Posted:

| Last updated: November 12, 2023

- Bitcoin may withstand a decline due to declining coin distribution.

- Compared to the 10 to 100 BTC sales cohort, the 100,000 to 1 million group stacked up.

Bitcoin [BTC], once again passed the $35,000 mark as the coin gained $3.18% over the past seven days. While the increase may not be compelling enough compared to October’s performance, Mignolet, an author at CryptoQuant, noted that a significant downtrend is unlikely to occur.

Is your portfolio green? look at the BTC profit calculator

The weak hands of sellers have nothing on BTC

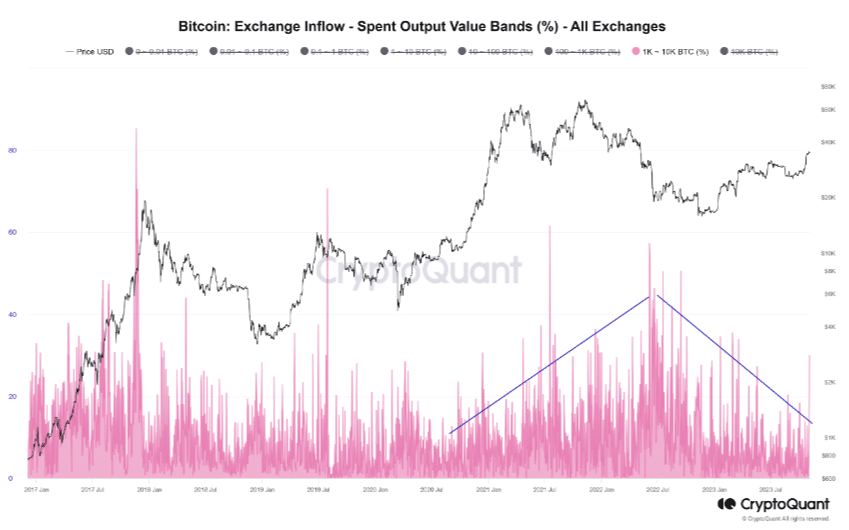

Mignolet, in his analysis, the Bitcoin exchange used Inflow Spent Output Value Bands (SOVB) to arrive at the conclusion mentioned above. The Bitcoin SOVB shows the distribution of all issued outputs that have flowed into exchange wallets, based on their value.

This statistic allows one to obtain the total value of the coins issued by a given cohort. The chart shared by Mignolet shows that whales holding around 1,000 to 10,000 BTC were quiet around the time of publication.

While the analyst believed there has been some movement, he said this could be the case irrelevant on BTC’s price action and says:

“It is estimated that the recent increase in movement is due to the reflection of internal wallet transfer data, and even if it is considered as actual investor deposits, this may not be a significant concern.”

Mignolet also mentioned that the 10 to 100 BTC cohort made profits. But compared to the current accumulation on the market, the selling pressure can be called weak.

So if we look at it critically, the circumstances suggest that Bitcoin may not have a significant impact dive the next few days.

Upside potential and caution

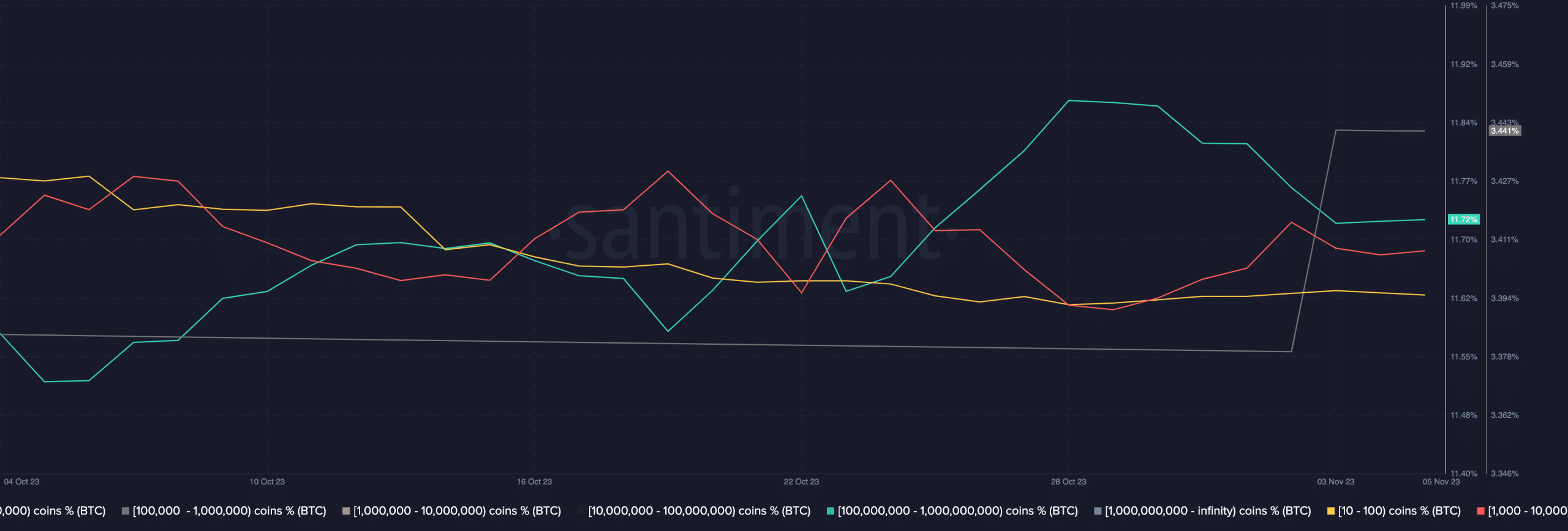

Using Santiment’s data, AMBCrypto also assessed current Bitcoin accumulation and distribution activity. Accumulation means that market players are buying. Distribution involves holders of a coin selling.

