- The crypto market recovered after an aggressive interest rate cut by the Fed.

- Trump became the first former president to transact with BTC.

The crypto market responded positively to the Fed’s first interest rate cut in four years.

On September 18, the US Fed cut rates by 0.50% (50 basis points), a surprisingly aggressive move that caught most economists, who expected a 25 basis point rate cut, by surprise.

After the Fed pivot, Bitcoin [BTC] posted a 2.3% gain during the intraday trading session on Wednesday. On September 19, during the early Asian hours, BTC climbed higher to $62.5K.

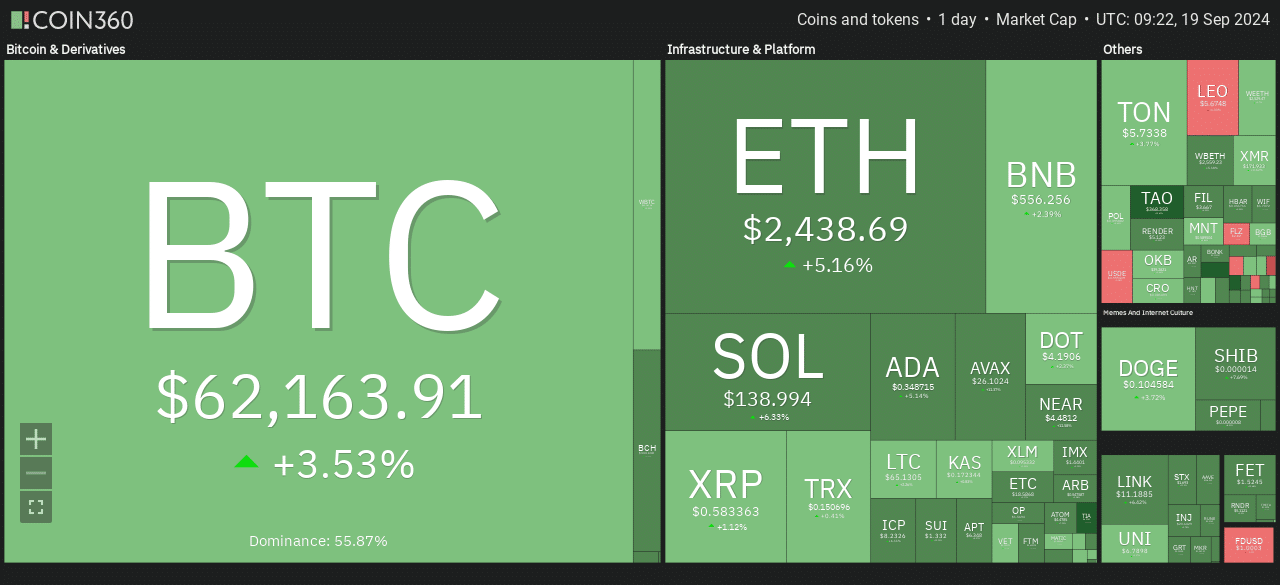

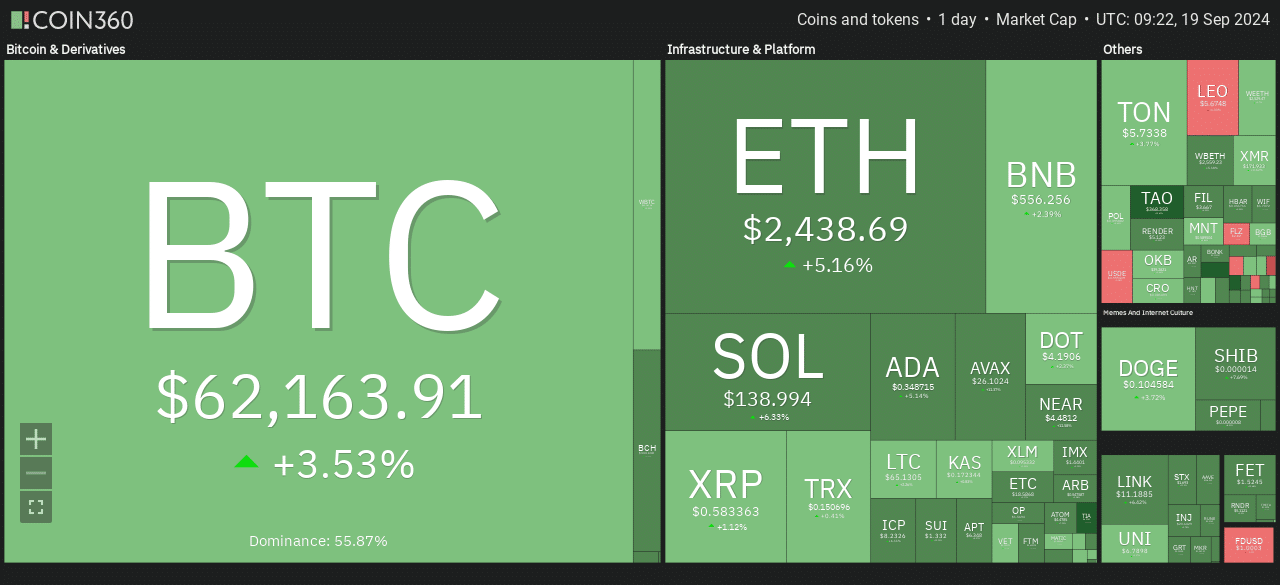

Source: Coin360

At the time of writing, the asset was valued at $62.1K, with notable gains across the sector. Ethereum [ETH] up 5% in the last 24 hours.

But Solana [SOL] had the highest daily gains among major assets, with a gain of almost 6.4% over the same period.

However, market experts remained cautious, pointing out that the Fed’s big rate cut could signal a slowing economy, which could disrupt risky assets in the short term.

BitMEX founder Arthur Hayes called the aggressive cut a “nuclear catastrophe for the financial markets” that could lead to subdued prices after two days.

He further warned that Friday’s BoJ (Bank of Japan) decision could be another factor determining BTC’s next price direction. Hayes noted,

“A weak JPY means a stronger BTC and vice versa.”

However, Antony Pompiliano, a BTC investor, claimed that recession concerns only mattered to short-term speculators. For long-term investors, the Fed’s rate cuts were bullish for BTC.

Trump becomes the first president to transact using BTC

On September 18, Donald Trump, former US president, stopped at the famous PubKey bar in New York and paid with BTC.

He bought food and drinks for the supporters at the tent and paid via BTC. PubKey owner Thomas Pacchia called the promotion “history.”

“The first transaction by a president on the Bitcoin protocol. History!”

In contrast to his first stint in the White House, Trump has become pro-BTC and has even announced plans to establish it as a strategic reserve if he is elected president.

As a result, BTC’s price action has also become increasingly correlated with Trump’s chances of winning the 2024 US elections.

