- According to Hayes, BTC could fall below $50,000 despite the expected Fed rate cut.

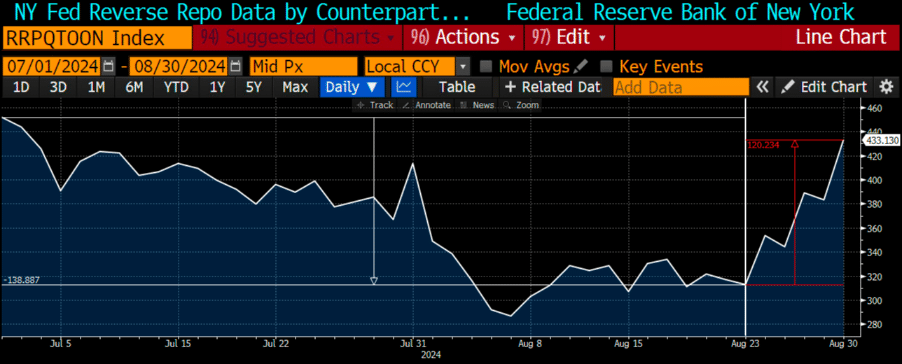

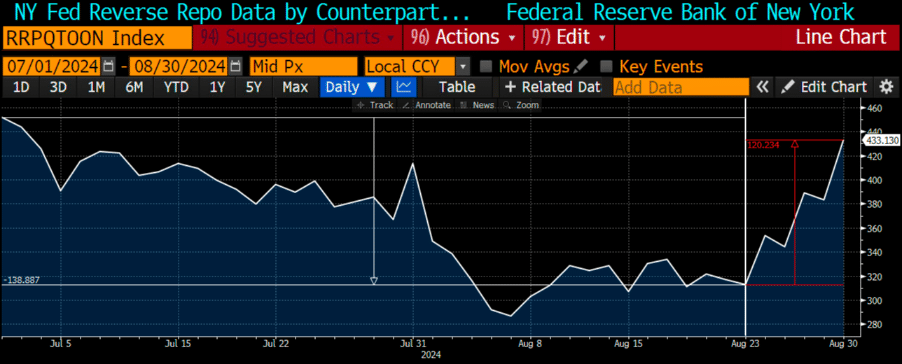

- Financial institutions are reportedly parking money in the Fed’s RRP for higher returns instead of risky assets like BTC.

In less than a week in September, Bitcoin [BTC] is down 4%, from $59.8k to barely over $56k at the time of writing. Market observers have widely expected the Fed’s likely rate cuts in September to be a potential catalyst for BTC and the risk market.

However, short-term weakness could persist even after the Fed’s expected rate cuts on September 18, according to Arthur Hayes, founder of BitMEX.

According to Hayes, BTC could fall or drop to $50,000 if financial institutions send liquidity to the Fed’s RRP (Reverse Repurchase Agreement) for higher returns. Part of his latest analysis report read,

“As such, RRP balances should continue to rise, and Bitcoin will at best chop around these levels and at worst slowly drop to $50,000.”

Source: Bloomberg

The RRP is an important monetary policy tool of the Fed, especially in controlling the money supply (liquidity) and short-term interest rates. A sharp increase in the RRP would limit US liquidity and vice versa.

Macro uncertainty for BTC?

Initially, Hayes had predicted that the US could increase issuance of government bonds (T-bills), worth more than $300 billion, injecting needed liquidity and boosting BTC. However, he recently noted an increase in RRP compared to government bond issuance, which on balance is negative for US liquidity.

“Assuming the Fed doesn’t cut rates before the September meeting, I expect Treasury yields to remain firmly below the RRP.”

For context, BTC is positively correlated with US liquidity. As such, the aforementioned liquidity crisis could be bad news for digital assets in the short term.

However, the executives noted that are bearish BTC Outlook was temporary and the weakness would be a buying opportunity.

‘Because of my changed opinion, my hand hovers above the buy button. I don’t sell crypto because I’m bearish in the short term.”

In addition to this likely caveat on the macro front, BTC has posted historically weak September results. However, if noted from QCP Capital, the crypto could experience a strong relief in October.

