As the highly anticipated Federal Open Market Committee (FOMC) meeting approaches, the financial world is abuzz with speculation about the possible implications for Bitcoin and crypto. Tomorrow, on Wednesday, July 26 at 2 p.m. EST, the FOMC will announce its interest rate decision. As usual, Federal Reserve (Fed) Chairman Jerome Powell will address the media at 2:30 p.m. EST.

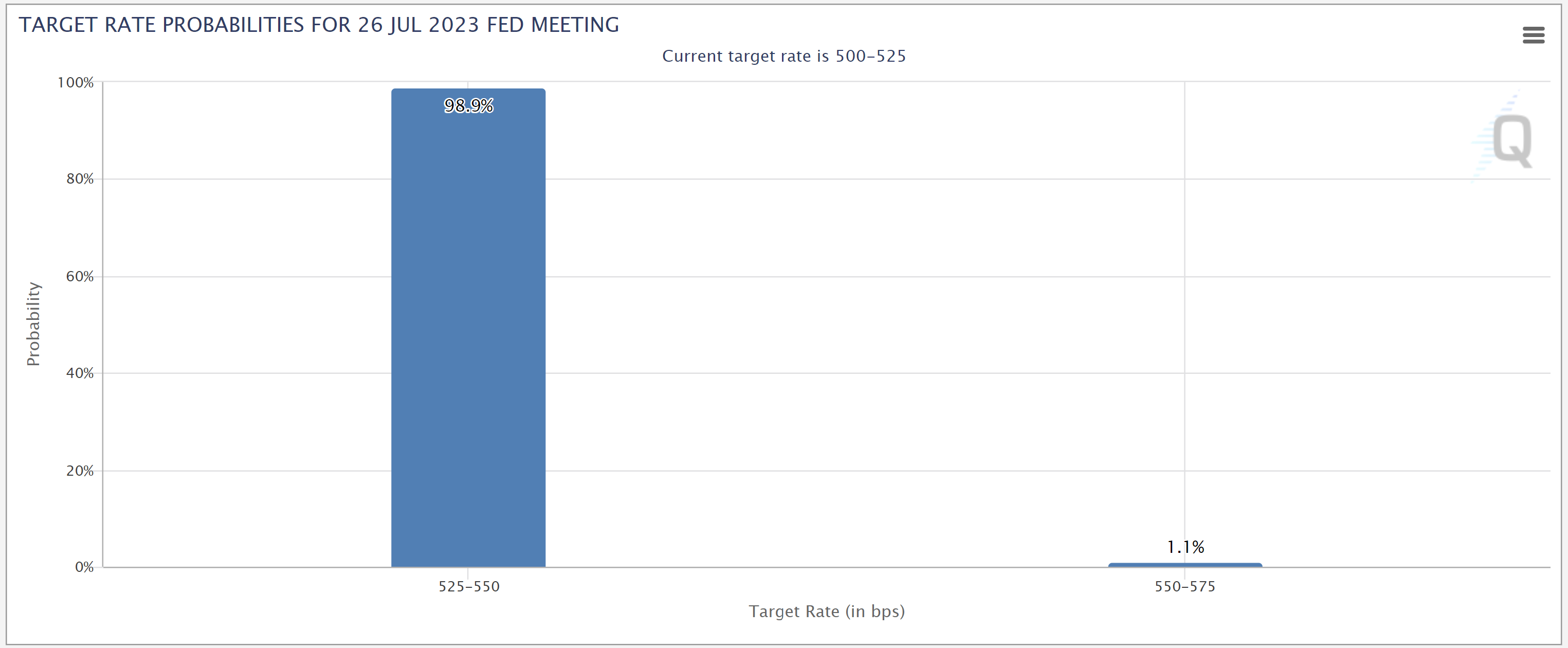

According to the CME FedWatch tool, the majority of the market expects an increase of 25 basis points (99.8%). However, the real intrigue lies in what comes after this move and whether it marks the end of the rate hike cycle.

After tomorrow’s decision, the market expects the Fed to keep policy rates high for an extended period of time. A first rate cut could come as early as March 2024, if not May.

Tomorrow is #FOMC day, expect volatility. #Bitcoin #crypto

98.9% chance of a 25 basis point rate hike by the Fed.

The market expects the Fed to keep policy rates high for an extended period of time. A first interest rate cut could come as early as March ’24, if not May. pic.twitter.com/C8wscv6BMd

— Jake Simmons (@realJakeSimmons) July 25, 2023

Implications for Bitcoin and Crypto

For the past 16 months, the US Federal Reserve has struggled with inflation while raising interest rates to levels not seen in 20 years. But all signs point to a possible end of the tightening cycle. The market firmly expects the 0.25 bps increase to a range of 5.25 to 5.5% to be the last.

Meanwhile, Bitcoin and crypto have gone through a period of relative immunity to macroeconomic events and interest rate hike speculation in the first seven months of the year. However, investors should be aware that such terms may not last indefinitely.

On Monday, Bitcoin price returned to the $29,000 support level. It appears that market participants have been cautious leading up to the FOMC meeting in July, aware that the FOMC meeting could have a major impact.

In June, Fed Chair Jerome Powell hinted at the possibility of further rate hikes this year, with some committee members calling for two more hikes. The market now eagerly awaits the outcome of this meeting to determine the central bank’s future policy stance.

However, factors such as declining inflation in the United States and a weaker labor market are strengthening market expectations. The previously sky-high inflation that led to the tightening cycle is showing signs of abating. June Consumer Price Index (YoY) data showed inflation falling from 4.0% to 3.0%. Core interest rates fell from 5.3% in May to 4.8% in June. Both declines were stronger than previously expected. Remarkably, core interest rates are now trading below the level of the US federal funds rate, which has been quite rare in the past 20 years.

The long-term strength of the US labor market has long been the biggest concern for the Federal Reserve because of the imbalance between supply and demand. At the peak of this imbalance, there were two job openings for every available worker, driving up wages accordingly. As supply and demand approach equilibrium, the number of new jobs has declined. There are even early indications of falling consumer spending.

So, what does all this mean for Bitcoin and crypto investors? As always, it is essential to approach the market from a balanced perspective. While BTC and cryptocurrencies have shown resilience in the face of traditional economic events, they are not completely isolated from larger macroeconomic trends.

Investors should pay close attention to the FOMC rate decision and subsequent statements by Jerome Powell. Any signals about the future rate hike cycle could affect both the traditional and Bitcoin and crypto markets, triggering a further sell-off.

At the time of writing, the market remained undecided. BTC was trading at USD 29,200.

Featured image from iStock, chart from TradingView.com