The cryptomarkt experiences a significant decrease caused by global trade tensions. In addition, President Trump’s executive order to set up a strategic Bitcoin reserve has abandoned surprisingly crypto traders. As a result, the price of Solana has fallen sharply, along with a decrease in important statistics on the chain. Despite a recent recovery of its lows, the Solana price probably seems to be falling below $ 100 soon.

The realized price of Solana falls low to 3 years

In the last 24 hours, Sol Price witnessed almost equal rule among buyers and sellers. Data from Coinglass shows that Solana was confronted with a total liquidation of approximately $ 27.3 million. Of these, buyers lie $ 15.7 million and sellers closed for $ 11.6 million in positions.

Solana’s Sol was confronted with turbulent times, because it fell by 15% to $ 114 today, amid a serious decline in the cryptomarkt. This marked the first time that the token fell under his realized price of $ 134 since May 2022, based on data from Glassnode.

Also read: Will Solana (Sol) reclaim $ 180? Key Chart Signals Massive Moving

The realized price, which represents the average cost basis of all the last coins that are last moved, suggests that the average holder is now confronted with losses. This situation is usually seen as a bearish indicator and can lead to panic sales or capitulation.

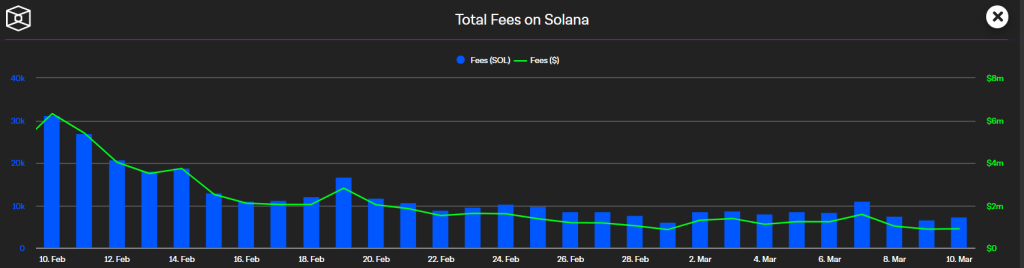

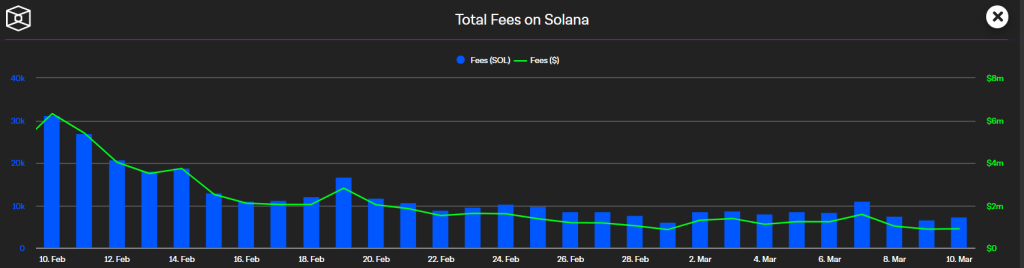

In addition, Solana’s turnover fell by 93% to around $ 4 million, the lowest it has been since September 2024.

In the aftermath of this decline, the total value locked (TVL) in the Defi Ecosystem of Solana also halved, which fell from a peak in January from more than $ 12 billion to around $ 6.38 billion, as reported by Defillama.

It is not surprising that Solana experienced a significant decrease because the interest in memecoins within the crypto community fell. After he reached the all time in January, the value of SOL has fallen by almost 57%.

What is the next step for Sol Price?

The Solana price remains under intense bearish because it recently dropped below the level of $ 114. While buyers have difficulty defending a decline, Sol Price now strives for a decrease under immediate FIB channels. From writing, the price of Solana is $ 127, after he has risen by 6.56% for the past 24 hours.

The SOL/USDT trade savings are confronted with several rejections while sellers defend an immediate increase in EMA trend lines. With the relative strength index (RSI) that floats under the center line at level 44, there is a possibility that the price of SOL could fall and test $ 110 again.

If it remains above this level, the buyers can benefit and possibly push the price for $ 139. An increase above that level can send the price to $ 153. On the other hand, if the SOL price falls below $ 110, we may see a strong correction below $ 100.