whales are losing confidence in the king coin. However, the reality may be different. The whales may have chosen to sell their assets to make a profit. Especially since the price of BTC was significantly high on the charts.

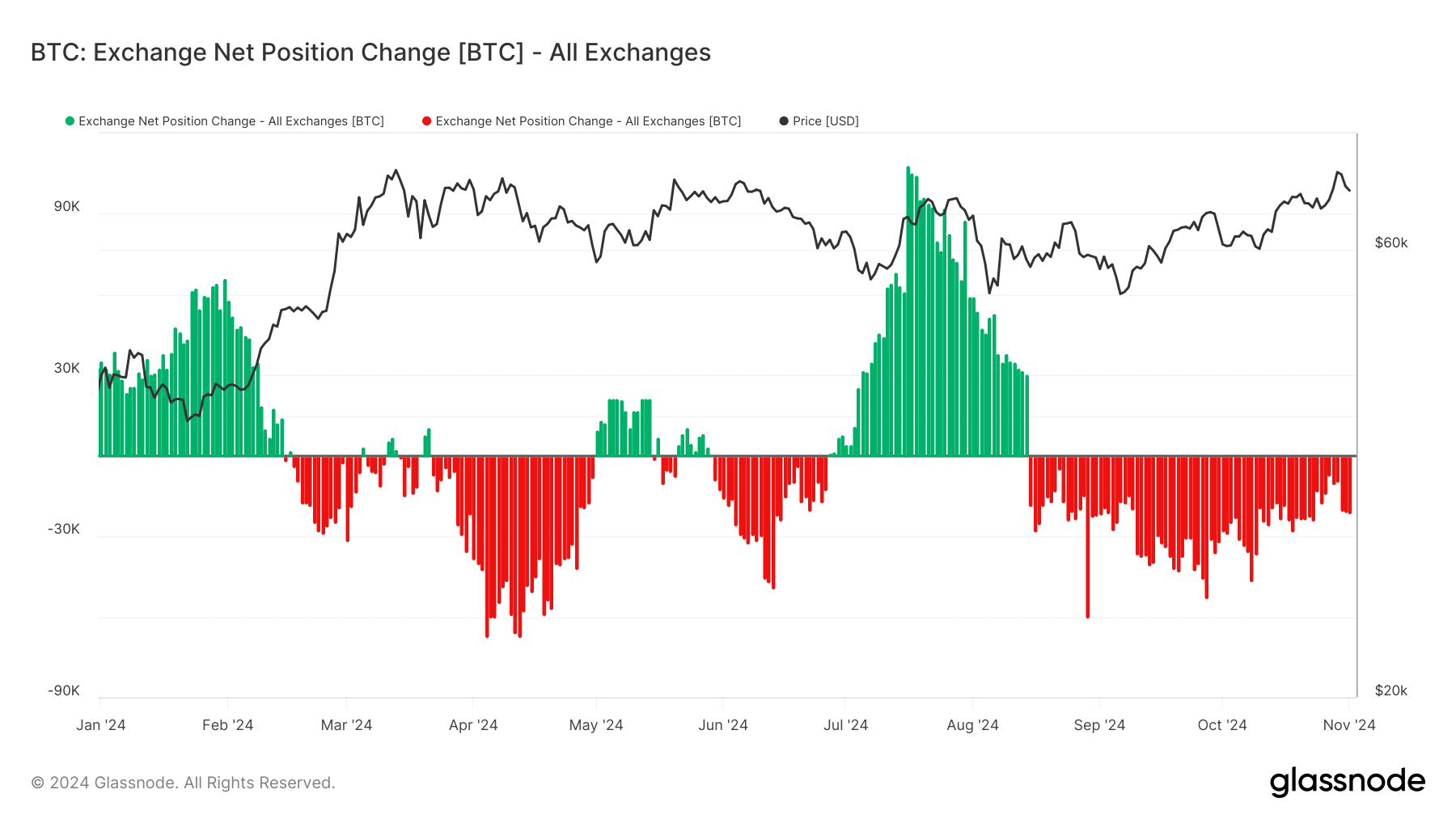

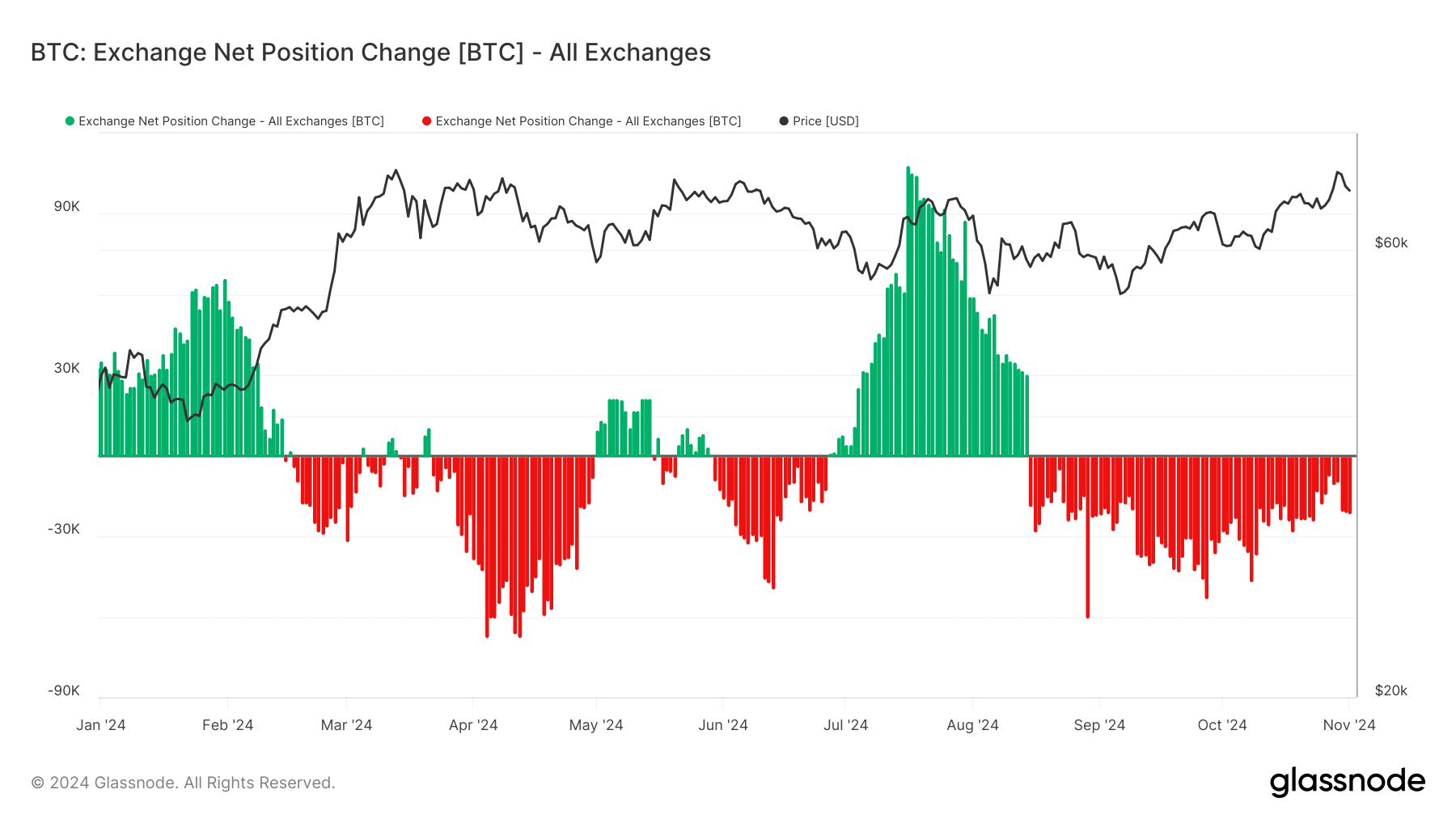

To check the same, AMBCrypto reviewed the crypto’s on-chain data. According to AMBCrypto’s analysis of Glassnode’s data, Bitcoin’s net position change has remained in the negative zone in recent months. An important reason for this could be the price increase of BTC during the same period. When prices approach ATHs, investors generally often choose to sell their holdings to take profits.

