- Investors showed confidence in BTC as they continued to buy.

- Ethereum ETFs also witnessed large net flows on November 7.

The election results in the United States roiled several economic sectors around the world, and crypto was not left out. The entire crypto market witnessed price increases including the king of cryptos, Bitcoin [BTC]. Not only did the price of BTC rise, it also registered record buying in ETFs.

Bitcoin ETFs have hit a new all-time high

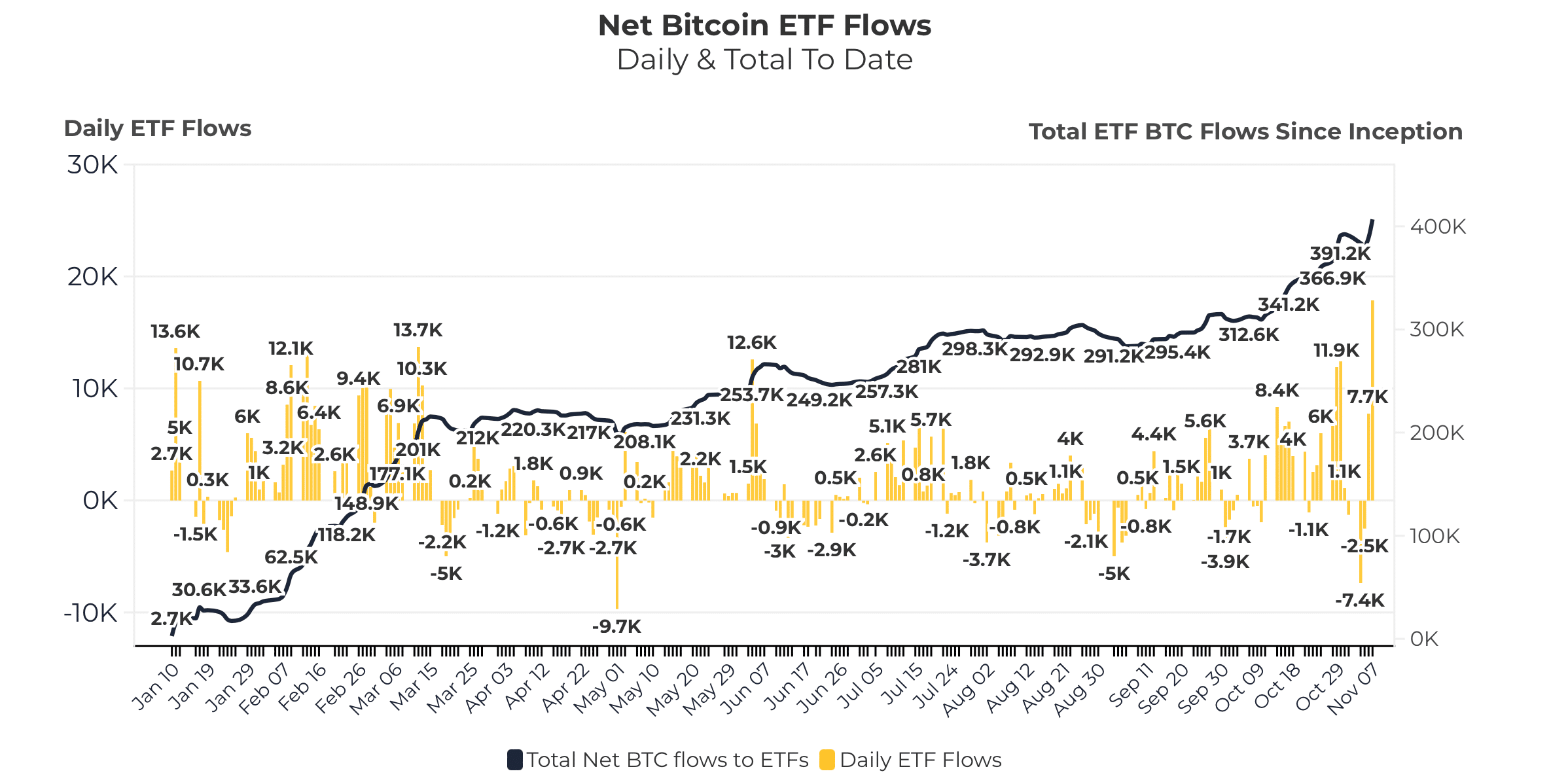

CRYPTOBIRD, a popular crypto analyst, recently posted tweet which shows an important development regarding BTC ETFs. According to the tweet, a record of over 17,000 BTC has been purchased in the recent past. To be precise, a total of 406,000 BTC net flows have been registered as of November 7.

