Devin Walsh, executive director of the Uniswap Foundation, a nonprofit organization supporting the growth and decentralization of the decentralized exchange Uniswap (DEX), believes that Uniswap decentralizes. Walsh even compares the current state of the DEX to that of Ethereum. The director also acknowledged that the current level of success of the DEX is due to the active participation and contribution of the developer community.

Uniswap becomes more decentralized?

The executive director responded to a thread on X in which Antonio Juliano, the founder of dYxX, a layer-2 DEX on Ethereum, insinuated that Uniswap is now centralized. However, it started on a decentralized path.

With centralization, Juliano added, the protocol can be quickly iterated, mainly to increase revenue. On the other hand, by being more decentralized, dapps can allow users to reap the full benefits of decentralized finance (DeFi).

Decentralization of protocols launched on public ledgers, such as Ethereum or Cardano, is crucial. Normally, the community will gauge how well a dapp is decentralized by looking at things like how decisions are made and which party is in charge of development.

In the case of Ethereum, Walsh pointed out that the community adopted it from Vitalik Buterin, the co-founder; and Consensys, a technology company developing solutions for Ethereum, left. Since then, multiple developers have refined the network and ensured it is secure and robust for anchoring dapps.

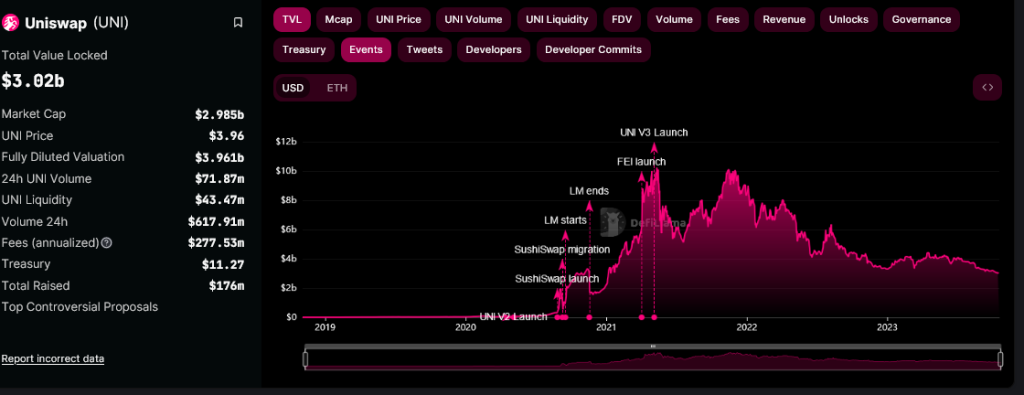

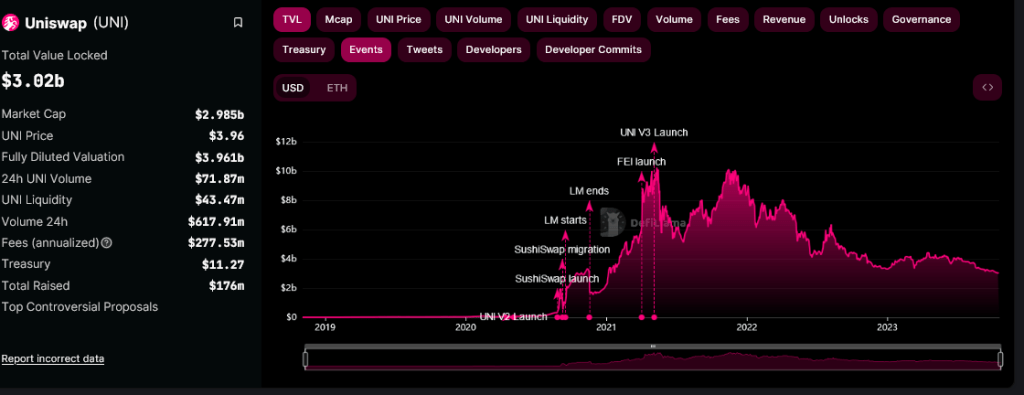

Uniswap is one of the most popular DEXes on Ethereum and looks at the total value locked (TVL). DeFiLlama data shows that the exchange manages more than $3 billion in assets and operates primarily on Ethereum. However, the exchange allows reliable swapping on layer 2 platforms such as OP Mainnet and public ledgers such as the BNB Chain.

Preparing for crochet and KYC?

Currently, Uniswap Labs is leading the development of Uniswap. Nevertheless, Walsh said more and more developers are now building and contributing solutions. This, the Uniswap Foundation director further noted, mainly takes into account the planned launch of Hooks in v4.

There is no specific timeline for when Uniswap will deploy the latest version, but the release of the Cancun upgrade on Ethereum will play a role. The protocol will be more customizable with Hooks, as the feature works more like a plugin.

Still, there are concerns that Hooks, while developed by community developers, will provide the basis for Uniswap to censor liquidity providers (LP) or traders who do not verify by adhering to know-your-customer (KYC) rules. UNI prices remain under pressure from spot rates and could move lower, setting new lows for 2023.

Feature image from Canva, chart from TradingView