- Biggest profit: Onyxcoin [XCN]Fartoin [FARTCOIN]Jasmycoin [JASMY].

- Biggest losers: Tezos [XTZ]Eos [EOS]Movement [MOVE].

The week started rough before the Crypto -MarketThe US economy feels the impact of rising trade stresses. However, it is a turn towards the end of the week. An important factor was the decision to exclude the technology sector from the new rates.

Consequently, it gave the market a much needed boost. Under the Top 100, there were even few risk assets even three -stern figures profits.

Weekly winners

Onyxcoin [XCN]: Next-Gen Crypto sees a triple numerical span

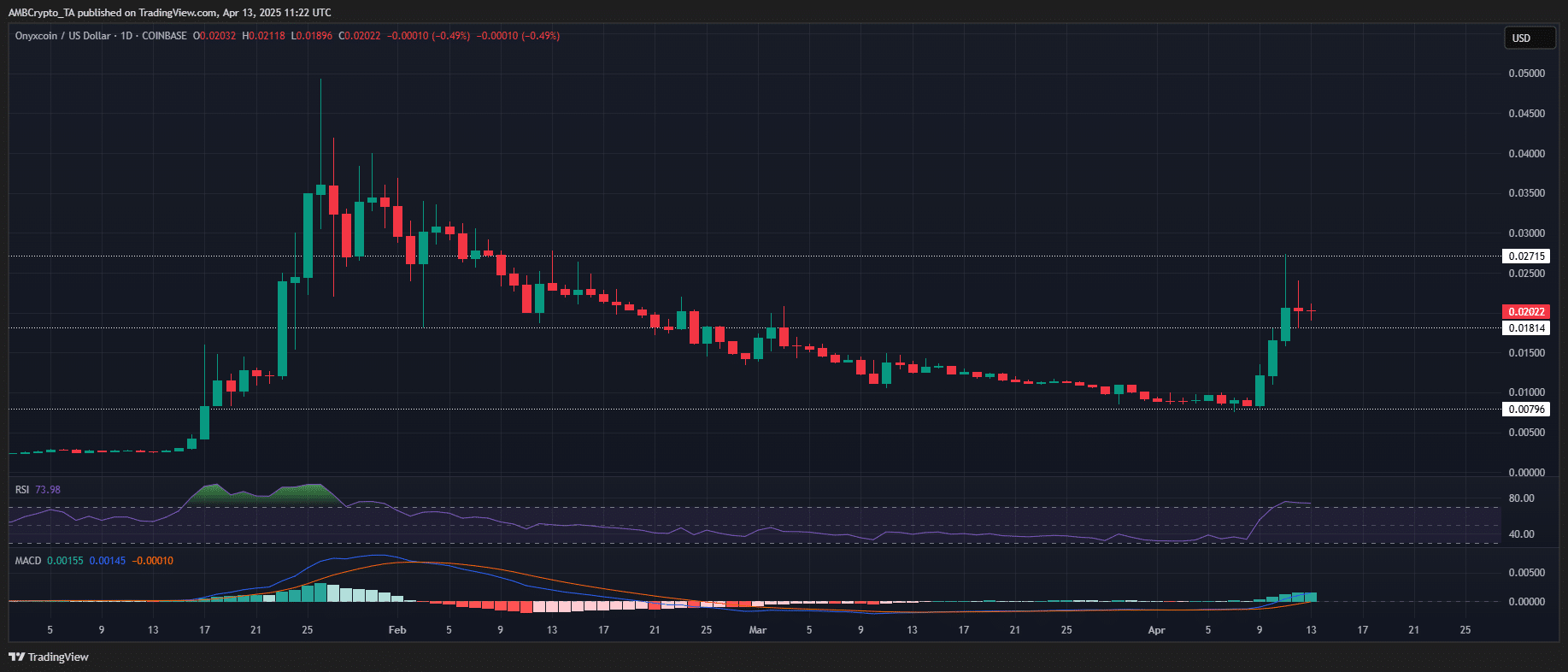

Onyxcoin [XCN] To it a rebound from the middle of the week, which on April 9, 43.88% nailed in a single day. This rally was followed by two consecutive days of increased purchase activity, with price increases of 36.78% and 24.65% respectively.

As a result, it actively dominated the weekly Gainers’ Chart and placed an impressive increase of 120%with low caps. For only three days, the price managed to erase two months of losses, which violated $ 0.027.

Source: TradingView (XCN/USDT)

As expected, taking a profit followed and the rally was overloaded, with the RSI getting a critical overbought situation at 81.09.