On the same day alone, ETFs witnessed a net flow of over 17.9 thousand euros, which was the highest. It is striking that this happened a few days after the American presidential elections.

Source: Heyapollo

This huge increase in ETF net flows clearly suggested that the general market had confidence in the king coin. If this trend is to be believed, BTC’s next few days could be even better in terms of price action.

At the time of writing, the price of BTC had risen almost 10% over the past seven days and it was trade at $75.89k, close to an all-time high.

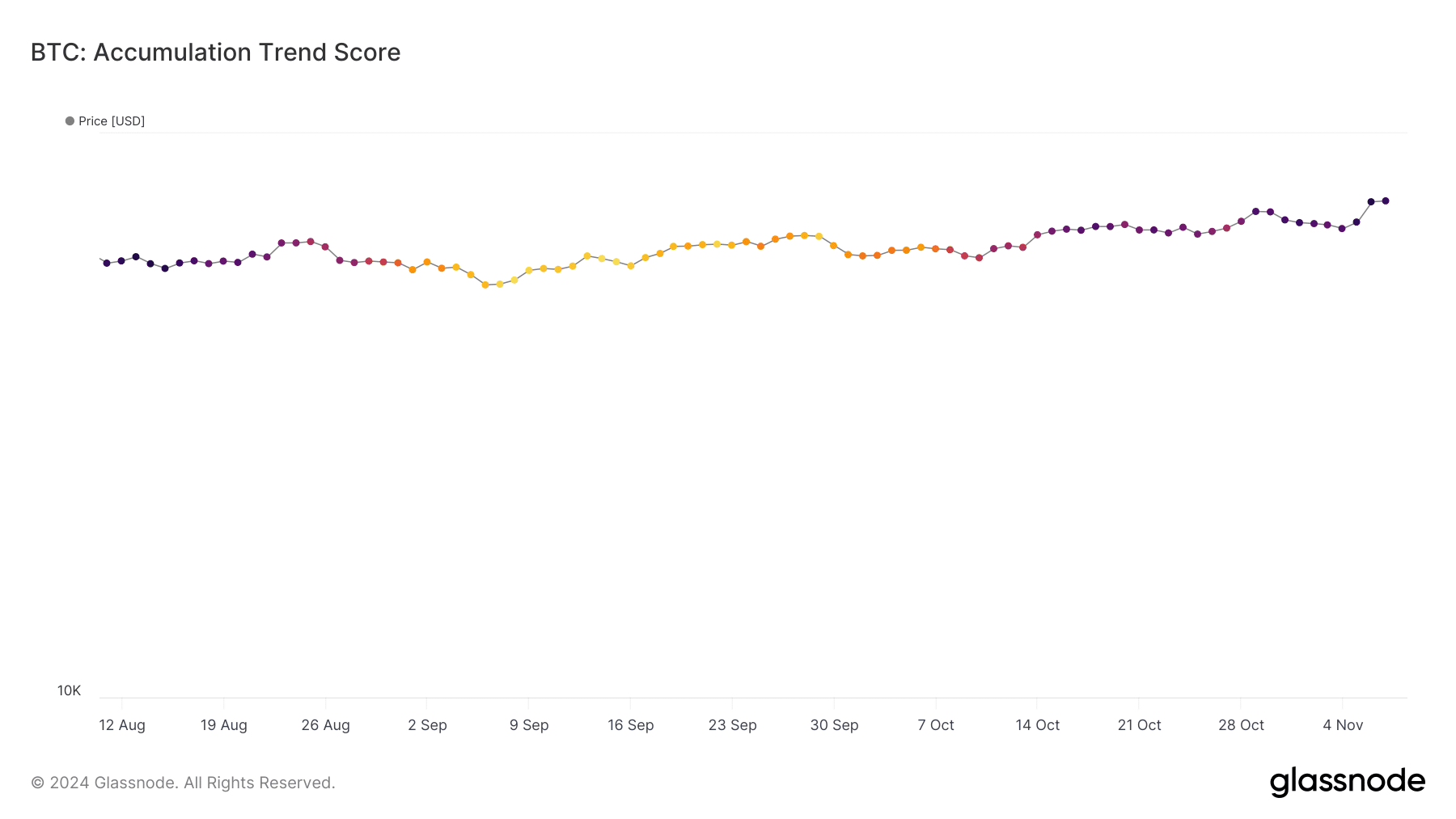

We then checked other data sets to find out whether buying pressure was high in the overall market. Our analysis of Glassnode’s data showed that BTC’s accumulation trend score rose from 0.04 to 0.8 within a month.

To begin with, the indicator reflects the relative size of entities actively accumulating coins on-chain in terms of their BTC holdings. A number closer to 1 indicates more buying pressure, which can be inferred as a bullish signal.

Source: Glassnode

How does Ethereum deal with it?

