This article is available in Spanish.

Like Bitcoin, Ethereum and other top altcoins, Solana remains under immense selling pressure. As bulls struggle for momentum, $160 is emerging as a local resistance level that traders should pay attention to.

Despite the upward momentum in September, Solana buyers have not lifted prices above this line. At the time of writing, there is a local double top even if one analyst is on X notes that Solana outperformed other platforms, with a sharp inflow in net inflows.

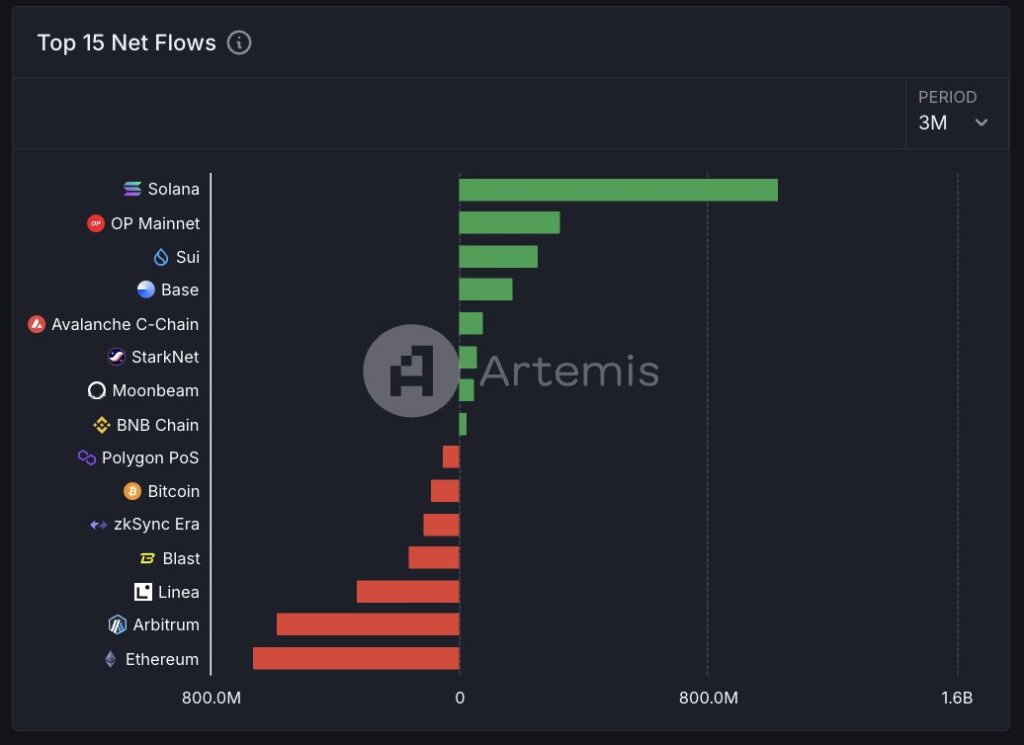

Solana received over $800 million in net flows in three months

Unlike Ethereum, Solana is a modern blockchain with relatively high scalability. The platform can process thousands of transactions every second, which translates into low fees. That’s why more and more projects are choosing to launch on the network so that the user experience remains unaffected. The events of the past three months, looking at the inflow of capital into Solana, strengthen this position.

Related reading

To put the numbers into figures, Solana recorded net flows of over $800 million. This capital injection is more than double what OP Mainnet, an Ethereum layer 2, received and much more than what Sui, another scalable blockchain, has posted in the past three months. It is also more than what Base and Starknet – two of Ethereum’s popular layer 2s, posted, and exceeds what Avalanche and the BNB Chain received.

Interestingly, during this period Arbitrum, an Ethereum layer-2 and the largest of them all, Linea, Blast and Bitcoin saw outflows. Despite being the largest smart contracts platform, Ethereum recorded massive outflows of almost $800 million.

It remains to be seen what could have caused the outflow in Ethereum and at the same time encouraged capital into Solana. While on-chain fee differences could be a factor, the continued dump of ETH in Q3 2024 could have caused the outflow. At spot prices, ETH is down 35% from its Q3 2024 highs, while Solana is down just 25% from its July highs, when it rose to around $192 before pulling back.

Will SOL Break $160?

Even as Solana raises capital, the currency remains under intense selling pressure. The local barrier of $160 must be convincingly broken if the upward trend of the second half of 2023 is to continue. Further gains will see Solana rise to $190 and possibly break out of the current range.

Related reading

However, there may be headwinds. If Bitcoin fails to recover, it could drag down the altcoin markets, including Solana. At the same time, there are concerns that the upcoming FTX token distribution would negatively impact SOL prices.

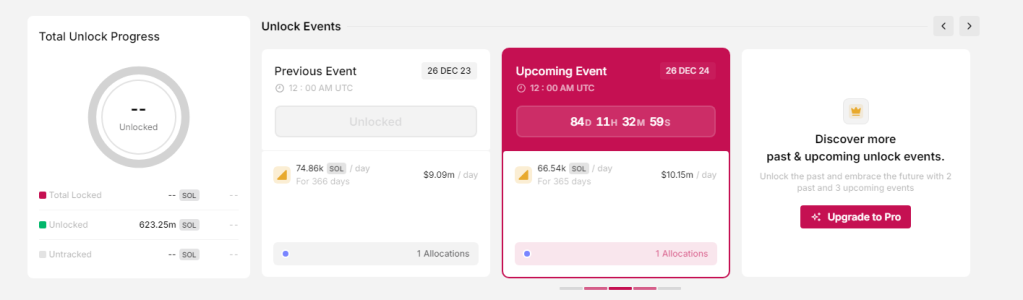

Moreover, according to Token unlocksthe team plans to release tokens on December 26, 2024. More than 66,000 SOL will be spent every day for a year.

Feature image of DALLE, chart from TradingView