However, if the low CAP activum reflects its price action in January, where, despite the overload, bulls absorbed the sale and the upward trend maintained, a similar rebound could unfold.

On January 23 it actively saw a dramatic rally of 97.28% by one day, which raised the price to $ 0.025. TSaid Hat, with XCN who closed the week 7.4% under the half week peak of $ 0.027, it may be active towards the headwind to expand his rally in the coming week.

Consequently, it is vital to keep track of volume profiles to assess whether the upward trend can regain strength or whether a consolidation phase is imminent.

Fartoin [FARTCOIN]: Privacy-oriented token affects an important resistance zone

Crooked [FARTCOIN] this week placed a strong bullish performance and collected more than 90% in the midst of an outbreak of an accumulation range of several weeks.

The low CAP token certainly knew the key resistance at $ 0.64, so that it was changed in intraday support. The breakout, initiated on April 9 with a sharp intraday win of 50%, extended to re -test the level of $ 0.98 within two sessions at the daily period.

Currently, $ 0.87 has established itself as a short-term supply zone on the 4H graph, with a price promotion that shows signs of exhaustion.

The rally in the direction of the psychological level of $ 1.00 got stuck, coinciding with a profit. Moreover, the RSI trending is lower due to overbought and the MACD has reversed Beerarish, which indicates decreasing upward pressure.

In view of these signals, Fartcoin can require a liquidity or corrective rinse before Bulls can organize another attempt to reclaim the resistance level of $ 1.00.

Jasmycoin [JASMY]: Data -driven coin has a solid trend conversion

Jasmycoin [JASMY] The week started with a modest stression of 4.85% of a new low of 52 weeks of $ 0.00897. What followed was a sharp and steadily recovery.

Towards the end of the week, Jasmy traded at $ 0.01656, an increase of 68.91%, making it the third best assets of the week.

The rally followed a clean outbreak of his downtrend of several months. Also supported by the rising purchase volume and a bullish crossover in indicators such as the RSI, which brought firmly to a positive area.

The price action also suggests accumulation at lower levels, with steady green candles and limited volatility – in contrast to more speculative peaks that are seen elsewhere. This indicates stronger hands that come in and possibly leave space for further upside down.

For now the most important resistance is $ 0.018 – $ 0.0194. A decisive outbreak above that could open the door for a movement to the next goal for $ 0.022.

Other remarkable profit

Beyond the top performers, the wider market showed remarkable price promotion.

Edge [EDGE] Led the rally with a meteoric increase of 825%, better than the top 1,000 tokens in terms of price momentum. Airgo [AERGO] and delay seeker currency [RFC] followed with a substantial price gain of 332.8% and 270% respectively.

