Cryptocurrency trading is an exciting and dynamic world, where traders want to understand and predict market movements. An effective way to do this is by using technical analysis, which includes studying different candlestick patterns. The Evening Star candlestick is one such pattern, known for its ability to signal a potential bearish reversal.

In this article, I will look at the key features of the evening star pattern, how to trade with it, and the risks and benefits of using it in crypto trading.

What is the evening star pattern?

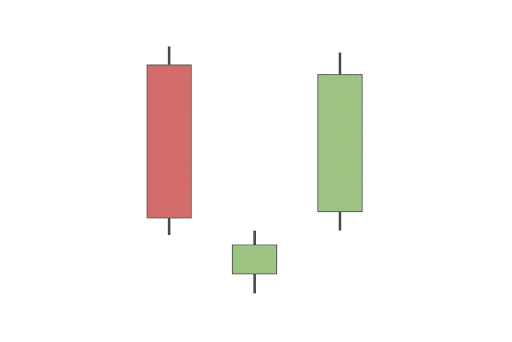

The Evening Star pattern consists of three candles: a large bullish candle, a small candle and a bearish candle. It acts as a bearish indicator and signals a possible shift from an uptrend to a downtrend when the bearish candle closes below the midpoint of the first bullish candle.

a candleor candlestick, is a type of price chart used as a visual representation of price action over a specific time frame.

It is typically used to exit (sell) an existing long position or enter a short position.

Features of the Evening Star Candlestick and how to identify it

The Evening Star candlestick is a bearish trend reversal pattern, which usually arises after a bullish trend. It consists of three Japanese candlesticks:

- A bullish candle. This green candle* represents a strong upward price movement, indicating that buyers are in control.

- A candle with a small body. This is a doji candle or a small green or red candle, which occurs when the opening and closing prices are close to each other, indicating indecision in the market.

- A bearish candle. This red candle indicates a downward price movement, showing that sellers are now dominating the market.

*Please note that on some cards you may see a blue, black or white candle. All of these colors can be used to represent bullish candlesticks.

The pattern is formed when the small-body candle is above the previous bullish candle, followed by a bearish candle that closes below the midpoint of the first candle. This pattern is considered more reliable if the bearish candle engulfs the (bullish) previous candle.

The opposite of the evening star candlestick is the morning star pattern. The Morning Star is a bullish reversal pattern that signals a potential trend reversal from a downtrend to an uptrend. It consists of three candlesticks: a bearish candle, a minor candle and a bullish candle.

The morning star pattern occurs when the small candle is below the previous bearish candle, followed by a bullish candle that closes above the midpoint of the first candle. Like the evening star pattern, the morning star pattern is considered more reliable when the bullish candle engulfs the bearish candle.

An example of the Evening Star candlestick pattern

Evening star patterns are more or less common in both the stock market and the crypto market. Instead of looking at a specific example, let’s imagine a hypothetical scenario where a trader wants to sell his Bitcoin or exchange his BTC for another cryptocurrency.

Let’s say that the price of Bitcoin has been on a strong uptrend in recent days. As the price continues to rise, a large bullish candle forms, representing a day of significant gains for Bitcoin. This bullish candle indicates that buyers are in control and driving the price higher, so our trader decides to hold on to his money.

The next day a small candle (doji or a small green or red candle) appears. This candle means that market participants are indecisive and price movement is limited. The small candle is above the previous day’s bullish candle, indicating that upward momentum may be slowing and there are bearish signals.

Finally, on the third day, a large bearish candle forms, closing below the midpoint of the first day’s bullish candle. This third candlestick is crucial for completing the evening star pattern and confirming the bearish reversal. This newly formed pattern serves as a bearish confirmation and indicates that sellers have taken control, pushing the price down. Our trader sees this as an opportunity to exit his BTC position.

