- Goat could be gearing up for a huge breakout from a falling trend channel

- Whales are instead selling Fartcoin and buying goats

At the time of writing, the price of geitseus maximus (goat) was trading within a descending trend channel. This was proven by the fact that its peak of $1.30+ underlined the potential for a significant breakout. Especially if certain conditions are met.

The Altcoin was trading at around $0.278 at the time, with a crucial support at $0.23. This support level must hold for the bullish scenario to remain viable, highlighting the importance of not falling below this threshold to maintain upward momentum on the charts.

Here, the downtrend channel indicated a pressured trend, but recent activity hinted at momentum that could lead to a breach above $0.80. If it breaks through this upper band of the channel and surpasses resistance, it could trigger a 100%-200% bullish rally.

Source: trading view

Conversely, a failure to hold above $0.23 could lead to further declines, with the lower supports being tested at $0.228 – a level that could see improved selling pressure.

Here, the KET is predicted to have the ability to sustain price movement above the aforementioned resistance and support levels. This may confirm the trend reversal from bearish to bullish.

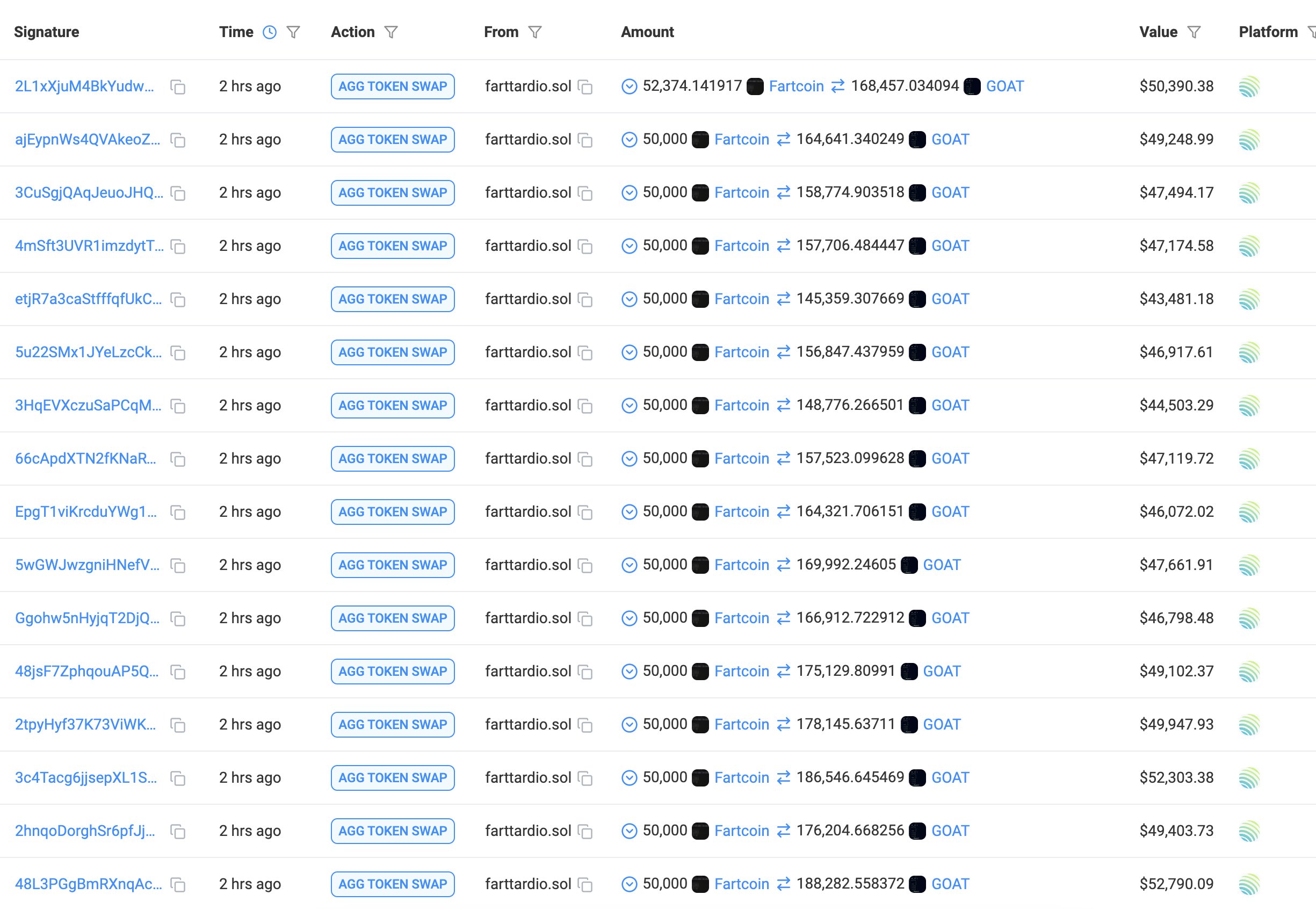

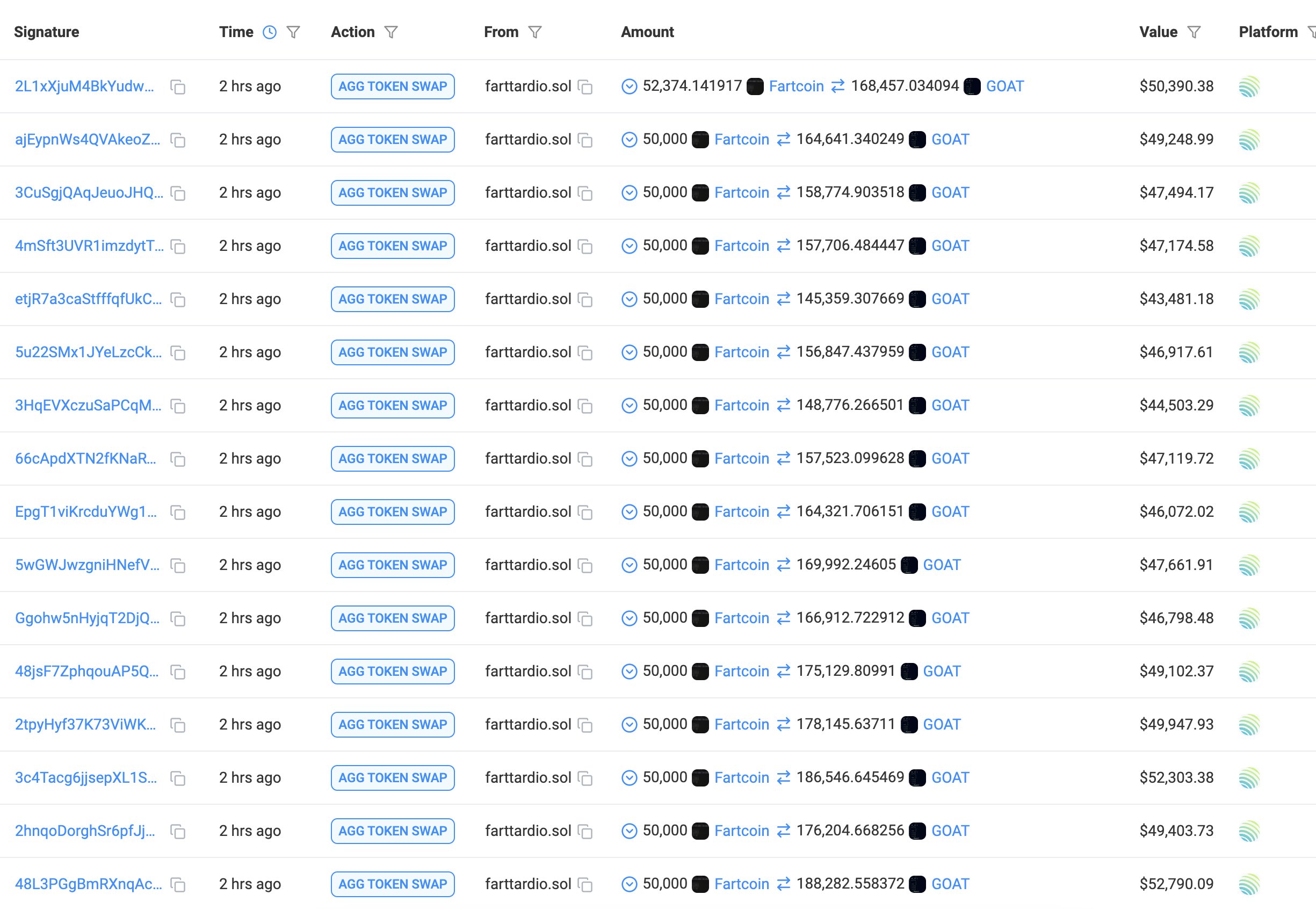

Whale activity on goats and liquidity delta

