- Bitcoin wHales resumed shorting as the price approached $65K.

- The bot tracker indicator indicates that there is more bot activity on the buy side.

Bitcoins [BTC] price movements are closely watched by the market as it is the largest cryptocurrency and thus affects the overall market performance.

Recently, whales resumed shorting BTC as it approached $65,000, raising concerns about a possible drop before significant upward movement occurs.

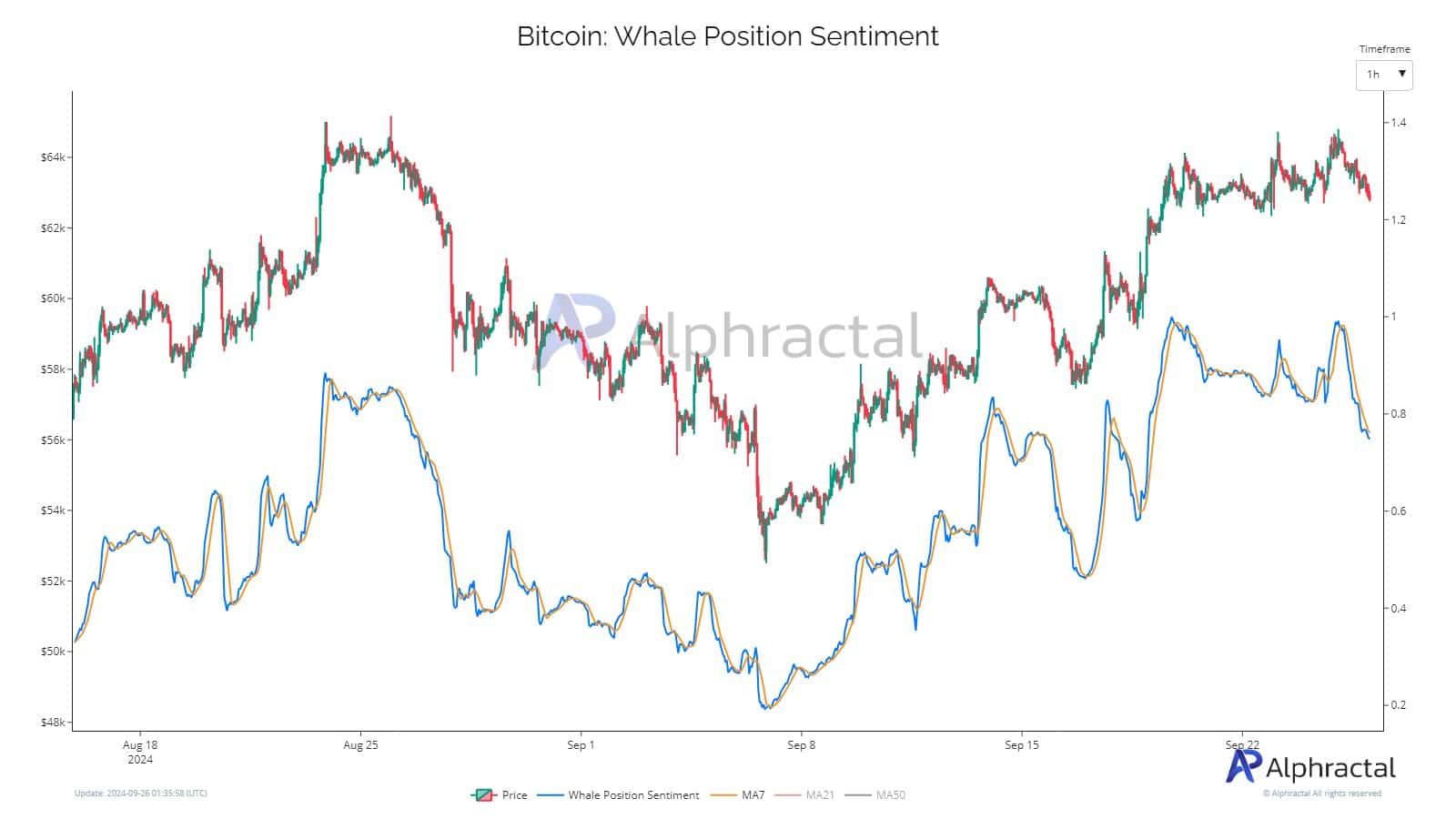

