- Bitcoin’s hashrate reached new highs, indicating positive mining activity.

- Onchain trends revealed a bias towards the movement of the coin during the exchanges.

Bitcoin [BTC] experienced a significant price drop in recent days, causing concerns in the market. However, there was a positive development in the form of BTC’s hashrate, indicating the resilience of the network.

If you want to know when #BitcoinIf the foundations of the company stop growing, just check the hashrate.

It continues to reach record highs every month.https://t.co/IwcFXPKOjH pic.twitter.com/TX64aSwoLD

— Ki Jonge Ju (@ki_young_ju) January 16, 2024

Looking at the condition of the miners

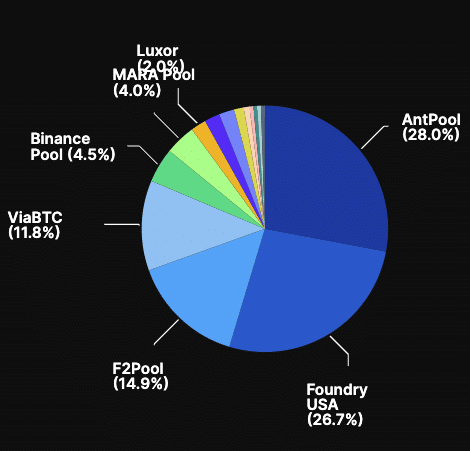

BTC’s hashrate growth can be attributed not only to improvements in chip performance, but also to the expansion of US mining companies.

The presence of these mining companies has played a crucial role in boosting BTC’s hashrate and contributed to the overall health of the network.

Source: Hashrate index

The positive trajectory of the mining sector is further highlighted by the collective market capitalization of the largest mining companies, which stood at an impressive $13.6 billion.

This significant market capitalization indicated the financial strength and stability of these mining entities, reinforcing the positive outlook for BTC.

What’s next for BTC

Analyzing trends in the chain showed that people were actively moving coins rather than holding them at the time they were pressed.

This suggested an active involvement in BTC rather than a passive approach, which could potentially contribute to greater liquidity and trading activity.

$BTC update

As mentioned in previous weekly stats, the onchain movement has favored coin movement over accumulation

Both Temporary (age of currency) + Economic ($ value)

The thesis has developed as proposed https://t.co/EHd4WTR9UI @santimentfeed pic.twitter.com/W0iL1PHCeI

— NeuroInvest Research (@Neuro__Invest) January 15, 2024

Will the halving double holder return?

Looking ahead, analyst Tom Wan’s projection points to the approaching date of Bitcoin’s next halving, set for April 15, 2024. During this event, block rewards will be halved from 6.25 to 3.125.

Read Bitcoin’s [BTC] Price forecast 2024-25

Halving events have historically had a profound impact on BTC prices. As the next halving approaches, market participants can expect positive price movements.

According to the latest data, BTC was trading at $42,715.13, reflecting a modest growth of 0.4% over the past 24 hours. The increased trading volume further supported the idea of active participation in the king coin market.

Source: Santiment