In the Bitcoin space, one question constantly echoes through the minds of enthusiasts and investors alike: When will Bitcoin rocket to the moon? While no one knows the answer, there are on-chain metrics and historical patterns that can be tracked to uncover the answer.

Bitcoin Price Analysis: When Will BTC Break Out?

For the past two weeks, Bitcoin price has been in a sideways trend. After the Bitcoin bulls managed to turn the tide at $24,900, the price has risen by more than 25%. However, BTC has been trading between USD 29,800 and USD 31,300 since then. Neither bulls nor bears have managed to gain the upper hand and break out of the trading range in higher time frames.

The renowned crypto trader and analyst “Rekt Capital” believes that all it takes is a positive catalyst for BTC’s current price action. According to him, Bitcoin’s current sideways trend within a tight range is just one step away from its ultimate demise. He affirms that “a BTC downtrend is just one positive catalyst away from an end. And a BTC uptrend is always a negative catalyst of the end,” adding:

BTC has performed a bullish monthly close but is poised for a healthy technical retest at ~$29250. With the price currently hovering around $30200…I wonder what negative catalyst will soon emerge to facilitate this technical retest.

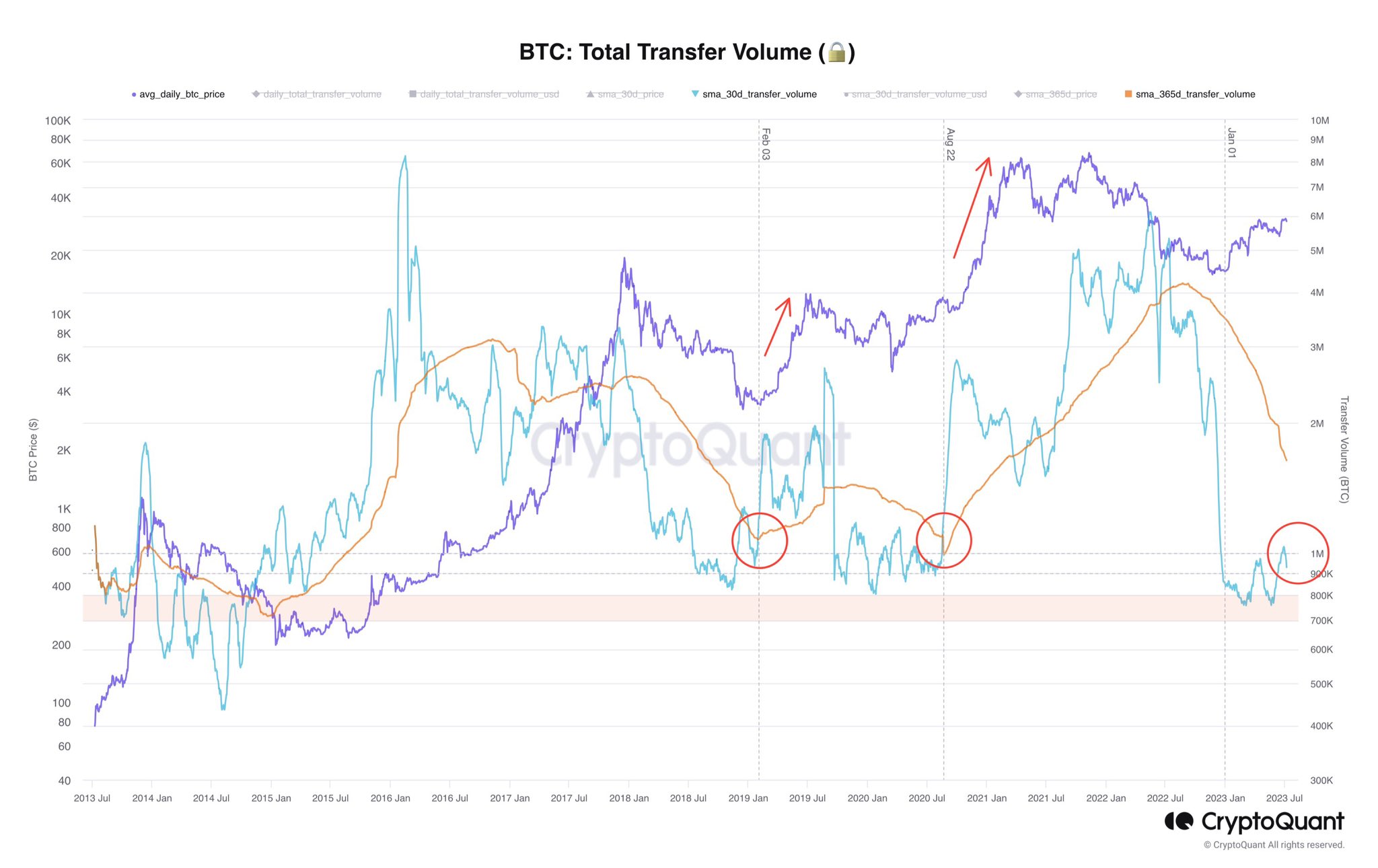

On-chain analyst Axel Adler Jr echoes this view, pointing to total BTC transfer volume as an indicator of a massive breakout move. While the exact timing remains elusive, Adler Jr suggests that the moonshot could be triggered by a major event, such as the approval of a Bitcoin Exchange-Traded Fund (ETF).

Based on historical evidence, Adler Jr highlights the correlation between explosive price pumps and an increase in BTC total transfer volume. Past events, such as the dramatic increases in February 2019 and August 2020, lend weight to the argument that a similar increase could be just around the corner.

Bulls Vs. Bears and whale games

Dan Crypto Trades comments on the current state of the market: “They call this candlestick pattern: thanks for your stops.” Zane’s keen eye eagerly awaits a decisive breakthrough that will propel Bitcoin to an important step.

As the battle between bulls and bears ensues, he sees the sustained action from a distance as a prelude to an imminent explosion. “Until then, it’s just a lot of chopping, stopping chasing and grabbing liquidity until one side emerges victorious.” Once the shackles of this consolidation are broken, Zane predicts that the resulting breakout will mark the 2023 peak:

If BTC were to bounce back to the highs from here, I’d be pretty sure the next breakout will be the one where we finally break out of this area. I also think this would be the sharpest move and likely to set the top for 2023 followed by a sluggish rest of the year. […]I would assume we would visit about 36-40K soon.

Meanwhile, well-known analyst Skew barn sheds light on the intricacies of Bitcoin market dynamics. With an eagle eye on the Binance Spot market, Skew notices significant BTC accumulation taking place. He revealed that supply is concentrated between $31.3K and $32K, while demand remains between $29.5K and $28K.

Skew revealed the tactics of larger players and pointed out how whales use aggressive short positions to manipulate price within the narrow hourly range, leveraging bid liquidity and supply.

BTC Perp CVD Buckets & Delta Orders – This one really shows how racks monkeys got earlier today (Long/Short CVD). Whales play the 1 hour range between good bid liquidity and supply. TWAP orders/CVD show Aggressive shorts price is down from $31.4K to $30K.

Featured image from iStock, chart from TradingView.com