This article is available in Spanish.

After rising above $72,000 earlier last week, the Bitcoin price experienced an unexpected crash below the $70,000 mark prior to the US presidential election. Reports cite the influence of whales and the upcoming US presidential election results as catalysts for this price drop.

Bitcoin price crashes as market braces for US election results

The Bitcoin price seems to be one crash before the elections. It is now trading below the $70,000 mark, after falling more than 3.64% in just a few days. Many label this sharp decline to the $68,000 level as the “largest Bitcoin crash,” indicating that the most significant downturn in Bitcoin history has just begun.

Related reading

Market intelligence platform Santiment has noted the recent Bitcoin crash, to emphasize the decreasing number of non-empty investor wallets. According to the analytical platform, there were 211,540 fewer addresses than three weeks ago. This massive drop is seen as a sign of intense fear, uncertainty and doubt (FUD), which usually accompanies future bullish performance and a tense market.

Currently the The crypto market is in excitement mode while investors, both private and institutional, await the outcome of the US presidential election. Even large-scale Bitcoin investors, often “Whales”, have been relatively quiet and have taken a wait-and-see approach as they keep a close eye on the results of the US elections influence the dynamics of the market.

Santiment too notes that Bitcoin whales have reduced their transaction activity, indicating a change in market sentiment. The market intelligence stated that “Bitcoin whales are patiently awaiting the results of the US presidential election as their activity calms down after last week’s spike near crypto’s top.

The outcome of the US elections is expected are starting to roll in today, and many crypto traders and investors are already preparing for high market volatility and unpredictability. On X (formerly Twitter) there was also a spike in mentions related to it Presidential candidate Donald Trumpwhich has received significant support from several members of the crypto community.

How the US Presidential Elections Could Affect the BTC Price

Many crypto analysts have different opinions and predictions about the future of the crypto market after the US presidential elections. With great candidates Kamala Harris or Trump are vying for the presidencyinvestors and crypto experts are closely watching the market for changes.

Related reading

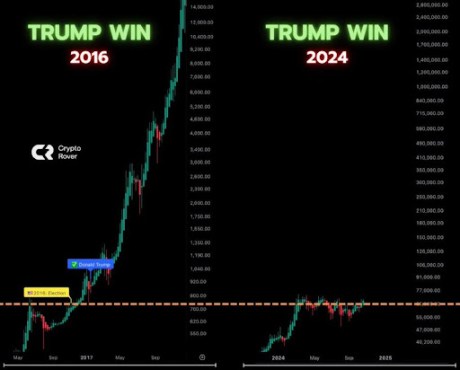

According to crypto analyst Crypto Rover, Bitcoin rose 2,714% the last time former President Trump won the US elections. The analyst has suggested that if history repeats itself, that is: if Trump wins the current presidential election and the Bitcoin price experiences a similar surge, the pioneer cryptocurrency could be worth $2 million by 2025.

Moreover, Santiment has done that too revealed that Bitcoin crashed by 5.5% in the previous election in November 2016 after Trump was announced president. In contrast, Bitcoin price rose 22.6% in November 2020 after Joe Biden was announced as president.

Based on the social sentiment on Trump as the next American president. However, Adam Khoo, a crypto analyst, has done just that noted that more than 50 million US citizens have already voted in the US elections, with exit polls showing a significant win for Harris.

Featured image created with Dall.E, chart from Tradingview.com