- Bitcoin sentiment is rising with ETF inflows, but analysts warn of a bearish head-and-shoulders pattern.

- Market corrections follow Bitcoin’s bullish sentiment, with the MVRV ratio showing balanced market conditions.

Bitcoin [BTC] has undergone a market correction after a period of increased bullish sentiment.

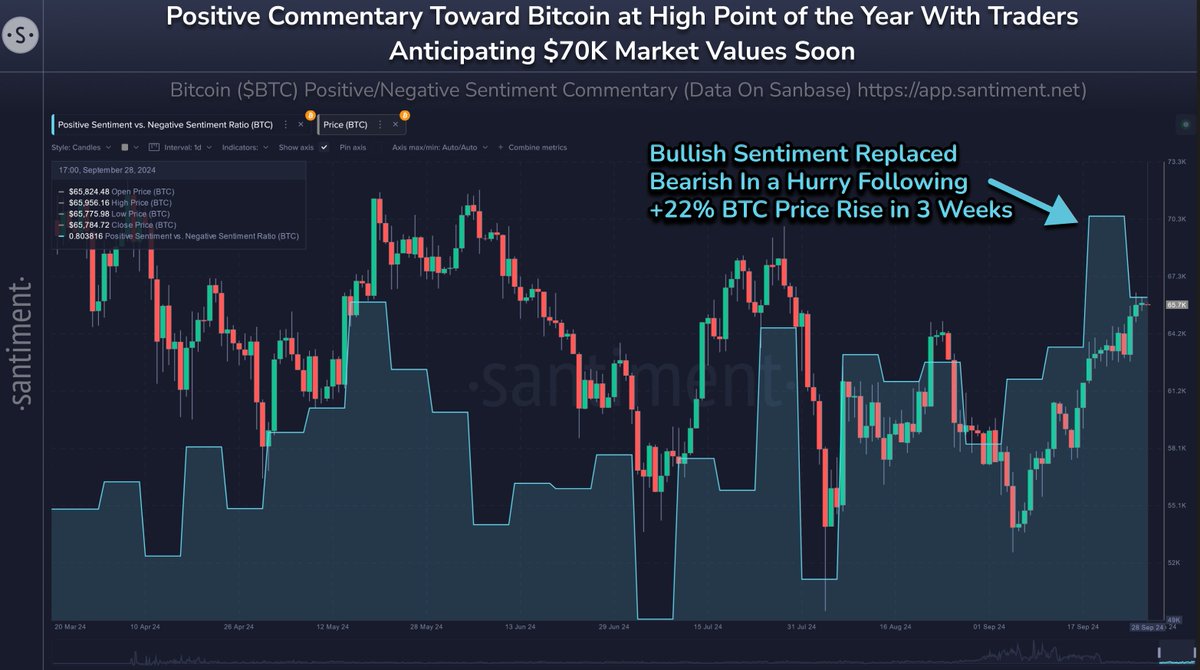

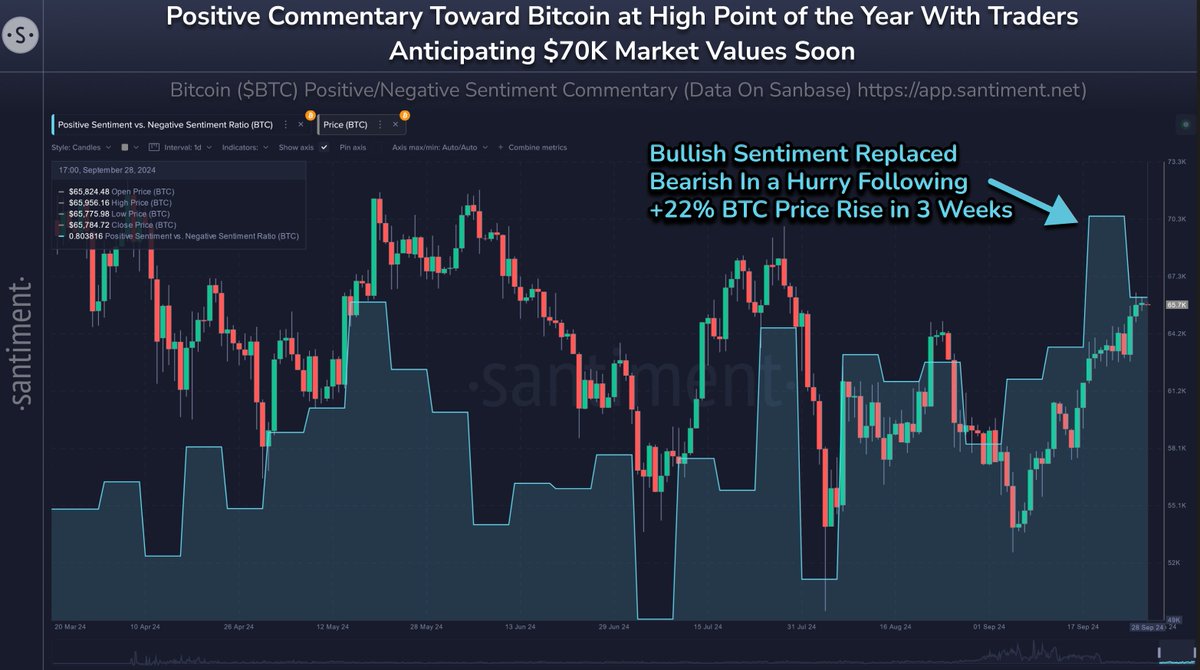

According to the market information platform Santimentthe public’s optimism towards Bitcoin has been steadily growing, with sentiment data showing a notable shift.

However, this optimistic outlook has raised concerns about a potential market top, which often leads to price corrections in the cryptocurrency space.

Bitcoin’s price found from $65,664 to $63,243 on Monday, driven by panic selling.

Santiment warns that if the current fear of missing out (FOMO) turns into fear, uncertainty and doubt (FUD), the Bitcoin market could experience increased volatility.

Santiment noted that the market has historically moved against public expectations, indicating a possible continuation of this correction.

Rising sentiment and ETF inflows

Santiment’s analysis last Friday indicated growing confidence among Bitcoin traders, following a 22% price increase in the past three weeks.

The sentiment ratio, which tracks the balance between bullish and bearish messages about Bitcoin, revealed a significant increase in optimism, with 1.8 bullish messages for every bearish message.

While this indicates positive sentiment, Santiment points out that excessive confidence often precedes market declines as traders may be too optimistic.

Source: Santiment

At the same time, Bitcoin Exchange-Traded Funds (ETFs) have seen massive inflows. On September 30, Lookonchain reported that $BTC ETFs witnessed a net inflow of 7,111 BTC.

This amounted to approximately $453.42 million.

A significant portion of this, approximately 3,085 BTC ($196.71 million), came from ARK21Shares, bringing its cumulative holdings to almost 50,684 BTC.

These institutional inflows come as market participants await the U.S. Securities and Exchange Commission’s (SEC) decision on pending applications for spot Bitcoin ETFs.

Anticipation of potential ETF approvals has likely contributed to the growing interest from institutions.

