This piece is a guest post by Blocmates. Blocmates is an invaluable crypto news and educational resource that offers clarity in the often complicated and jargon-filled crypto space. In this article, author Gaz critiques Vitalik Buterin’s recent actions, while explaining the advancements in Ethereum scaling solutions like roll-ups, particularly focusing on “based roll-ups.”

From Token Dumps to Roll-Up Tech: The Good, Bad, and Future of Ethereum

It seems that Vitalik has been doing everything he can to keep Ethereum bulls as poor as possible lately.

His terrible singing, not-so-great takes on defi, and endless token dumping via CowSwap TWAP orders to fund his bio-defense interests and high-maintenance girlfriend aren’t exactly what ETH maxis had hoped for from their project leader.

Since the beginning of 2024, the Ethereum Foundation has averaged one major sale every 11 days, with each sale averaging around $420,000 worth of ETH.

Thankfully, we have good Samaritans like Iggy Azalea doing god’s work and trying to figure out where he spends all that gas money. The circus rolls on.

It’s not all bad news, though.

Scaling solutions have always been a top priority for Ethereum’s future success, and thanks to roll-up tech, things have certainly been advancing in the right direction.

As with anything in crypto, iterations are made, and everything upgrades rapidly. Roll-up tech is no different, and some exciting improvements have been made in recent months that warrant a closer look.

What are roll-ups?

Before we discuss the details of based roll-ups, it is important to understand where this all started and what the roll-up world currently looks like.

Anyone who has spent enough time navigating around the Ethereum network probably noticed one significant difference when compared to other chains… It’s expensive af!

To address this problem, an explosion of Layer 2 protocols was launched that harnessed all the things that make Ethereum the most secure chain of all while also lowering the cost of using it.

By utilizing Ethereum’s underlying security, using their own sequencers, being smart contract compatible, and executing transactions off the main chain, these Layer 2 roll-up solutions have increased the Ethereum network’s scalability and performance.

The term “roll-up” came about because these protocols bundle transactions, execute them on the layer 2 chain, and then send that data back to the main chain, in this case, Ethereum layer 1.

Until now, there have been two main types of roll-ups: Optimistic roll-ups and Zero-Knowledge roll-ups.

What are Optimistic roll-ups?

Optimistic roll-ups are exactly that: optimistic. They assume that transactions are valid by default, removing the need for checking by the underlying layer 1 and saving precious time and computational power.

Optimistic roll-ups process the transaction bundles off the main network and then send these blocks of data back to the main chain, where no extra computation needs to be done, reducing the workload of the layer 1.

They rely on a fraud-proof mechanism to incentivize good behavior. They reward validators who discover faulty transactions while slashing validators who validate blocks that contain fraudulent transactions.

This fraud-proof mechanism creates some issues that make it sub-optimal for the perfect Ethereum scaling solution.

One example of this can be seen in the long wait times when withdrawing funds from the network, as a period is needed to ensure that no validators flag the block for containing false transactions.

What are Zero-Knowledge roll-ups?

Zero-Knowledge (ZK) roll-ups also bundle together transactions off the main chain to save time and computational cost and, therefore, improve the scalability of the layer 1.

ZK tech uses cryptographic proofs known as a SNARK (succinct non-interactive argument of knowledge) or STARK (scalable transparent argument of knowledge) to secure the underlying data.

Once the data is secured, it’s sent back to the layer 1 with a “proof-of-validity” that can be thought of as a receipt to show the work done by validators to ensure there are no fraudulent transactions in the block.

This proof-of-validity mechanism takes away the need for the layer 1 to do this work itself and therefore greatly increases the time it takes to validate blocks and in turn drastically increases throughput speeds.

For more insight into the world of ZK-proofs take a look at this thread by yours truly (shameless self-shill).

Zero-knowledge could be the next big thing.

Can you prove your knowledge of zero-knowledge proofs or is there no knowledge there to prove?

Here is everything you need to know about ZK tech

pic.twitter.com/UgGZ49XNIq

— Gaz (@defi_gaz) March 26, 2023

One of the big issues with both optimistic and ZK roll-ups is concerns surrounding the sequencing process, which can negatively impact decentralization, cause potential downtime, and create censorship issues, not to mention the sheer complexity of it all.

So, with all this knowledge in mind, let’s move on to the world of based roll-ups and find out what makes them that much better than the roll-ups of the past.

What’s so based about based roll-ups?

The concept of the based roll-up came to fruition in March 2023 thanks to the giga-brained effort of Ethereum researcher Justin Drake.

The idea behind Drake’s based roll-ups came as a possible solution for some of the issues faced by the current roll-up tech, mentioned above.

These roll-ups aren’t based in the way that they are down-to-earth and not influenced by the latest psyop, but instead, the fact that the sequencing of these roll-ups will take place on the base layer itself, in this case, Ethereum layer 1.