This discount in the price of the goat saw aggregate transactions from a whaling activity where 902,374 Fartcoin, worth $1.2 million, was exchanged for 3.07 million goat. This swap is symptomatic of a clear preference for goat over fartcoin among large holders.

The continued accumulation of the goats and sell-off of Fartcoin by whales could mean a bullish outlook for goat. As these big holders shift their holdings, they may be setting the stage for Goat to break out of his press trap channel.

If this trend continues and whales continue to gain capital in goats, we may see an increase in their value. In fact, the Altcoin could potentially rally 100% to 200% above its upper resistance.

Source: lookonchain/x

These activities can impact market dynamics and investor sentiment, further fueling the rally. Whales’ actions often precede key price movements, making their strategies important indicators of upcoming market trends.

Finally, the aggregate order book liquidity delta for goat revealed a tightening pattern on buying and selling pressure. Especially since Goat’s price has been fluctuating around the $0.30 range.

In particular, strong buying interest aligns with spikes in price, highlighting bullish momentum. Conversely, the sell-offs correlated with price dips. This liquidity interplay hinted at the potential for a breakout if buying pressure extends beyond key resistance points.

However, if selling pressure increases, the crypto could face further challenges, testing lower support levels. These market dynamics underscored the critical balance between supply and demand that impacts the price trajectory of goats.