Moderation in the market

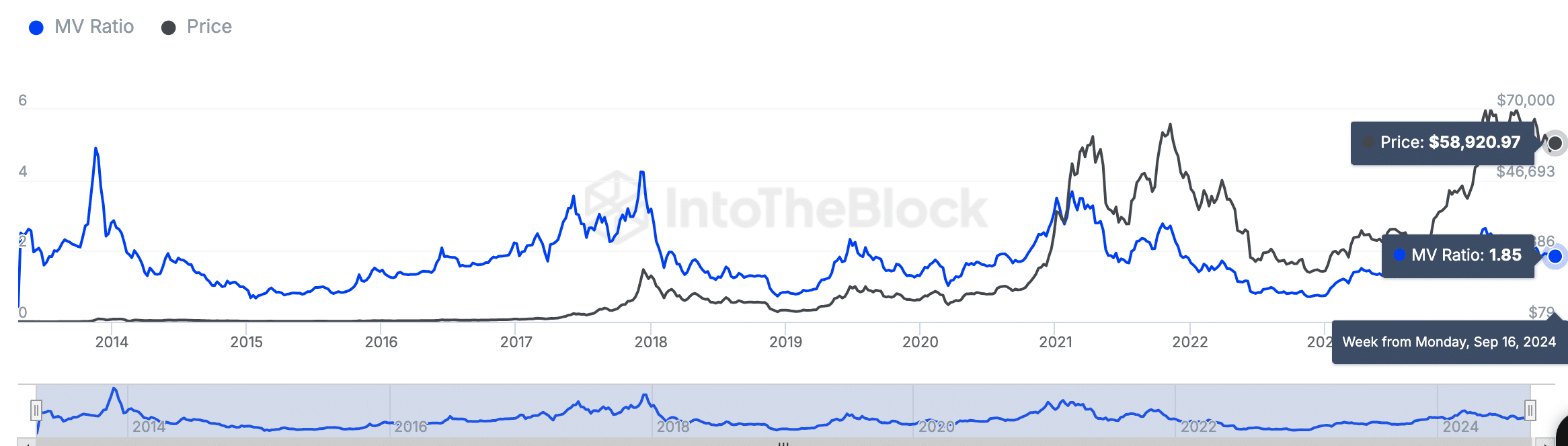

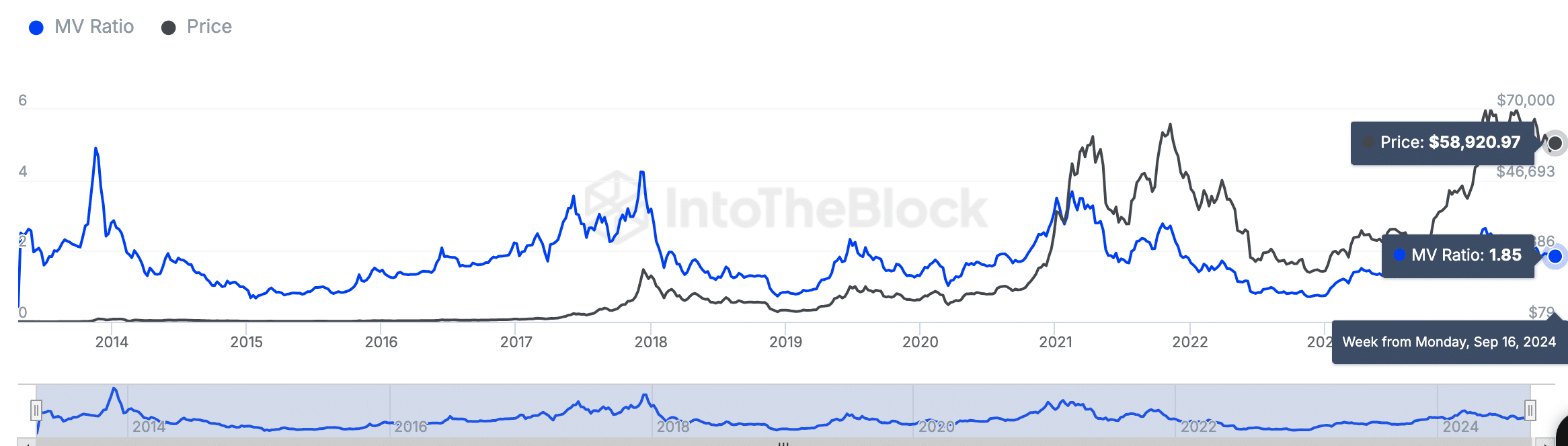

The MVRV ratio, which compares Bitcoin’s market value to its realized value, currently stands at 1.85. This suggests that Bitcoin is trading above its realized value, but is not in an overheated or undervalued state.

Historically, spikes in the MVRV ratio, typically above 3.5, have marked Bitcoin price peaks, such as during the bull markets of 2013, 2017, and 2021. These periods were followed by sharp corrections and bear market phases.

Source: IntoTheBlock

When the MVRV ratio falls below 1, it indicates that Bitcoin is trading below its realized value, which often presents buying opportunities.

However, the press time ratio of 1.85 suggested that the market was in a balanced state, with potential for further correction or recovery depending on future sentiment shifts.

A bearish technical pattern increases uncertainty

Adding to the uncertainty is a recent one report from AMBCrypto highlighted the concerns of a crypto analyst known as Ash Crypto.

Read Bitcoin’s [BTC] Price forecast 2024–2025

The analyst pointed out a multi-year bearish head-and-shoulders pattern on the Bitcoin chart that has been developing since 2021.

The price of the coin is approaching the neckline support of this pattern, and failure to hold this support could result in a substantial price drop.