The evaluation shows that the balance The number of addresses showed that 10,000 to 1 million coin holders were massively expanding their holdings. AMBCrypto also took the opportunity to compare with the previously discussed group.

We found that the pressure exerted by the cohort of 10,000 to 1 million people was much greater than that of others. Therefore, it is possible that BTC will continue to change hands above $35,000. If accumulation continues to increase, $36,000 may not be far away.

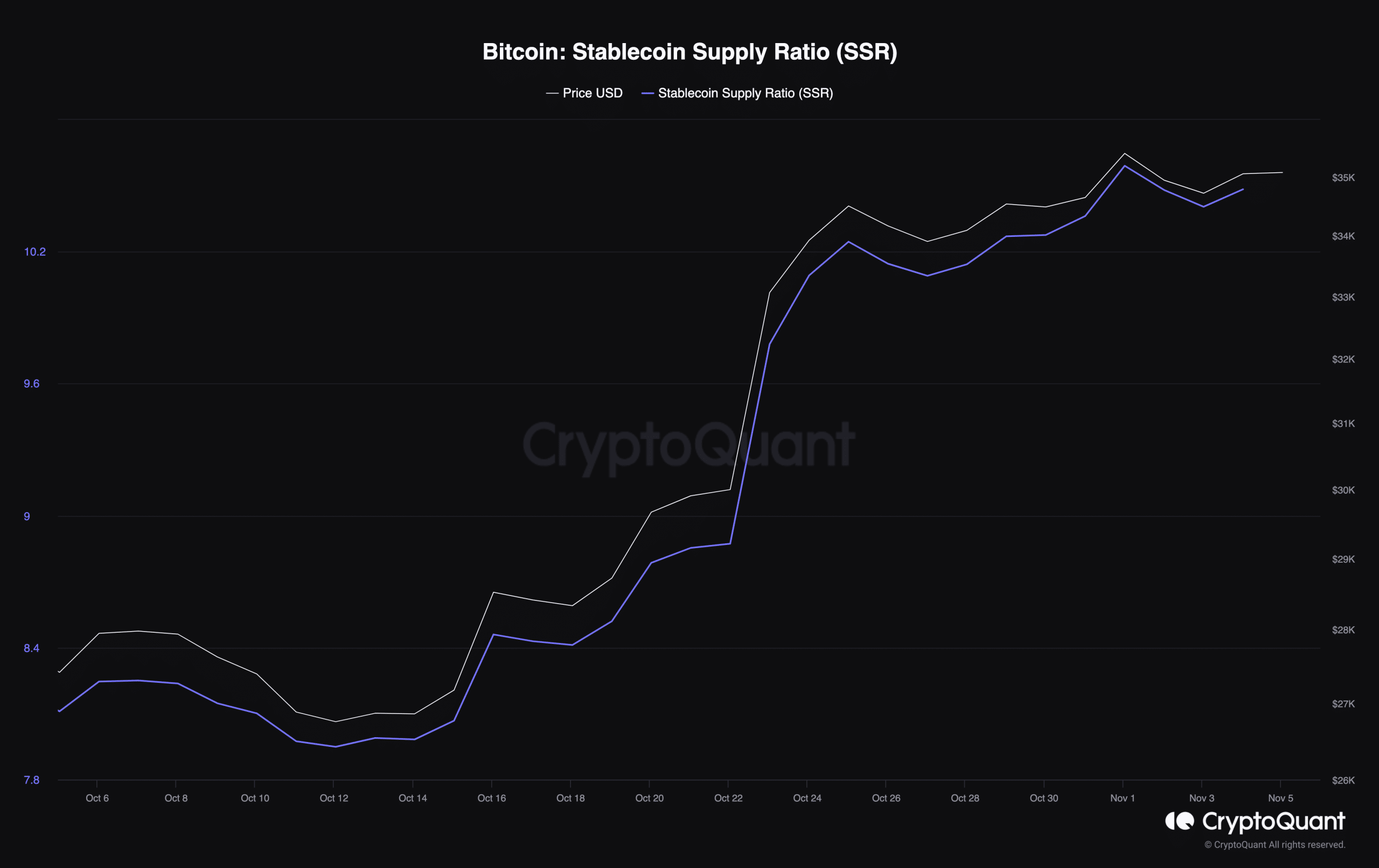

However, market participants should be wary of the Stablecoin Supply Ratio (SSR). The SSR reveals the rate at which traders hold stablecoins. When the value of the SSR is high, it means a low supply of stablecoins and a potential price drop.

How many Worth 1,10,100 BTC today?

When the benchmark is low, it means a high supply of stablecoins and a potential price increase. At the time of writing, Bitcoin’s SSR had increased. This indicated a possible retracement of the coin’s price.

However, a thorough assessment of the market revealed that the stablecoin may have been converted into Bitcoin. If so, this could serve as a force for BTC to rise.