- Honda announced that it now accepts Bitcoin and Ethereum payments.

- BTC looked mostly bullish, but ETH investors may have some concerns.

The crypto market has recently gained some momentum as the king of cryptos. Bitcoin [BTC], witnessed a price increase. Not to be outdone, Ethereum [ETH]The company also boasted of some developments that could have an additional positive impact on the overall market.

Read Bitcoins [BTC] Price prediction 2023-24

Bitcoin is showing bullish signals

BTC has finally managed to cross the $27,000 mark, which it was previously unable to sustain. According to CoinMarketCapBTC has risen by more than 4.5% in the past seven days. At the time of writing, BTC was trading at $27,557.89 with a market cap of over $537 billion.

However, tThe good news was that according to the latest data, the situation could get even better. Seth, a popular crypto influencer on X (formerly Twitter), revealed that Bitcoin closed just above its 20-day moving average (20MA) for the month.

This was a bullish signal, indicating that the price of the king cryptos could rise further in the coming days. Moreover, the tweet also talked about it BTC‘s Relative Strength Index (RSI), which could also turn bullish soon, provided other metrics support BTC’s growth.

Bitcoin just closed above its 20-day moving average (20MA) for the month, signaling a potential bullish trend ahead!

The RSI is also flirting with entering the bullish zone, fueling the excitement even further.

Are we about to witness a major #Bitcoin rally?… pic.twitter.com/nmu0EK6t1F

— Seth (@seth_fin) October 3, 2023

Which way is the market going?

A deeper look at Bitcoin’s ecosystem also revealed quite a few other bullish metrics. For example, BTC’s Exchange Reserve was declining at the time of writing, meaning the coin was not under selling pressure.

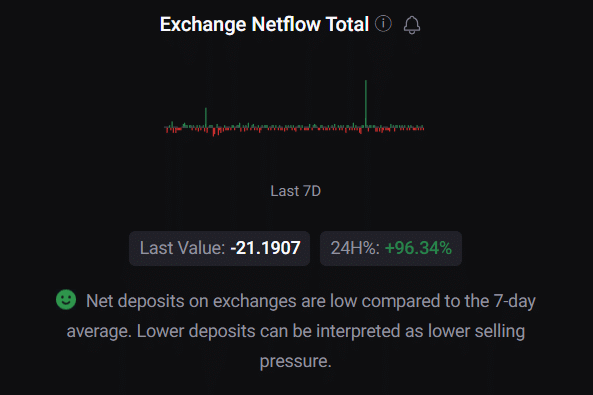

This fact was further proven by its Exchange Netflow, which showed that net deposits of BTC on exchanges were low compared to the 7-day average.

Source: CryptoQuant

Moreover, long-term bond movements over the past seven days have also been lower than average. This clearly suggested that long-term owners had high expectations for it BTCThat’s why they were willing to keep their assets.

Similar to the aforementioned metrics, BTC derivatives market metrics also remained bullish. Particularly CryptoQuant facts revealed that BTC’s funding rate was in the green at the time of writing, meaning derivatives investors were buying the coin at the higher price.

Buying sentiment in the derivatives market was also dominant, as evidenced by BTC’s green Taker Buy/Sell ratio. Interestingly, Bitcoin Open Interest registered an increase along with the price.

Normally, an increase in this measure means that the ongoing price trend will continue.

Source: Coinglass

The adoption of Bitcoin and Ethereum is increasing

While BTC’s numbers looked bullish, there was an interesting development that suggested cryptocurrency adoption was increasing on a global scale. Honda, one of the world’s leading automakers, opened its doors to crypto payments.

To be precise, it announced that it now accepts payments in BTC and BTC ETH.

Latest news

Honda now accepts #Bitcoin And #Ethereum as payments!

Honda leads into the future with #Crypto payments!

#Honda @Honda pic.twitter.com/Xvkr1W89Ef

— Seth (@seth_fin) October 2, 2023

How did ETH behave?

From CoinMarketCapEthereum’s weekly chart was also in the green as its value rose more than 2% over the past seven days. At the time of writing, Ethereum was trading at $1,649.12 with a market cap of over $198 billion.

Crypto market sentiment surrounding ETH also improved last week. This was evident in LunarCrush’s data, which showed the bearish sentiment ETH fell 40% last week, while bullish sentiment rose more than 20%.

Not only that, the AltRank also improved, which was a development in favor of the buyers.

Source: LunarCrush

Is your portfolio green? look at the ETH profit calculator

While the metrics were bullish, the same was not true for ETH’s market indicators. For example, both Ethereum’s Relative Strength Index (RSI) and Money Flow Index (MFI) fell and hovered around their respective neutral points.

ETH’s Chaikin Money Flow also looked bearish, another metric that indicated the token’s price could fall in the coming days.

Source: TradingView