By using the underlying infrastructure that already exists on the Ethereum L1, namely the searchers, builders and proposers to perform the sequencing tasks needed, it greatly increases the decentralization, reliability and security of the entire process.

This increase in decentralization is made clear by the fact that anyone who can see the roll-ups mempool can take part in the sequencing tasks without permission. This furtherment of decentralization can take place without the need for a token-based operational system.

Using the already existing entities that manage building blocks on the Ethereum network, based roll-ups can be implemented with a massively increased level of simplicity compared to their optimistic and ZK roll-up cousins.

In simple terms, the rolled-up transactions that would normally be validated by the L2 and then sent to the L1 network are now validated by the L1 itself, cutting out the extra steps needed by other roll-up solutions, making the most efficient use of Ethereum’s existing mechanisms.

By simplifying the mechanisms used to sequence transactions on the base layer, costs can be reduced, speed can be increased, and the inherent security and decentralization that comes with the use of the Ethereum network can be maintained.

All of these factors give based roll-ups the upper hand when compared to the traditional roll-ups that are used today.

Based roll-ups design and sequencing

Based roll-ups are made up of four different layers. You have the consensus layer, the data availability layer, the execution layer and the settlement layer.

Of these four layers the consensus, data availability and settlement layer are all layers of the underlying layer 1, in this case Ethereum. Only the execution layer is taken care of by the roll-up itself.

Sequencing structure is one of the biggest focus points when it comes to all roll-ups, and based roll-ups are no different. Collaboration is the buzzword in the based roll-up world and is what makes a big difference compared to traditional roll-ups of the past.

So, what is meant by collaboration in regard to sequencing structure?

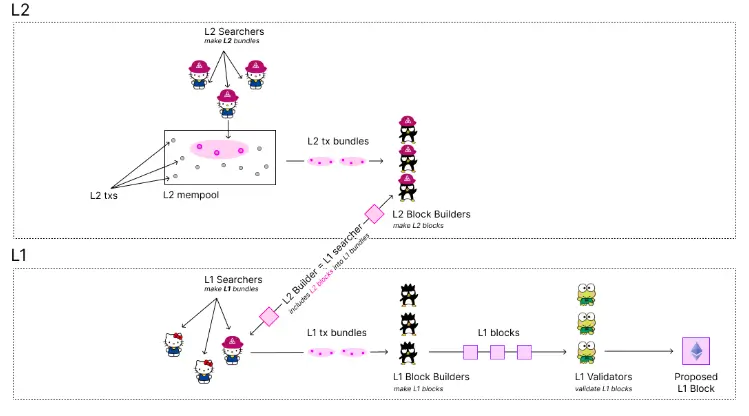

In its simplest form, collaboration refers to the way that the layer 1 proposes work together with the layer 2 searchers and builders to process the rolled-up transaction bundles.

The transaction lifecycle of a based roll-up is made up of four main steps.

In step one, the L2 searchers bundle up the transactions made on the L2 by the users.

Step two involves the L1 searchers and L2 block builders who sequence the transactions to create full L2 blocks. It is worth noting that L1 searchers can also be L2 builders.

In step three, the L1 searchers take these full L2 blocks and submit them to the L1 block builders.

In the final fourth step, the L1 block builders pass on the L1 blocks that now contain the data from the L2 blocks to the L1 validators, who process them the same way as any other transaction on the network would be processed.

All of this can be seen in the diagram below.

https://modular.4pillars.io/BasedRollups

This process is made permissionless, meaning that any roll-up block can be added to the main layer 1 block without the need for any special permissions.

What this does is create an environment where transactions are added to the Ethereum block with all the benefits of Ethereum’s underlying security and guaranteed uptime.

The end result is low cost, speed, and reliability, which is what we all want from a top-performing network. The low-cost factor comes from the fact that gas overheads are now removed from the signing of contract verifications.

Another huge benefit of based roll-up design is their usage of Pre-Confirmations.

Pre-confirmations allow transactions to be confirmed before they are included on-chain. This massively speeds up transaction times and improves the overall user experience.

These pre-confirmations require proposers to take on increased slashing penalties in order to forcefully include these transactions on-chain. Basically, if any of the promises made in the pre-confirmation agreements are broken when pushing these transactions onto the chain then higher slashing rates will occur to those proposers responsible.

The good, bad, and the ugly

As with all new tech there are pros and cons that must be considered, based roll-ups are no different. There is no single fix-all solution in the world of crypto.

The benefits should be relatively clear by now:

- Increased decentralization thanks to the usage of the underlying L1 infrastructure as opposed to the roll-up itself.

- Reliability and minimal downtime risk due to leaning on the L1 sequencer and validators.

- Reduced costs by eliminating the need for sequencer signature verification and the gas fees that are required to carry this out, creating a zero gas overhead environment.

