Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Tony “The Bull” Severino, a well-followed crypto analyst, recently went to the social media platform X to share a detailed breakdown of the historical price behavior of Bitcoin. The analysis uses a cyclical lens that many in the crypto community (both bulls and bears) match is a considerable relevance.

In particular, Tony Severino focuses on the concept of Bitcoin’s four -year cycles and how troughs and tops consistently marked the periods of the greatest opportunities and the greatest risks for investing in Bitcoin. This analysis comes in the light of Bitcoin’s Recent price correction below $ 90,000 in March.

Cycli Define sentiment: From opportunities from opportunities to risky

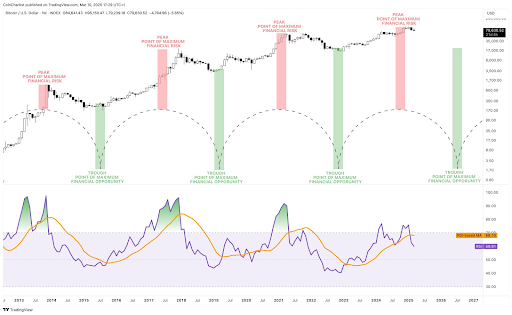

Severinos Analysis starts from A fundamental conviction shared in the crypto industry. The widespread conviction is that Bitcoin works in clearly defined cycles, usually around four years, usually in relation to the Cycli stop. His technical prospects are based on Bitcoin’s cycle indicator on the monthly candlestick Time frame graph that already goes in 2013.

Related lecture

As shown in the graph below, Bitcoin has completed four definitive cycles in its history. This cycles, he explains, must be viewed from “Trough to Trough”. The valleys are the darkest moments in the market, but they also represent the point of maximum financial opportunities.

As these cycles progress, Bitcoin turns into periods of increasing optimism and ultimately finds what the analyst calls the ‘cyclical comb’. These peaks, marked in his card in his graph, are the periods in which Bitcoin has reached its point of maximum financial risk. This is passed on in the subsequent price actions, where the Bitcoin price comes out immediately after passing every cyclical top.

Bitcoin passed his top in the current market cycle just before he reached his record high of $ 108,786 in January 2025. If earlier cycles were an indication, could reveal in the coming months or There is already a top.

Translated peaks on the right: Does BTC get up in this cycle without time?

Bitcoin is switched on A correction path since February and has currently fallen by 20% compared to this price of $ 108,786. The Bitcoin price even continued to correct $ 78,780 in the second week of March, which activates reactions about whether the crypto has has already reached this cycle its peak price.

Related lecture

Bitcoin can, however not yet in the forest, Because not all tops are immediately followed by market tops. Severino pointed out that earlier cycles ‘translated on the right’ contains peaks where Bitcoin continued to rise slightly, even after crossing the top. The Bull Run 2017 was the most right translated, with a price action that remained strong for a while after the red zone. Other cycles, on the other hand, started to reach a maximum risk long after reaching this point.

Bitcoin seems to have already passed the red top based on the Severino model, but this does not confirm that there is a top. Instead, this means that the error margin quickly narrows. The longer BTC continues to correct after this point, the more increased the risk of a bearish phase.

BTC tries Bullish Momentum recovered At the time of writing, trading at $ 87,300 after increasing 3.6% in the last 24 hours. Many other analysts claim that the Bitcoin price could be Still map a higher territory this year Before a definitive top is confirmed.

Featured image of Istock, graph of TradingView.com