- In the last 24 hours, whales sold a considerable amount of ADA, which forced a fall.

- Other important technical indicators in the derivatives market have also influenced a downward trend.

Sentiment around Cardano [ADA] has been in particular Beerarish, as investors have sold the past month. This can continue, While recent market revelations show that continuous sales efforts have been dominant.

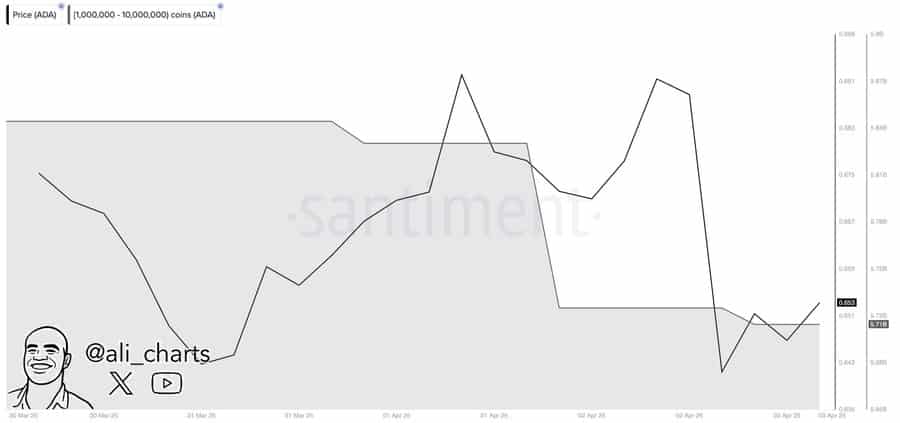

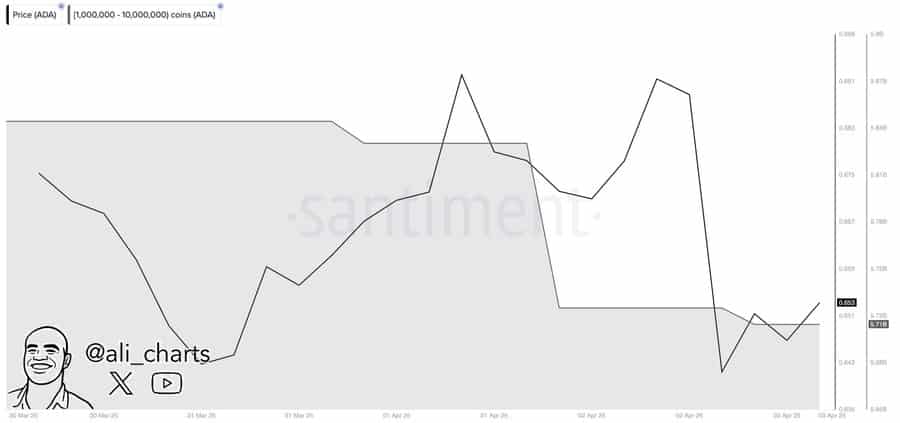

Whale whales unload large Ada

Whales, which usually control a large stock of actively, have continued to sell in the last 48 hours, so that the total turnover is brought to 120 million.

When there is such a huge sale in the market, this implies a lack of trust, and so there is potential for Ada to stay lower trending.

Source: Santiment

In the Derivatenmarkt, the sales pressure looked clearer, because the open interest in the futures and options market continued to fall.

Press data showed a slip of 1.01% and 0.27% to $ 697.15 million and $ 374.92k in the last 24 hours respectively.

A decrease in the open interest in the derivatives market means that contracts have been concluded, with various factors, including lack of trust and long liquidation that contribute to the fall.

Source: Coinglass

The trading volume is largely dominated by sellers, if the long-to-thrower ratio that points to a high purchase volume when above 1 and strong sales pressure when under 1-after a period of 0.9767.

With more sellers than buyers on the market, the ADA could influence to keep falling, unless the metric again crosses over 1.

Ambcrypto discovered that Defi investors also sell, because the total value locked (TVL), which is used to evaluate the value of protocols on the Cardano chain, has fallen in particular.

From a high point of $ 319.58 million in April, the press had fallen by $ 15.54 million to $ 304.04 million.

Source: Defillama

If Defi investors continue to unlock their ADA over these protocols, it will probably continue to dive.

Bullish opposition arises

Despite the dominant Bearish -trend on the market, spot market traders continued to collect the actively in the past week.

According to AmbcRYPTO’s gaze on the Netflow data of Coinglass, traders continued to buy their assets and move them to private portfolios, suggesting that signs of long-term marketing involvement.

In the past week alone, $ 11.23 million was purchased from ADA, after the previous week $ 44.75 million in ADA purchases.

Source: Coinglass

However, the effect of Bullish Spot market traders would have a minimal impact, unless other important market sentiments shift in a bullish direction.