This formation of a bullish candle, followed by a small body candle and then a bearish candle is the evening star candlestick pattern. In this hypothetical example, the appearance of this pattern in the Bitcoin market suggests that the uptrend may be reversing and that a downtrend could be on the horizon. Traders who recognize this pattern might decide to take profits or take short positions in anticipation of a bearish market move.

How to trade with the Evening Star Candlestick Cartridge

To trade effectively with the Evening Star candlestick, follow these steps:

- Identify the pattern. Look for a bullish trend followed by the formation of the evening star pattern, which should signal a potential trend reversal.

- Attach the pattern. To increase the reliability of the signal, you can wait for additional bearish candlestick patterns or other technical indicators that point to a bearish reversal, such as resistance levels or trend lines.

- Set a stop loss. Place a stop-loss order above the high point of the pattern to minimize potential losses if the trend reversal does not materialize.

- Enter a short position. Once the pattern is confirmed and the stop loss is entered, enter a short position, expecting the price to fall.

- Keep an eye on the trade. Monitor price movements and adjust stop-loss and take-profit levels if necessary.

The risks and benefits of using the Evening Star pattern in crypto trading

Like any other method of analyzing charts and optimizing your trading, the Evening Star candlestick pattern has its risks and rewards. Be careful and try to use more than one market analysis technique when making decisions.

Advantages:

- Early warning sign. The evening star pattern provides an early indication of a possible trend reversal, allowing traders to react accordingly and profit from the bearish move.

- Increased chance of success. Combining the evening star pattern with other technical analysis tools can increase the chances of a successful trade.

Risks:

- False signals. Like any technical analysis tool, the evening star pattern can occasionally produce false signals, leading to potential losses.

- High volatility. Crypto markets are known for their high volatility, which can sometimes result in the pattern not being able to accurately predict a trend reversal.

Conclusion

The Evening Star candlestick is a powerful bearish reversal pattern that can help traders identify potential trend reversals in the crypto market. By understanding its characteristics, using it in combination with other technical analysis tools, and being aware of its risks and benefits, traders can increase their chances of success. As with any trading strategy, it is essential to manage risk and maintain discipline to achieve consistent results.

FAQ

What is the evening star candlestick pattern?

The Evening Star candlestick is a bearish reversal pattern that typically signals a potential reversal from an uptrend to a downtrend. It consists of three candles: a long bullish candle, a small-body indecision candle and a bearish candle.

This bearish candlestick pattern indicates that bullish momentum is losing steam and bearish sentiment is taking over, potentially leading to a downtrend in the asset price.

What are the best bearish reversal patterns?

Some of the best bearish reversal patterns in the financial markets are the evening star candles, bearish harami, shooting star and bearish engulfing. These patterns help traders identify potential reversals in price uptrends, allowing them to profit from bearish market moves. Each pattern has its unique characteristics, but they all indicate a weakening of bullish momentum and a shift toward bearish sentiment.

Is the evening star pattern reliable?

The Evening Star candlestick is considered a relatively reliable bearish reversal signal, especially when it appears after a strong uptrend and other technical indicators, such as resistance levels or price oscillators, confirm it. But like all technical analysis tools, the evening star pattern can occasionally produce false signals. To limit this risk, traders should combine this pattern with other indicators and maintain strict risk management practices.

What is the morning star pattern?

The morning star pattern, which is the opposite of the evening star candlestick, is a bullish reversal pattern. It indicates a possible change from a downward trend to an upward trend in the financial markets. The pattern consists of three candles: a bearish (red or black) candle, a small-body indecision candle, and a bullish (green or white) candle. The Morning Star pattern indicates that bearish momentum is waning and bullish sentiment is taking over, potentially leading to an uptrend in the asset price.

Disclaimer: Please note that the content of this article is not financial or investment advice. The information contained in this article is solely the opinion of the author and should not be considered as trading or investment recommendations. We make no guarantees about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional random movements. Any investor, trader or regular crypto user should research multiple points of view and be familiar with all local regulations before making an investment.