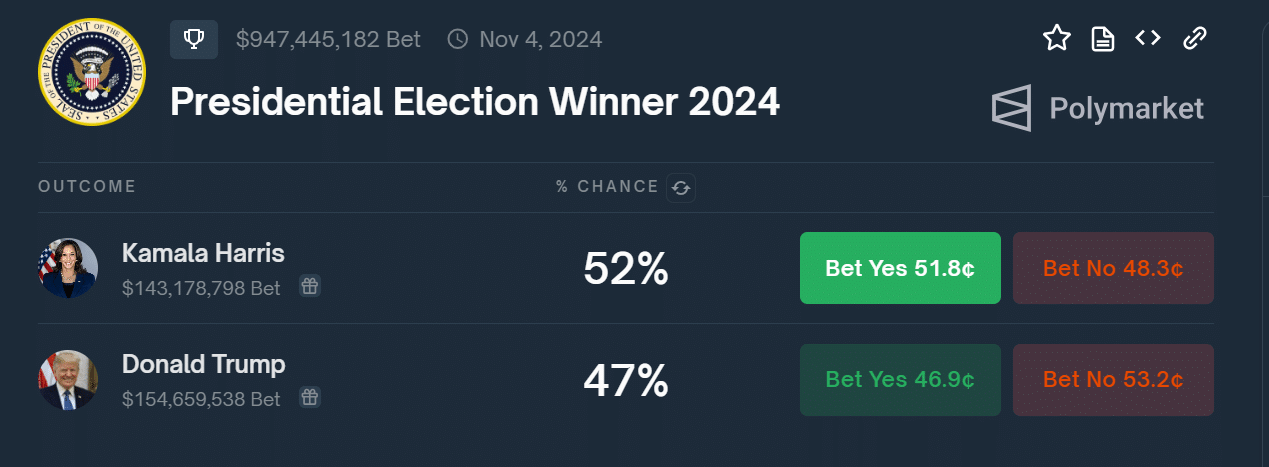

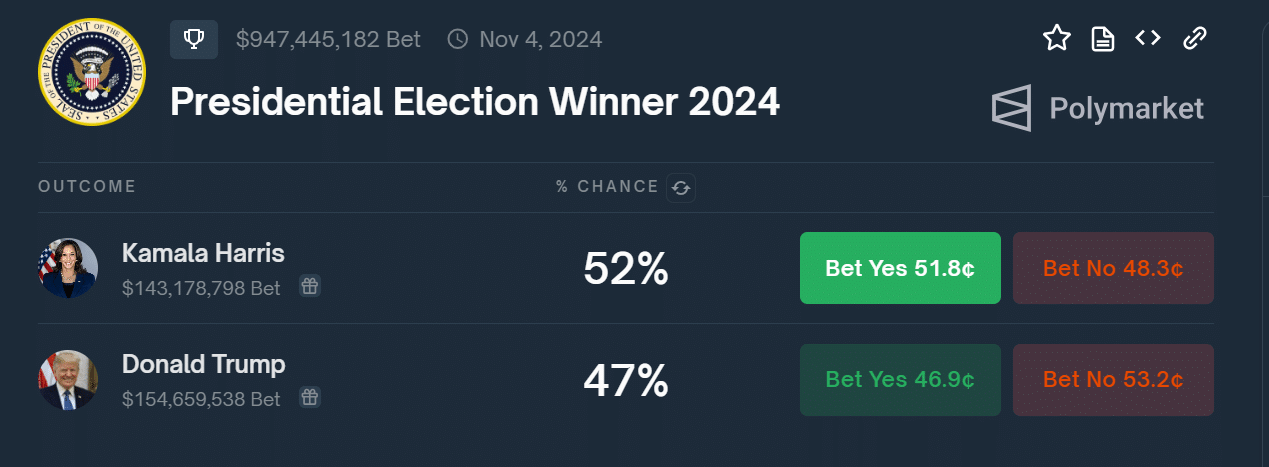

Source: Polymarkt

At the time of writing, the probability of a Trump victory stood at 47% as Harris dominated with a 5-point lead on the prediction site Polymarkt.

Wisdom Tree unveils RWA platform on Ethereum

Finally, Wisdom Tree, an asset manager with $110 billion in assets under management, unveiled a real-world asset (RWA) tokenization platform which will run on Ethereum.

The product, called Wisdom Tree Connect, will enable integration between TradFi and DeFi, according to the company. Will Peck, Head of Digital Assets at WisdomTree, said:

“With the increasing interest in tokenized real-world assets, WisdomTree Connect… will provide access to digital funds to on-chain companies without leaving the ecosystem.”

Wisdom Tree will join other asset managers such as BlackRock and Franklin Templeton, which have similar products aimed at providing yield-bearing products to crypto companies that want exposure to US government bonds as a reserve.