Source: Glassnode

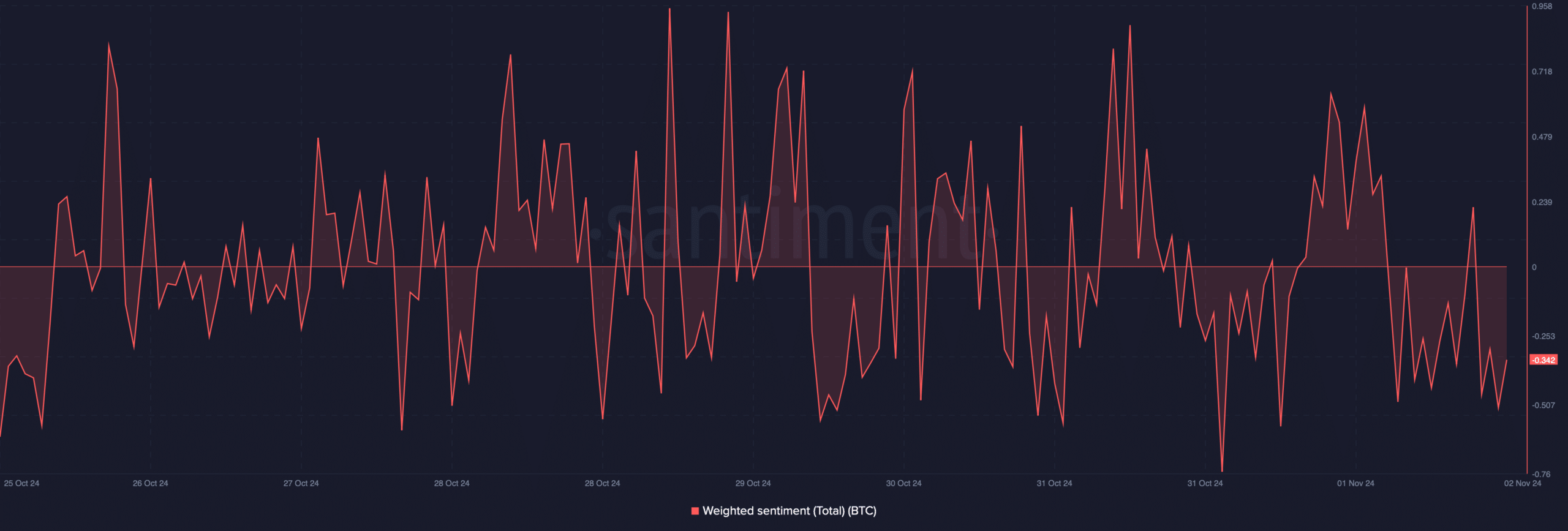

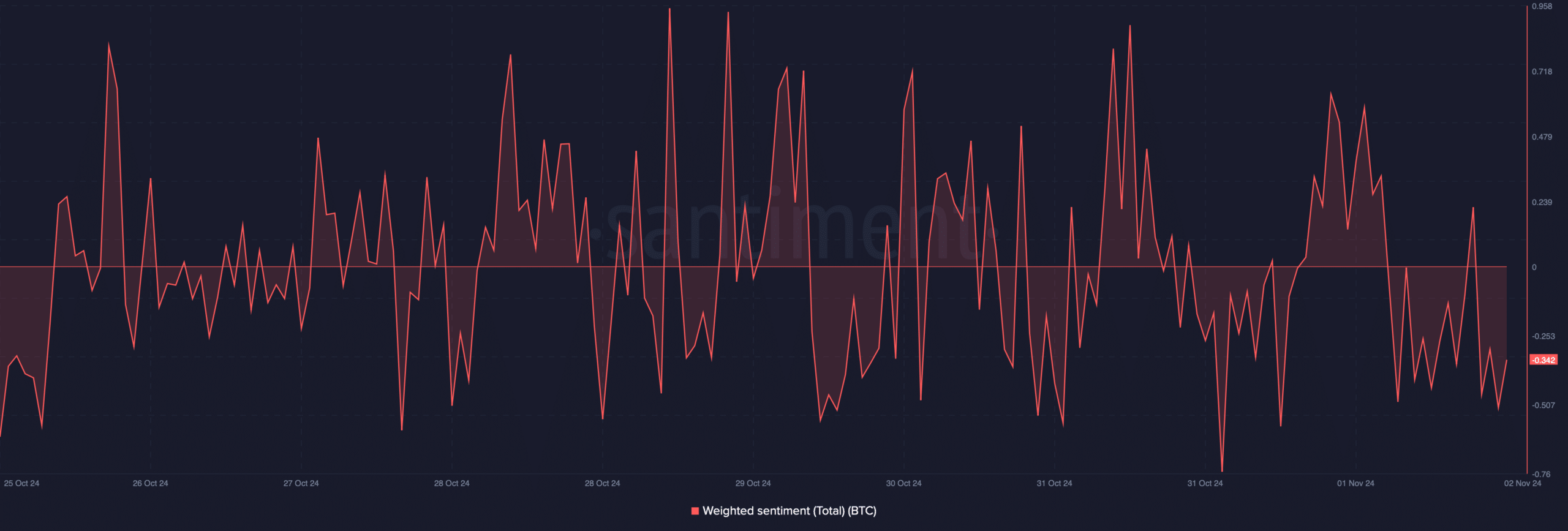

AMBCrypto then checked Bitcoin’s social metrics to find out if trust in the coin has actually declined. According to our analysis, BTC’s weighted sentiment continued to move regularly into the positive and negative zones over the past week.

This meant that no particular sentiment was dominant in the market. Therefore, the possibility of whales being sold for profit seemed high.

