- Bitcoin collapsed to $42,500, causing a widespread market crash.

- 1-hour volume increased while many long positions were wiped out.

The enthusiasm about a Bitcoin [BTC] The 2024 bull run has suffered a setback as the price fell 4.85% in the past hour at the time of writing.

According to CoinMarketCap, BTC started above $44,000 on January 3, with many predicting the coin would reach $50,000 before the end of the month.

However, all this may have calmed down at this point as BTC’s price was just above $42,500. Moreover, Bitcoin was not the only cryptocurrency affected.

Solana [SOL] fell 7% within an hour, while XRP fell 12%. Ethereum [ETH] also participated with a decline of 5.30%.

Bitcoin ETFs Are Delayed?

At the time of writing, AMBCrypto discovered this just before the Matrixport dump reported the US SEC would not approve Bitcoin ETFs this month.

The news sent waves of panic across the market. Economist and trader Alex Kruger also previously noted that a crash was coming.

Moreover, Bitcoin trading volume soared as a result. At the time of writing, BTC volume surpassed $40 billion. This was evidence of the high selling pressure. Liquidations have also affected traders, especially longs.

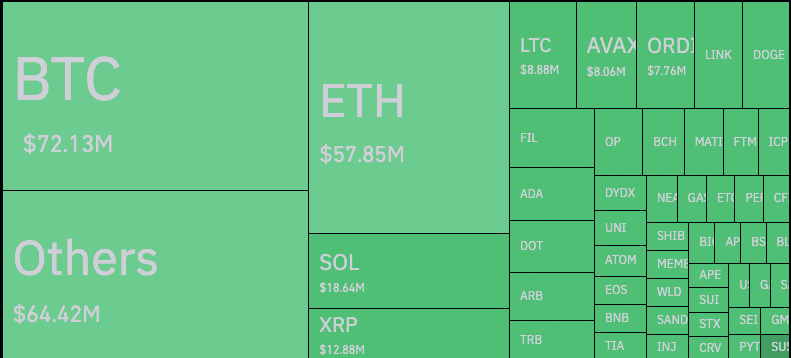

According to Coinglass, the Liquidation HeatMap showed that more than $500 million had been wiped out. Bitcoin took much of the hit with $72.13 million.

Details from the HeatMap also showed that lungs were most affected.

Source: Coinglass