- Bitcoin at $80,000 means a higher stake, paving the way for massive market volatility.

- Now more than ever, it is crucial that whales take action.

As anticipation grows about Trump’s next policy move regarding the crypto market, Bitcoin [BTC] experiences a huge wave of euphoria, bringing it to almost $80,000.

Although the market has not become overloaded phase still, its risky nature could deter some investors.

Renowned investor Robert Kiyosaki has done just that weighed in, emphasizing the need to avoid wishful thinking and focus on sound investment principles, regardless of the current price.

On the other hand, another well-known analyst has spoken out caution as Bitcoin approaches an all-time high.

With these extreme conditions, AMBCrypto analyzed current market trends and concluded that a hidden catalyst is needed to prevent Bitcoin from facing a potential pullback.

The market is primed for volatility

In the last presidential election, it took two months of inconsistent price action to push Bitcoin to $40,000 for the first time, with noticeable pullbacks along the way.

However, while the rise has been more consistent over the past five days with green candlesticks, the stakes are much higher this time considering Bitcoin’s current value.

So with the price approaching $80,000, the stakes are higher, and any pullback could trigger significant market reactions.

One factor fueling this uncertainty is the high leverage ratio in perpetual trades, as highlighted by another AMBCrypto reportmaking BTC vulnerable to sudden fluctuations.