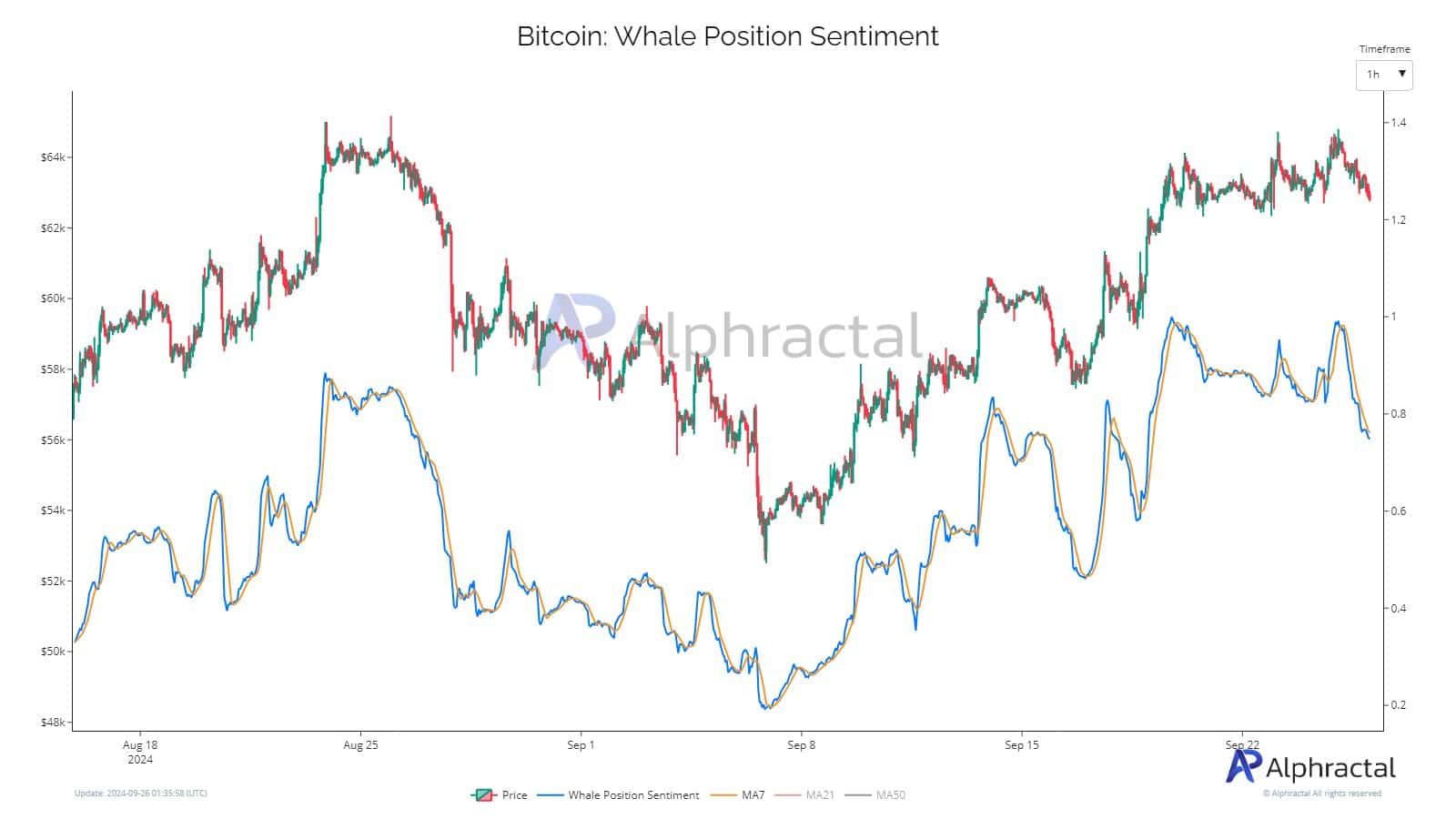

Whale Position Sentiment, an indicator that tracks whale activity across various exchanges, has shown a drop in sentiment, indicating more short positions have been taken. This sentiment shift often has a strong correlation with Bitcoin’s price action.

Source: Alpharactal

To prevent BTC from falling into bearish territory, it must hold above $62,000, the Short-Term Holder Realized Price, a key level that signals the continuation of the current trend.

