Once again, the NFT marketplace and aggregator Blur has shaken up the NFT space. On May 1, the company announced the launch of Blend, a peer-to-peer lending protocol co-developed with Web3 investment firm Paradigm. Blur claims the new protocol will help unlock liquidity for NFTs and help the market grow overall.

In the first 24 hours after release, Blend became the number one lending protocol both in terms of volume and users on the Ethereum blockchain.

Unsurprisingly, the launch has been met with praise, criticism, and everything in between. Blur is no stranger to controversy, but its latest move is its most controversial and influential yet. Here’s what you need to know about how Blend can impact the NFT ecosystem, what people are saying about it and why it matters.

How does Blend work?

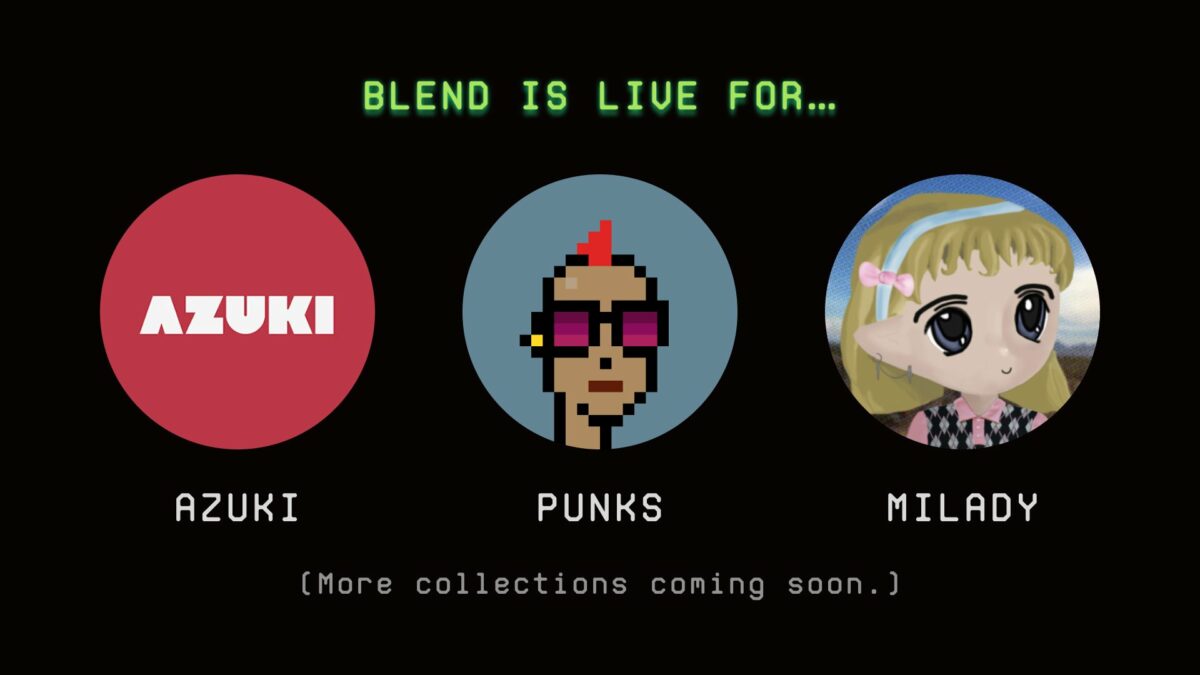

Blend supports two new product offerings from Blur. The former allows people to use their NFTs as collateral to access ETH liquidity. The second is the buy-now-pay-later feature, which allows users to access expensive blue-chip NFTs for a small deposit. Currently, Blur users can only use Blend on three NFT collections, including Azuki, CryptoPunks, and Milady Maker. However, the platform said it will add more collections in the near future.

What sets Blend apart from other lending protocols like NFTfi is that Blend loans are fixed at fixed rates and have no maturity date, with interest accruing until the loan is repaid. Blend automatically “rolls a lending position as long as a lender is willing to lend that amount against the collateral,” and on-chain transactions are only required if someone decides to exit the position or if there is a change in interest rates.