Source: Santiment

Mapping the future of BTC

As the deep-pocketed boards took profits and reduced their holdings, AMBCrypto then assessed how this could affect the crypto’s price.

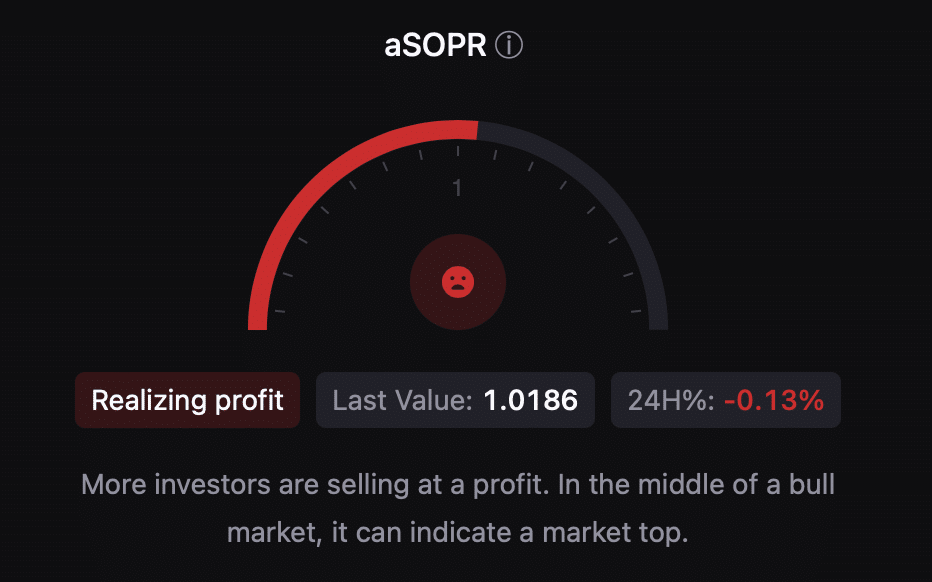

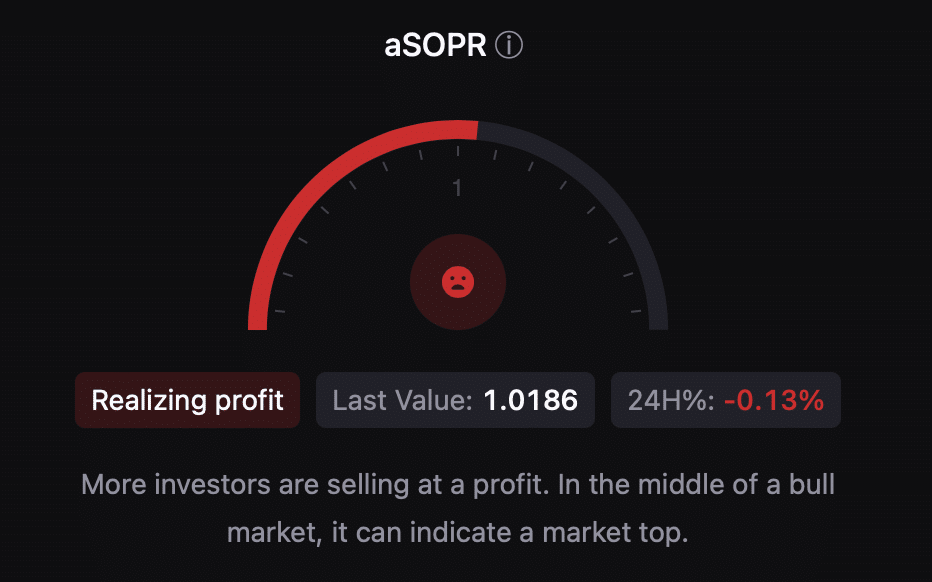

According to our analysis of CryptoQuant’s data, Bitcoin’s aSORP was red. This indicated that more investors sold at a profit. In the middle of a bull market, this could indicate a market top.