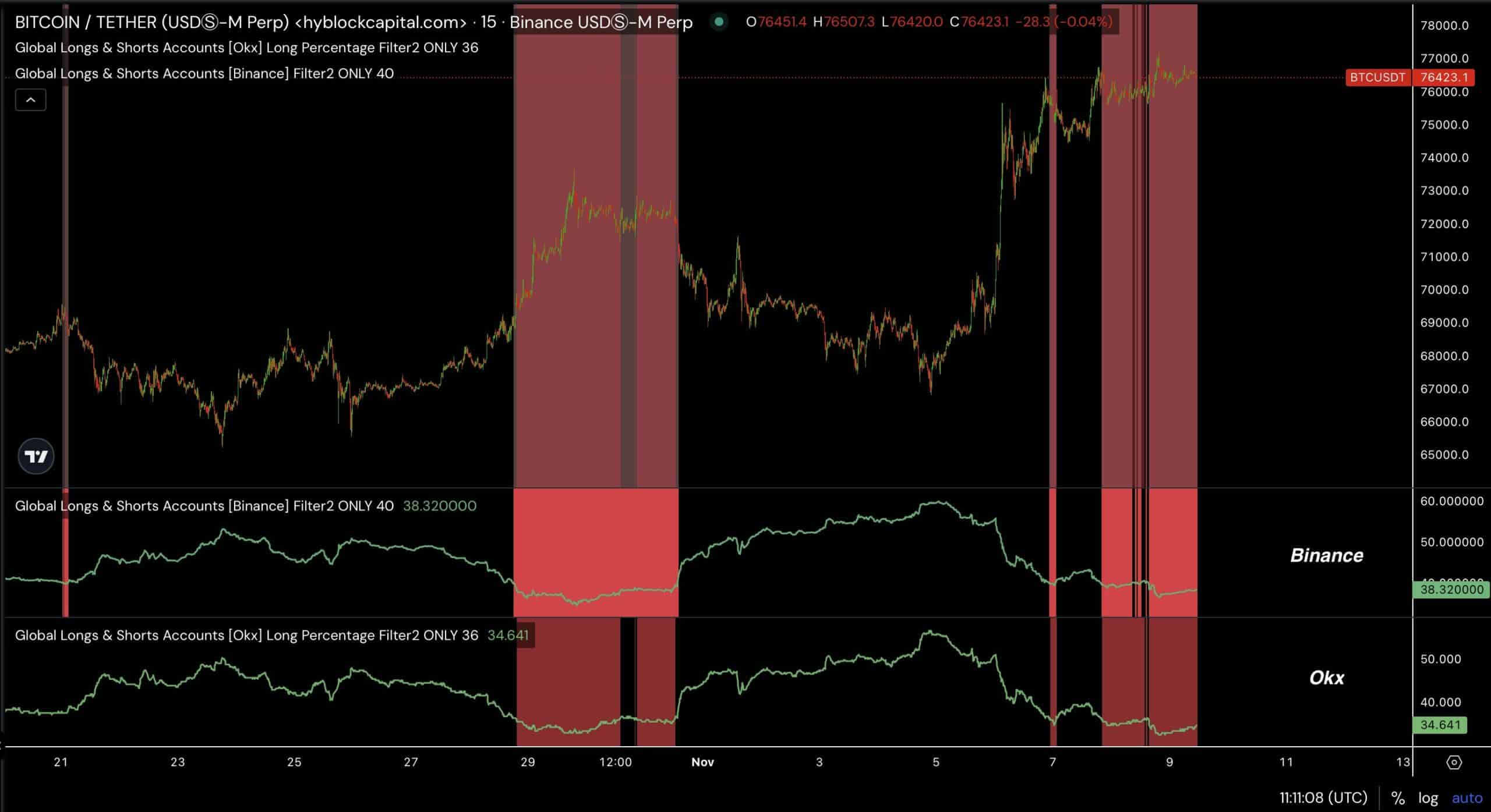

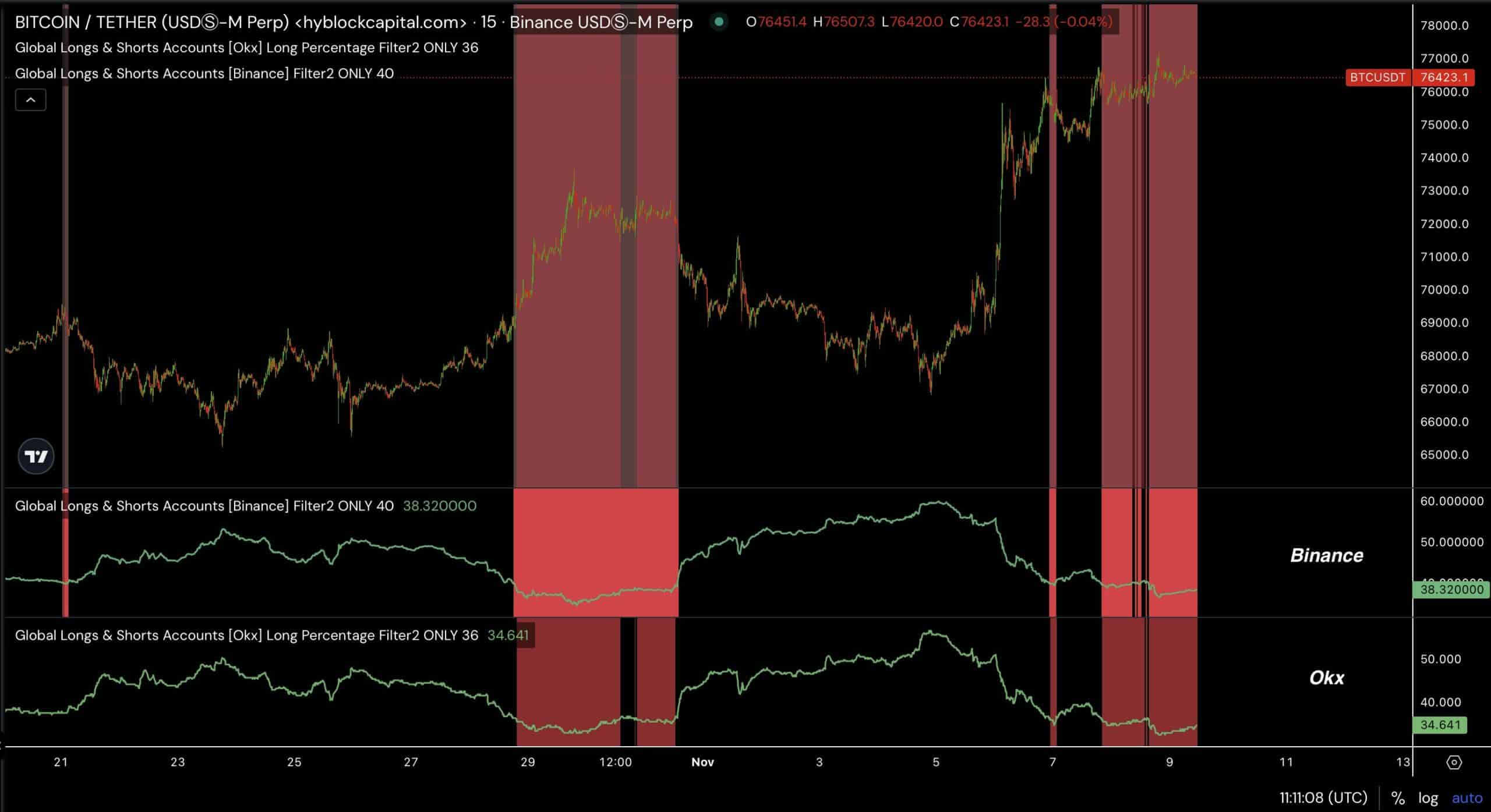

Source: HyblockCapital

Currently, much of the volatility is driven by activity on major trading platforms such as Binance and OKX.

The percentage of traders taking long positions has fallen significantly, while short positions have seen a strong rebound, creating conditions ripe for a potential long squeeze.