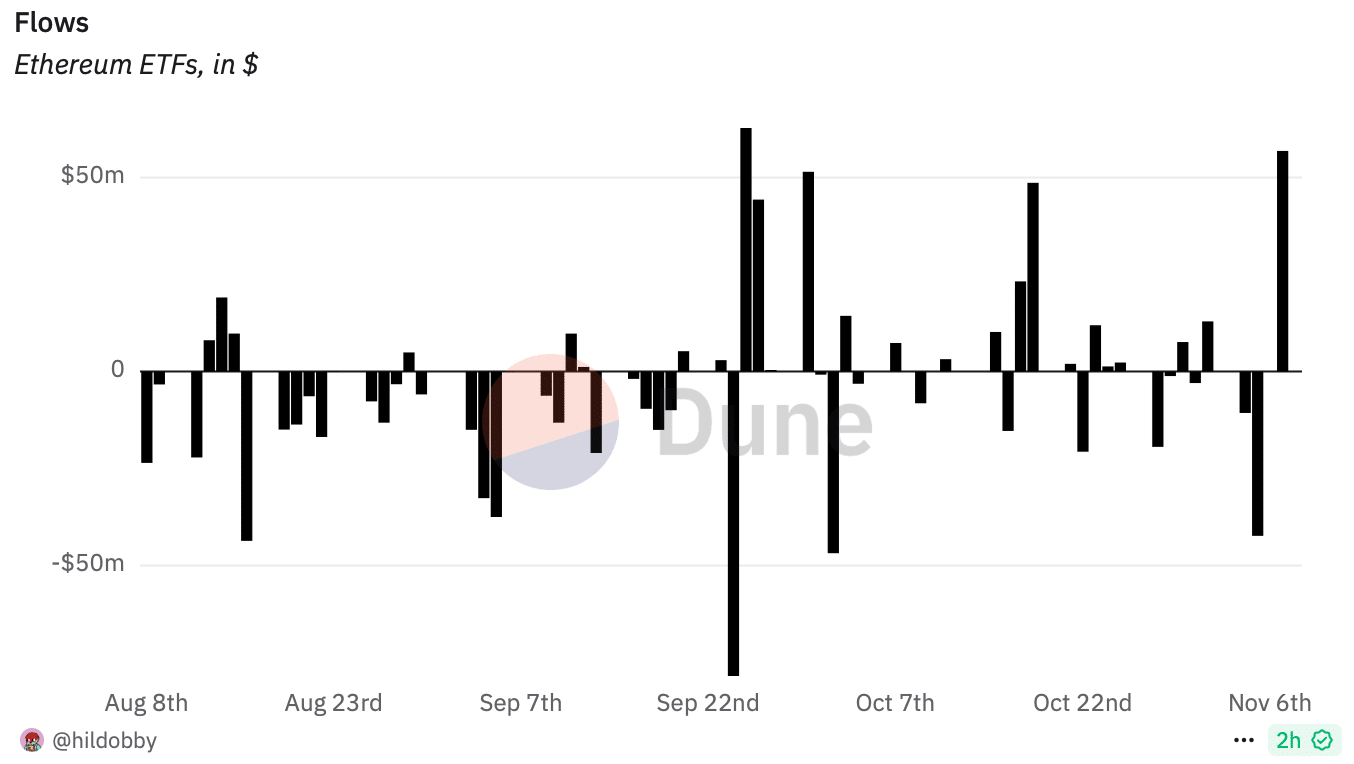

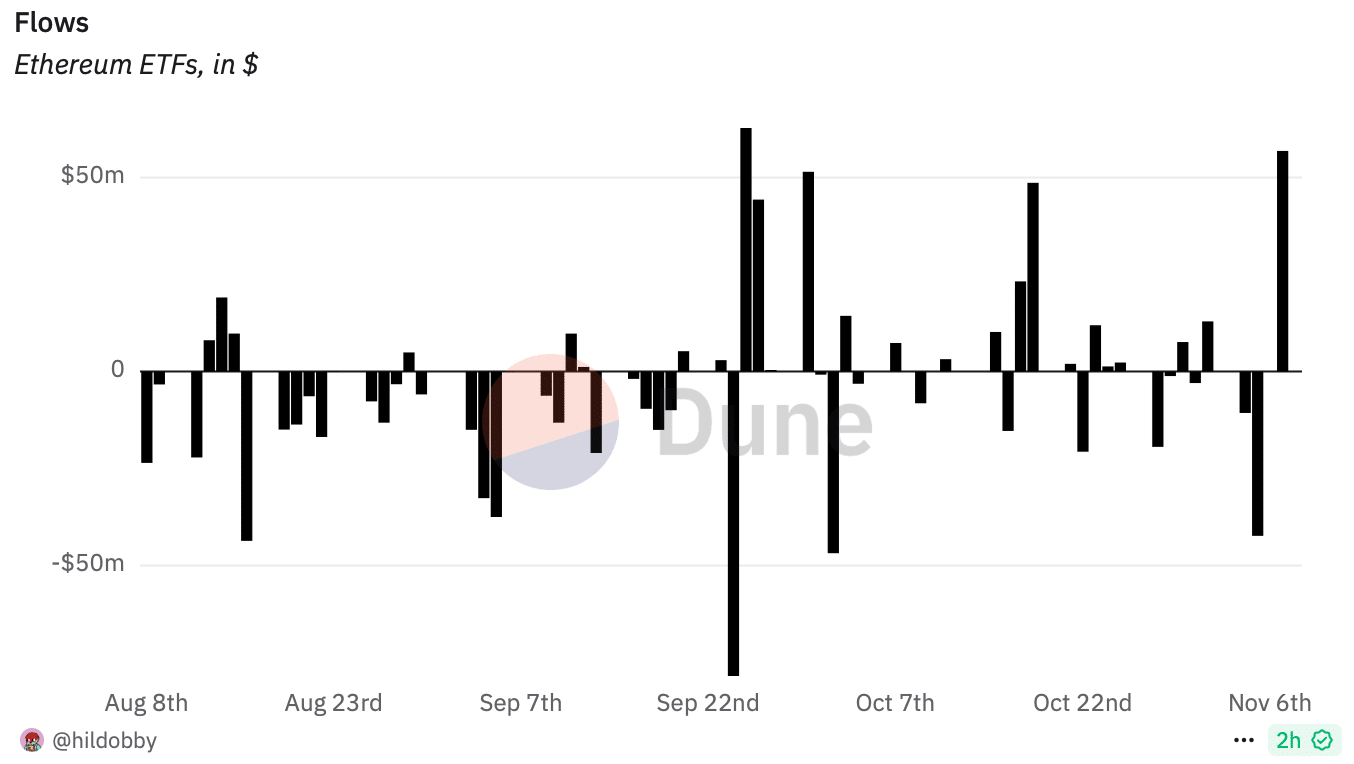

With Bitcoin ETF net flows reaching record highs, AMBCrypto next took a look Ethereum [ETH] The state of ETFs. Our analysis of Dune’s data showed that ETH ETF net flows exceeded $56 million on November 7.

This was one of the largest inflows since the introduction of ETH ETFs, which was commendable.