Source: CryptoQuant

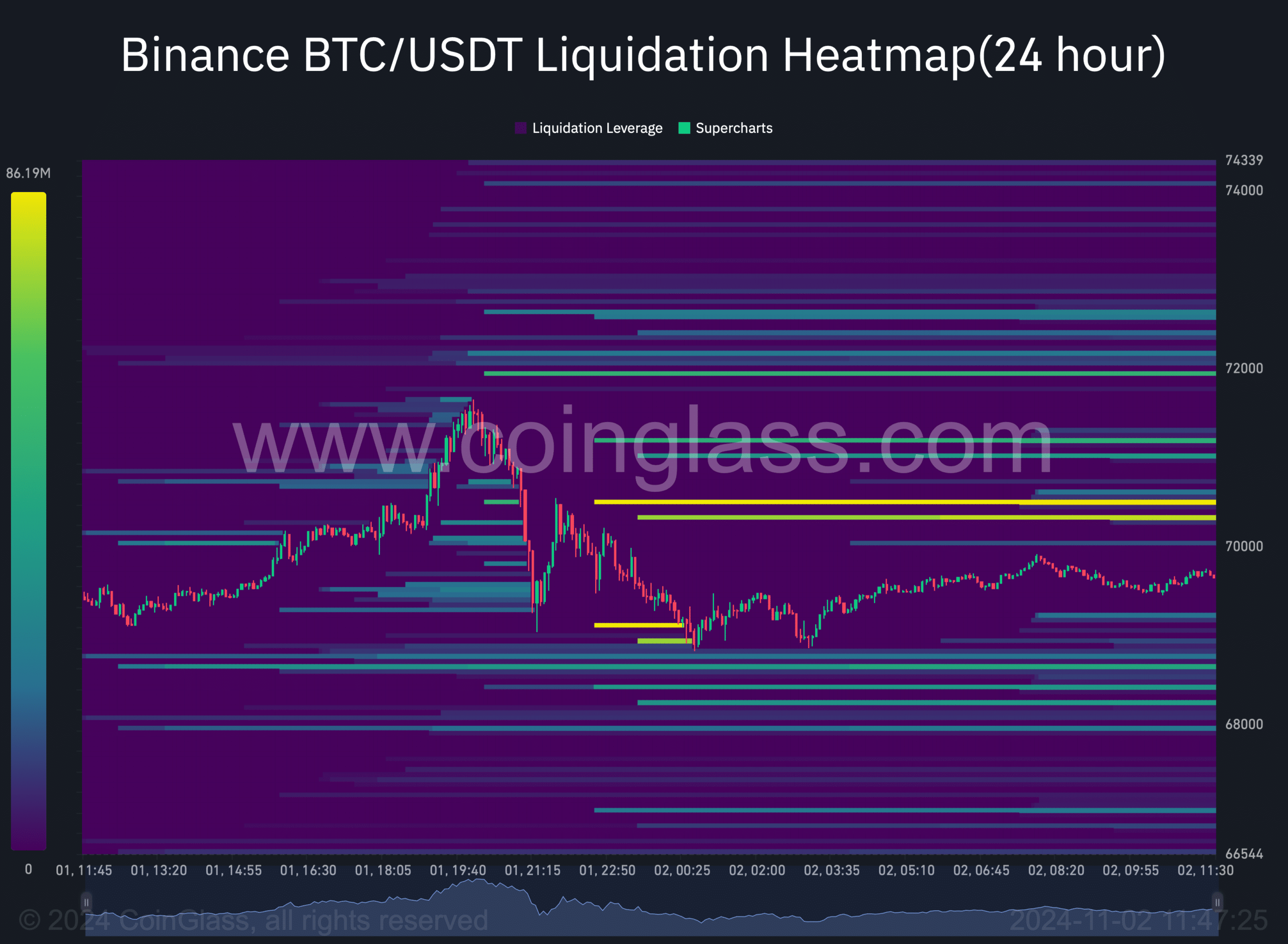

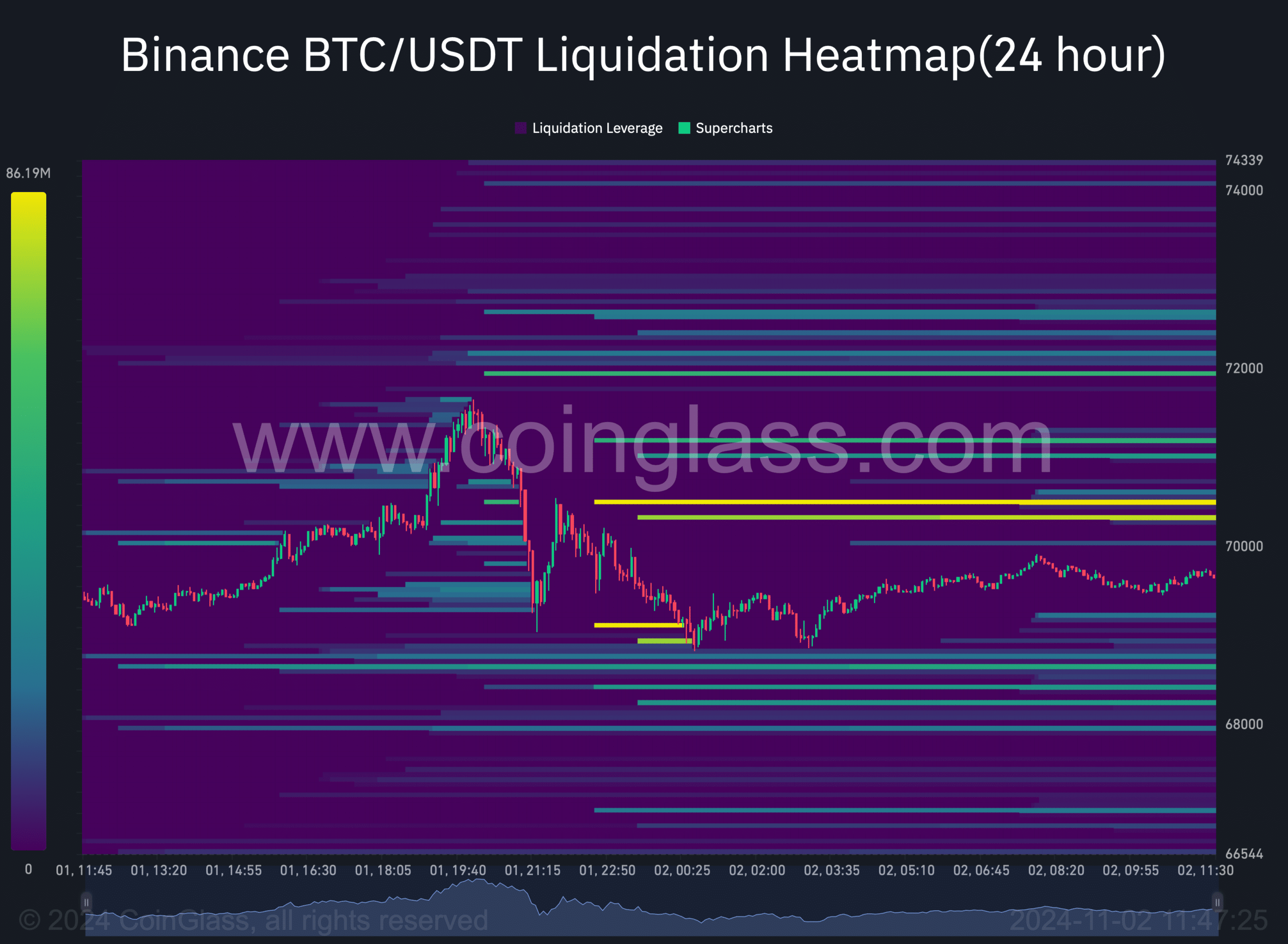

Coinglass’ liquidation heatmap also revealed that in the event of a price drop, BTC’s value could drop to $68.6k. This was the case as liquidations are set to rise sharply, potentially serving as support for bulls given a chance to bounce back.

Read Bitcoins [BTC] Price prediction 2024-25

Nevertheless, AMBCrypto reported that BTC’s NVT ratio has fallen in recent days – a finding that indicated a price increase.

Source: Coinglass