Weekly losers

Tezos [XTZ]: On-Chain Token knew his profits after the elections

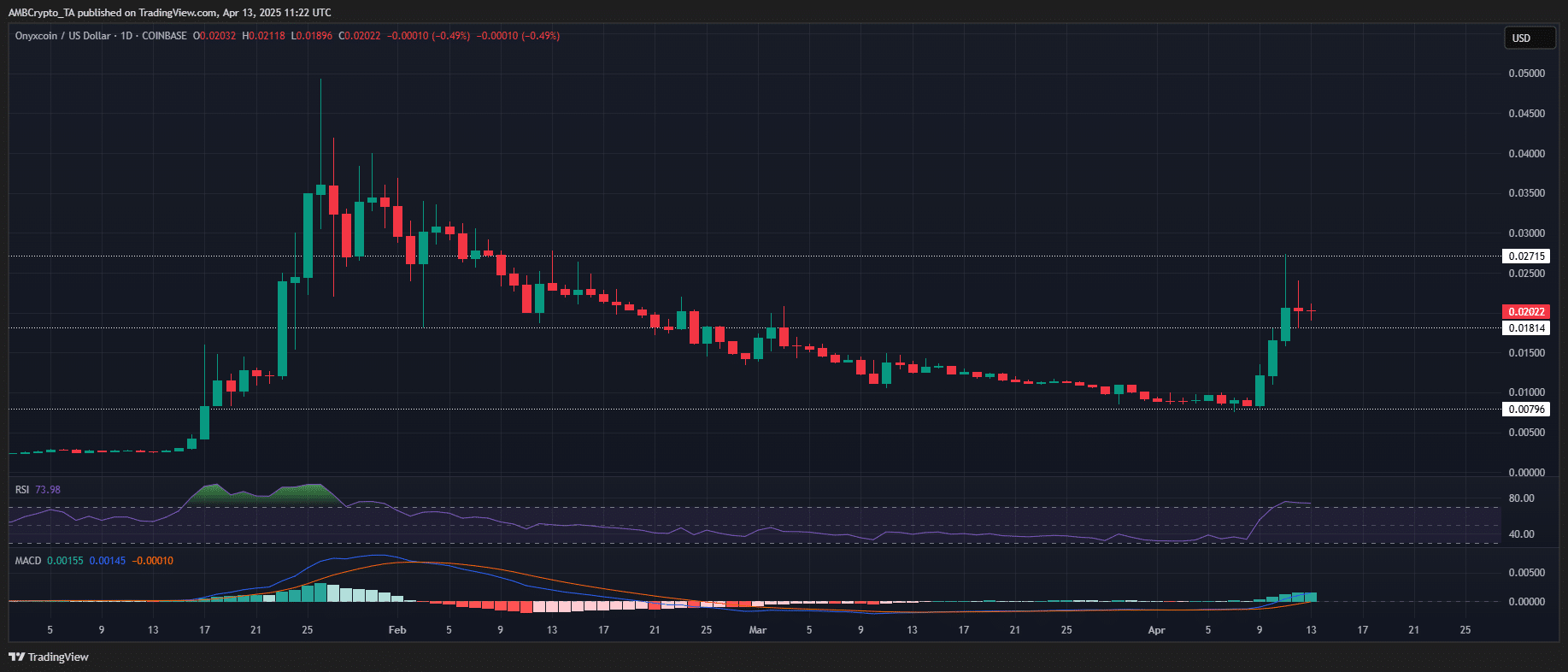

Tezos [XTZ] Finished the week as the largest underperformer, with a decrease of 17.20%, who expanded his successive losses from week to week.

At the time frame of 1D, price action remains under significant bearish, without observable bid side absorption to stop the sales momentum.

As a result, XTZ has formed a new lower layer, formed a new support for $ 0.53 under the peak after the $ 1.90 elections.

Source: TradingView (XTZ/USDT)

Despite the retracement, the question remains weak, without signs of strong dip purchases.

The absence of accumulation on these levels suggests that the downward momentum of XTZ could continue to exist, unless a strong support basis occurs to absorb sale.

Without a shift in the market structure or a bouncing of important support, it will probably probably continue its downward trend in the short term.

Eos [EOS]: Scalable blockchain shifts from winner to loser

EOS [EOS] This week experienced an important pivot, which went from the biggest winner of last week to second place in the loser schedule, which placed a weekly drawing of 12.34%.

The Altcoin started the week with a 7.28% rally, with early signs of an outbreak attempt after forming three consecutive lower lows.

However, Momentum quickly returned as bears took over control, which led to a sharp 12.83% bearish -flooding candle, which knew the early profits of the week and pushes the price back to $ 0.65.

In the 4 -hour period, the price structure sturdy bearish remains, with successive red volume staves that indicate a strong distribution.

The absence of bid-side absorption suggests a lack of liquidity support, and without substantial interest on the buying side, EOS can get a deeper withdrawal to test the following support at $ 0.53.

Movement [MOVE]: Fitness -Platform places lower lows

Movement [MOVE] placed a weekly marking of 12.78%, which receding from last week’s close to $ 0.37, making the third under the top decliners.

Price promotion continues to reflect a distribution phase, because bulls do not generate sufficient momentum for a structural outbreak. In fact tHroughhout the week, relocation traded within a consolidation channel between $ 0.24 – $ 0.40.

However, the absence of absorption on the demand side near local lows confirms weak market participation, without signs of accumulation or basic education.

Despite an increase in volume of 21% (up to $ 76.88 million), the increase in the opportunistic liquidity fluctuations seems to reflect instead of a real shift in the dynamics of the order.

The RSI remains in a downward process, with bearish front, while the lack of a confirmed higher low suggestion can be established for a new liquidity rinse under the range of $ 0.24 low.

Other remarkable losers

Various tokens underwent considerable price provisions in the wider market.

Metfi [METFI] led the decreases, confronted with a steep drawing of 51%, while MMX [MMX] and comedian [BAN] followed with 41.7% and 40% pullbacks respectively.

Conclusion

Here is the weekly summary of the top win and losers. It is important to remember the very volatile nature of the market, where price fluctuations can occur quickly.

As such, the execution of thorough due diligence (Dyor) is strongly recommended before you make investment decisions.