Source: Dune

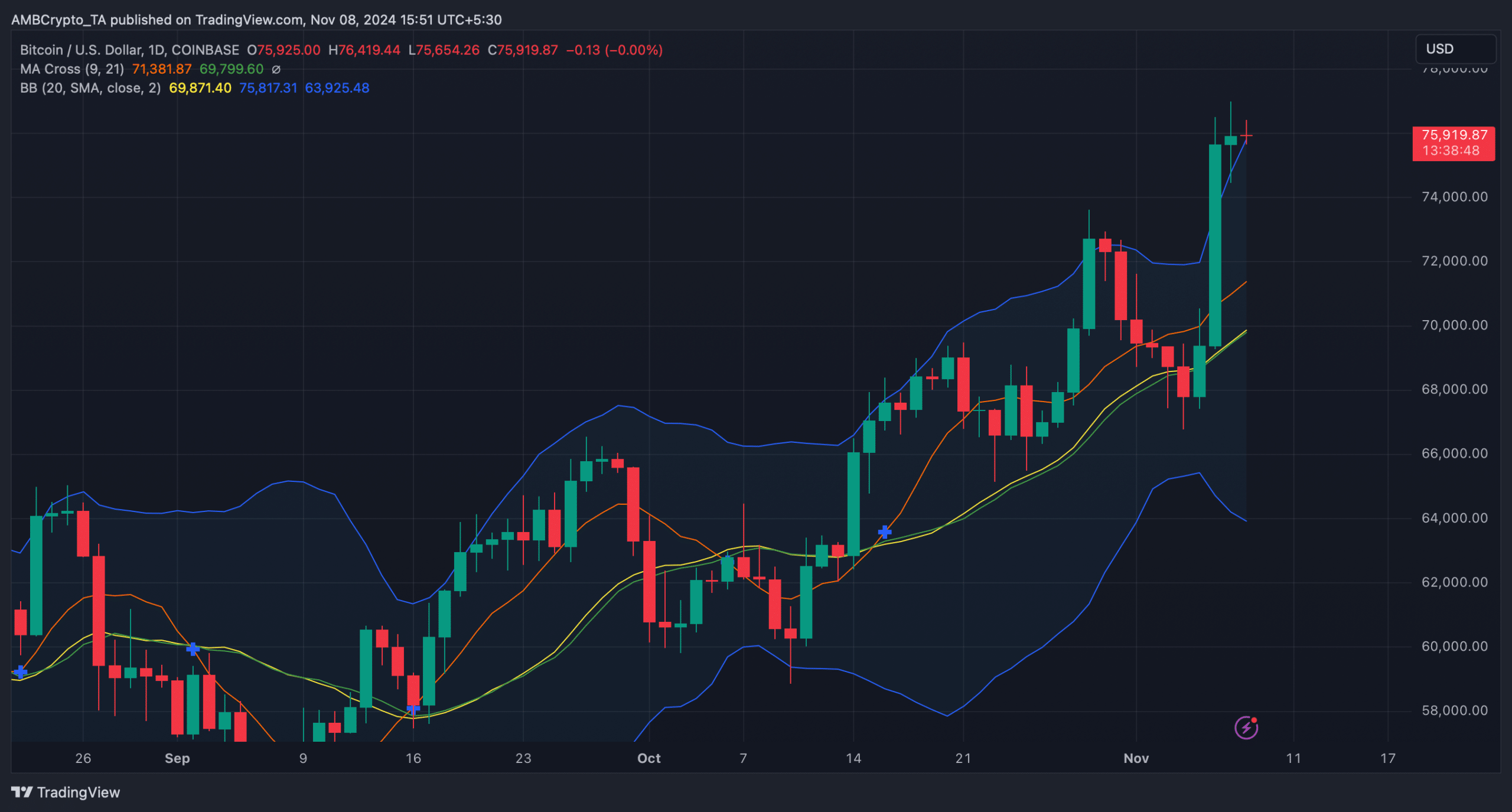

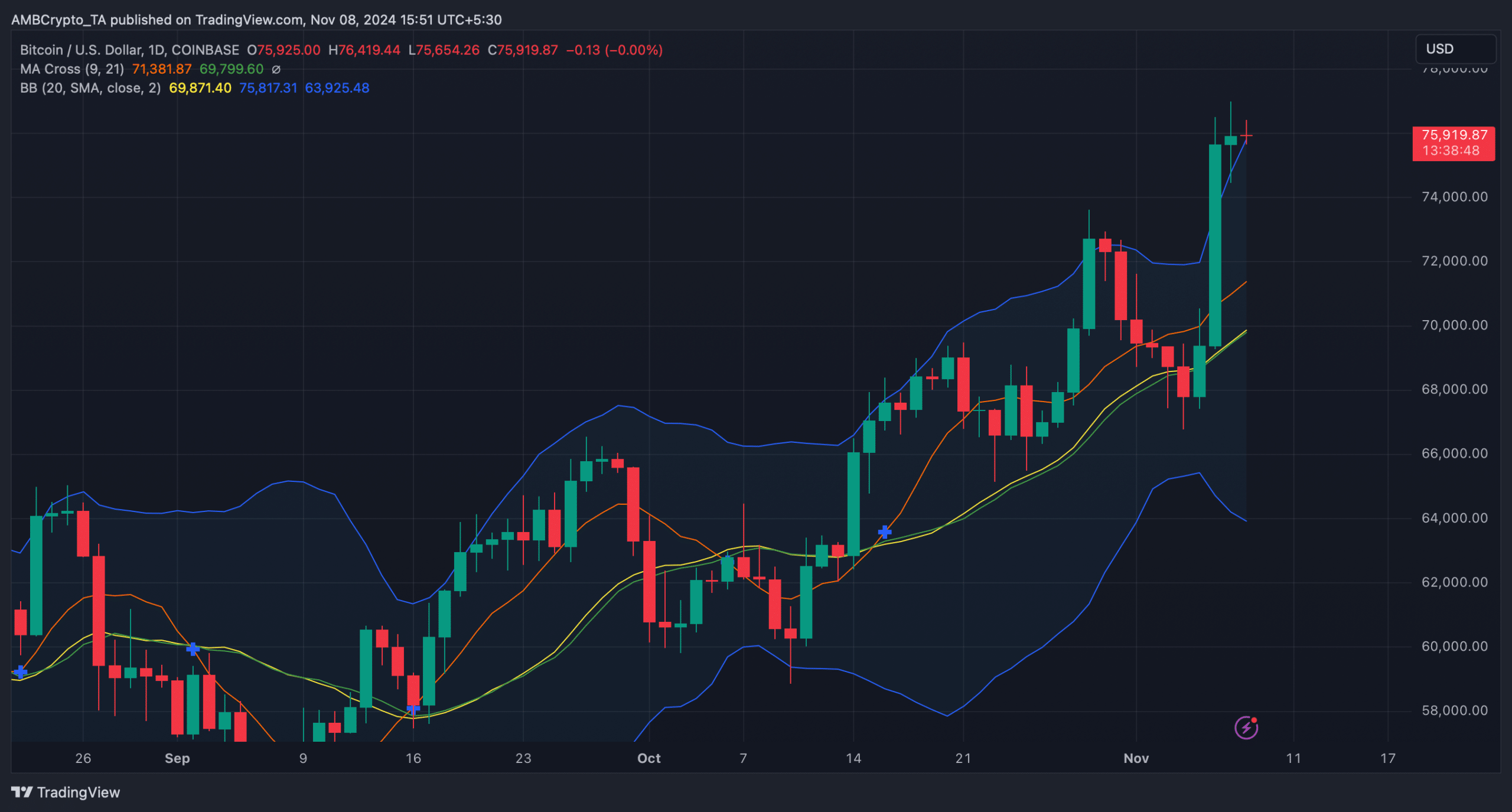

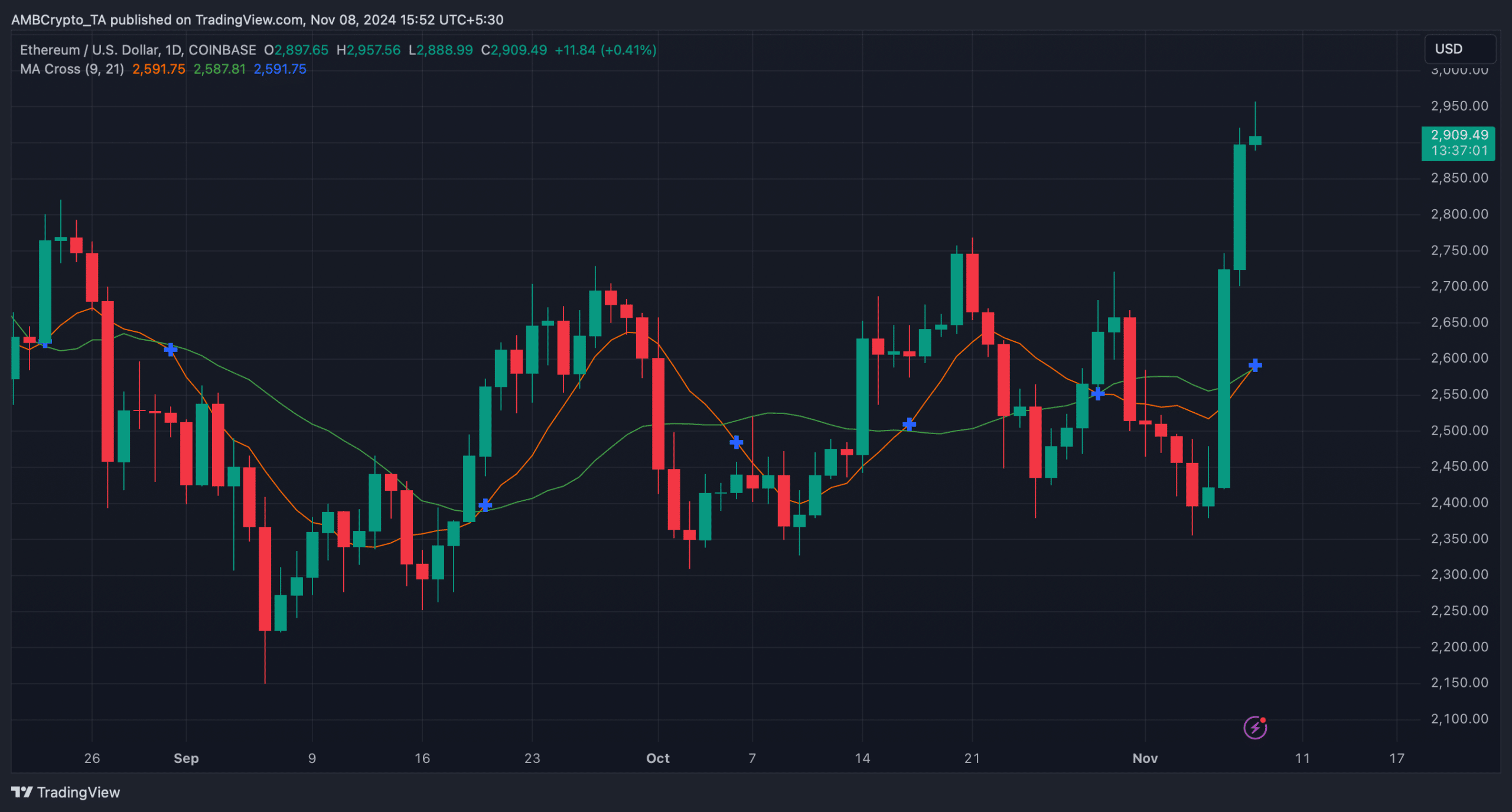

That’s why we checked the daily charts of both BTC and ETH to see if this renewed interest will translate into continued price increases.

Starting with Bitcoin, the MA cross indicator suggested a clear bullish advantage in the market. But the king coin could witness a brief pullback in the coming days as the price would reach the upper limit of the Bollinger bands.

Source: TradingView

Read Bitcoins [BTC] Price prediction 2024–2025

By mentioning Ethereum, the MA cross indicator revealed that a golden cross occurred, which if it happens could fuel further growth for ETH. At the time of writing, ETH was trading at $2.9k, having seen its value rise by over 15% last week.

Source: TradingView