- Increased simplicity due to leveraging the existing L1 tech and, therefore, removing the need for many of the complexities that come with L2 sequencers and consensus mechanisms.

There are, however, a number of downside limitations that these based roll-ups will either need to address or simply accept as part of the parcel.

A big disadvantage is that the based roll-up itself doesn’t receive the same economic incentive in the form of maximal extractable value (MEV) that it would if it used its own sequencer, as seen in the ZK and optimistic roll-up variants.

Instead, this revenue stream is chewed up by the L1 itself, as it is here that the sequencing is taking place.

There is also a loss in sequencing flexibility that would be enjoyed by other roll-up designs.

This can have a negative impact on the ability for faster transaction confirmation and removes the opportunity for big-brained developers to make changes to the sequencing design to achieve maximum efficiency.

Basically, the sequencing process and potential scalability are at the mercy of the underlying L1, and not much can be done about it by any builders on the outside.

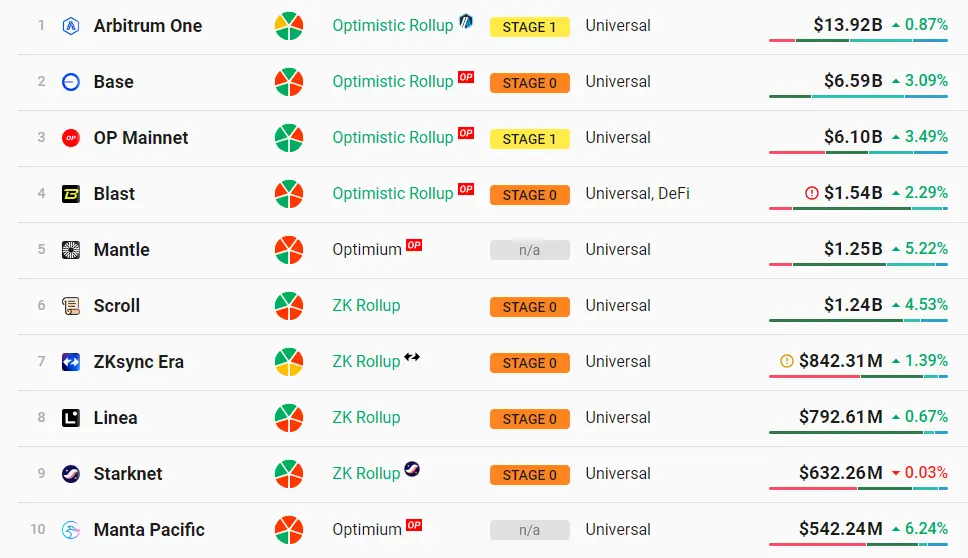

Whether or not the pros outweigh the cons is up to you to decide but it seems like Vitalik himself has made his mind up on the matter and will no longer be mentioning anything beside stage 1+ roll-ups from now on.

I take this seriously. Starting next year, I plan to only publicly mention (in blogs, talks, etc) L2s that are stage 1+, with *maybe a short grace period* for new genuinely interesting projects.

It doesn’t matter if I invested, or if you’re my friend; stage 1 or bust.

Multiple… pic.twitter.com/4cGxgsfmUc

— vitalik.eth (@VitalikButerin) September 12, 2024

To really understand what he means by stage 1+, you can check out this article, where he outlines the steps required to go from stage 0 with full training wheels to stage 2 with no training wheels.

Probably worth a read if the man himself is basically turning his back on anything that doesn’t make the cut!

The layer 2 scaling fight for supremacy continues, and based roll-ups are the newest competitor in the realm.

When looking at the current roll-up marketplace we can see that the optimistic roll-ups currently dominate the space and only two, Arbitrum and Optimism, have made the stage 1 cut to be privileged enough to get the attention of Vitalik himself.

With based roll-ups sharing the same fraud-proof mechanism as optimistic roll-ups they clearly look to take the best from the sector leaders and add to it with a more decentralized sequencing system.

This slight difference in tech gives based roll-ups an edge in the realms of cost efficiency for the user and simplicity for the builder and should hopefully push them to the top of this list.

The obvious question that remains is who is actually building this stuff?

To save this article from turning into a novel, I will list a few projects for the keen alpha hunters to dig deeper into themselves. After all, that is where the real rewards are found.

Taiko, Espresso, Fairblock, Sorella, and Chainbound are all dabbling in the based af roll-up arena, so be sure to check them out for yourself if you’re interested in seeing what the future of this sector is all about.

For now, however, one can only hope that Vitalik stops dumping on us and that Ethereum bagholders will one day be rewarded for their loyalty and patience.

One can only hope!

Are you optimistic about Ethereum’s future? Share your thoughts and opinions about this subject in the comments section below.