BlackRock’s filing for a Bitcoin spot ETF (iShares Bitcoin Trust) has revitalized the market and sparked a strong rally. The hope is that BlackRock will unleash a “Great Accumulation Race” around Bitcoin, fueled by the fact that 69% of all investors have been unwilling to sell their Bitcoins for over a year, Bitcoinist reported.

Market experts give the BlackRock ETF a high chance of approval. Remarkably, BlackRock has an endorsement ratio of 575:1, but the US Securities and Exchange Commission (SEC) ratio when it comes to rejecting Bitcoin spot ETFs is just as clear: 33:0.

But because BlackRock has close ties to US regulators and Democratic politicians, there is room for an optimistic view of the likelihood of approval. As K33 Research writes in their latest market analysis, BlackRock is unlikely to commit time and resources if they don’t consider the likelihood of approval very high.

Race for the first Bitcoin Spot ETF

Rumors have circulated in recent days that BlackRock’s ETF application could be decided within “days to weeks,” NewsBTC reported. But what are the exact deadlines? SEC regulations provide a clue.

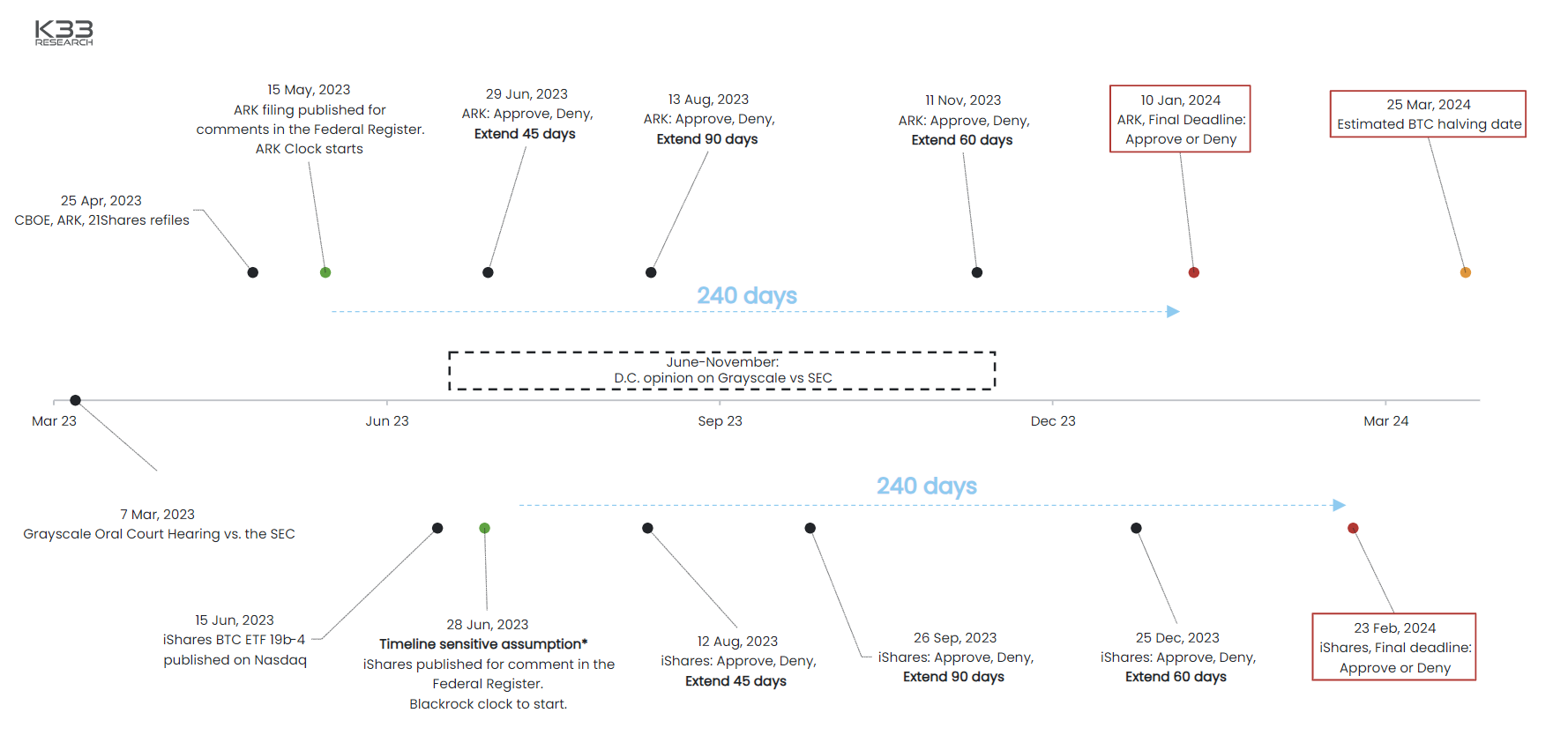

The important thing to know here is that the deadlines for the SEC and its decision on the iShares Bitcoin Trust depend on when the application is published in the Federal Register for comment. Since this has not officially happened yet, there are only approximate estimates so far.

Still K33 Research has drafted a rough timeline based on SEC deadlines. Theoretically, a decision can be made within four time intervals, with the decision-making process following a schedule of anchored decision data.

After the filing is published in the Federal Register, the SEC has 45 days in the first time window to approve, reject, or renew the ETF. Assuming the filing is published on the registry on June 29, the SEC’s first deadline would be August 12, 2023. Similar tipping points occur 45 days later, 90 days later, and 60 days later.

When BlackRock #Bitcoin spot ETF?

The timeline depends on the publication in the Federal Register. As of July 29:

August 12: Extend 45 days

September 26: Extend 90 days

December 25: Extend 60 days

Deadline: February 23, 2024.h/t @K33Research

More details

— Jake Simmons (@realJakeSimmons) June 22, 2023

K33 Research states that the SEC must announce a decision after 240 days at the latest. This means that the market will make a decision no later than February 23, 2024 (may be postponed by a few days depending on the publication in the Federal Register).

Will Grayscale or CBOE Prevent BlackRock?

While everyone is currently talking about BlackRock’s ETF filing, there is a possibility that two other institutions will get approval, or at least a decision on their affairs, for the world’s largest asset manager.

As K33 Research shows in its ETF chart, the CBOE deposited its “ARK 21Shares” ahead of BlackRock and could potentially benefit from BlackRock’s momentum. As early as May 9, Cboe Global Markets filed to list and trade shares of a spot Bitcoin ETF from Cathie Woods Ark Invest and crypto investment product firm 21 on the Cboe BZX exchange.

In addition, Grayscale could also get a ruling ahead of BlackRock’s legal battle with the SEC. A final ruling on Grayscale’s lawsuit is said to be imminent. The final ruling is expected three to six months after the hearing. The hearing was held on March 7, 2023. The gist of Grayscale’s lawsuit is that the SEC acted arbitrarily by approving futures-based ETFs and rejecting spot ETFs.

As K33 Research discusses, all market participants are currently in a race for first mover advantage. The launch of ProShares BITO has clearly demonstrated this benefit. BITO saw $1 billion in inflow two days after launch. To date, BITO has a 93% market share among futures-based long BTC ETFs.

But whoever wins the race, it seems clear at this point that Bitcoin investors will be the winners. Julio Moreno, head of research at CryptoQuant, recently shared the chart below and commented: “This is what happens when a large fund [Grayscale’s GBTC] increases the demand for Bitcoin.

At the time of writing, BTC price has taken a breather above USD 30,000 after yesterday’s rally and is trading at USD 30,150.

Featured image from ETF database, chart from TradingView.com