This setup is similar to the period in late October when BTC rose to $72K, only to fall back to $67K within a week, as seen in the chart above.

Additionally, during the run-up to the election, a wave of investors went long Bitcoin, leading to record-breaking shorts liquidations of approximately $371 million.

However, these long positions could be at risk if FOMO disappears, buying interest weakens and the market comes under pressureheated – especially as the RSI is hovering in overbought territory. Therefore,

Bitcoin needs a catalyst to absorb the pressure

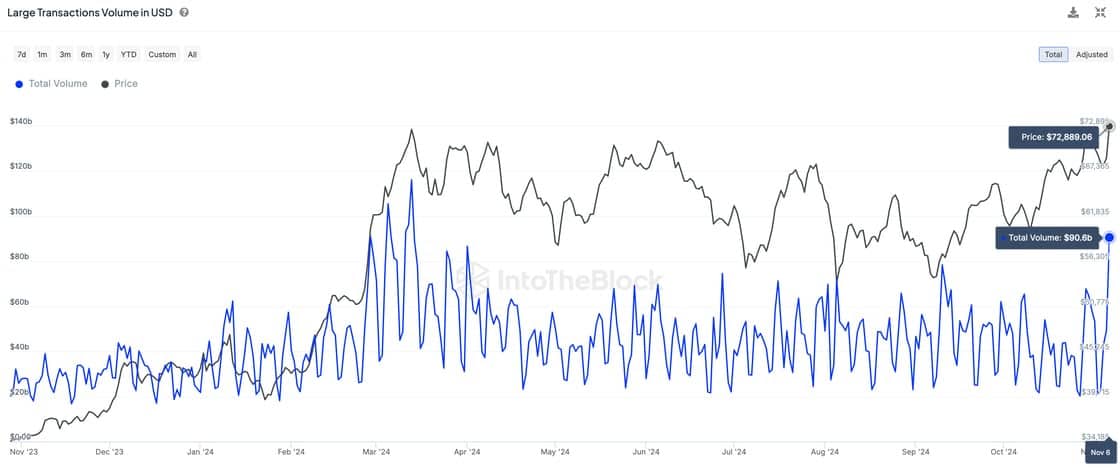

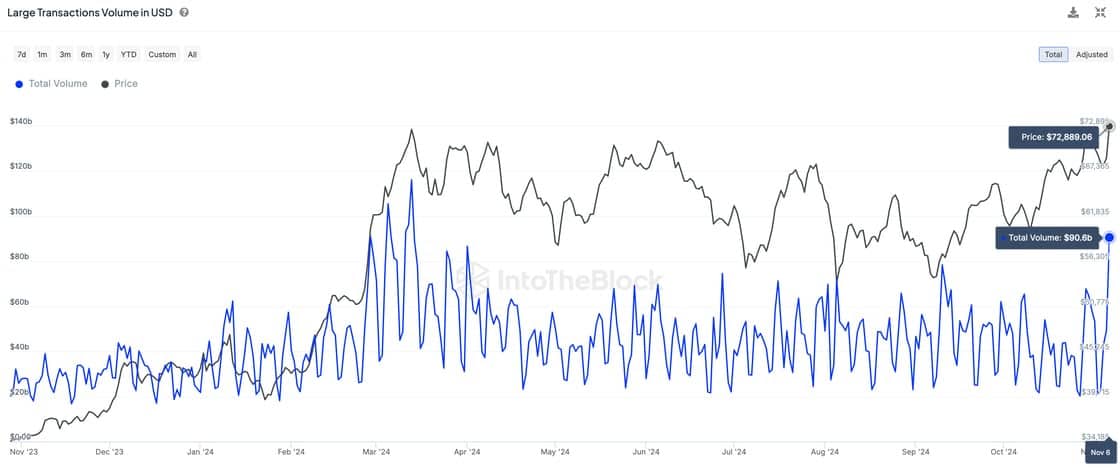

After the election, large Bitcoin transactions soared, peaking at $90 billion, signaling a sharp increase in whale activity. Their perspective on the current price as the right entry point is more important than ever.

Source: IntoTheBlock

AMBCrypto’s chart analysis shows that the current Whale accumulation mirrors the March peak when BTC reached its ATH of $73K.

However, that peak was followed by a decline, driven in part by fluctuations in the derivatives markets, as discussed earlier.

Therefore, for Bitcoin to remain above $80,000, consistent support from major HODLers is essential. This is something to keep a close eye on in the coming days.

Read Bitcoin’s [BTC] Price forecast 2024–2025

Overall, Bitcoin remains bullish, with a potential near-term surge above $80,000.

But with increasing volatility and increasing short positions, the steady accumulation of whales is crucial to cushioning the pressure and maintaining risk-free market sentiment – especially when the stakes are so high.