“October, however, has the strongest bullish seasonality, with BTC showing positive returns and an average gain of 22.9% in 8 of the past 9 October.”

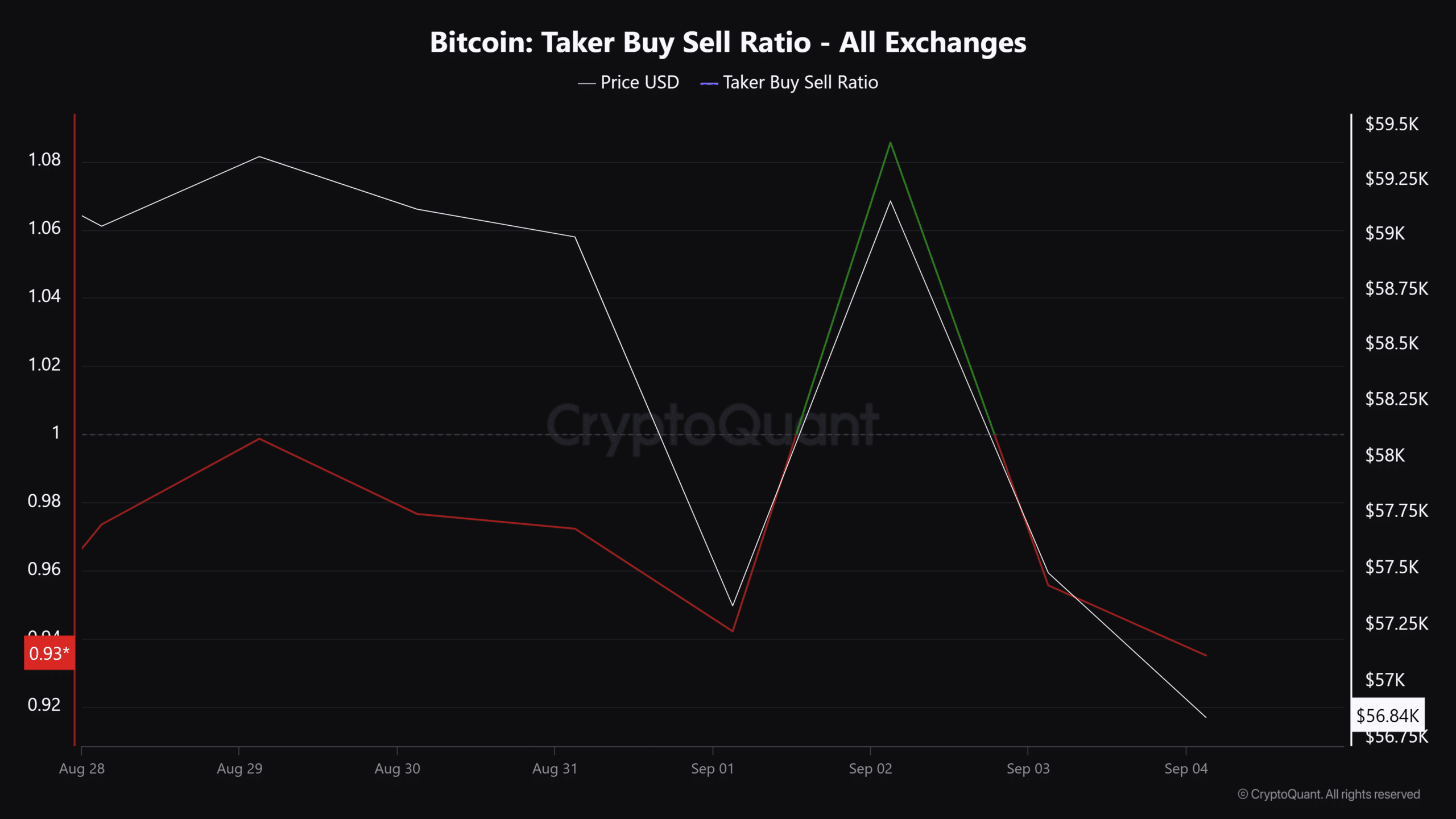

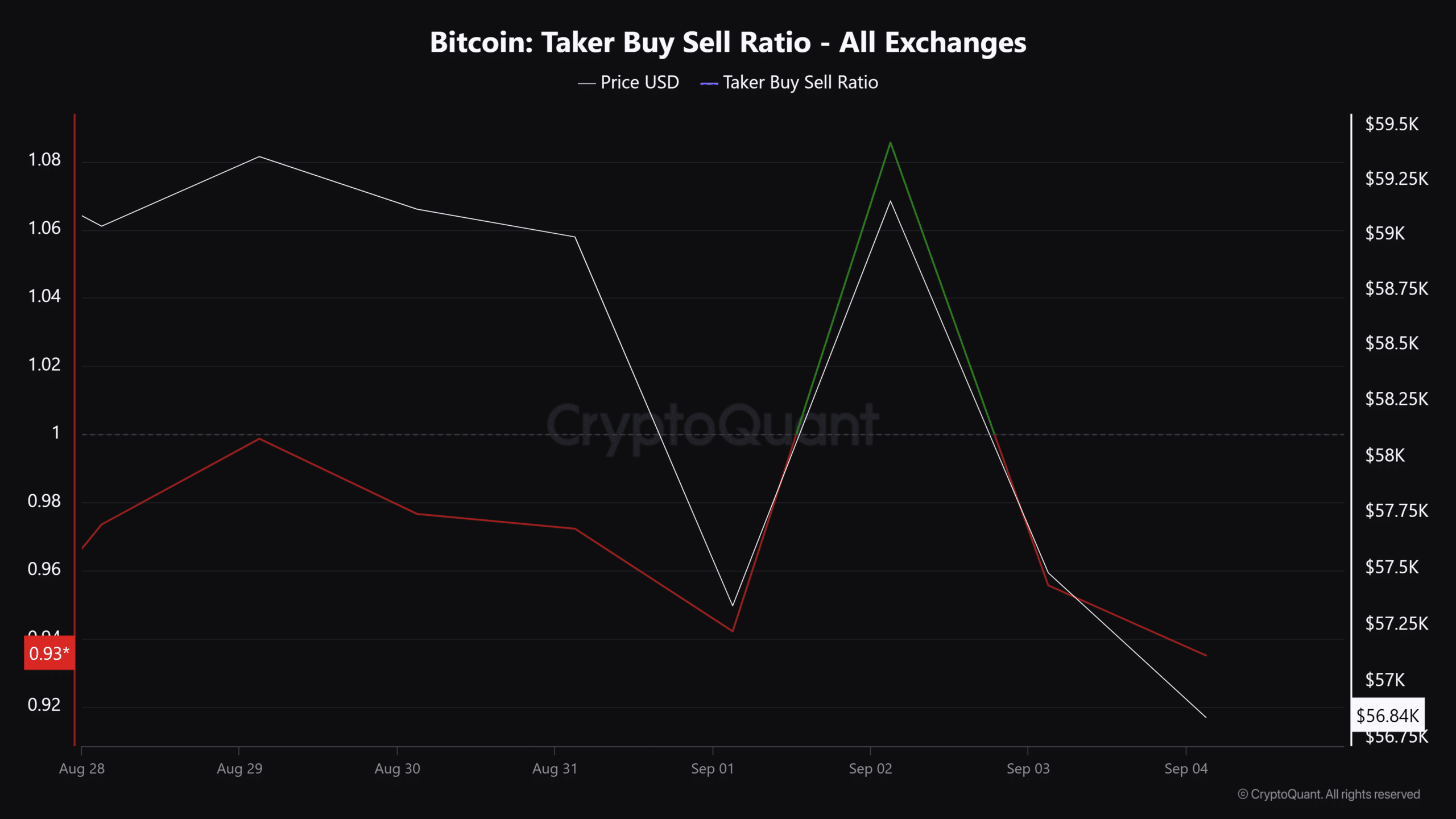

In the meantime, the crypto Fear and Greed index is active reading was 27 and flashed “anxiety” at press time. The derivatives segment was also overwhelmingly bearish, as evidenced by the negative Taker Buy Sell Ratio.

These figures showed that seller volume dominated buyers, illustrating that weak sentiment prevailed.

Source: CryptoQuant