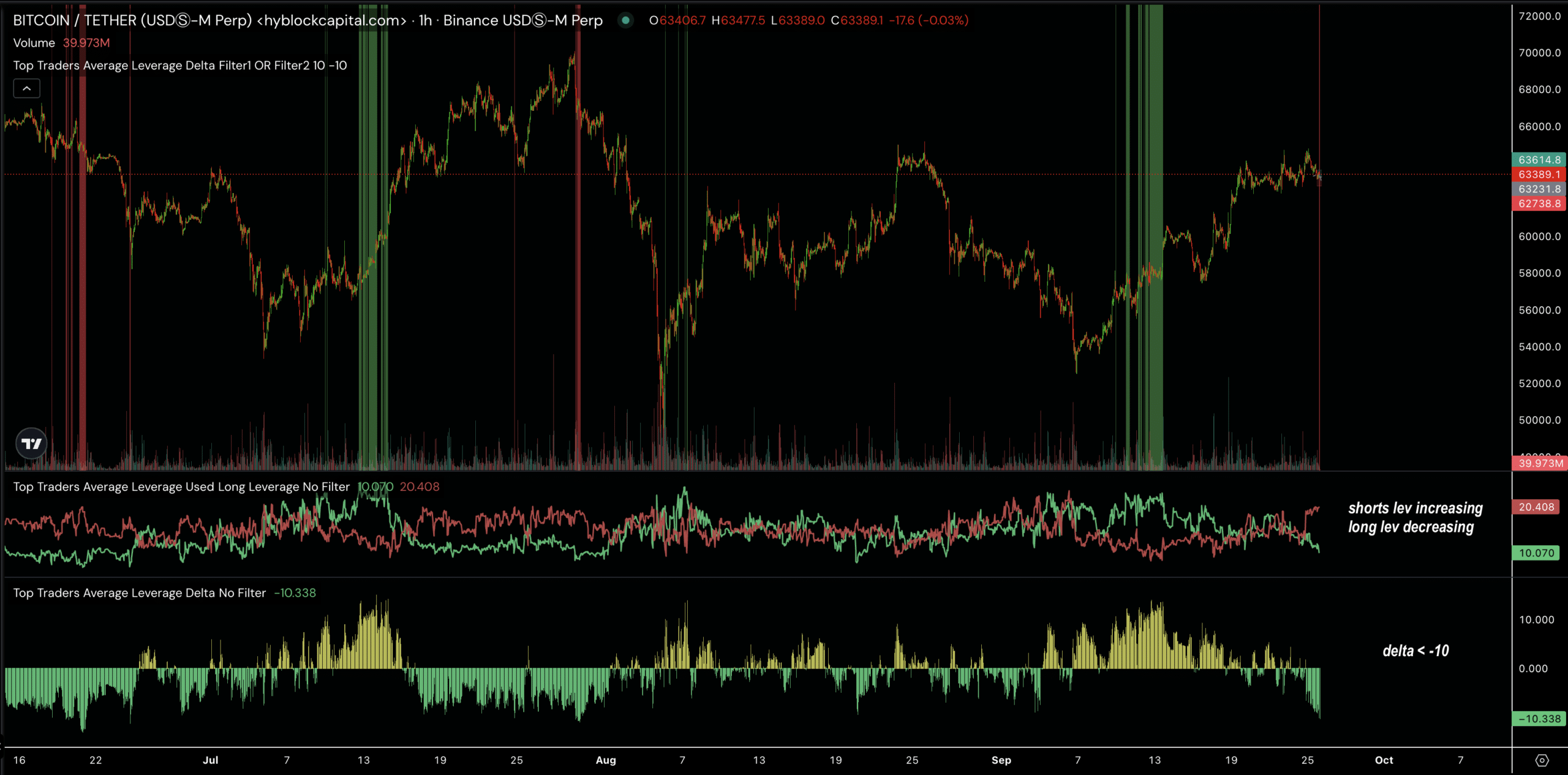

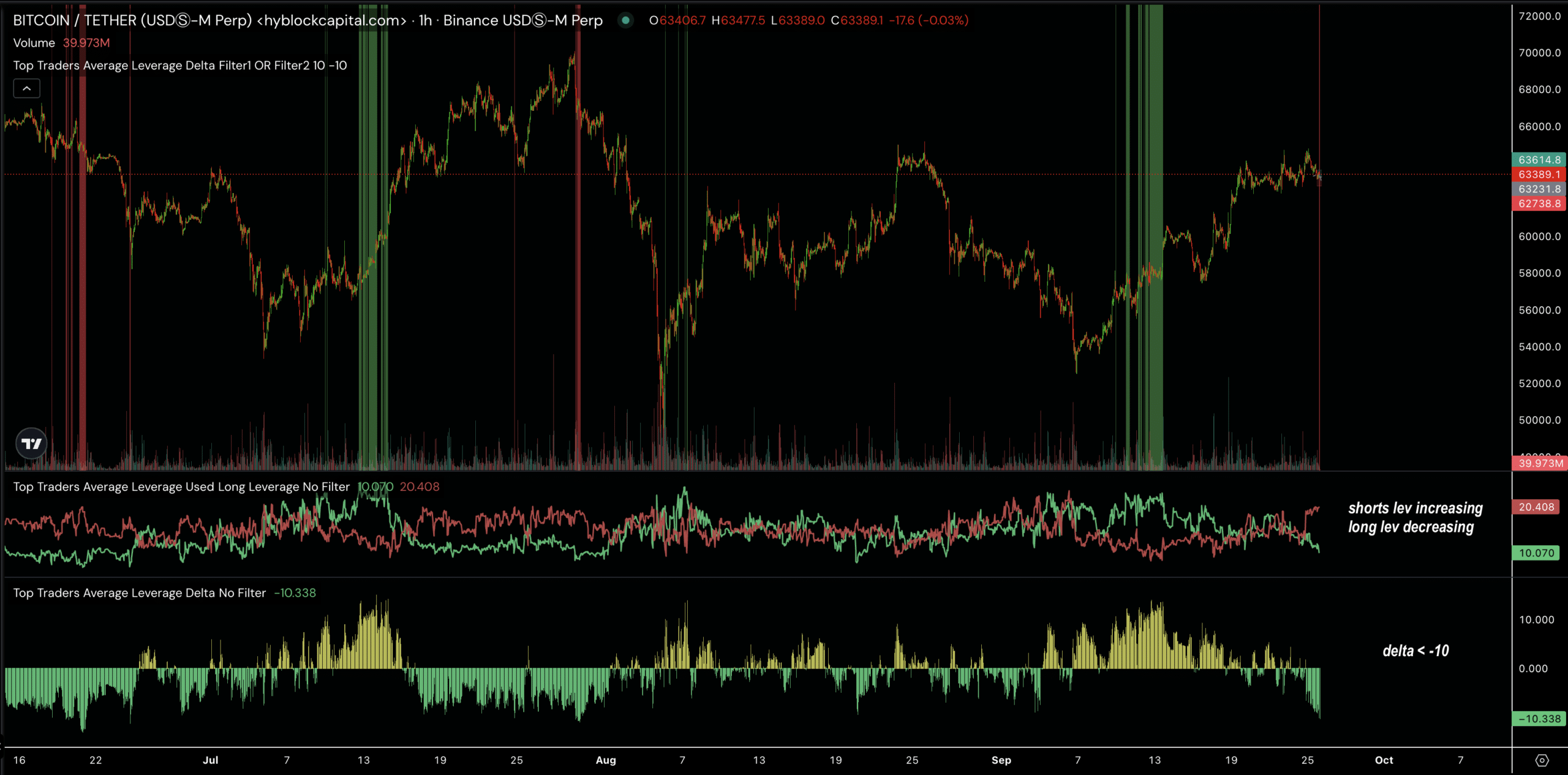

Average leverage delta

The decline in whale sentiment has caused the average leverage delta between Bitcoin longs and shorts to fall below -10. This means that short leverage currently dominates the market, while previously it was driven by long leverage.

Although whales have shifted their positions, the average leverage delta does not yet confirm a bearish outlook. Bitcoin is still above the $63,000 level and maintaining support at the 200 exponential moving average.