Borrowers can repay their loan at any time. If a borrower does not pay the full amount by the due date, lenders can initiate a Dutch auction refinancing option (whenever they want). New lenders can then catch up on the loan at an interest rate that appeals to them. If there are no interested bidders on the loan, the original lender takes ownership of the NFT with collateral.

And because Blur offers rewards to users who offer loans, lenders are incentivized to offer favorable terms.

The risk to the borrower can be significant; they have a 24-hour window to repay their loan if the lender triggers a 30-hour loan auction. If they can’t, the interest on the loan can rise significantly to make it attractive to other potential lenders. Lenders also run the risk of not being able to find someone to take over the loan within those 30 hours. While the lender would currently receive the NFT as collateral for the loan, its value is unlikely to cover the amount of the loan they provided.

Because the platform offers platform points rewards to backers, Blur users are incentivized to partake in the latest toys on the market. The company has also made it clear that there are no marketplace fees for borrowing or lending, although Blend fees are managed by $BLUR token holders. After a period of 180 days, the Blur DAO will vote on whether or not to change fees for lenders and borrowers. For now, Blend is drawing users to the platform, contributing to Blend’s sudden rise to the top of the lending protocol hill.

As such, Web3 is already feeling the effects of Blur’s latest launch, and the company’s one-stop-shop strategy seems to be paying off. In addition to Blend’s release, Blur has updated the way it hands out reward points, recently stated that points can change per set.

Blur is guaranteed to cause a stir when it makes an announcement. And despite Web3’s well-deserved reputation unnecessarily hyperbolic, it’s true that few other platforms make as many bold moves as Blur (except maybe OpenSea). But the difference between these two platforms is that over the past six months, Blur has tended to trade rather than react to Web3 trends.

This attitude naturally causes controversy. When the company announced it would be double points rewards for listing and bidding on its platform, it leaned for the financialization of tokens on its platform, which has arguably linked the health of entire NFT collections to the behavior of a handful of influential traders.

strong appreciation for the paradigm’s zero-oracle, arbitrary collateral approach

no doubt in my mind that fully onchain mechanisms are the future

more difficult to build but much more robust. then the question becomes how to remove the complexity from the end user https://t.co/ddE5BxgcvQ

— foobar (@0xfoobar) May 1, 2023

With Blend’s announcement, along with Blur founder and core contributor Tieshun Roquerre’s (Pacman) verbal confirmation that the financialization of NFTs is something it believes is lacking in the space, Blur has tripled on a stance that has taken the NFT community by surprise made. , impressed and even more concerned about what this could mean for the future of Web3 than ever before.

From a market development perspective, some announced mix as a product that could significantly extend the reach of the ecosystem and inject some much-needed energy into an industry that has been decidedly struggling lately. Others predicted that Blend could go that far counter the effects of Blur’s bid-and-quote-based points reward system, which can seriously contribute to rock bottom prices due to misalignment of trade incentives.

Not everyone is thrilled with Blur’s latest development. Artist Bryan Brinkman hit a chillingly clever note when he said Web3’s latest utility appears to be debt. At the same time, HUG co-founder Debbie Soon outlined the case for what she considers a development worthy of any comparison to the subprime mortgage crisis of 2007-2008.

What happens now

The usual suspects have already started taking advantage of Blend, with pro trading legend Machi big brother to the top of Blur’s largest lenders list on May 2. Such traders need little incentive to chase Blur Reward Points. While Season 2 of the marketplace’s token-boosted airdrop hasn’t been given an official end date yet, Blend looks like it’s just what the platform needed to retain and attract new users.

Overall, Blend has shaken up an NFT ecosystem that hurts badly. Blur’s new guess could be just what the space needs, breaking a poorly healing bone to ensure it resets properly. Conversely, the concern about piling risk upon risk with a relatively new asset class in the rather vague name of “growing the market” is also nothing to scoff at. The company continues to introduce powerful tools to the Web3 world. Whether those tools prove to be too powerful or not remains to be seen.

debt

debt (@debsoon)

(@debsoon)