Bitcoin Spot Exchange-Traded Funds (ETFs) have once again captured the attention of crypto enthusiasts and investors as the products witnessed a whopping $10 billion in total trading volume in the first three days of trading.

Bitcoin Spot ETF Sees Significant Increase in Trading on Day 3

The development was revealed by Bloomberg Intelligence analyst James Seyffart on the social media platform X (formerly Twitter). The information shared by the analyst shows that there is a strong appetite for exposure to digital assets through regulated financial markets.

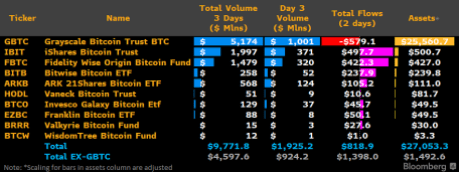

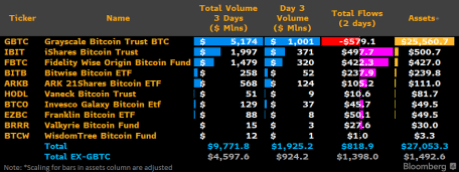

Seyffart’s X-post takes a closer look at the data from the “Bitcoin ETF Cointucky Derby.” According to the analyst, “ETFs traded a total of almost $10 billion over the past three days.”

The analyst also provided a virtual overview of the data to further elaborate on the substantial trading volume. With a total volume of more than $5 billion, Grayscale Bitcoin Trust (GBTC) stands out as the top performer among notable financial companies.

Meanwhile, iShares Bitcoin Trust (IBIT) and Fidelity Wise Origin Bitcoin Fund (FBTC) are next in line. The data shows that the financial firms witnessed a total trading volume of $1.997 billion and $1.479 billion respectively.

ARK’s 21Shares ETF (ARKB) and Bitwise Bitcoin ETF (BTTB) followed with substantial total trading volume of $568 million and $258 million, respectively. This spike in trading volume indicates that both institutional and individual investors are becoming more comfortable using traditional investment engines to trade BTC.

Although shades of gray Bitcoin The fund continues to achieve the highest total trading volume, but the fund has seen significant withdrawals from investors looking to reduce their exposure.

Since Grayscale began trading on January 11, withdrawals have totaled more than $579 million. Currently, Grayscale is still considered the ‘Liquidity King’ of the Bitcoin spot ETFs.

However, that is what Bloomberg analyst Eric Balchunas says anticipates that Blackrock could oversee Grayscale to claim the title. “IBIT continues to lead and is likely to overtake GBTC as Liquidity King,” he stated.

3-day trading surpassed 500 ETFs in 2023

Eric Balchunas did this in response to the report as long as a context for the massive wave of these products. The analyst did this by comparing the trading volume of BTC ETFs with all ETFs launched in 2023.

“Let me put into context how insane the $10 billion volume is in the first three days. There are 500 ETFs launched in 2023,” Balchunas said. Today, he said, the 500 ETFs had a combined volume of $450 million, and the top ETF had $45 million.

Moreover, Balchunas emphasized that Black rock‘s BTC ETF Outperforms the 500 ETFs. “IBIT alone sees more activity than the entire ’23 Freshman Class,” he stated. It is notable that half of the ETFs launched in 2023 today recorded a total trading volume of “less than $1 million.”

Balchunas also emphasized the difficulty in gaining volume, noting that it is more difficult than flows and possessions. This is because the volume really has to come into the market, which is what gives an “ETF staying power.”

Featured image from iStock, chart from Tradingview.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.