Source: Hyblock Capital

Despite the whales’ activity, this suggests that BTC could still go higher if certain conditions are met…

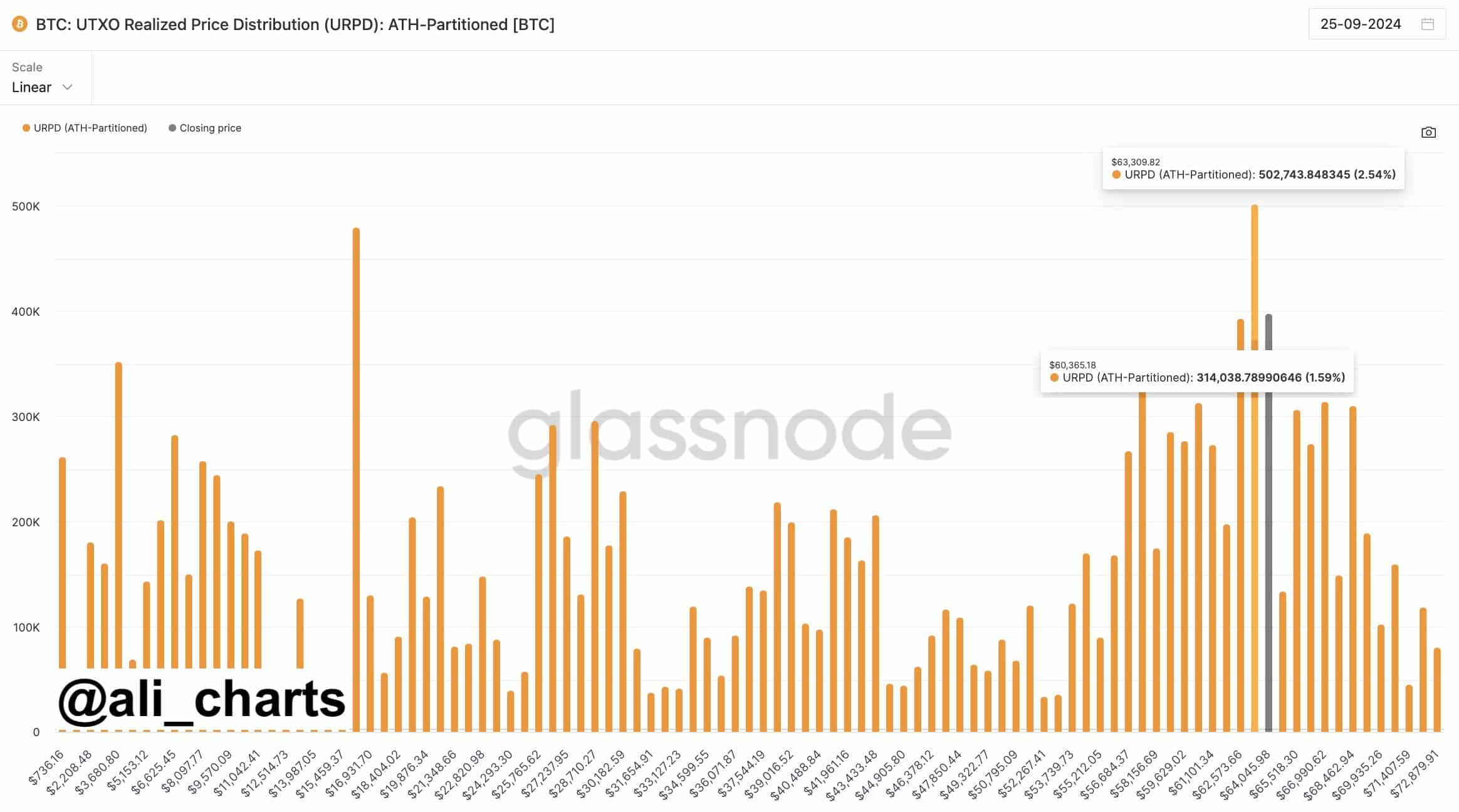

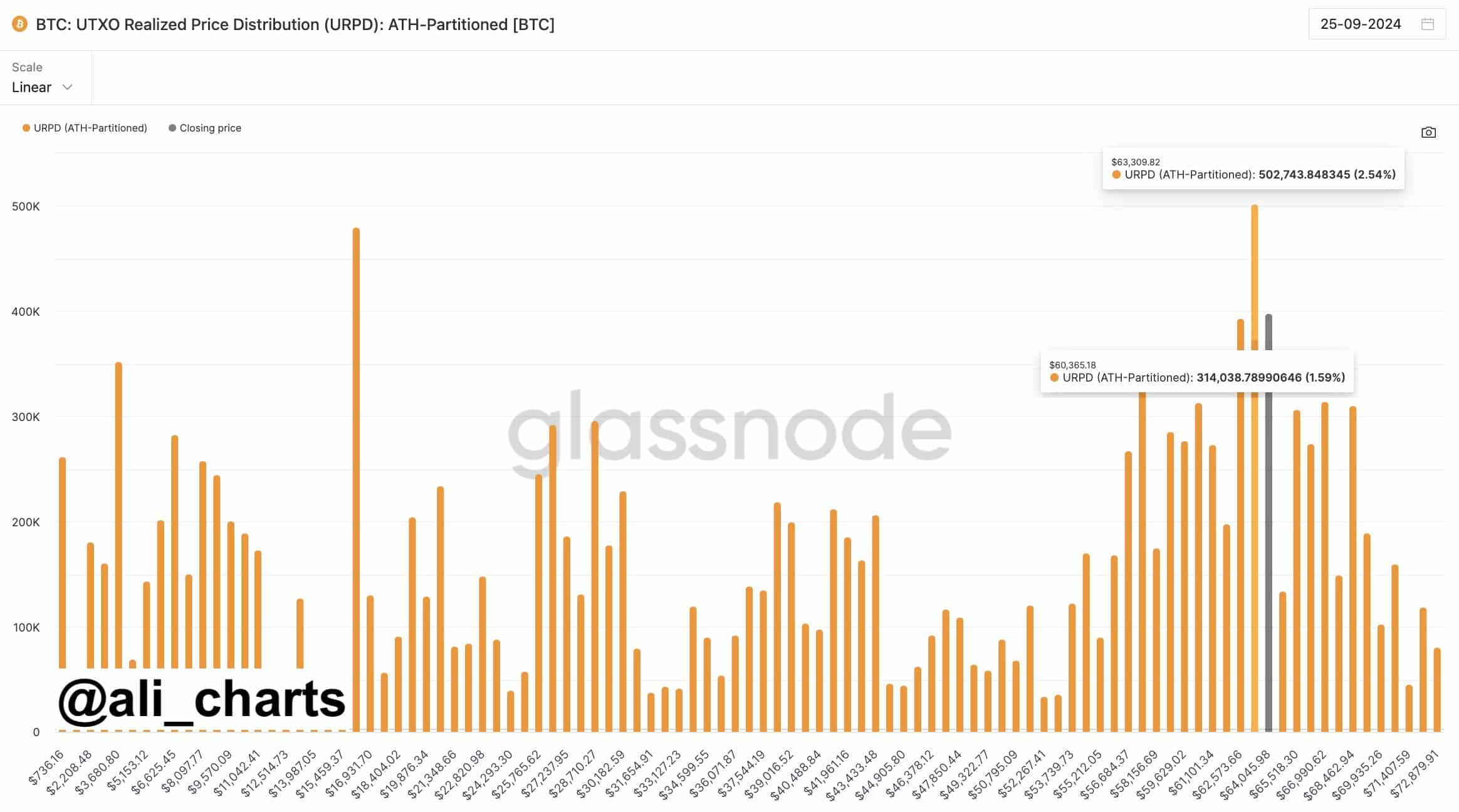

UTXO realized price distribution

The first crucial indicator supporting Bitcoin’s prospects is the UTXO Realized Price Distribution (URPD), which shows that the $63K level is one of the key support zones. This area also includes the $65K resistance level.

Source: Ali/Glassnode

If Bitcoin manages to stay above $63,000, it has the potential to break through the $65,000 mark. However, a drop below this support could lead to a dip towards $60,000 before another upward move. The market is closely watching this zone to determine Bitcoin’s next direction.

Bitcoin bot tracker indicator

Further supporting a bullish outlook for Bitcoin is the Bot Tracker Indicator. This tool tracks high-frequency bot-like activity in the market, which shows that bots are building long positions.

Increased bot activity on the buy side is often associated with a price increase. If Bitcoin experiences a slight decline to $60,000, it could attract more whale purchases at discounted prices, which could push BTC back to $65,000, resulting in significant gains for larger holders.

Source: Hyblock Capital

Although whales are shorting Bitcoin again as the price approaches $65,000, the overall market structure remains intact. As long as BTC remains above key levels such as $62K and $63K, there is potential for higher gains.

Read Bitcoin’s [BTC] Price forecast 2024-25

Bot activity and other on-chain indicators support a bullish outlook, suggesting any dip could be short-lived before BTC makes another upward move.

Traders and investors should keep a close eye on these key support and resistance levels to gauge the market’s next move.