This article is available in Spanish.

Crypto analyst Master Kenobi has provided a comprehensive analysis, discussing Bitcoin price dominance and altcoin season. In his analysis, Master Kenobi also revealed what this sudden volatility means for the market.

Where Bitcoin Price Dominance Is Going

In one X messageMaster Kenobi stated that Bitcoin price dominance was meant to decline yesterday. However, the decline started twenty days earlier than expected. The crypto analyst added that. After recording three consecutive red weeks, Bitcoin’s dominance has entered a phase of volatility that may last for some time.

Related reading

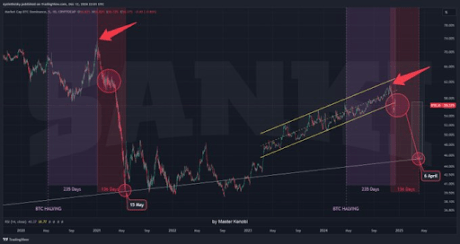

The analyst’s accompanying chart showed that the Bitcoin price dominance experienced this volatility phase for 136 days. If history were to repeat itself, this volatility would not end until April 6 next year. Master Kenobi opined that the market is currently in the first and probably most critical phase of capital rotation through Bitcoin gains.

Once the market moves past this period of capital rotation, Master Kenobi predicts that a massive decline in dominance will follow, which on the other hand can be interpreted as the beginning of the economic crisis. altcoin season. Master Kenobi stated that even if the bull market continues beyond April 6, this period will likely be the most productive for most altcoins.

Master Kenobi noted that the low point of Bitcoin’s price dominance on May 14, 2021 coincided with the crypto market’s first peak during the 2021 bull run. The analyst expects a similar pattern to emerge this time. Meanwhile, the analyst indicated that the low point of dominance could occur in early March instead of April 6.

From the Bitcoin halving perspective

Master Kenobi also used the Bitcoin halving date as a reference point to prove that Bitcoin’s price dominance could move with these timelines. He noted that in the previous cycle there was a short interval (four days) between the one-year anniversary of Bitcoin’s halving on May 11 and the first major trough in dominance on May 15.

Related reading

In line with this, the analyst noted that the timeline for the bottom of Bitcoin price dominance (which would also mark the peak for the crypto market) could stretch from April 20 to April 23, 2025. Master Kenobi warned that the exact date for the market peak cannot be determined at this time.

However, as time goes by, he believes there is a good chance he will be able to pinpoint with greater accuracy the date when the first phase of the disaster will occur. bull market will end.

At the time of writing, Bitcoin price is trading at $100,300, down in the last 24 hours, while its dominance stands at 55.13%, according to facts from CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com